AI Era: NVIDIA's Valuation Tops 20 Intels, Highlighting Divergent Paths of Chip Titans

![]() 01/26 2026

01/26 2026

![]() 389

389

By Yang Jianyong

Success and failure often hinge on adherence to or deviation from technological paradigms. Intel, once the undisputed leader of the semiconductor industry, now exemplifies a company constrained by its own legacy—trapped by the very principles that once defined its dominance. Having missed both the mobile internet revolution and the current AI wave, the chip giant finds itself in a precarious position.

Intel's latest financial report revealed weak performance guidance and a product supply warning, signaling an inability to meet market demand and production yields falling short of expected targets.

The market reacted swiftly: Intel's stock plummeted 17%, erasing $46.1 billion (approximately ¥320 billion) in market value overnight, leaving its valuation at $225 billion.

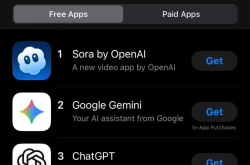

This decline starkly contrasts with the fortunes of its rivals. AMD now commands a $422.7 billion market cap, while NVIDIA has soared to a staggering $4.56 trillion—equivalent to 20 Intels combined.

The AI era is reshaping the global semiconductor landscape, with NVIDIA spearheading the transition from general-purpose GPU computing to AI-accelerated architectures. This strategic pivot has fueled explosive revenue growth, profitability, and market valuation.

Meanwhile, Intel grapples with its most severe strategic crisis in 58 years. Lacking competitive AI computing solutions, the company that once defined technological progress now faces an innovator's dilemma, with stagnant revenues reflecting its inability to keep pace.

In 2025, Intel reported $52.9 billion in annual revenue—essentially flat year-over-year (a 0.47% decline) and a fraction of NVIDIA's quarterly performance. NVIDIA's latest quarterly revenue hit $57 billion, with net profits surging to $31.9 billion.

Over five years, Intel's revenue has shrunk from $77.87 billion in 2020 to $52.8 billion in 2025—a $25 billion decline. This downward trajectory underscores its lagging position in the chip market.

In contrast, NVIDIA's revenue has nearly decupled, rising from $10.9 billion in fiscal 2020 to $130.5 billion in fiscal 2025. Cumulative revenue for the first three quarters of fiscal 2026 (through October 26, 2025) already reached $147.7 billion, with full-year projections exceeding $200 billion.

NVIDIA's dominance stems from its pivotal role in AI applications across industries. By continuously innovating GPU products and technologies, it has captured the burgeoning demand for AI computing power, seizing opportunities in the large language model market and becoming the first company to surpass a $5 trillion valuation.

As technological tides shift, enterprises must adapt or risk obsolescence. Self-transformation remains a critical driver of sustained leadership.

NVIDIA's success is no fluke. Since inventing the GPU in 1999, it has driven growth in PC gaming and, more recently, AI development. Today, NVIDIA's high-performance chips underpin training models across sectors, cementing its status as a technological cornerstone.

The rise and fall of tech giants often hinge on their ability to pivot amid technological and market shifts. Intel, once a master of seizing opportunities, now struggles to regain its footing.

A former titan of the PC era, Intel played a pivotal role in global tech history, popularizing semiconductors, computers, and information technology. Yet, during its heyday, it overlooked the disruptive potential of mobile internet and, later, generative AI.

Though Intel has pursued transformation strategies, its journey serves as a cautionary tale of corporate change. Years of efforts have yielded little progress, while frequent CEO changes reflect desperate attempts to reverse fortunes.

The reality remains harsh: sluggish performance and lagging AI chip development continue to challenge operations, with revenues declining for multiple years.

Intel's CPUs still dominate the PC market, and its high-performance processors remain a formidable force. However, intense competition from AMD and ARM, coupled with the rise of generative AI, has left Intel struggling to adapt.

With generative AI driving semiconductor industry restructuring, tech giants increasingly favor NVIDIA chips for large model training. This demand has made NVIDIA the clear winner in the AI race, with its chips in short supply.

Nevertheless, the author remains hopeful that Intel, despite its transformation struggles, can pivot and regain momentum.

Yang Jianyong, a Forbes China contributor, shares personal viewpoints. He specializes in analyzing cutting-edge technologies, including AI large models, artificial intelligence, IoT, cloud computing, and smart hardware.