![]() 01/26 2026

01/26 2026

![]() 550

550

Original Tech Insights AI New Tech Team

The AI video sector, once stagnant, is now witnessing significant movement.

According to an exclusive report by LatePost, Kling has successfully established a viable business model, boasting over 12 million monthly active users and projected revenue of $140 million in 2025, akin to a rapidly growing 'cash cow'. Its success is attributed to a clear tool positioning and paywall strategy, targeting professional creators (P-end) and enterprises (B-end), while also reaching the mass market through viral features like 'motion control'. This underscores the immediate monetization potential of technology. The news triggered a 5% surge in Kuaishou's stock, validating its narrative of a 'second curve'.

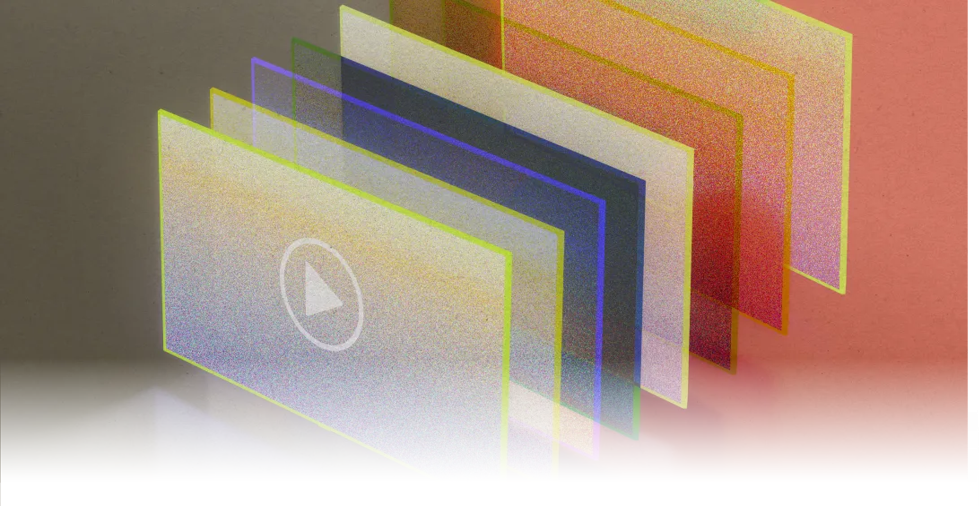

In contrast, ByteDance-backed Jimeng, once dubbed the 'TikTok of the AI era' by Zhang Yiming, takes a different approach. Jimeng's leader, Zhang Nan, redefined human-AI relations through a retrospective of its practices, stating that AI is not merely a tool but an 'amplifier' of human capabilities, akin to Steve Jobs' 'bicycle for the mind'. This suggests that Jimeng is 'not in a rush to monetize', hinting at greater ambitions and a 'long-termist' mindset. Across the ocean, OpenAI's Sora2 made a splash in late 2025 with stunning visuals, amassing one million downloads globally in just five days and topping app store charts. However, Silicon Valley's initial excitement faded quickly—data from venture firm a16z reveals that its 30-day user retention rate plummeted to just 1%, rendering it a 'use-and-discard' technological marvel.

These three paths reflect differing interpretations and strategic bets on AI video by global tech giants.

The core objective lies in laying a solid foundation for future content ecosystems. Jimeng's Zhang Nan echoes this sentiment: with minimal technical gaps at present, rushing to monetize may not be the best course of action—building long-term capabilities and ecological niches is more crucial.

Thus, this is not a simple race for superiority but a 'dual validation' of AI video's future. Kling validates the immediate path of independent product commercialization, while Jimeng explores the potential of ecosystem-level apps to shape future rules. Sora2, in pursuit of possibilities, tests the sector's explosive potential. Their coexistence not only depicts the present but also contemplates the future: Should one pursue immediate commercial victories or strategize for ecological blueprints in deeper waters?

01

Path Divergence: Sora's Viral Dilemma, Kling's Pragmatic Loop, and Jimeng's Ecological Gamble

Three distinct paths have emerged in the AI video landscape. From Silicon Valley to Beijing, Sora2, Jimeng, and Kling are exploring the future of video generation differently. Sora2 rose rapidly on the back of its technical prowess, hitting one million downloads in just five days and topping app stores globally. Yet, this explosive growth failed to sustain user retention.

Data from a16z partner Olivia Moore reveals Sora's 1-day, 7-day, 30-day, and 60-day retention rates at 10%, 2%, 1%, and 0%, respectively—a stark contrast to TikTok's 50% day-one and 32% 30-day retention.

The issue lies in product positioning ambiguity. Sora2 attempts to blend tools and social features but fails to deliver stable, controllable generation like professional tools or the interactivity of social platforms. Meanwhile, it appears to be targeting a consumer platform route. Most users treat it as a one-time novelty, generating a video or two out of curiosity before abandoning it. Worse still, its 'AI TikTok' social vision falters due to immature recommendation algorithms.

User feedback indicates that Sora2's system 'always pushes similar videos', and its feature designs fail to foster engagement.

Kling AI takes a starkly pragmatic route. This Kuaishou-backed platform has formed a professional creator (P-end)-centric model, with P-end paid subscriptions contributing nearly 70% of revenue. Official Kuaishou data confirms this, listing Kling as a top-tier business alongside its main platform, commercialization efforts, and e-commerce.

By January 2026, its monthly active users exceeded 12 million, with projected 2025 revenue at $140 million. While its B-end focus offers immediate viability, it limits imagination. Kling addresses this by integrating with consumer businesses, such as the viral AI Vientiane for livestream scenes, enriching its ecosystem. This reflects strategic foresight in commercialization and growth.

Unlike Sora2 and Kling, ByteDance's Jimeng AI prioritizes ecosystem-building through long-termism. Despite being backed by a short video giant, Jimeng delays commercialization, focusing on lowering creation barriers and nurturing AI-native content. By March 2025, its monthly active users reached 8.93 million, reflecting a user expansion-first strategy.

Jimeng's 'AIGC Short Drama Recruitment Plan' heavily supports AI short drama creation, offering up to 50-70% investment per project (capped at $280,000). This investment paid off: the debut AI paid short drama, 'Mysteries of Xing'anling', garnered 30 million views in three days on Douyin.

Three paths, three choices: pursue short-term traffic bursts, deepen commercial loops, or build long-term content ecosystems? This strategic divergence marks a crossroads for the entire AI video industry. The ultimate answer lies in each player's next moves.

02

Battle Focus: Short-Term Monetization Temptation, Long-Term Ecosystem Layout, and Technical Controllability Challenges

The differing paths stem from varying judgments on AI video's essence and commercialization timing. These shape product strategies, resource allocation, and long-term visions.

Sora2's predicament exposes the limits of pure technology-driven routes. While visually impressive, users frequently encounter distorted figures, vanishing objects, and broken physics.

Industry analysis notes that only 5-10% of Sora2-generated content is publishable. This 'lottery-like' uncertainty undermines its viability as a productivity tool.

Meanwhile, Sora2's 'AI TikTok' social ambition faces hurdles. Compared to TikTok's mature algorithms and engagement, Sora2's system 'repeats similar videos' and suffers from 'poor feature designs'. Most users download it for novelty, abandoning it after a few videos.

Kling AI's pragmatism stems from precise market demands. From inception, it targeted professionals and enterprises, driving efficient commercialization.

Financially, Kling's ARPU (average revenue per user) is 6.4 times that of rival PixVerse. Despite having just 15.4% of PixVerse's downloads, Kling matches its revenue. This efficiency made it a Kuaishou priority, elevated to a top-tier business alongside core platforms.

Jimeng AI's ecosystem strategy reflects ByteDance's vision for content industry transformation. Zhang Nan argues that with minimal technical gaps at present, rushing to monetize may not be optimal—building long-term capabilities and ecological niches matters more.

Ecologically, ByteDance needs robust content tools as platforms like Short Drama Platform Red Fruit, Douyin Select, and AI Douyin emerge. Jimeng, as a key upstream component, grows more critical.

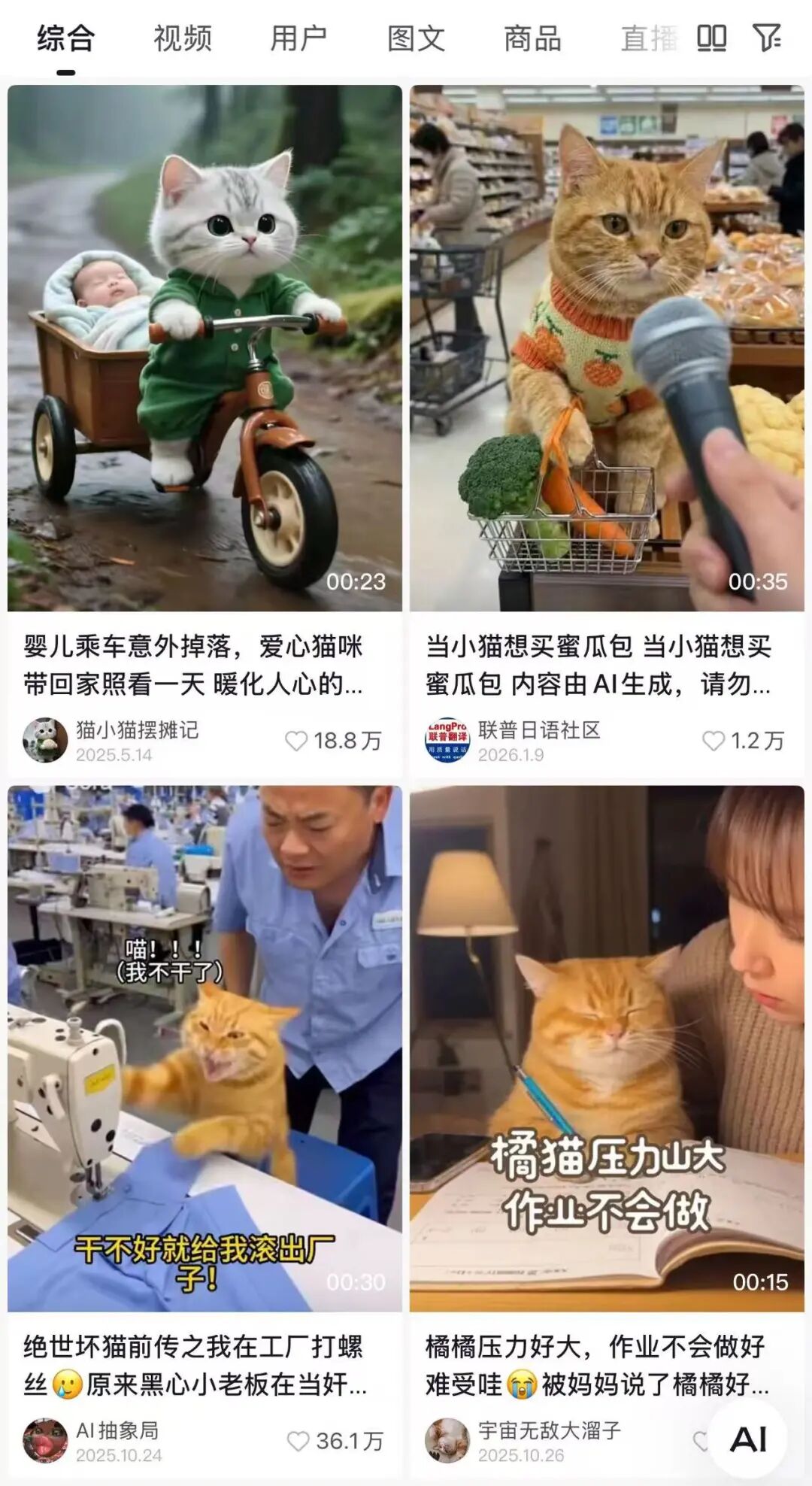

Figure/AI videos on Douyin

This strategy shines in AI short dramas. Through the 'AIGC Short Drama Recruitment Plan', Jimeng offers funding, unlimited six-month credits, annual memberships, and customized tech solutions.

Critically, Jimeng bridges AI generation and content distribution. It provides 30-50 million views per project, with flagship works receiving up to 100 million exposures.

This seamless generation-distribution link is what Sora2 lacks.

As the three paths clash, the future's decisive factors emerge—the next breakthrough hinges on them.

03

Decisive Factors: Balancing Computational Costs, Validating Business Models, and Nurturing Creator Ecosystems

As video AI competition deepens, mere model capability is no longer decisive. Future success depends on balancing technology, ecology, and sustainability.

The fundamental challenge is computational costs. Industry data shows that high-quality video generation costs $30-50 per minute. This makes scalable profitability elusive for most firms.

User behavior exacerbates this: due to unpredictable results, users often generate and revise content repeatedly, creating dozens of 'wasted' clips per usable segment. These represent sunk costs.

In exploring business models, the three firms diverge. Sora2 attempts an in-app ecosystem but struggles with low retention.

Kling integrates with Kuaishou's e-commerce ecosystem, partnering with thousands of enterprises like Xiaomi, Amazon Web Services, Blue Focus, and NetEase. In e-commerce and gaming, some clients achieve 60% AI material penetration.

Jimeng's long-termism focuses on nurturing the creation ecosystem. Beyond tools, it addresses talent gaps—AI experts lack filmmaking skills, and filmmakers lack AI knowledge. Through training and knowledge-sharing, Jimeng bridges these communities.

The controllability of technology is the key to determining whether video AI can transform from a toy into a tool. Currently, although companies are racing to extend video generation durations and improve resolution, few have fully addressed the core issue of "controllability", which creators care about the most.

A research report by TF Securities points out that Sora2 and Veo3.1, released in 2025, have achieved native multimodality (combining understanding and generation), and overseas multimodal models are expected to further iterate in 2026. Meanwhile, domestic large models such as ByteSeed and Minimax Conch are rapidly catching up.

The future of the industry may not see a "winner-takes-all" scenario but instead a differentiated division of labor. If Sora2 can break through the controllability bottleneck technically, it may redefine professional creative tools; if Kling can maintain high commercial efficiency, it could secure a place in the enterprise services market; if Jimeng can successfully cultivate a healthy creator ecosystem, it may become the first platform for AI-native content.

The true "GPT moment" for video AI requires not just algorithmic breakthroughs but also a profound understanding of the essence of content creation and the ability to organically integrate technology with human creativity.

When the first AI-paid short drama, Mysterious Tales of Xing'anling, surpassed 30 million views on Douyin in just three days, when Kling's "motion control" feature sparked global user excitement, and when Sora2's retention rate data was made public, the competitive landscape of video AI had quietly changed.

Technicians at a company repeatedly adjust prompts to keep AI-generated characters' expressions consistent; a traditional film and television director tries Jimeng for the first time to create storyboard scripts; Kuaishou's e-commerce merchants use Kling to generate product showcase videos with one click.

These seemingly small moments are converging into an irreversible trend—the barrier to video creation has been permanently lowered, and more people's imaginations have been unleashed. Whoever can lower the barrier while building a sustainable ecosystem will define the future of video AI.

- The end -