From Technological Hype to Tangible Value: Navigating the Second Half of the AI Large Model Race

![]() 01/26 2026

01/26 2026

![]() 453

453

The coming year is poised to witness deeper integration and innovation within the large model sector.

© Original content from TMT Planet · Author | Huang Yanhua

Recently, Alibaba's AI large model, Qianwen, hosted a product launch event in Hangzhou, drawing widespread attention from the industry.

At the event, Alibaba announced the full integration of Qianwen into various business sectors, including Taobao, Alipay, Gaode Maps, and Fliggy, aiming to create a seamless, closed-loop consumer experience.

At this juncture, Qianwen has transcended its role as a mere Q&A tool, evolving into an AI Agent. This transformation empowers users to shop, order food, and perform other tasks effortlessly through voice commands.

Towards the end of 2025, ByteDance and Nubia jointly unveiled the "Doubao AI Phone." This device boasts autonomous cross-application capabilities and has been lauded by numerous users as "a truly AI-powered phone."

Both the Doubao AI Phone and Alibaba's upgrade of Qianwen to integrate with Taobao's ecosystem reflect the intense competition in the large model sector in 2025.

From the emergence of DeepSeek at the beginning of the year, which ignited a nationwide AI large model application craze, to the relentless efforts of Alibaba, ByteDance, Baidu, and others throughout the year, and culminating in the rush by companies like Zhipu and MiniMax to go public and become the first AI large model stock by year-end, the once-vibrant scene of nearly 300 large models vying for dominance has gradually faded. Price wars, ecosystem battles, and struggles for commercialization have now fully commenced.

The development of large models is at a critical juncture, transitioning from "technological exuberance" to "value realization."

01

Chaos and Reshuffling: The Market Landscape Accelerates Transformation

In January 2025, DeepSeek released its R1 series of reasoning models, which not only impressed the industry with their cost-effective training but also made ordinary people realize that large models are no longer "artificial idiots" but genuine AI assistants in work and life. It set a new benchmark for consumer-grade AI large models, amassing 100 million users in just one week.

While DeepSeek disrupted the existing market equilibrium, it also acted as a catalyst, fully igniting the enthusiasm of C-end users. AI large models from ByteDance's Doubao and Tencent's Yuanbao soon followed suit, propelling the large model sector from a diverse landscape into a rapid reshuffling phase, with the industry structure shifting from fragmentation to concentration.

Backed by abundant resources and capital, the large model sector gradually formed a faction dominated by giants such as ByteDance, Alibaba, and Baidu. Leveraging their strengths in computing power, data, and ecosystems, they launched aggressive offensives, pushing industry competition to unprecedented heights.

In particular, ByteDance rapidly seized market share with its strategy of "superior models + competitive pricing + ease of implementation."

In December 2025, ByteDance released Doubao Large Model 1.8, optimized for multi-modal agent scenarios. Its tool-calling and complex instruction-following capabilities were significantly enhanced, achieving stellar results in various public evaluations for tasks such as visual reasoning and video understanding. Its overall performance approached that of the world's leading general-purpose models, boasting over 150 million monthly active users.

Yuanbao was deeply integrated into Tencent's business ecosystem, encompassing WeChat, QQ Browser, Tencent Maps, and Tencent Meeting, while also aggressively acquiring users through advertising.

According to China Business Journal, Tencent invested a staggering 1 billion yuan in advertising for the Yuanbao project in June and July 2025, underscoring its massive commitment to promoting AI products.

Baidu and Alibaba, on the other hand, focused on technological iteration and open-source strategies to bolster their core competitiveness.

In March 2025, Baidu released Wenxin Large Model 4.5 and Deep Thinking X1. The former outperformed GPT-4o in multi-modal capabilities, with API prices just a fraction (1%) of competitors', while the latter, as the first deep-thinking model capable of autonomously using tools, could seamlessly call upon various tools such as search and drawing.

Alibaba, centered around its open-source strategy, released the open-source Tongyi Qianwen Qwen series in April 2025, launching eight models with varying parameter scales simultaneously, with comprehensive upgrades in multi-modal and reasoning capabilities.

Subsequently, Alibaba's "1+6+N" restructuring became a thing of the past, with AI ascending to its top strategic priority. By the end of 2025, Qianwen had undergone further upgrades, evolving from a simple Q&A tool into the era of "AI-powered task completion."

The relentless investment by industry giants has accelerated the development of the large model sector while also fostering a differentiated market landscape.

On the one hand, large model companies lacking core technologies and R&D capabilities faced elimination;

On the other hand, previously highly regarded unicorns in the sector, such as Yuezhia'anmian, DeepSeek, and Jieyuexingchen, came under significant pressure. Some pivoted to industry-specific solutions, while others abandoned general-purpose large models to focus on niche domains, seeking breakthroughs through differentiation.

DeepSeek, backed by High-Flyer Quantitative, continuously iterated its models in 2025. The V3.1 version adopted a hybrid architecture, supporting both thinking and non-thinking modes, with core benchmark test performance improving by over 40%. It remained open-source under the MIT license, amassing a vast pool of developer resources while continuously pushing the technological envelope.

Zhipu, MiniMax, and Jieyuexingchen, while adhering to large model training, also placed unprecedented emphasis on commercialization, penetrating the C-end market through product ecosystems to forge unique competitiveness.

Industry analysts pointed out that with the advancement of AI technology, every application and industry will be reshaped by AI in the future, creating immense enterprise application demands. Investors and institutions are now more inclined to invest in innovative companies in AI applications, consumer applications, and AI infrastructure rather than those solely focused on underlying models.

Clearly, amid the accelerated reshuffling of the large model sector, some small and medium-sized players lacking funds or technical prowess are gradually being sidelined. Others, burdened by exorbitant computing costs and underwhelming commercialization, are forced to scale back their business lines, shifting from general-purpose large models to vertical domains. The "Matthew effect" in the industry is becoming more pronounced, with market resources accelerating their concentration towards the top players.

02

Cooling B-End Adoption, Heated C-End Competition

According to the "2025 China Large Model Industry Development Research Report" released by 36Kr Research Institute, the Chinese large model market size reached 29.426 billion yuan in 2024, with a year-on-year growth rate of 62%. It is expected to maintain a growth rate exceeding 50% from 2025 to 2026, with the market size surpassing 70 billion yuan by 2026, reflecting the transition of China's large model industry from the technological exploration phase to the commercialization and large-scale application phase.

Currently, large models can be broadly categorized into general-purpose large models and vertical large models. The former includes models like Doubao and Qianwen, while the latter is distinguished by application industries, such as Tuolesi in finance, Xueersi in education, and Zhiyun Health in healthcare.

Additionally, from the perspective of commercialization target users, general-purpose large models cater to a broad user base, encompassing both B-end enterprise users and C-end individual consumers, while vertical large models primarily target B-end enterprise users.

In B-end applications, most AI large models perform admirably in controlled environments but encounter challenges in reliability and standardization when deployed in real enterprise settings.

Take reliability, for instance. In scenarios like financial risk control and medical diagnosis, a mere 1% error can lead to vastly different or even catastrophic outcomes. Standardization, on the other hand, demands deep customization due to customer disparities, resulting in protracted delivery cycles and high costs, making it arduous to achieve economies of scale.

In contrast, large models exhibit diversified development in C-end applications. Companies like ByteDance, Alibaba, and Baidu have ramped up their investments in C-end applications, integrating them into various life scenarios such as office work, shopping, learning, food delivery, and health, providing users with services like intelligent dialogue, information query, and content creation, showcasing broader commercial prospects.

However, compared to the B-end, the C-end of AI large models generates more complex demands due to its vast user base. Different users may exhibit varying preferences or indifference towards a particular large model based on their needs.

According to TMT Planet's research, for programmers, ByteDance's Doubao may be more efficacious than DeepSeek or Kimi, while for graduate school applicants, Doubao may not be as beneficial as DeepSeek.

Figure/Douyin

Moreover, for certain users' specific needs, mainstream C-end application large models on the market may prove ineffective. Some netizens reported that neither DeepSeek, Doubao, nor GPT were useful for writing literature reviews.

Figure/Douyin

Clearly, facing the vast and more personalized demands of the C-end, AI large model products and companies focusing on the C-end need to allocate more resources and funds towards continuous rapid iteration to attract and retain users, gain greater initiative in fierce market competition, and lay the groundwork for commercial operations.

It is worth noting that while large model products are deeply integrated into users' daily lives, they also bring a series of challenges, such as data privacy, algorithmic bias, and liability determination, which can cause unexpected troubles or even catastrophic consequences during user operations.

TMT Planet observed that with the popularity of AI large models in C-end applications, a technique called Generative Engine Optimization (GEO), which involves content integration and structured data optimization in a generative AI environment, has gained traction. The goal of this technique is to enable AI to swiftly extract key information from content and prioritize brand content when generating answers, thereby achieving brand exposure or product conversion.

In this scenario, the content users obtain through AI large models, such as answers to questions or shopping recommendations, is no longer pristine. Instead, it may be deliberately optimized by merchants with strong marketing inclinations, directly influencing user decisions. For users who blindly trust AI and lack discernment, the consequences are unpredictable.

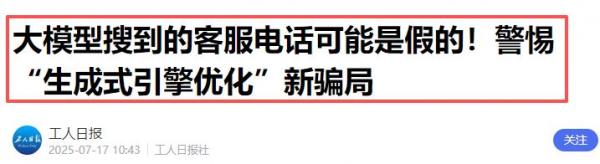

According to a previous report by Workers' Daily, some financial black and gray market organizations have interfered with large models to produce fake customer service phone numbers for financial institutions, leading some users to believe the incorrect numbers and fall victim to scams.

Figure/Internet

According to a report by IT Times, some merchants have exploited the lack of basic filtering and verification capabilities in large models by using structured knowledge "feeding" and scenario-based content design to subtly incorporate brand information into the models' responses, thereby increasing their exposure and driving traffic to their stores. This behavior disrupts the fair competition environment that should prevail in the GEO field, making it difficult for high-quality merchants to gain reasonable exposure based on their value and potentially becoming a breeding ground for fraud.

03

Rise of Intelligent Agents: Ecosystems Become Crucial

Despite the various challenges in the development of AI large models, it is undeniable that with the widespread adoption and application of technology, large models are deeply integrating into all facets of life. Through technological upgrades and capability enhancements, they have transformed from "dialogue machines" into "action partners (Agents)."

In the B-end market dominated by enterprise users, large model applications may enter a cooling-off period to address issues such as high costs, data element integration and protection, and the iteration and optimization of old workflows that arose during previous applications. During this process, feasible products with measurable commercial value will emerge, driving the large-scale implementation of large model technologies in vertical industries and initiating a journey of value ascension.

On the C-end, as internet giants like ByteDance, Alibaba, and Baidu continue to leverage their existing ecosystems to strengthen AI large model-based products and position themselves early as super app entrances in the AI era, competition in the large model sector will escalate from a comparison of single model capabilities to a contest of the completeness and openness of "ecosystems."

Northeast Securities pointed out in a related research report that the main trends for large models in 2026 will be continuous breakthroughs in multi-modal capabilities, long-text processing, multi-intelligent tool calling, and complex reasoning. For large companies like ByteDance and Alibaba, the focus will be on comprehensive layout in AI infrastructure, large models, and AI applications to construct deeper and broader "moats."

Zhou Hongyi, the founder of 360 Group, made a prediction on his personal social media platform. He stated that with AI becoming fully integrated into the social economy, 2026 will be recognized as the "Year of Billions of Intelligent Agents." Empowered by large AI models, intelligent agents will transcend their role as mere passive Q&A tools. Instead, they will evolve into digital assistants endowed with profound goal-planning and execution capabilities, effectively serving as a "second brain" for both personal life and work scenarios.

The proliferation and widespread adoption of large model applications have spurred the rapid development of policy compliance and governance frameworks. In China, the "Measures for the Identification of AI-Generated and Synthetic Content" have been officially released and implemented. These measures prioritize trustworthiness and security as core evaluation criteria, compelling relevant companies to embed security mechanisms during the model design phase to tackle challenges arising from algorithmic失控 (loss of control, here we keep the pinyin to showcase the original cultural context while the translation of its meaning is given above).

Industry analysts posit that in the consumer (C-end) market, following the initial phase of free model offerings and a surge in quantity, the market has now completed its preliminary nurturing stage. Applications built upon large AI models are poised for further explosive growth, fostering a more diverse and robust AI large model application ecosystem.

For companies involved, they are also about to embark on the inaugural year of AI Agent commercialization. In this competitive landscape, the contest among large models will revert to its fundamental essence: those entities capable of genuinely addressing users' real needs and pain points, while maintaining a user-centric approach and ensuring compliance, thereby creating unique value, are most likely to secure a competitive edge in the C-end market.

04

Conclusion

In 2025, the AI large model industry experienced a period of reshuffling amidst chaos, achieved maturity through competition, and realized implementation through in-depth cultivation, marking a pivotal transition from "wild growth" to "rational development."

Throughout this journey, the dynamic interplay between industry giants and unicorns reshaped the industry's landscape. The trend towards segmentation and specialization charted a clear course for technological implementation.

Concurrently, with ongoing technological advancements, a return to rational capital investment, and the expansion of application scenarios, the integration of large models with various industries is steadily permeating different sectors of the economy and society, becoming the driving force behind the digital economy's development.

Looking ahead to 2026, the large model sector is expected to witness deeper integration and innovation, with closer collaborative development between general-purpose and specialized models, and further enhanced commercialization efficiency.

For companies, the latter half of the large model race represents both a protracted battle of technological deep cultivation and a struggle for commercial value realization.

As for who will emerge victorious, it is premature to draw conclusions. Let us allow more time for the outcomes to unfold.

*The featured image in the article is sourced from the official Doubao website.