Is AI Turning Silver into Melted Metal?

![]() 01/26 2026

01/26 2026

![]() 339

339

On January 23, spot silver prices briefly soared past $99 per ounce, hitting yet another record peak.

Prior to this spike, silver prices had already surged nearly 150% in 2025, outpacing gains in other precious metals. Since the start of the year, silver prices have climbed over 30%. As silver continues its upward trajectory, discussions around its price surge have intensified. Interestingly, a growing number of people have started asking me for my perspective on this silver price rally. When I mention that I haven't been closely tracking it, some even send me memes with phrases like "you know what I mean" or "those in the know get it."

At first, I was puzzled. After all, my focus is on AI and technology, not finance or precious metals. Then I realized there's a widespread belief that the sharp rise in silver prices is being driven by the growing demand for AI and AI computing infrastructure, which is consuming vast amounts of silver. This new source of demand has disrupted the traditional supply-demand balance, leading to the price surge.

The underlying narrative seems to be that as long as AI continues to grow, silver prices will remain robust. But is this really the case? Are AI and data center infrastructure truly turning into silver furnaces?

AI is indeed consuming more silver, and tracing the origins of this narrative often leads back to reports from the World Silver Association.

For instance, in its report titled "Silver: The Next-Generation Metal," the association argues that solar photovoltaics, electric vehicles, and AI are the three pillars driving silver demand growth. The continued expansion of these industries is making silver an indispensable element in driving global economic and technological transformation.

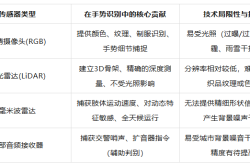

Breaking down how AI consumes silver, we can identify two main areas. First is the semiconductor sector, particularly the demand for silver in chip packaging. Silver, with its exceptional electrical conductivity, is widely used across various industrial sectors, especially in semiconductors. AI development relies heavily on specialized computing hardware like GPUs, TPUs, and NPUs, which require high-performance semiconductors like silver in their packaging.

Beyond chips, the more critical area where AI consumes silver is in the assembly of AI servers and data centers. Silver’s high electrical conductivity, thermal conductivity, and corrosion resistance make it an ideal metal for stable and well-cooled AI computing facilities. It is widely used in server and data center networks, cooling modules, and other components. As AI servers strive for higher computing efficiency and better cooling performance, silver has surpassed metals like copper as the preferred choice for high-end servers and data centers. For example, an NVIDIA H100 server contains 1.2 kilograms of silver, far exceeding the roughly 0.5 kilograms used in traditional servers.

Following these two AI-driven silver consumption scenarios, the next well-known fact is the expanding scale of AI computing power. Data shows that global data center construction has accelerated 11-fold since 2000. Initiatives like the U.S.'s "Stargate" and China's "New Infrastructure" will continue to invest heavily in AI-related data center construction. This means the scale of AI chip, server, and data center construction will keep growing, leading to a continued increase in silver consumption. Since silver is a precious metal with a relatively stable mining output, its global supply-demand gap is likely to widen due to AI demand.

Thus, the narrative of "AI melting silver" seems straightforward and convincing. But is this the whole truth?

When we delve deeper into the seemingly clear logic that "AI is driving up silver prices," we uncover some inconsistencies.

The first question is: How significant is AI as a silver consumer? While AI computing cards and servers are already substantial, can they really consume that much silver? According to data from the World Silver Association, AI-related silver demand surged by 30% in 2025, with annual usage exceeding 1,000 tons. However, this accounts for only 3%–6% of global silver demand. While this is a notable share, it seems somewhat tenuous to claim that AI is the primary driver of silver price increases given these limitations and modest growth.

Another point of contention is that silver is not irreplaceable in many AI applications. For instance, many manufacturers are promoting the use of copper instead of silver in AI servers and mid-to-low-end AI chips. While copper has inferior electrical and thermal conductivity compared to silver, its cost advantage is significant. As AI infrastructure shifts from large-scale deployment to optimizing computing efficiency, replacing silver with copper has become a key topic in AI infrastructure construction.

Additionally, the rise of optical modules and accelerated technological iteration in recent years are visible trends. In short-distance transmission within data centers, the use of optical modules instead of silver cables is maturing, meaning silver will lose another significant AI-related consumption scenario. Silver’s use in AI-related fields is only truly irreplaceable in high-end electronic packaging and specialized cooling applications, where consumption is relatively limited.

The issue with the narrative that AI will permanently drive up silver prices is that it requires piecing together too many assumptions to form a complete logical chain, yet many of these assumptions are vulnerable to challenge.

For example, some argue that while AI’s share of silver consumption is small, its rapid growth will disrupt the supply-demand balance. But will AI computing infrastructure continue to expand indefinitely? With ongoing optimization of model costs and stabilizing computing demand, this premise may not hold.

Others claim that silver’s irreplaceability in AI applications will make it a long-term driver of prices. However, there are many alternatives to silver in AI scenarios, making this argument difficult to sustain.

Some also argue that AI, along with photovoltaics and new energy vehicles, forms the "three pillars" of industrial silver demand growth, ultimately driving up prices. But this may involve numerous details from other fields and risks attributing everything to whatever is currently popular.

In short, the narrative of AI becoming a silver black hole relies on a series of inferences to hold up, and stories like this often conclude differently than the public imagines.

Discussing AI and silver serves as a gateway to a recurring, outdated narrative: that our enthusiastic development of AI is consuming natural resources and even harming the environment.

To date, this story has many branches. Let’s briefly review a few.

The first is the tale of "AI competing for electricity." Many media reports and data analyses link AI development to excessive electricity consumption. For example, a recent U.S. data report suggested that data centers could consume 8.6% of the nation’s electricity by 2035. This has led to discussions about AI competing with ordinary citizens for power resources.

The second story is "AI consuming water." Training large models requires vast amounts of water for liquid cooling, with ChatGPT alone using tens of thousands of tons. Reports indicate that global AI water consumption could exceed half of the UK’s annual water usage by 2027.

The third story, which we’re exploring here, is "AI consuming precious metals." AI servers and chips require significant amounts of copper and silver, while humanoid robots need large quantities of titanium. This has led to rising precious metal prices and environmental damage from mining, seemingly attributable to AI development.

The fourth story is "AI creating electronic waste." Some argue that AI drives large-scale hardware upgrades, leading to massive server retirements in data centers and constant replacement of consumer hardware like phones and computers by individual users. The generation of electronic waste is thus linked to AI technological advancement.

From this perspective, AI seems to be the natural enemy of the environment. But like the narrative of AI melting silver, similar stories often carry more complexity. For instance, AI’s electricity consumption is a well-known public concern, yet digital systems like AI account for only about 2% of global electricity usage while contributing 45%–58% of global GDP, with this share steadily rising. While AI model training consumes significant electricity, it also saves vast amounts in dark factories, AI healthcare, intelligent transportation, and smart photovoltaics. Moreover, AI’s energy efficiency issues are being addressed through model optimization and compression technologies.

Of course, the issue of AI consuming natural resources must be taken seriously. However, it’s worth noting that since the information revolution, humanity has increasingly relied on digital and intelligent advancements to reduce dependence on non-renewable resources.

It’s particularly noteworthy that narratives like "AI consuming silver" are often used in two contexts.

First, to inflate financial products tied to natural resources, such as precious metals and energy. Conventionally, these may seem unrelated to AI, but by framing AI as a resource consumer, they find renewed relevance in the modern era. If AI is the hottest trend, why shouldn’t silver and gold benefit from its popularity as much as semiconductors or robots?

Second, in the globally prevalent discourse of political correctness, anything labeled as resource-consuming seems to carry original sin, even if it’s an environmentally beneficial technology. This line of reasoning often devolves into double standards: when I’m ahead, AI is truly eco-friendly; when you’re ahead, we must guard against AI’s excessive environmental impact.

Between focusing on practical matters and getting caught up in narratives, it’s essential to maintain perspective.

From my limited perspective, the primary drivers of silver price increases are geopolitical factors and the global shift to low interest rates. While AI development plays a role, it’s hardly the main cause. In this scenario, both silver and AI are merely supporting actors. You could just as easily argue that carrots are driving tomato prices up or that aliens are fueling lizard people’s rise—the story can be twisted to fit.

Of course, everyone is entitled to their own opinion. We merely caution against letting seemingly plausible narratives interfere with rational judgment.

AI has already shouldered much blame; this silver pot is best left unclaimed.

The workload is too heavy; the model is struggling to keep up.