2026 Davos: The Collective Apprehension Among Business Leaders—When Will AI Investments Yield Returns?

![]() 01/23 2026

01/23 2026

![]() 467

467

AI Capital Bureau - Shi Tao

Over the past two days, the Annual Meeting of the World Economic Forum (WEF) has commenced in Davos, Switzerland. Contrary to the AI fervor witnessed last year, this year's Davos Summit has seen a more collective and pragmatic stance among global business leaders regarding AI. The pressing question now is: How can the substantial AI capital invested over the past two years be transformed into measurable, sustainable business returns? This concern over the return on investment (ROI) from AI is emerging as a pivotal factor reshaping the valuation logic in capital markets in 2026.

CEO's Collective Pragmatic Reflection: The Rise of AI Investment ROI Concern

During the Davos Forum, PwC's '2026 Global CEO Survey' presented quantitative evidence of this growing concern.

1. A Sharp Decline in Optimism

PwC's survey reveals that only 30% of global CEOs are optimistic about revenue growth in 2026, marking a new low in recent years. The attitude of CEOs towards AI has shifted from 'investing at any cost' to 'cautiously assessing outcomes'.

Data Insights:

Input-Output Imbalance: Over the past year, over 80% of surveyed CEOs have increased their investments in AI infrastructure and talent. However, fewer than 15% believe these investments have led to significant, quantifiable revenue growth.

Key Obstacles: CEOs have identified inadequate data governance (55%), a lack of strategies to integrate AI into core business processes (48%), and talent skill gaps (42%) as the primary hurdles in converting AI investments into ROI.

2. Pressure Shifts from Capital Expenditures (CapEx) to Operational Expenditures (OpEx)

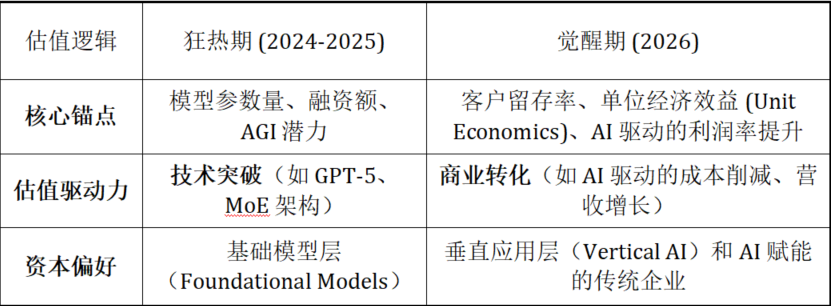

During the AI boom of 2024-2025, capital markets primarily focused on companies' CapEx, such as investments in GPUs and computing clusters. This allowed infrastructure providers like Nvidia to enjoy substantial valuation premiums. However, as we enter 2026, markets are demanding evidence of OpEx efficiency—how AI investments translate into profits.

This pressure is now being felt by AI software and application-layer companies. Firms that rely solely on general-purpose large model concepts without clear monetization strategies will face intense scrutiny from capital markets and significant valuation adjustments.

This pressure will also be felt domestically. For established AI leaders like SenseTime and emerging AI players such as Zhipu and MiniMax, including Moonshot AI, which is rumored to have secured new financing, investors in both primary and secondary markets will demonstrate unprecedented concern over their AI application progress and commercialization efforts.

Reshaping of Capital Market Valuation Logic for AI Assets

The 'ROI anxiety' evident at the Davos Forum signals a profound transformation in the valuation logic of AI assets in capital markets.

1. Decline of 'Artificial General Intelligence (AGI) Premium' and Rise of 'Efficiency Premium'

In the past, many AI startups enjoyed conceptual premiums based on the potential of AGI. However, as CEOs prioritize actual returns, capital will flow towards companies with efficiency premiums.

2. Vertical AI as a Capital 'Safe Haven'

The World Economic Forum unveiled a new batch of MINDS (Meaningful, Intelligent, Novel, Deployable Solutions) pioneer companies in Davos, focusing on deploying high-impact AI solutions in verticals such as healthcare, energy optimization, and supply chain resilience.

This is no mere coincidence. Vertical AI solutions, with their well-defined application scenarios and data boundaries, are easier to demonstrate ROI, as seen in AI healthcare and energy:

AI Healthcare: AI-assisted diagnostics can be directly quantified as improved doctor efficiency and reduced misdiagnosis rates, as demonstrated by domestic companies like Baichuan, Senyi, and Yidu.

Energy AI: Optimizing grid dispatch can be directly quantified as reduced energy losses and operational cost savings, as shown by domestic companies like Damao Intelligence, Envision Intelligence, and Longshine.

Capital is transitioning from a 'broad net' approach in general AI to a 'precision strike' model in vertical AI, seeking clearer and faster investment returns.

From 'Potential' to 'Performance'—Consensus on Pathways to Enhance AI Investment ROI

Discussions at the Davos Forum also reached a consensus on how companies can bridge the gap between 'potential' and 'performance'.

1. Redesigning Human-Machine Collaboration

Manish Sharma, Chief Strategy Officer of Accenture, emphasized at the forum that maximizing AI investment returns 'requires human wisdom.' This means companies must:

Embed AI into workflows: AI should not be an isolated tool but a 'copilot' integrated into core business processes.

Skill retraining: Invest in retraining employees' AI skills to enable efficient collaboration with AI rather than being replaced by it.

2. Strategic Importance of Governance and Data Foundations

The WEF report underscores that key factors for successful AI scaling include strengthening data foundations and supporting responsible governance. In the AI era, data is no longer just 'oil' but the 'fuel' driving AI value. Without high-quality, well-governed data, no advanced model can generate reliable ROI. Meanwhile, responsible AI governance (e.g., transparency, fairness) has become essential to avoid potential legal and reputational risks and ensure long-term commercial value.

Conclusion: AI Investment Enters 'Maturity'

The 2026 Davos Forum marks the formal entry of AI investment into 'maturity.' Markets are no longer content with grand narratives about AGI but are demanding tangible business value.

For capital markets, this means valuation logic will become more rational, with funds flowing to companies that can convert AI investments into clear, quantifiable ROI.

For companies, success lies in treating AI as a comprehensive organizational transformation rather than a mere technology procurement. Only by deeply integrating AI into strategy, processes, and talent development can they truly overcome ROI anxiety and achieve long-term AI-driven growth.

AI Capital Bureau is a professional observation and analysis platform dedicated to tracking capital market dynamics in the artificial intelligence field. We closely monitor AI companies' capital operations, including financing, listings, and mergers and acquisitions, while providing in-depth analysis of industry trends and investment opportunities to offer valuable insights for industry participants. In an era of rapid AI technological advancement and deep capital integration, we are committed to becoming a bridge connecting AI innovation and capital markets, helping Chinese AI companies realize value discovery and growth.

Risk Warning and Disclaimer: The market involves risks, and investment should be made with caution. This article does not constitute investment advice and should not be used as practical operational guidance. Trading risks are assumed by the investor.