Why Are Vendors of Large Models Increasingly Being Required to Prove Their Worth?

![]() 01/27 2026

01/27 2026

![]() 331

331

Writer: Haishan

Source: Bowang Finance

The AI battlefield at the turn of the year is shrouded in a competitive haze. For the players in this arena, demonstrating their capabilities has emerged as the paramount task at present.

Initially, Volcano Engine declared its participation in the Spring Festival Gala. Subsequently, Manus announced its acquisition by Meta. Following suit, Zhipu and Minimax entered the capital market in quick succession. On January 15, Alibaba's QianWen hosted a product launch event titled "Answering All Questions," heralding the "era of getting things done" with AI. Additionally, QianWen's monthly active user count surpassed 100 million. Prior to this, Tencent also announced the establishment of the AI Infra/AI Data/Data Computing Platform Department, with Yao Shunyu appointed as the Chief AI Scientist.

Each participant is fervently striving to prove its commercial value both within and outside the industry. However, all AI endeavors must be constructed upon a robust foundational service infrastructure. Multiple institutions predict that China's AI-related capital expenditure will reach 600 - 700 billion yuan by 2025, with cloud vendors' annual CapEx (capital expenditure) growth expected to approach 65%. This indicates that China's internet sector is re-entering a phase characterized by "daring to spend and knowing why to spend."

The competitive logic has undergone a corresponding shift. Victory no longer solely depends on model parameters or rankings but on the capacity to integrate chips, clouds, models, and real-world applications into a closed-loop system, thereby forming a comprehensive framework.

The intensity of competition in the large model industry now rivals the "life-or-death" struggle in the new energy vehicle sector. Those with superior capabilities will have the opportunity to go public on the A-share market, the Hong Kong Stock Exchange, or elsewhere. Large model vendors lacking foundational capabilities are likely to find it challenging to attract investment.

01

The Industry Embarks on a Monetization and Capital Sprint

If vendors of large models fail to become profitable within a few years, they will undoubtedly face market scorn. OpenAI's initial non-profit aspiration may ultimately prove unrealistic in the current climate, as it has begun to release intelligent hardware products and seek breakthroughs in advertising revenue.

Over the past three years of AI enthusiasm, ChatGPT has reshaped the U.S. stock market. Since its launch a few years ago, the S&P 500 index has cumulatively risen by 64%, and in subsequent years, it has further fueled the AI industry's boom.

Upon calm reflection, the current wave of monetization in the large model industry is not accidental. Driven by technological maturity and capital cycles, profit-making has become an inevitable pursuit for entrepreneurs.

Over the past three years, the large model sector has witnessed a frenzy of financing. For instance, Zhipu's previous IPO planned to issue 37.4195 million H shares at a price of HK$116.20 per share, raising a total of approximately HK$4.348 billion, with a post-IPO market value expected to exceed HK$51.1 billion. According to market reports, its public offering was oversubscribed by about 1,164 times.

Earlier this month, Minimax's IPO surged over 100% on its debut, ultimately pricing at the upper limit of HK$165 per share and raising a total of approximately HK$5.54 billion. This further confirms the point.

In reality, capital patience has its limits. With changes in the macroeconomic environment and increased difficulty in securing financing in the primary market, the "burn money for growth" model has become unsustainable. Against this backdrop, going public has become an important avenue for leading companies to achieve capital exits and sustained financing.

During the time window from the end of 2025 to the beginning of 2026, Moore Threads, Muxi Corporation (Muxi shares), and Biren Technology successively completed their listings on the A-share market, STAR Market, and Hong Kong Stock Exchange, respectively. Meanwhile, more computing power and AI chip companies have entered the IPO approval process. The consecutive IPOs of several GPU vendors have sent a significant signal: the capital market is beginning to recognize these AI enterprises.

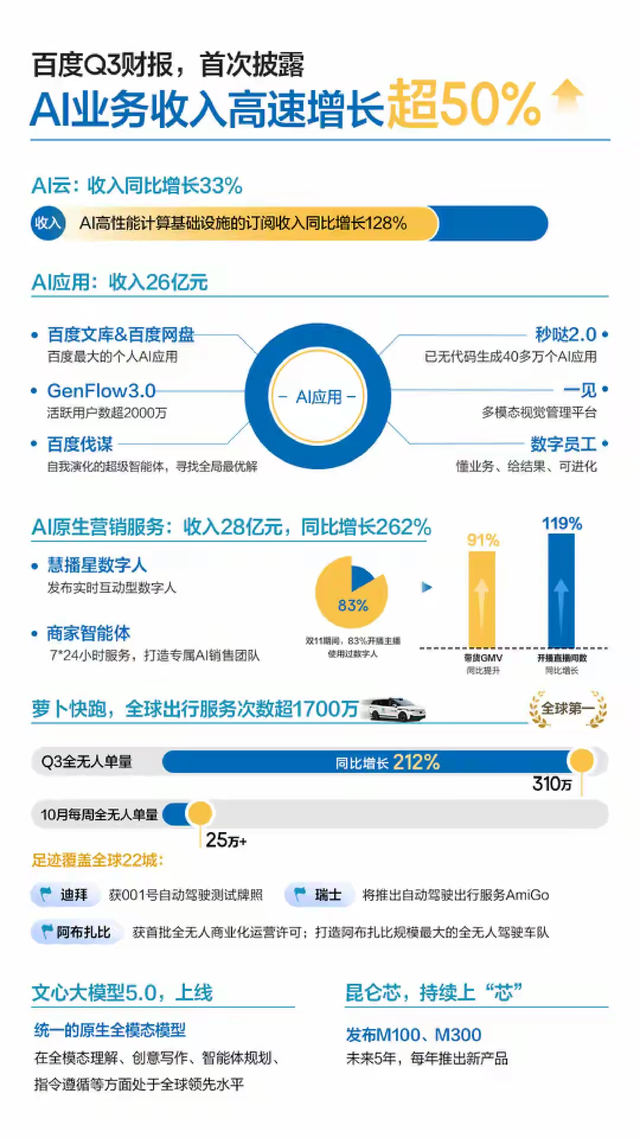

In addition to these companies, the AI monetization capabilities of established giants are also strengthening. For example, Baidu's AI business revenue grew by over 50% year-on-year in the third quarter, with specific businesses including AI cloud, AI applications, and AI-native online marketing services.

From public market IPOs to B2B services and C-end product subscriptions, the monetization paths for large model companies are becoming increasingly clear. The industry has transitioned from a focus on "technology and financing" to a new phase centered on "revenue and profit."

No matter how advanced the technology, it remains merely a castle in the air if it cannot be monetized. A sustainable commercial closed loop is the foundation for enterprise survival and the inevitable choice for the AI industry to progress from conceptual hype to industrial implementation.

02

After the Capital Ebb, Capabilities Will Become the Core Competitiveness

If the large model industry in the previous two years was characterized by "pitching concepts and telling stories," then the market in 2026 has reached a clear consensus: only tangible commercial capabilities can win recognition. After the capital frenzy subsides, the once-inflated valuation bubbles are gradually dissipating, and user willingness to pay and project implementation capabilities have become the core metrics for measuring enterprise value.

Since 2023, global investment enthusiasm in the AI sector has cooled. Crunchbase data shows that global AI startup financing decreased by 28% year-on-year in 2024, with financing in the large model sector dropping by 35%. Capital has become increasingly cautious towards companies lacking a clear commercialization path. In contrast, capable vendors have gained capital favor, leading to the smooth progress of IPOs for some model enterprises and significant commercialization results.

Competition in the C-end market has long transcended mere technical parameter comparisons, shifting towards user retention and paid conversion. OpenAI's commercialization path is highly representative. Building on personal and team subscription services, it not only plans to launch advertising but will also introduce its first hardware device this year, transitioning from software services to a software-hardware integration model.

With an increasing number of screenless portable terminals featuring practical functions like handwritten note transcription and real-time voice interaction entering the workplace, it marks the beginning of large model companies enhancing user stickiness and expanding paid spaces through scenario-based hardware.

Domestic companies are also making frequent moves. MiniMax has created a C-end product matrix including Talkie and Hailuo, achieving user paid conversion through differentiated scenarios. This "model-application integration" model has also become key to its capital recognition.

The B-end market places greater emphasis on the implementation capabilities of solutions. Previously, enterprises adopted large models out of technological curiosity, but now they prioritize actual business value. Zhipu has achieved commercialization through the MaaS (Model as a Service) model, becoming an invisible giant in serving enterprise clients (B-end) with large models. From 2022 to 2024, Zhipu achieved doubled revenue growth for three consecutive years. Among China's top ten internet companies, nine use Zhipu's GLM large model. As of September 2025, Zhipu has served 12,000 enterprise clients worldwide, over 80 million terminal user devices, and more than 45 million developers.

These cases demonstrate that B-end clients are no longer satisfied with generic large models but require customized solutions tailored to industry scenarios. Enterprises' service capabilities, data adaptation capabilities, and engineering implementation capabilities have become the core of competition.

After capital returns to rationality, market logic begins to change: technologies without commercial capability support will eventually be eliminated. Whether it is user paid conversion on the C-end or industry solutions on the B-end, they are essentially testing enterprises' ability to convert technological value into commercial value.

03

In 2026, the Large Model Industry Will Likely Undergo a Reshuffle and Reconstruction

We predict that with intensifying monetization pressure and an upgrade in capability competition, the large model industry in 2026 will undergo profound structural reconstruction, with market differentiation and factionalization becoming the main theme.

Of course, this reshuffle is not simply about enterprise elimination but rather a process of industry resources concentrating towards advantageous enterprises and business models iterating towards greater efficiency.

The industry will gradually be divided into three clear tiers. The first tier consists of ecological giants, represented by tech giants like Alibaba, Tencent, and Huawei. Leveraging their advantages in computing power, data, and channels, they build a full industry chain ecosystem encompassing "basic models + industry applications + hardware terminals." These enterprises can not only provide one-stop solutions for clients but also reduce costs through ecological synergy.

The second tier comprises "vertical domain leaders" focusing on specific sectors such as government affairs, finance, and healthcare, building barriers through deep industry understanding. For example, enterprises specializing in financial large models, familiar with regulatory policies and business processes, have improved risk control efficiency severalfold, securing long-term cooperation with banks and insurance institutions. The third tier consists of "technology-specialized enterprises" delving into niche technical areas like multimodality and code generation, achieving survival through technology output and collaboration with leading enterprises.

During the reshuffle process, enterprises lacking core competitiveness will gradually be eliminated.

Simply put, small and medium-sized enterprises without clear application scenarios, relying solely on imitation and trend-following, will see their survival space continuously shrink amid high computing costs and pressure from leading enterprises. Conversely, enterprises with technological barriers and commercial capabilities will receive more resource allocation, significantly increasing industry concentration.

The essence of the industry reshuffle is the transformation of the large model industry from "wild growth" to "high-quality development." The industry will place greater emphasis on technological practicality, application scenarioization, and service standardization.

We predict that in the future, large models will no longer be a bonus for enterprises but a "necessity" integrated into production and daily life. Those capable of truly solving practical problems will ultimately stand out in the reshuffle. As for the tracks, the following three may be more attractive:

(1) Hot tracks centered around AI hardware, such as smart glasses, smartphones, and smart learning machines, are fiercely competing for user attention and interaction entry points;

(2) Digital service industries. Evergreen sectors like consumption and entertainment, empowered by technologies such as large models, are being reactivated and rejuvenated with new growth vitality;

(3) Long-term tracks like commercial aerospace, currently accelerating towards a new phase of commercialization. These align with the long-term direction of deep integration for large models.

From the IPO frenzy of Zhipu AI and MiniMax to OpenAI's hardware layout and the gradual improvement of industry standards, the monetization path for the large model industry has become clear. Behind this collective monetization lies the inevitable return of technological rationality to industrial essence and a mature sign of the industry's transition from concept to value.

In 2026, monetization will no longer be a multiple-choice question but a survival question for the large model industry. After the capital ebb, true technological value and commercial capabilities will stand out. Although the industry reshuffle brings challenges, it also harbors greater opportunities.