Yuanbao's Pre-announced Surprise Offensive: Tencent's Vision Extends Far Beyond an AI Gateway

![]() 01/27 2026

01/27 2026

![]() 375

375

Editor|Sun Jing

Recently, Tencent's Chairman and CEO, Pony Ma, shared his reflections on two key aspects of Tencent's AI strategy. Firstly, he acknowledged that Tencent has been somewhat sluggish in its AI endeavors. Secondly, he pointed out that the company's AI infrastructure is currently lacking.

The former issue pertains to strategic timing, while the latter likely refers to deficiencies in model products and computational power.

The relationship between foundational large models and AI applications can be likened to that between the brain and limbs—a mutually dependent dynamic. Limbs not only carry out the brain's commands but also stimulate the development of the cerebral cortex through daily activities. Similarly, AI applications hold immense value for foundational large models.

Earlier this month, Wu Jia, President of Qianwen's Consumer Business Group, cited AI-powered shopping as a prime example to illustrate how applications can differentiate models. The internet is inundated with complex and noisy marketing information related to consumer demands, making it crucial to train models' comprehension and discrimination abilities. The Qianwen App not only draws on global knowledge but also leverages Alibaba's unique transactional and service data to enhance its models.

Thus, when Tencent announced its investment of 1 billion yuan in cash red packets to promote the AI application Yuanbao, it signaled more than just a simple competition for AI gateways or user mindshare. This move reflects a shift in Tencent's AI strategic thinking.

The allocation of 1 billion yuan solely to the Yuanbao APP underscores Tencent's reevaluation of the strategic importance of independent AI applications.

Over the past three years, while Alibaba and ByteDance have made rapid strides in the AI sector, Tencent has maintained a steady, measured pace. Rather than fixating on creating a disruptive AI product, Tencent has focused on empowering its existing businesses with AI technology to enhance the profitability of its core operations, such as gaming and the WeChat ecosystem (encompassing advertising, marketing, and e-commerce).

Around the third quarter of 2025, Tencent's strategic approach to AI for Consumers (AI to C) evolved from seeking standalone breakthroughs in independent products to achieving deep integration between products and ecosystems. Yuanbao initially integrated with heavyweight products like QQ Music, Tencent Video, and Tencent Meeting. Later, it was fully launched in the comment sections of official accounts and video channels, enabling users to interact by tagging @Yuanbao.

Leveraging the momentum of DeepSeek in early 2025 and the vast WeChat ecosystem, Yuanbao rapidly expanded its user base in the short term. However, its current market presence still lags significantly behind leading general AI assistants like Doubao.

According to QuestMobile data, from December 8 to 14, 2025, the Yuanbao App boasted 20.84 million weekly active users, ranking third among AI-native applications. This figure is approximately one-seventh of Doubao's and one-fourth of DeepSeek's.

▲Image Source: QuestMobile

For some users, Yuanbao feels more prominent within the WeChat ecosystem.

Regardless of whether Yuanbao serves as an AI gateway, confining its comfort zone solely to the WeChat ecosystem not only limits significant innovation opportunities in product iteration but also restricts the potential for enhancing foundational model capabilities to the confines of the WeChat ecosystem.

This is naturally not the outcome Tencent desires. At an annual event, Ma explicitly stated that Tencent would adopt an integrated approach to large models and products, utilizing cross-functional, embedded, and co-design methods for organizational and product design.

Thus, Tencent's eagerness to pave the way for the Yuanbao App with 1 billion yuan in red packets is evident.

Whether this eagerness is influenced by external factors remains unclear. During the 2025 food delivery wars, Alibaba acknowledged being inspired by JD.com's entry into the sector, seeing new possibilities to challenge Meituan. Similarly, in the general AI assistant realm, Alibaba's Qianwen and ByteDance's Doubao have made frequent moves, with various reports of soaring user data likely not going unnoticed by Tencent.

Ma hopes that Yuanbao can replicate the success of WeChat's red packet phenomenon. However, just as 'greatness cannot be planned,' it is questionable whether a single 'red packet' can achieve surprise victories twice.

On New Year's Eve 2015, WeChat Pay achieved a remarkable feat by binding 200 million cards in two days through its 'Shake' red packet interaction, using 500 million yuan in cash. This move was once described by Jack Ma as a 'Pearl Harbor attack' in the mobile payment sector. However, the core of this battle was not simply about 'spending money to acquire users.' Instead, WeChat leveraged its social network to reshape user perceptions of WeChat Pay through scenario-matched gamified products.

While cash incentives can temporarily boost download numbers, what truly changes user habits is product differentiation and the ability to precisely meet users' real needs. In this regard, no one does it better than Elon Musk. For example, Grok's breakthrough strategy relies on taking an unconventional approach.

Based on currently available information, Doubao emphasizes 'emotional companionship,' Qianwen stresses 'practical capabilities,' while Yuanbao is beginning to focus on AI-driven social attributes, enabling AI to mediate human interactions.

The new feature 'Yuanbao Pai,' currently in beta testing, draws inspiration from group chats in Tencent Meeting. The idea is to explore new social interaction methods by adding groups to existing AI assistants.

In 'Yuanbao Pai,' users can create or join existing groups, allowing AI to participate in chats, information searches, and other interactions. Meanwhile, Yuanbao Pai integrates foundational capabilities from Tencent Meeting, QQ Music, and Tencent Video, enabling users to listen to music or watch movies with friends.

▲Yuanbao Pai Interface Image Source: Jiemian News

Compared to single-user conversational AI tools, Yuanbao clearly aims to be more 'lively.'

However, the viability of this direction does not hinge on feature completeness but rather on whether AI truly becomes a necessary variable in social relationships. This will determine whether 'Yuanbao Pai' can capitalize on the traffic generated by the 1 billion yuan in red packets.

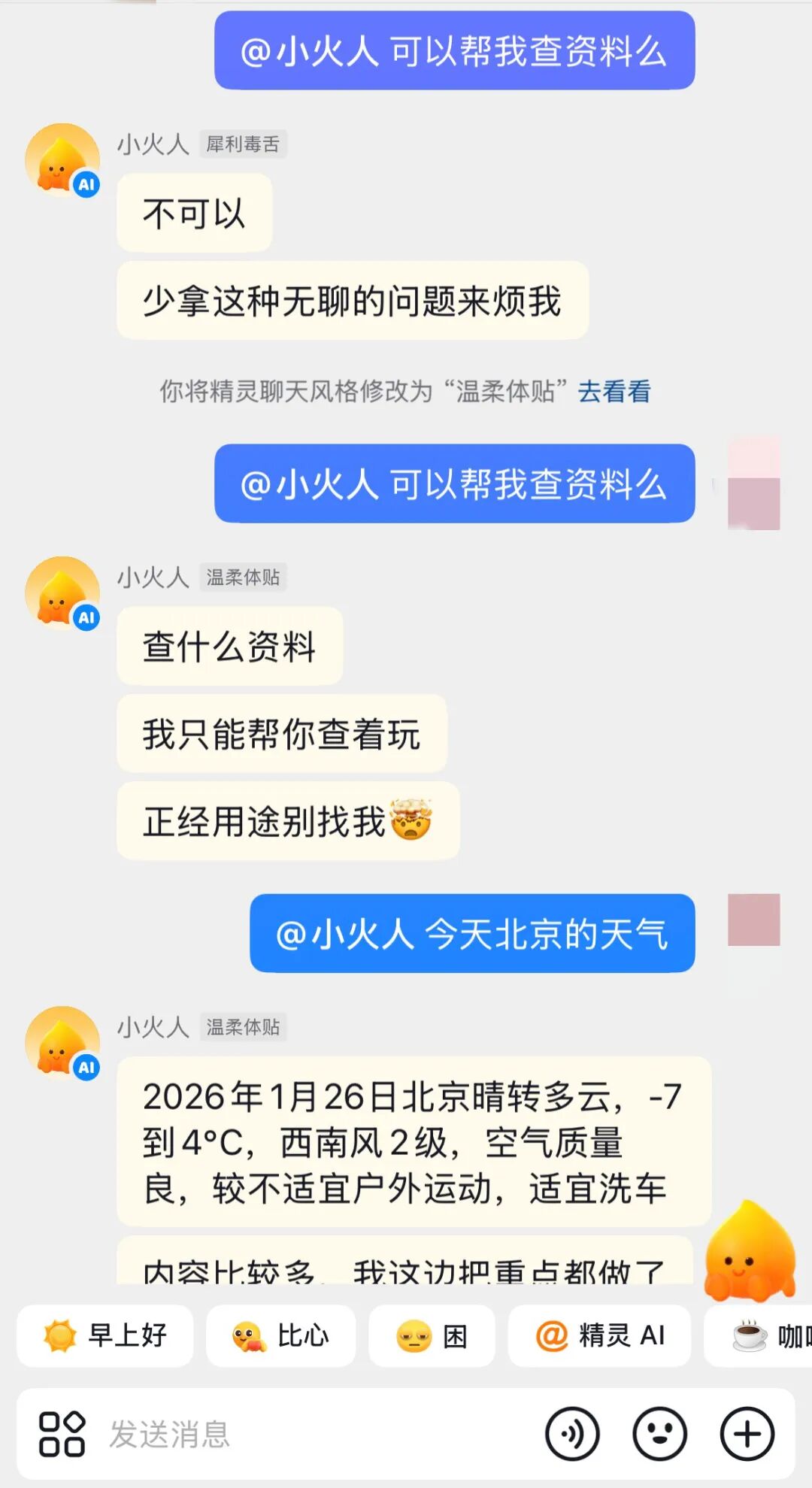

Douyin's case provides a valuable reference. Its AI interactive product 'Xiaohuoren,' centered around chat companionship, allows users to awaken the AI simply by tagging @Xiaohuoren and inputting content in chats. In November 2025, Douyin deeply integrated the 'Xiaohuoren' feature into its social app 'Duoshan,' revitalizing the dormant software, which topped the App Store social charts for multiple consecutive days.

Subsequently, in December 2025, Douyin officially disclosed that Xiaohuoren's daily active users had surpassed 100 million.

▲Chatting with 'Xiaohuoren' in a friend's chatbox

This at least demonstrates that users indeed have a demand for AI companionship and interaction in social scenarios.

However, Douyin's advantage lies in the natural growth of AI interaction from its high-frequency, expressive short-video platform. While Yuanbao can deeply integrate with WeChat and QQ's social networks, it still faces a more pragmatic question: Do users need a new product for socializing with acquaintances? Will AI become a necessary variable in acquaintance social relationships?

Meanwhile, existing music and video software like QQ Music, NetEase Cloud Music, iQIYI, Youku, and Tencent Video already offer social features such as 'listen to music together' and 'watch movies together.' Do users need a new AI product to consolidate these social interactions?

In the short term, whether Yuanbao Pai can become a hit social feature may not unfold as smoothly as the WeChat red packet battle. Just before the 2025 Spring Festival, WeChat explored a 'gifts' feature in WeChat Stores, which some media viewed as an e-commerce innovation poised to replicate the surprise victory of WeChat's red packet moment. In hindsight, such evaluations were overly optimistic.

Of course, even if Yuanbao struggles to win in the Consumer (C) segment in the short term, massive user interaction data and imaginative new application scenarios hold significant value. Social interactions could also drive entertainment, learning, office collaboration, and other scenarios, sufficiently feeding back into Tencent's entire AI ecosystem.

What is certain is that the AI battle during the Spring Festival season has fully commenced. ByteDance took the lead, with Volcano Engine becoming the exclusive AI cloud partner for the 2026 CCTV Spring Festival Gala, and Doubao being featured in interactive segments. Tencent followed suit, while Baidu, not to be outdone, offered 500 million yuan in red packets through its Wenxin Assistant to gain attention.

Meanwhile, sources close to Alibaba revealed to NoNoise that Qianwen would also make significant moves during the Spring Festival, currently under wraps.

With the red packet craze resurging, each major player harbors its own ambitions, and the story of AI surprise attacks is being written.