Why Are Car Companies Embracing the 'Seven-Year Low-Interest Loan' Trend?

![]() 01/23 2026

01/23 2026

![]() 327

327

In early 2026, driving away a Tesla Model 3 with a monthly payment of just 1,918 yuan or a Xiaomi SU7 with a mere 50,000 yuan down payment is no longer a mere promotional gimmick. It is a vivid illustration of the intense financial competition unfolding in China's auto market. A stealthy 'battle' waged through financial instruments is quietly reshaping the way people purchase cars.

The Tesla Model 3 can now be acquired with a down payment starting at 79,900 yuan and monthly installments of only 1,918 yuan, translating to a daily cost of just 63 yuan. Since its launch on January 6, 2026, this financing plan has sparked a domino effect.

Within a mere half-month, brands like Xiaomi, Li Auto, XPeng, Dongfeng eπ, and Geely Galaxy have jumped on the bandwagon, introducing similar seven-year low-interest car financing policies.

Financial tools are emerging as the new weapon of choice for automakers to woo consumers, replacing traditional price wars. The core features of these policies are largely uniform—low down payments, reduced interest rates, and extended loan terms of up to seven years.

From Price Competition to Financial Competition?

The concentrated rollout of seven-year low-interest policies by automakers stems from a confluence of factors. The auto market faced significant headwinds at the start of the year, with national passenger vehicle retail sales plummeting by 28% year-on-year from January 1 to 18, 2026, and new energy vehicle retail sales declining by 16% over the same period.

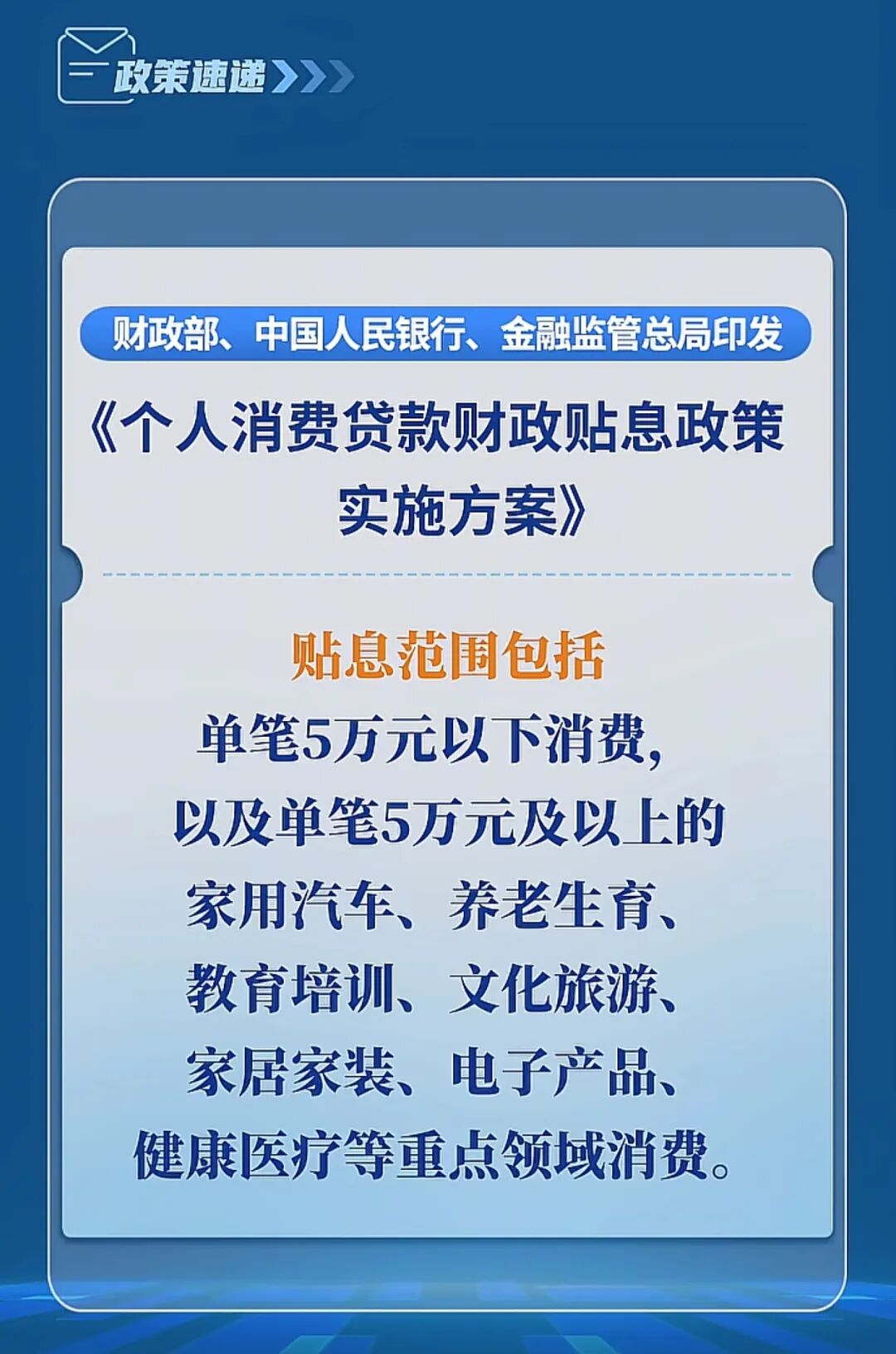

Meanwhile, national policy support has created a conducive environment for automakers to implement low-interest policies. In August 2025, the Ministry of Finance, the People's Bank of China, and the Financial Regulatory Bureau jointly unveiled the 'Implementation Plan for Fiscal Interest Subsidy Policies on Personal Consumer Loans.'

The policy stipulates that from September 1, 2025, to August 31, 2026, personal consumer loans actually used for consumption may qualify for interest subsidies, with home automobile purchases of 50,000 yuan or more per transaction identified as a key supported area.

For banks, the imperative to expand high-quality loan businesses is also a driving force behind this policy. With regulatory efforts to standardize 'high-interest, high-rebate' models, banks are seeking new avenues for growth.

Tesla, the instigator of this financial war, has its seven-year low-interest policy viewed by industry observers as a meticulously crafted industry shakeup. Through this strategy, Tesla precisely targets the vulnerabilities of several competitors.

Firstly, this policy directly challenges the premium pricing power of traditional luxury brands. For a budget of around 300,000 yuan, the monthly payment for a comparable BMW SUV approaches 4,000 yuan, while the seven-year low-interest monthly payment for a Tesla Model Y is only 2,263 yuan. The stark contrast in financial costs renders brand premiums ineffective on paper.

For emerging brands, Tesla's financial strategy strikes at their financial fragility. According to third-quarter 2025 financial reports, XPeng Motors reported a gross margin of 13.1%, while Li Auto incurred its first quarterly loss.

Faced with Tesla's seven-year low-interest policy, emerging brands find themselves in a quandary: following suit would see interest subsidy costs directly erode their meager profits, while not doing so could lead to further declines in sales.

Consumers Are Not Guaranteed a Win

The most direct beneficiaries of the seven-year low-interest policies are consumers, particularly young individuals and budget-conscious families. Loan-based consumption has become a mainstream trend among the younger generation, and long-term low-interest policies align seamlessly with this trend.

Improved efficiency in capital utilization is another significant advantage. Most automakers' seven-year low-interest plans offer annualized interest rates as low as 0.98%, significantly lower than the conventional market rates of 4%-8% for auto loans.

However, these policies also harbor hidden risks. The technological update cycle for smart electric vehicles is typically only 3-5 years, meaning that over seven years, new technologies such as solid-state batteries and advanced autonomous driving systems could become widespread, rendering currently purchased models quickly obsolete.

The three-year residual value rate for new energy vehicles generally hovers around 50%, with the seven-year residual value potentially dropping below 30% of the original price. Some models may even experience negative equity, where the vehicle's value falls below the remaining loan balance.

Consumers planning to sell their vehicles before paying off the loan should pay special attention to the relevant procedures and potential costs. The most straightforward approach is to settle the loan early, but this may involve paying a penalty of 1-5% of the remaining principal, details that are often not prominently displayed in manufacturers' promotional materials. Therefore, consumers must inquire thoroughly before purchasing.

For example, with a remaining loan balance of 100,000 yuan, the penalty could reach up to 5,000 yuan. To apply for early repayment, consumers need to submit a request to the financial institution, pay the remaining principal and any applicable penalties, obtain a 'Loan Settlement Certificate,' and finally visit the vehicle registration authority to release the lien.

However, as policies continue to evolve, the new 'lien transfer with loan' policy offers greater convenience for consumers. Nevertheless, for most car buyers, the prospect of purchasing a used vehicle still 'carrying' a loan is difficult to accept.

Industry observers predict that as this financial war intensifies, the competitive landscape of the automotive industry will undergo profound changes. Not all brands possess the capacity to offer similar financial plans, which will further accelerate the concentration of purchases toward 'larger' brands and models.