China's Hybrid Vehicles May Face New EU Tariffs, Heightening Export Pressures

![]() 01/23 2026

01/23 2026

![]() 335

335

Lead | Introduction

The European Union's intention to impose tariffs on Chinese hybrid vehicles has captured the attention of the automotive industry. This development comes on the heels of a preliminary agreement between China and the EU regarding price commitments on electric vehicle (EV) tariffs. For Chinese automakers, achieving genuine 'fair competition' in the EU—the world's third-largest automotive market—may just be the beginning of a long journey.

Published by Heyan Yueche Studio

Written by Zhang Dachuan

Edited by He Zi

2,859 words | 4-minute read

According to European media outlet Euractiv, the European Commission is planning to extend tariff coverage to include hybrid vehicles (including Plug-in Hybrid Electric Vehicles, or PHEVs, and Hybrid Electric Vehicles, or HEVs), with rates ranging from 7.8% to 35.3%. When combined with the standard 10% import tariff, the total rate for Chinese hybrid vehicles exported to the EU could reach as high as 45%, posing a significant challenge to Chinese automakers' strategies in the European market.

△The European Commission is planning to impose tariffs on hybrid vehicles (including PHEVs and HEVs).

Why is the EU targeting Chinese hybrid vehicles?

The EU's direct rationale for imposing tariffs on Chinese hybrid vehicles points to alleged 'government subsidies.' The office of the EU Industrial Commissioner claims that Chinese hybrids, like their EV counterparts, receive government subsidies during the manufacturing process.

However, a deeper cause lies in the evolving market dynamics. Hybrids have gradually supplanted pure EVs as the primary driver of China's automotive export growth to Europe. Data reveals a staggering 155% year-over-year (YoY) increase in Chinese hybrid exports to the EU in 2025, compared to a mere 12% growth for pure EVs. For EU automakers, the influx of Chinese hybrid models poses an increasingly formidable competitive threat.

△SAIC's MG Hybrid+ family achieved sales of 137,000 units in Europe, marking a 300% YoY increase.

Take SAIC as a case in point: Its European sales surpassed 300,000 units in 2025, representing a nearly 30% YoY increase. The MG Hybrid+ family accounted for nearly half of these sales, with 137,000 units sold (up 300% YoY), while MG's pure EV series managed sales of 46,000 units. BYD's Seal U PHEV emerged as Europe's best-selling Chinese new energy model in 2025, driving BYD's overall growth in the region.

△BYD's Seal U PHEV became Europe's best-selling Chinese new energy model in 2025.

In the hybrid segment, Chinese automakers have established significant advantages in extended-range and long-range PHEV models, gaining first-mover competitiveness akin to that of pure EVs. Compared to pure EVs, hybrids currently offer a better balance of user experience: daily commutes can be conducted in pure electric mode for cost savings and quiet operation, while long trips avoid range anxiety through flexible refueling options. Additionally, Chinese hybrid models generally feature advanced smart configurations and price advantages, making their rapid growth in the EU market entirely reasonable.

Hybrid vehicles may follow EV model to counter EU tariff pressures

The recent preliminary resolution of the China-EU EV anti-subsidy tariff dispute may provide a valuable reference for addressing the tariff challenges faced by hybrid vehicles.

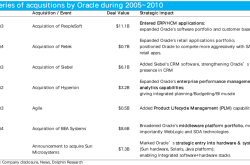

In October 2024, the EU formally initiated an anti-subsidy investigation into Chinese EVs. By October 2025, the EU decided to impose additional tariffs of up to 35.3% on Chinese EVs, bringing the total tariff (inclusive of the standard 10%) to 45.3%.

As the EU plans to extend tariff coverage to hybrids, Chinese automakers may draw upon their experience in the EV dispute, seeking sustainable operations in the EU through policy consultations, industrial collaborations, or market strategy adjustments.

△China and the EU reached a solution on EV tariffs.

The EU's unilateral tariff policy has significantly impacted Chinese automakers' legitimate interests. China's Ministry of Commerce engaged in multiple rounds of intensive consultations with the EU, culminating in a key breakthrough on January 12: Both sides agreed to replace high tariffs with a 'price commitment' mechanism. Under this arrangement, Chinese automakers can sell EVs in the EU at or above committed prices, thereby avoiding punitive tariffs.

This arrangement has proven beneficial for Chinese automakers. Costs previously paid as tariffs can now be converted into profits, while a relatively higher pricing system helps build a premium market and brand image. Despite adjusted cost and price advantages, Chinese EVs continue to excel in product strength (e.g., three-electric technologies, smart connectivity), maintaining strong recognition among European consumers.

Notably, EU EV exports encompass not only Chinese brands but also models from Volkswagen, BMW, and other European automakers produced in China and re-exported to Europe. Thus, this mechanism benefits both Chinese automakers and European brands operating in China, providing a more stable trade environment.

△Volkswagen produces the TAVASCAN in China for export to Europe.

For hybrid vehicle tariffs, the solution reached in the EV dispute may serve as a crucial reference for future China-EU consultations. The EU may employ transitional arrangements, such as price commitments, to maintain relatively higher prices for Chinese hybrids in the short term, thereby reducing pressure on local automakers and granting European firms like Volkswagen, Stellantis, and Renault time to develop their own hybrid models. This strategy essentially trades market access for industrial adjustment time.

EU policy shifts warn Chinese automakers: Expand globalization strategies

The EU's planned tariffs on Chinese hybrids provide a clear strategic warning for China's auto industry. Currently, most Chinese automakers rely on vehicle exports as a relatively straightforward and cost-effective means of entering overseas markets.

With ample domestic auto production capacity, exporting has proven to be a highly efficient way to reduce inventory and boost utilization rates. Even with rising tariffs or price commitments, exporting remains more cost-effective and lower-risk than directly constructing factories in Europe, which entails navigating legal compliance, business environment challenges, supply chain restructuring, and high costs.

However, as overseas trade barriers continue to rise, Chinese automakers must optimize their product and cost competitiveness while exploring diversified overseas models, such as localized production, regional supply chains, and joint ventures, to build a more resilient global system.

From a trade balance perspective, large-scale auto imports can impact an economy's foreign trade structure. For the EU, with its complete auto supply chain and substantial employment base, China's rapid entry into the new energy vehicle market intensifies local competition and may exert pressure on related industries and jobs.

Currently, Chinese new energy vehicles boast significant performance and cost advantages, leading European automakers by a generation. To protect its auto industry and employment, the EU may adopt trade adjustment measures against Chinese new energy vehicles as a predictable policy option.

To address the current challenges, Chinese automakers can adjust their strategies in three key areas:

First, shift away from exporting excess capacity. Domestic overcapacity should be resolved through domestic market mechanisms. Mass exports risk trade friction; inefficient capacity should be optimized via market integration or exits, requiring proactive planning.

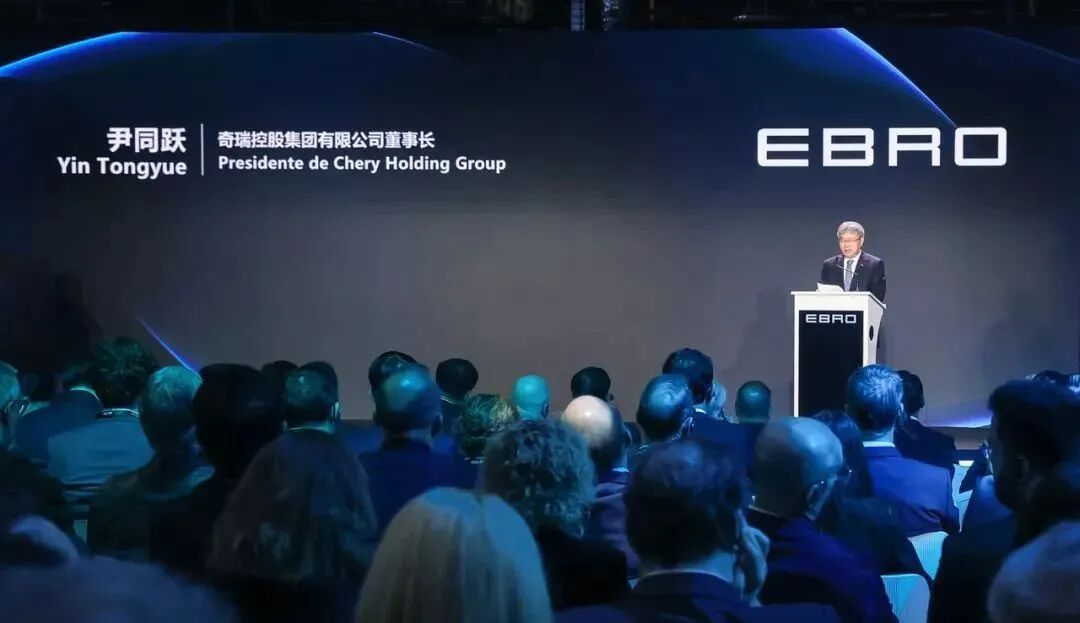

△Chery and a Spanish automaker jointly produce the EBRO brand for Europe.

Second, deepen localized cooperation for win-win growth. Drawing on past experiences of foreign automakers establishing joint ventures in China, explore reverse joint ventures with EU automakers. Output technology, supply chains, and management experience to reduce market resistance. For example, Chery's partnership with Spain's EV Motors to produce EBRO models represents a viable path.

Third, strengthen technology licensing and soft exports. Compared to vehicle exports, technology licensing and platform collaborations face fewer trade barriers. For instance, Geely licensed its technology to Volvo for EX30 production in Belgium, boosting sales and achieving sustainable revenue through technology output. Such models help Chinese automakers integrate into global supply chains with lighter asset investments.

△Volvo produces the EX30, based on Geely technology, at its Belgian factory.

Commentary

Long-term EU market share for European automakers cannot rely solely on tariff protections, which are inherently unsustainable. Overusing trade barriers may trigger chain reactions, ultimately harming their own industrial ecosystem.

True competitiveness requires European automakers to launch more market-appealing products and upgrade their new energy and smart connectivity supply chains, thereby regaining industrial advantages reminiscent of the fuel vehicle era. Tariffs offer only short-term relief; they cannot replace technological innovation and systemic competitiveness, nor sustain the technological dividends enjoyed over the past decades.

(This article is original to Heyan Yueche. Unauthorized reproduction is prohibited.)