Scavenging Leftovers and Court Rich Partners! Is Oracle Fighting for Survival?

![]() 01/23 2026

01/23 2026

![]() 494

494

Previously, Dolphin Research covered CoreWeave, a rising star in the AI-era cloud market, as a shadow case study for the U.S. IaaS industry. This time, we turn our attention to a more pivotal player in the new cloud landscape—Oracle, one of OpenAI's primary partners.

As our inaugural coverage, Dolphin Research will focus on the following questions:

1) A concise overview of Oracle's development history, tracing how a 50-year-old company evolved into a new cloud services powerhouse;

2) Clarifying Oracle's business and revenue composition to identify key drivers of performance;

3) Unpacking the 'tipping point'—what the $300 billion deal signifies and where it originates;

4) After replacing Microsoft as OpenAI's primary partner, what has Oracle gained and lost? What motivates this high-stakes gamble, and what are its implications?

Below is a detailed analysis.

I. The Past and Present of a 50-Year-Old Company

1.1 Development History: From Databases – Enterprise Management Software – Cloud

As a prelude, let's briefly review how Oracle, a '50-year-old company,' transitioned from a traditional software firm to an AI cloud giant, now second only to the three major players, with significant market and industry influence:

a. Database Era (1977–1990s): In its early years, Oracle's business was relatively singular, focusing on database management systems, primarily relational databases (RDBMS) combined with SQL retrieval (as seen today). This laid the foundation for databases as Oracle's core and strongest business, gradually making it the market leader in the U.S. database industry.

b. Diversification—Software First, Then Hardware (1990s–2009): After establishing itself in core database operations, Oracle began diversifying its business in the 1990s.

First, it entered enterprise management software, including ERP (resource management), CRM (customer relations), HCM (human resources), and other management tools. During the early diversification phase (1990s–2000), Oracle primarily relied on internal development, creating prototypes for software like Oracle E-Business Suite.

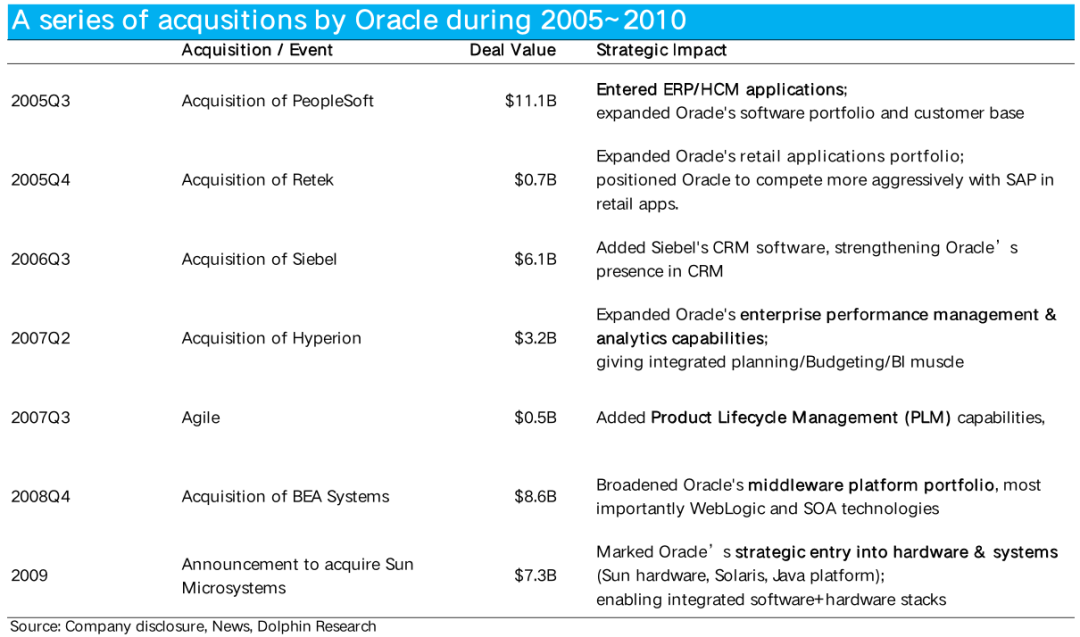

However, from 2003–2009 (after recovering from the dot-com bubble), Oracle shifted to external acquisitions, strategically buying leading companies in each enterprise software segment (see table below for details).

Through these acquisitions, Oracle rapidly strengthened its technical capabilities and business scale in enterprise management software, becoming the second-largest player after SAP.

The final major acquisition in this phase—Sun Microsystems—helped Oracle further expand from software services into hardware and operating systems.

c. Integration Era (2010–2015): After acquiring Sun in 2010, Oracle shifted its focus to integrating and streamlining its existing and acquired businesses. It evolved from offering standalone services to providing comprehensive solutions spanning underlying hardware to end-user applications.

By this point, Oracle had largely completed its vertical integration, covering hardware, foundational software services (e.g., databases and operating systems), and end-user applications.

d. Early Cloud Transition Struggles (2012–2022): Amid the broader industry shift from traditional on-premise software to cloud, Oracle was initially skeptical, only belatedly starting its cloud transition in 2012.

Oracle's cloud journey occurred in two phases. The first phase (2012) involved SaaS-ifying its software services, launching Oracle Cloud Application (OCA).

It also introduced early IaaS services (Cloud 1.0), but due to technological backwardness, these failed to gain market traction.

The second phase began in 2016 with the launch of Cloud 2.0, later renamed Oracle Cloud Infrastructure (OCI). This included BareMetal (bare-metal hardware) offerings and integrating its flagship Autonomous Database into OCI, marking its true entry into the IaaS cloud services sector.

However, OCI's early progress was sluggish. By FY2022 (ending May 2022), cloud revenue (SaaS + IaaS) accounted for just 25% of total revenue, with OCI contributing only ~7%. It remained a minor player in the cloud services industry.

e. New Cloud Era in AI (2023–Present): Only by late 2022 (FY2023) did Oracle's OCI business begin to grow rapidly, fueled by the AI boom's surge in computing demand.

The September 2025 announcement of a $300 billion deal with OpenAI and other clients catapulted Oracle into a critical position in the AI + cloud services ecosystem and investment narrative.

(Note: In early FY2023, Oracle made a major acquisition—Cerner, a leading healthcare software company—boosting total revenue by ~14% and accelerating growth that year. Excluding this impact, organic revenue growth remained low single-digit.)

1.2 IaaS Business—OCI: The 'Biggest' and 'Only' Bright Spot

Above, we briefly reviewed Oracle's transformation from a traditional database and software company to one of the most closely watched cloud services providers.

As cloud operations became Oracle's primary revenue growth engine, the company restructured its revenue/business segment disclosures starting in FY2026 (August 2025).

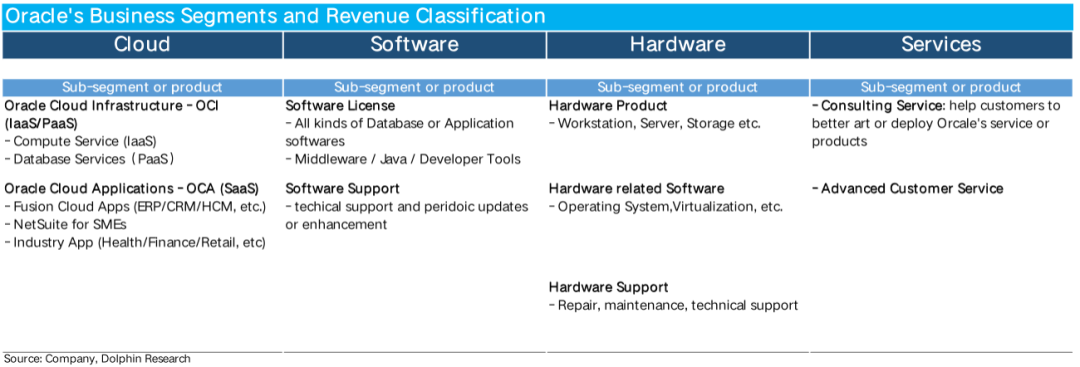

The key change was separating cloud operations into a standalone segment, resulting in four clearer divisions: Cloud, Software, Hardware, and Services, enabling better tracking of cloud growth.

Based on these four segments, here's a brief overview of Oracle's business composition:

a. Cloud Business: Currently the most critical segment, further divided into IaaS (OCI) and SaaS (OCA) lines.

OCA includes SaaS-based ERP/CRM/HCM and other general management tools, along with vertical industry solutions. OCI focuses on Oracle's signature database services and computing power leasing.

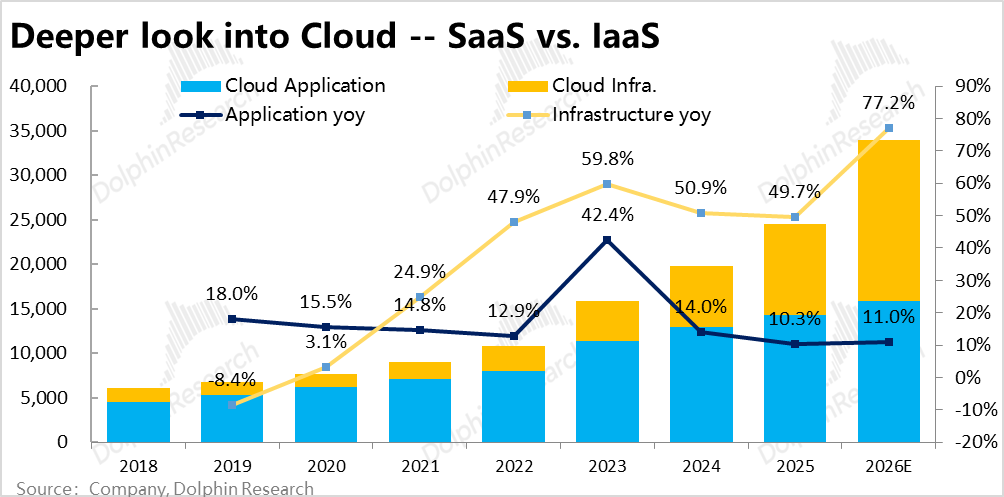

Historically, OCA dominated the cloud segment (70–80%), but OCI's share has surpassed OCA in the past 1–2 years due to rapid growth.

b. Software: Traditional on-premise software deployed and managed by customers. Once Oracle's largest revenue segment, it has been overtaken by cloud operations (declining from over 60% to under 40%).

It comprises two main parts: one-time software license sales and recurring support services (e.g., updates, maintenance). Support revenue typically exceeds license sales by 3–4x.

c. Hardware: Similar to software, it includes one-time hardware (e.g., servers) sales and recurring maintenance/support. It contributes the least revenue, now around 5%.

d. Services: Other non-hardware/software services, including consulting on deploying Oracle's offerings and custom services, accounting for a high single-digit percentage of annual revenue in recent years.

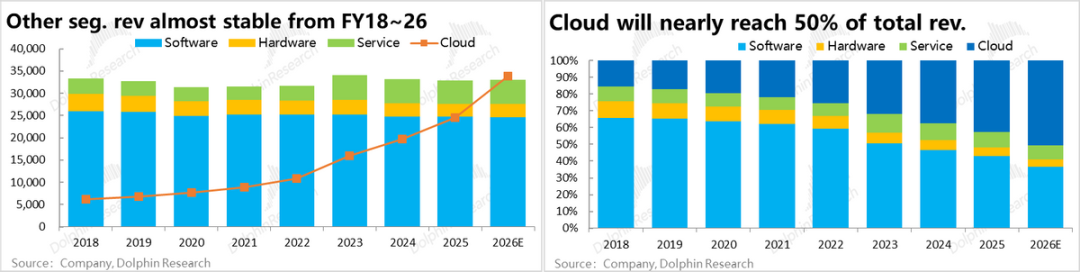

Based on FY2026's new classification, we reclassified Oracle's historical revenue. From FY2018 to FY2026 (forecast), revenue growth by segment shows:

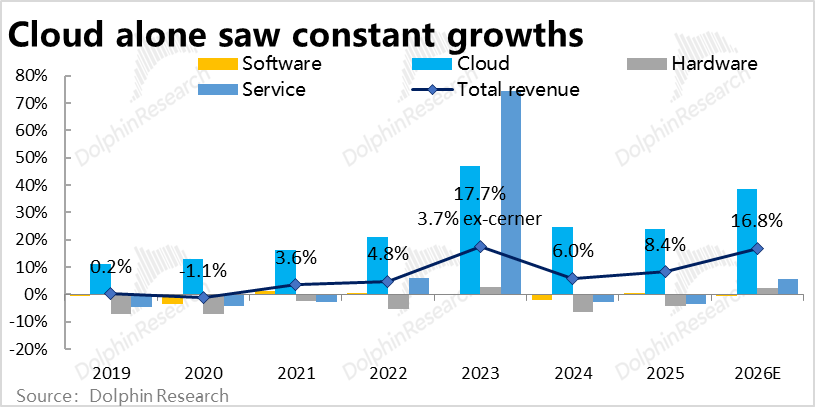

a. Since FY2018, Oracle's non-cloud traditional businesses (software, hardware, services) have stagnated, often dipping into negative growth (even post-AI boom).

Annual revenue hovered between $30–35 billion over nine years. Dragged by traditional businesses, total revenue growth remained low single-digit from FY2018–2024 (excluding acquisition impacts in FY2023).

b. Cloud operations have been Oracle's sole revenue growth driver in recent years, contributing over half of total revenue by FY2026 and becoming the largest and fastest-growing core business.

c. Further analysis reveals that OCA, the larger cloud segment historically, has seen weak growth (<20%) since FY2018, decelerating annually (except FY2023 due to acquisitions), dragging overall cloud growth.

The true driver of Oracle's cloud and total revenue growth is OCI under IaaS. As shown below, OCI's revenue has sustained ~50%+ annual growth since FY2022.

With OCI's rapid expansion surpassing OCA, it has propelled cloud and corporate revenue growth. Fueled by AI demand and OpenAI partnerships, OCI is poised for continued high-speed growth.

II. The Decisive Factor—OCI

Our review shows Oracle's traditional software core has declined for years, while its cloud SaaS business has seen modest growth. Nearly all growth now hinges on IaaS (OCI).

Thus, subsequent analysis focuses solely on cloud operations (especially OCI), omitting traditional businesses.

2.1 Tipping Point—The $300 Billion Mega-Deal

Oracle's F1Q26 earnings call featured a bombshell announcement: ~$300 billion in new demand contracts signed that quarter, equivalent to 5.8x FY2025's total revenue or ~2.4x the $138 billion backlog at F4Q25's end.

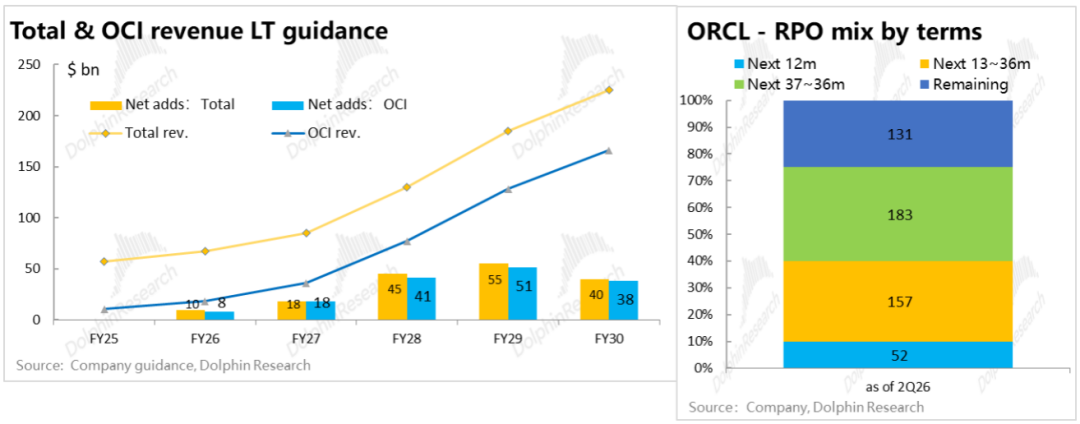

Oracle also provided rare multi-year guidance through FY2030, later revised upward in analyst meetings. Current guidance:

a. Total Revenue: Growing from ~$57 billion in FY2025 to $225 billion in FY2030, a 31% CAGR over five years;

b. OCI Revenue: OCI, the core driver, will grow from ~$10 billion in FY2025 to $166 billion in FY2030, a ~16x increase over five years, with acceleration starting in FY2028;

c. OCI-Driven Growth: From FY2027–2030, 90–100% of annual total revenue growth will come from OCI.

In other words, OCI will continue to single-handedly drive Oracle's growth in the foreseeable future, suggesting minimal growth in SaaS and non-cloud businesses during the guidance period.

The latest RPO (remaining performance obligations) reflects amounts to be recognized over time (divided into four intervals: next 12 months, 13–24 months, etc.), roughly aligning with revenue guidance for FY2026, FY2027–28, and FY2029–30. Key observations:

a. Oracle mentioned Cloud RPO accounts for ~95% of total RPO. Given flat SaaS (OCA) revenue guidance, RPO beyond 12 months can be roughly attributed to OCI.

b. For FY2026–28, expected OCI revenue is fully covered by existing RPO, indicating high certainty.

However, post-FY2029, current RPO covers only ~62% of expected OCI revenue, leaving a ~$110 billion gap over two years. Oracle must secure more large deals to meet guidance (implying strong confidence in future prospects).

2.2 Where does the Hundred-Billion-Dollar Contract Come From?

So where does this 'suddenly appearing' $300 billion+ order come from? The simple answer is that the market currently consensus is that the vast majority of this large order still comes from a single customer, OpenAI. A more detailed look:

a. Hundred-billion-dollar orders have long been expected: Prior to the 1Q26 earnings announcement, Oracle had already announced a cloud services order worth approximately $30 billion annually with a certain customer starting from FY28 (mid-2027 in the natural year), but did not disclose the contract duration or total amount.

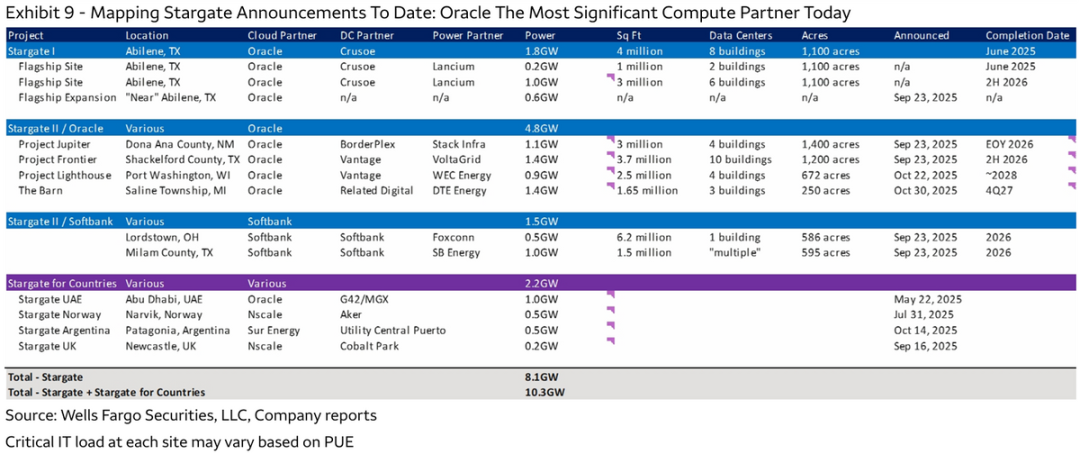

Combined with OpenAI's announcement on July 22nd of a new batch of computing power supply agreements with Oracle under the Stargate framework, adding approximately 4.5GW in scale, namely the four projects in Stargate II in the table below, the market therefore believes that this $30 billion annual order corresponds to the Stargate II project, and with a five-year contract period, it is expected that RPO will increase by approximately $150 billion quarter-on-quarter in F1Q26.

b. Actual order scale doubles: However, the actual quarter-on-quarter increase in RPO in 1Q26 was over $300 billion, double the initially expected scale.

This greatly exceeded everyone's expectations but also brought a new question: where did the extra $150 billion order come from? Since the company's official statement in the F1Q26 announcement was that 'the new orders this quarter came from three different customers,' the market once tried to find out who the other two major customers besides OpenAI were, but to no avail.

Currently, the market understands that the vast majority of the $300 billion+ order still comes from OpenAI alone. The difference from before is that the cloud services contract actually signed between OpenAI and Oracle is actually $60 billion annually, for a period of five years starting from the natural year 2027.

Therefore, in simple terms, the net increase in RPO doubling from $150 billion to $300 billion is most likely not because Oracle found other customers comparable in size to OpenAI, but because the scale of OpenAI's order doubled compared to the previously announced amount.

2.3 A 'Substitute' for Microsoft and a Larger Version of CoreWeave?

1) Replacing Microsoft as OpenAI's Largest Partner

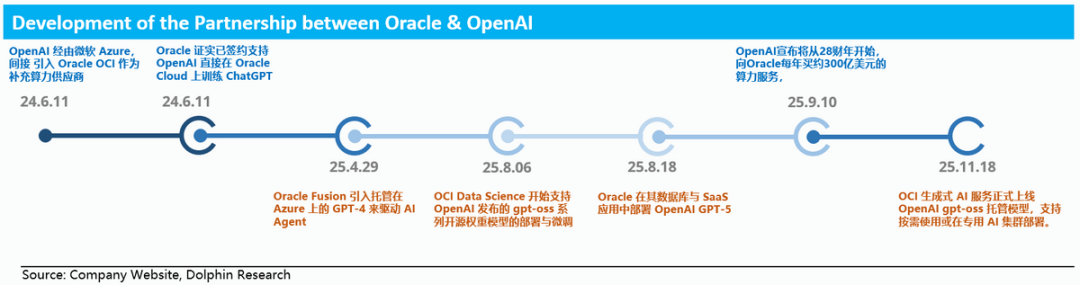

There have actually been signs of cooperation between OpenAI and Oracle for a long time. In June 2024 (when Microsoft still had the exclusive right to provide computing power to OpenAI), Oracle had already, as a 'subcontractor,' obtained an order to provide computing power to OpenAI through Microsoft, the 'main contractor.' (Similarly, Microsoft had previously outsourced some of its demand to CoreWeave due to supply constraints.)

In January 2025, Microsoft and OpenAI renegotiated their contract, with Microsoft voluntarily giving up its exclusive right to provide computing power to OpenAI, essentially because Microsoft was unwilling to bear the risks of excessive customer concentration and overinvestment in OpenAI's 'dream.' Subsequently, Oracle replaced Microsoft as one of OpenAI's primary cloud services partners.

Moreover, the cooperative relationship between Oracle & OPENAI is very similar to the previous relationship between OPENAI & Microsoft. Oracle not only generates revenue by providing computing power to OPENAI but also relies on the latter's technological capabilities to strengthen its own weakness of being unable to independently develop large models.

According to reports, Oracle has also integrated OPENAI's AI capabilities into its own Fusion SaaS software, databases, and other services, and can begin selling pre-deployed GPT model services to customers within OCI.

2) Taking What Microsoft Doesn't Want? Is Oracle's Deal Really a Good One?

However, as the market says, 'What Oracle gets from OpenAI is what Microsoft doesn't want'—that is, low-value business. While Oracle has gained two benefits from its cooperation with OpenAI—a massive order volume and enhanced AI capabilities—it also bears considerable risks.

From this perspective, Oracle resembles another emerging AI cloud player, CoreWeave, studied by Dolphin Research. Specifically, the potential risks include:

a. Highly Concentrated Customer Structure: Based on Oracle's contract volume with OpenAI of $300 billion (possibly more), it accounts for approximately 58% of the company's current total RPO. Although not as severe as CoreWeave, and with approximately $60 billion in new orders in 2Q26 reportedly coming from two new customers, Meta and Nvidia, the issue of highly concentrated customers still exists.

b. Relatively Weak Technological Capabilities: Similar to CoreWeave, Dolphin Research believes that Oracle's software/technological capabilities are not strong, at least compared to the traditional three major cloud providers. Therefore, its bargaining power with customers is not high, or it cannot significantly improve the profitability of its business through value-added services such as software.

This is evident from the fact that most of the computing power leasing currently provided by the company is in BareMetal mode; historically, the company's early IaaS services (Cloud 1.0) failed due to relatively backward technology. Before the AI wave, the growth of the company's IaaS business had been lukewarm; these situations all reflect this issue.

c. Although better than CoreWeave, the profit margin of the AI cloud business is still not high: It is a market consensus that the profit margins of AI cloud services are generally lower than traditional businesses (due to the high cost of the latest GPUs and other equipment). For Oracle, which primarily relies on BareMetal with relatively low added value and is highly dependent on a single customer, OpenAI, with low bargaining power, the pressure on gross profit margins will naturally not be small.

The market once believed that Oracle's AI cloud business had a gross profit margin of less than 20% (assuming Oracle's computing power utilization rate was only 60%-90%). However, at an investor conference in October, the company officially guided that the gross profit margin of the AI cloud would be between 30%-40%. Referring to CoreWeave's gross profit margin of approximately 25%-30%, we believe the company's guidance is generally credible.

Oracle's profit pressure in the AI cloud is not as great as CoreWeave's, and it will not be 'struggling at the break-even point,' but it is still a significant decline compared to its original gross profit margin of 70%-80%.

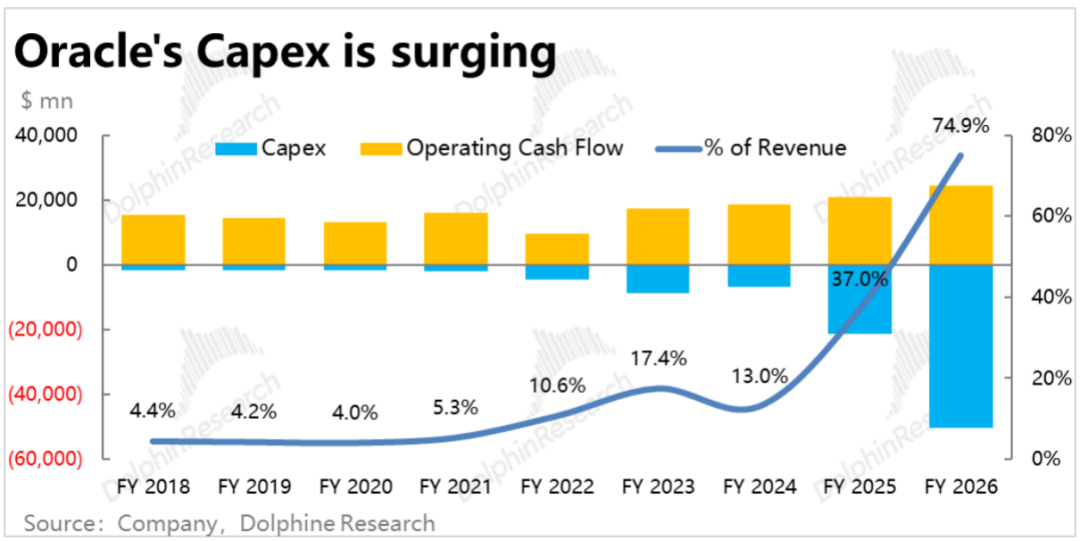

d. Significant Capex and debt pressure, with the peak yet to come: Similarly, similar to CoreWeave's situation, the pressure brought by large-scale new data center construction on Oracle's cash flow and debt is enormous.

According to the company's latest guidance, the total Capex for FY26 is expected to double to $50 billion, equivalent to 75% of the expected total revenue for the year and more than twice the expected operating cash flow. Such a huge cash flow gap will either consume existing cash reserves or require debt financing.

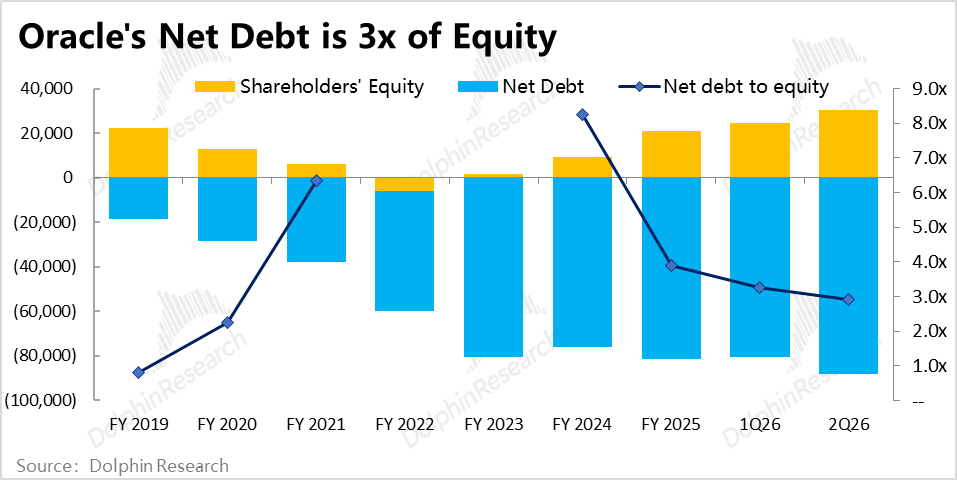

However, due to some historical reasons, the company's cash reserves are quite limited, less than $20 billion as of 2Q26, and its current net debt is nearly three times its shareholders' equity, with the true peak of Capex and debt issuance yet to come.

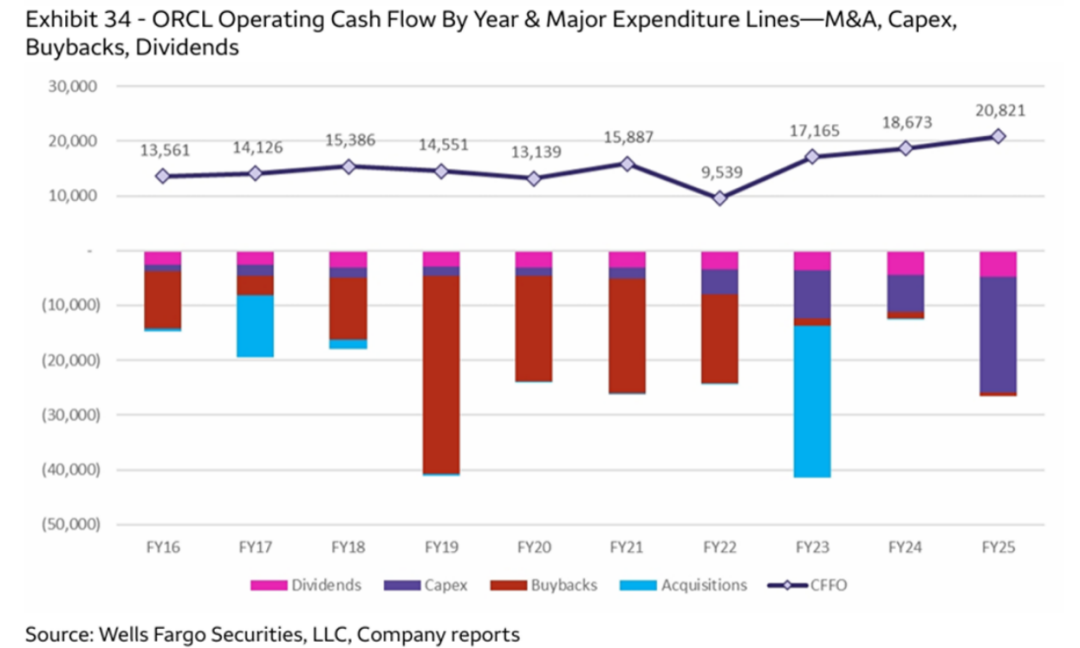

For more than a decade, Oracle has adopted the philosophy of 'operating on debt.' As seen in the figure below, since FY16, the company's cash expenditures have almost every year exceeded its operating cash flow, primarily used for massive repurchases and external acquisitions in the early years, and will mainly be used for Capex in the future.

Moreover, as mentioned earlier, Oracle's existing data center construction plan will reach its peak production capacity starting from FY28, meaning the company's Capex investment peak will begin around FY27.

In other words, the real stress test for the company's cash flow gap and debt has not yet arrived, but the company's current balance sheet structure is already not healthy. If a black swan crisis occurs, Oracle truly risks insolvency and shareholders' equity falling to zero.

III. Conclusion: Coexistence of Great Opportunities and Risks

Through the analysis in this article, Dolphin Research's key judgments on Oracle are:

a. Traditional businesses offer no highlight (literal translation: no highlights; meaning: no significant growth prospects), OCI is not 'icing on the cake' but 'a fight for survival.' Whether from past performance or the company's own guidance, except for the IaaS-type OCI business, all other businesses of the company have entered a mature or even declining phase with little to no growth. (SaaS cloud still has slight growth, while non-cloud has been in negative growth for many years.)

Therefore, for Oracle, OCI is not something that would be nice to achieve but not a big deal if it fails. OCI must succeed; otherwise, the company will become a traditional software company with little to no growth, constantly at risk of being revolutionized by AI, and 'waiting to die.'

Because OCI means survival if successful and failure if not, Oracle is so proactive in its cooperation with OpenAI and is willing to bear the enormous risk of 'possible overinvestment in AI computing power' for the latter.

b. A 'Larger CoreWeave' with all its problems: Although Oracle is much larger in scale than CoreWeave, its essential positioning is similar—a supply chain-type company tied to OpenAI's ship, doing the 'hard work.'

Highly concentrated customers, low bargaining power, and low technological added value lead to low profits in the AI business; significant Capex investment and reliance on debt financing require bearing the enormous risk of possible insolvency. Oracle also has these problems.

c. As OpenAI's new close ally, there are both significant opportunities and risks: On the one hand, replacing Microsoft as OPENAI's primary partner has brought the company enormous potential revenue space, and even if other businesses do not grow, it is expected to drive a compound annual growth rate of total revenue as high as 31%.

On the other hand, the company's current RPO may also increase significantly further. Among the total 26GW cooperation intentions previously signed by OpenAI with chip companies such as Nvidia, AMD, and Broadcom, Oracle may 'get a share' as a cloud services operator. Additionally, the company may also receive new orders from customers such as Meta and xAI.

However, on the other hand, there is also a possible risk of 'intentional overreporting' in the over 30GW of computing power supply intentions already signed by OpenAI. The orders currently held by the company may not all be fulfilled and may become 'bad debts' left uncollected.

- END -

// Reprint Authorization

This article is an original piece by Dolphin Research. If you wish to reprint it, please obtain authorization.

// Disclaimer and General Disclosure Notice

This report is for general comprehensive data purposes only, intended for users of Dolphin Research and its affiliated institutions for general reading and data reference. It does not take into account the specific investment objectives, investment product preferences, risk tolerance, financial situation, or special needs of any person receiving this report. Investors must consult with independent professional advisors before making investment decisions based on this report. Any person making investment decisions using or referring to the content or information mentioned in this report does so at their own risk. Dolphin Research shall not be liable for any direct or indirect responsibilities or losses that may arise from using the data contained in this report. The information and data in this report are based on publicly available sources and are for reference purposes only. Dolphin Research strives for but does not guarantee the reliability, accuracy, and completeness of the relevant information and data.

The information or opinions mentioned in this report shall not, under any jurisdiction, be considered or construed as an offer to sell securities or an invitation to buy or sell securities, nor shall it constitute advice, solicitation, or recommendation regarding relevant securities or related financial instruments. The information, tools, and materials in this report are not intended for or proposed to be distributed to jurisdictions where the distribution, publication, provision, or use of such information, tools, and materials contradicts applicable laws or regulations or requires Dolphin Research and/or its subsidiaries or affiliated companies to comply with any registration or licensing requirements in such jurisdictions to citizens or residents of those jurisdictions.

This report only reflects the personal views, insights, and analytical methods of the relevant creators and does not represent the stance of Dolphin Research and/or its affiliated institutions.

This report is produced by Dolphin Research, and the copyright is solely owned by Dolphin Research. Without the prior written consent of Dolphin Research, no institution or individual may (i) make, copy, reproduce, duplicate, forward, or distribute in any form copies or reproductions in any way, and/or (ii) directly or indirectly redistribute or transfer them to other unauthorized persons. Dolphin Research reserves all related rights.