ARR reaches US$240 million. Can Kling propel Kuaishou to soar?

![]() 01/23 2026

01/23 2026

![]() 504

504

Source | Bohu Finance (bohuFN)

As 2026 begins, Kuaishou's stock price has embarked on a strong upward trajectory. After a nearly 25% retracement from its peak in October last year, Kuaishou's stock price has surged by over 23% so far this year. Over the past year, the stock price has skyrocketed by nearly 88%.

The capital market still favors Kuaishou Kling, with its latest "Motion Control" feature going viral overseas and dominating download charts in multiple countries.

Riding this wave, Kuaishou recently announced that Kling AI's revenue surpassed US$20 million in December 2025, with an annualized revenue run rate (ARR) reaching US$240 million, doubling from the US$100 million ARR announced in March 2025.

Today, Kling has validated its commercialization capabilities within a year, transforming from a mere "AI story" into a core engine driving growth, supporting valuations, and even reshaping the company's narrative.

Kuaishou's consecutive stock price gains are the best proof of the capital market's vote of confidence. However, behind this wave of stock price dividends, the real challenges for Kuaishou and Kling are just beginning, not only in running faster but also in running more steadily.

01 Kling Dominates Overseas Charts

In June 2024, Kuaishou's AI video generation model, "Kling," made its debut. After over 20 iterations, Kling upgraded to version 2.6 in December last year, achieving an innovative breakthrough in generating complete audio-video content in a single pass.

This version introduced the new "Motion Control" feature, allowing users to convert static images into animated videos by drawing motion paths directly on the images, creating highly engaging short videos.

Ordinary users can now easily produce high-quality dynamic videos, meeting overseas users' strong demand for personalized expression and social sharing. This "low-threshold, high-creativity" experience has propelled Kling to rapid popularity overseas.

According to Sensor Tower data, as of January 2, Kuaishou's Kling AI app ranked first in revenue among graphics and design apps on iPhones in South Korea and Russia, and within the top ten in markets such as the United States, United Kingdom, Japan, and Australia.

Kling's chart dominance has also caught the attention of industry leaders. Justin Moore, investment partner at a16z, praised the "Motion Control" feature as "Nano Banana for the video world," highlighting its disruptive significance.

This "disruptive innovation" holds even greater significance for Kuaishou, signifying that Kling is no longer a "storytelling product" but has truly transformed sophisticated AI into a accessible toy for everyone, sparking viral growth.

Currently, Kling has taken the lead in revenue scale. Kuaishou revealed that Kling's ARR reached US$240 million, accounting for less than 1% of Kuaishou's total revenue but still standing strong compared to global AI companies.

From a global perspective, according to Feifan Industrial Research data (as of August 2025), U.S. AI companies dominate the top tier of the global AI ARR rankings (top ten). As a player in the AI video and creative generation niche, Kling's ARR of US$240 million places it in the second tier, successfully carving out a high-value slice of the global AI market.

According to Orient Securities research, Kling ranks 14th globally in ARR revenue, sharing the same tier as Runway, Perplexity AI, and Cohere, which have ARRs ranging from US$200 million to US$500 million.

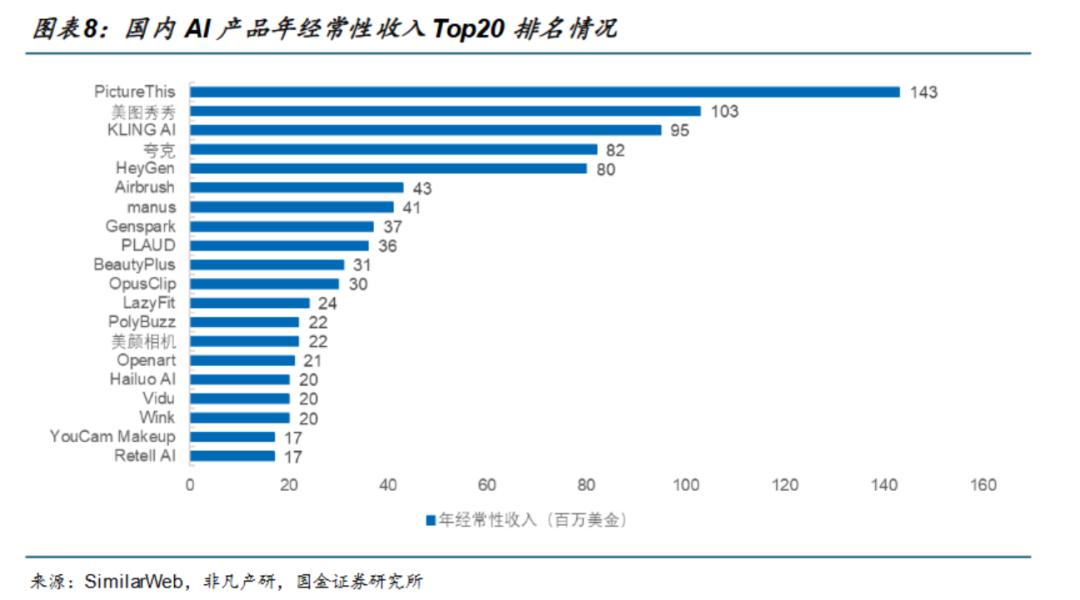

In the domestic market, Kling's revenue consistently ranks in the top tier. As of July 2025, the top three domestic AI products by revenue were PictureThis, Meitu, and KLING AI. Minimax, which recently went public, reported an ARR of approximately US$70 million in 2024, according to foreign media.

(Source: Guojin Securities)

Confidence stems from solid capabilities. Over the past year, Kuaishou has pressed the "accelerator" on AI.

In April last year, Kuaishou established the Kling AI Business Unit, upgrading it to a first-tier business department. Since March last year, Kling has released over eight major version updates, with Kuaishou Senior Vice President Gai Kun describing the iteration pace as "running at full speed."

Kling 2.5 Turbo significantly improved image quality, details, and smoothness; Kling 2.6 became the first true "audio-video synchronous" model, featuring stronger multimodal understanding capabilities.

The world's first unified multimodal large model, "Kling O1," released late last year, supports local video modifications through natural language instructions or image references, allowing users to complete the entire creative process from generation to modification in one stop.

On the global benchmark testing website Artificial Analysis, Kling is the only Chinese model ranking in the top three for both text-to-video and image-to-video performance. In Gai Kun's view, to maintain a lead over local competitors like ByteDance and startups like MiniMax, the Kuaishou team must sustain a high-frequency upgrade pace.

02 Accelerating Technology Monetization

However, Kling's global resurgence stems not only from its "strongest technology" but also from its true "usability."

Over the past year, competition in the AI video sector has shifted from pure model capability comparisons to the implementation of AI video technologies across different scenarios and sectors. For Kling, it's not just about model capabilities but also about implementation.

This is an area where Kuaishou can leverage its strengths. According to an Orient Securities report, Kuaishou receives 40 million short video uploads daily and has long used clear annotations for precise video distribution, providing rich video material for Kling's iterations.

Moreover, getting more users on board is crucial. Over the past year, Kling has introduced two significant price reductions, with the API cost of Kling 2.5 Turbo slashed by approximately 30%.

Wan Pengfei, head of Kling AI's visual generation and interaction center, stated that Kling's technological iterations always focus on enhancing foundational model capabilities and user co-creation optimization, tightly integrating model capabilities with user experience to continuously improve the product.

Additionally, lightweight gameplay and low entry barriers have accelerated viral spread. For example, Kling's overseas user-favorite "Motion Control" feature allows users to generate dynamic videos with specified actions by simply uploading a static image.

This easily replicable and highly engaging interactive gameplay enables users to quickly generate massive amounts of shareable video content, creating a viral effect. Besides, Kuaishou has launched a series of challenge events overseas, such as the "Dance King Contest," further enhancing the Spread potential energy (dissemination momentum) of video content.

Kling's outstanding performance has led to more optimistic expectations for "Kling propelling Kuaishou."

Firstly, Kling has validated a replicable commercialization path, where AI can be embedded into content platforms themselves, completing a closed-loop process from technical capabilities to content participation and then to paid conversion.

Sensor Tower data shows that after upgrading the "Motion Control" feature, Kling's downloads surged, with daily revenue peaking on January 2, soaring by 150% compared to mid-December, indicating a significant increase in user willingness to pay.

Furthermore, Kuaishou's B-end influence continues to expand. Gai Kun stated that over 30,000 enterprises and developers have integrated Kling's API; Kling has also entered the film and television production sector, collaborating with Xingmang Short Drama to release the world's first AI microfilm and launching China's first AIGC original fantasy micro short drama.

Secondly, AI is driving Kuaishou's "internal and external circulation" flywheels to spin faster.

In terms of internal circulation, AI continuously optimizes the advertising placement structure for Kuaishou merchants. In the third quarter of 2025, the internal circulation consumption of Kuaishou's site-wide promotion products increased to 65%, with small and medium-sized merchants' placements growing by over 30% year-on-year in the first quarter of last year, indicating a more decentralized advertising base for Kuaishou and bringing new elasticity to its advertising business.

In terms of external circulation, AI technology enhances the advertising placement effectiveness for external merchants. In the third quarter of 2025, Kuaishou's online marketing business revenue reached RMB 20.1 billion, up 14% year-on-year; daily active and monthly active users reached 401 million and 736 million, respectively, up 4.8% and 5.0% year-on-year.

Thanks to intelligent models like OneRec and G4RL, AI extends from recommendation to material generation, placement rhythm, and user reach, increasing Kuaishou's advertising consumption by 4-5%, with AIGC materials contributing over RMB 3 billion; advertisers using AI materials see conversion efficiency 10-20% higher than the industry average.

Currently, Kuaishou is gradually validating the feasibility of reshaping its growth path with AI. As Kling accelerates technology monetization, Kuaishou has forged a path distinct from traditional internet platforms—an "AI-native content ecosystem."

03 Pressure of "Laotie's" Transformation

However, beneath the feast, currents swirl. Recent high-level changes at Kuaishou have raised external concerns.

Zhou Guorui, Kuaishou's Vice President and head of foundational large models and recommendation models, was reported to have left in late 2025; in August last year, Zhang Di, former Vice President of Kuaishou and technical leader of Kling AI, announced his departure.

Since Cheng Yixiao officially took over as chairman and fully led Kuaishou's strategic direction three years ago, over ten core AI executives have left the company, covering key areas such as multimodal and algorithmic recommendations.

On one hand is the core strategy of "AI first," and on the other, the successive departures of AI executives reflect the contradiction behind Kuaishou's transformation—how to balance commercial narratives with technological ideals.

In recent years, Kuaishou has aggressively advanced AI. Gai Kun has repeatedly emphasized the importance of "timing" in interviews, believing that AI is a resource-constrained competition—entering too early means burning money wastefully, while entering too late means losing the advantage.

When this strategic "urgency" permeates the company, it inevitably brings pressures such as resource allocation, short-term performance, and technological breakthroughs, leading to disagreements between the core team and executives.

However, a deeper reason lies in the need to enhance synergy between Kling and Kuaishou's main business.

Improvements in Kuaishou's operational data are one aspect, but in the long run, whether Kling can truly integrate into the "Laotie" ecosystem is key to determining whether Kuaishou's AI narrative can move from "fiction" to "reality."

According to Gai Kun, most of Kling's current paying users are overseas, including film studios, marketers, and social media influencers; Kuaishou revealed in the first quarter of last year that 70% of Kling's revenue comes from the P-end (creator end). It is evident that Kling's current user base mainly consists of high-paying clients with demanding video quality needs.

However, in the domestic market, Kuaishou's core users are in the lower-tier markets (lower-tier markets), where "Laoties" demand AI that is "fast, cheap, and convenient," with higher price sensitivity. Therefore, while Kling dominates overseas markets, domestic users have yet to fully adopt it.

The "cultural" differences between domestic and overseas markets extend beyond user habits to policy and ethical boundaries. In January this year, relevant authorities launched a month-long special governance campaign against "AI-altered" videos.

Kuaishou is also aware of this sense of detachment. While pursuing AI's "future," it has accelerated its layout (layout) of the "present," such as launching "Quanquan" to tap into the household services market, collaborating with Meituan on offline business layout (layout), and exploring the consumer finance sector.

Indeed, Kuaishou's AI story is captivating, but no matter how appealing the story is, Kuaishou must still prioritize performance pressures.

Over the past two years, Kuaishou's revenue growth has gradually slowed. Although the year-on-year growth rate saw a slight rebound in 2025, it remained below 15%, slower than in 2024.

Therefore, while Kling has brought Kuaishou a vast imagination space, the current Kling may not be the "final answer" Kuaishou seeks.

For Kuaishou to truly evolve from an internet content platform to a technology-driven content and commercial ecosystem, the key is not whether Kling shines brightly enough but whether its light can truly illuminate the Kuaishou ecosystem, creating a more efficient and sustainable content business.

Kling must become "Kuaishou's Kling" to unleash its maximum value.

The copyright of the article's cover image and accompanying pictures belongs to the respective copyright owners. If the copyright holders deem their works unsuitable for public browsing or free use, please contact us promptly, and our platform will make immediate corrections.