1.5 Billion Spring Festival Red Packets in Full Swing: ByteDance Holds Position, Alibaba Fights Back, Tencent Launches Surprise Attack, Baidu Chases Hard

![]() 02/06 2026

02/06 2026

![]() 560

560

© New Game of Strategies

In recent years, "handing out money" during the Spring Festival has become a key strategy for major tech companies to capture user attention. Eleven years ago, WeChat leveraged Spring Festival red packets to bind approximately 200 million bank cards. Later, Douyin capitalized on its partnership with the CCTV Spring Festival Gala, using interactive gameplay like "collecting cards + snatching red packets" to achieve a staggering peak of 70.3 billion interactions, securing its position in short-video e-commerce. The marketing potential of Spring Festival red packets has gradually become synonymous with nurturing the next national-level app.

This year, major companies are setting their sights on the battle for AI super entrances.

So far, Tencent and Baidu have collectively placed 1.5 billion yuan in cash red packets into the prize pool. ByteDance continues its partnership with the CCTV Spring Festival Gala, with a high probability of a red packet rain on New Year's Eve. Douyin's 300 million red packet gameplay is already live. Alibaba's Tongyi large model, rebranded as Qianwen, is adopting increasingly aggressive tactics in the consumer market... With all players actively making moves, this year is destined to be another fierce battle.

Doubao's Daily Active Users Surpass 100 Million

Alibaba Takes the Lead in Fighting Back

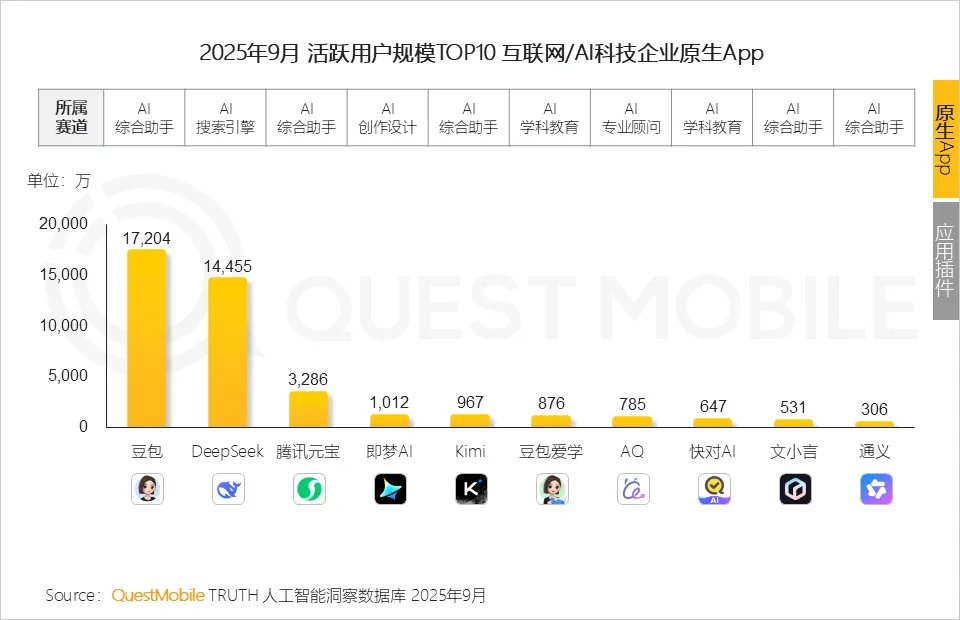

In December 2025, 36Kr reported that Doubao's daily active users had surpassed 100 million. Prior to this, QuestMobile's Q3 2025 AI application industry report showed that Doubao had overtaken DeepSeek with 172 million monthly active users (MAUs) to claim the top spot.

These two sets of data reflect, on one hand, that Doubao, with its rapidly expanding user base, is gradually pulling ahead of its competitors. On the other hand, surpassing 100 million DAUs means the domestic AI application market is one step closer to its first national-level app.

Also in December, Doubao collaborated with ZTE to launch the engineering prototype Nubia M153, which went on sale. With system-level permissions, the Doubao AI assistant can easily handle complex cross-app operations like price comparisons, payments, navigation, and chatting. This caused a stir in the market, with the original price of 3,499 yuan for the Nubia M153 quickly skyrocketing to over 10,000 yuan in the second-hand market.

However, major manufacturers quickly implemented countermeasures, effectively restricting the core functions of Doubao's phone. Even so, ByteDance has sent an important signal to the outside world: Doubao is not just an AI application using chat as a super entrance but also a Dispatch Center (dispatch center) capable of leveraging various tools—a core capability crucial for the upcoming Agent era. The launch of Doubao's phone proclamation (declares) that this AI product, previously focused on dialogue and Q&A, has evolved into a complex "Agent collection."

This means Doubao not only enjoys higher popularity in the consumer market but also has the strength to compete in the enterprise market.

Still in December, ByteDance's enterprise-focused cloud and AI service center, Volcano Engine, hosted the Volcano Engine FORCE Conference at the Shanghai World Expo Center. At the event, Volcano Engine president Tan Dai announced that over 90% of China's mainstream automakers and 9 out of the top 10 global smartphone manufacturers are already Volcano Engine clients. Additionally, over 1 million enterprises and developers are leveraging Doubao's large model capabilities on its platform, with over 100 enterprises surpassing 1 trillion cumulative Tokens in usage.

In other words, Doubao's rapid growth in the consumer market is already feeding back into the enterprise segment. Recall that in 2014, WeChat's Spring Festival red packet gameplay achieved a total of 1.01 billion sends and receives, with a peak of 810 million shakes per minute in interactive gameplay, directly influencing the later landscape of the mobile payment market. At the time, Jack Ma compared it to a "Pearl Harbor sneak attack." Today, ByteDance's approach to AI super entrances is having a similar impact on Alibaba, as entering the enterprise market directly targets Alibaba's core business, a point underscored by Alibaba's aggressive push into the AI to C strategy.

In November 2025, Alibaba's Tongyi was rebranded as Qianwen and began targeting the consumer market. Prior to this, Alibaba's AI layout (layout) focused primarily on the enterprise segment. According to Hugging Face data, as of January 9, Alibaba's Qianwen large model had accumulated 700 million downloads, making it the most widely adopted open-source large model among global developers. After the rebranding, Alibaba's AI to C strategy became a key pillar of the company's growth.

On one hand, Qianwen is positioned to compete with ChatGPT and was fully integrated into Alibaba's ecosystem businesses, including Taobao, Alipay, Taobao Deals, Fliggy, and Gaode, enabling AI-powered shopping functions like ordering food, shopping, and booking flights, with open testing for all users. This integration came shortly after the launch of Doubao's phone. Subsequently, on January 27, Alibaba officially released the Qianwen flagship reasoning model, Qwen3-Max-Thinking, further strengthening Qianwen's native Agent capabilities for tool invocation.

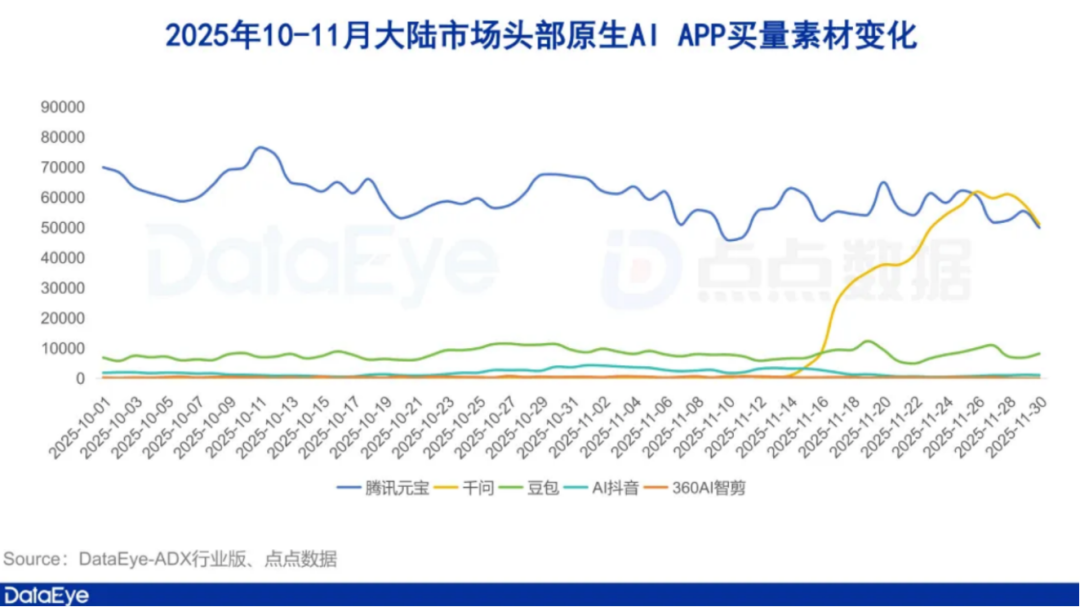

On the other hand, as a latecomer to the consumer market, Alibaba quickly adopted a strategy of driving user growth through aggressive marketing spend. Data from DataEye Research's ADX industry version shows that since November 2025, Qianwen's marketing spend has rapidly risen to a level comparable to Tencent's Yuanbao. This drove Qianwen to reach 40 million MAUs within a month of its launch, showing strong growth momentum.

However, it's worth noting that whether competing with Doubao in the consumer market or facing off against Volcano Engine in the enterprise segment, both sides are bound to engage in even fiercer battles to secure the AI super entrance in the Agent era.

Previously, Alibaba's Qianwen exclusively sponsored Bilibili's 2025 New Year's Eve Gala and introduced red packet gameplay to further connect with the younger market. ByteDance, meanwhile, continues its partnership with the CCTV Spring Festival Gala, with a deliberate focus on promoting Volcano Engine in this year's collaboration. The latter became the exclusive AI partner for the 2026 CCTV Spring Festival Gala, with Doubao synchronously advancing related interactive gameplay.

Tencent Plays the Social Card

Baidu Makes a Strong Push in the Consumer Market

Of course, more players are further disrupting the competitive landscape.

In reality, as Doubao's user base continued to grow, Tencent's Yuanbao and Baidu's Wenxin AI Assistant were also actively expanding their market presence. Tencent, in particular, has invested heavily in Yuanbao, with AppGrowing estimating that Yuanbao's marketing spend reached 15 billion yuan in 2025. Specifically, Yuanbao's marketing spend surged in the second half of 2025, with around 10.5 billion yuan invested in the third and fourth quarters combined. This period coincided with Doubao's rapid expansion and eventual overtaking of DeepSeek to claim the top spot.

In contrast, QuestMobile data shows that Yuanbao has maintained around 30 million MAUs for some time, relatively stably holding the third position in the industry. This reflects that Tencent's heavy investment has not translated into significant user growth, whereas Doubao's growth has not relied on heavy marketing spend.

It's understood that Doubao, positioned for the consumer market from the outset, did not overly pursue solution quality in its early development, unlike enterprise-focused products like Alibaba's Tongyi or Baidu's Wenxin Yiyan. Instead, it explored the range of problems such an AI product could solve. Therefore, rather than exchanging quality for enterprise market returns, Doubao offered more attractive pricing. According to Zhu Jun, ByteDance's vice president of product and strategy, Doubao's large model is priced at 0.0008 yuan per 1,000 Tokens, approximately 1% of the prevailing market price at the time.

This operational model allowed Doubao to quickly attract a large number of developers in a short time. Based on this, Doubao, while not the "smartest" in the market, has demonstrated stronger human-like characteristics in later competition. For instance, content like Doubao guiding users on outfits or supervising children's homework has spread widely on Douyin. Its witty and sharp dialogue capabilities have been key to its popularity, revealing that Doubao's rapid growth is fundamentally driven by content.

Under these trends, Tencent finally unveiled its "ace in the hole."

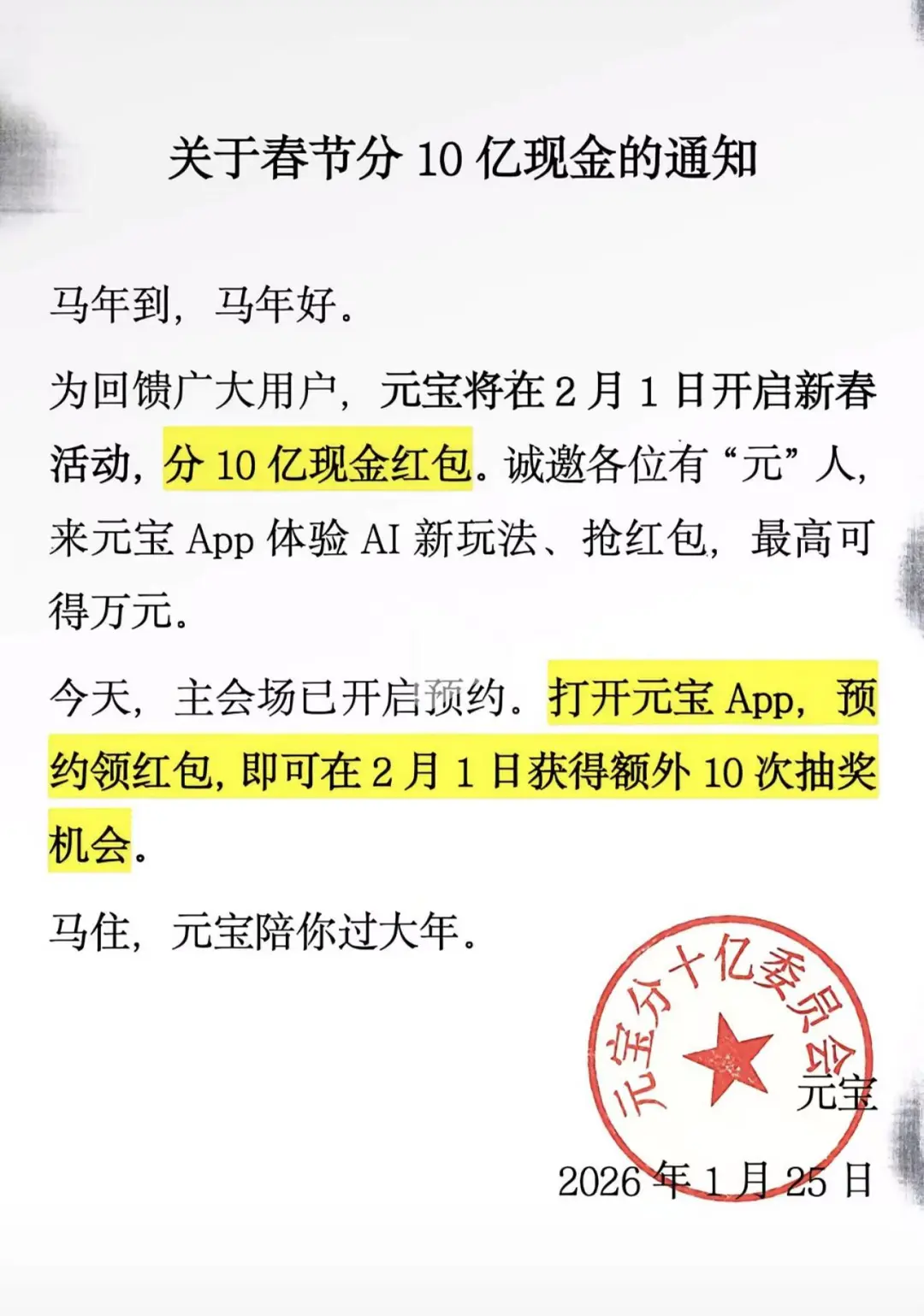

First, it revived its tried-and-true Spring Festival red packet gameplay. On January 25, Tencent's AI application Yuanbao announced that it would launch a New Year event on February 1, allowing users to compete for 1 billion yuan in cash red packets on the Yuanbao App, with individual red packets reaching up to 10,000 yuan. Tencent attached great importance to this, with Pony Ma stating at the subsequent annual meeting that he hoped the event would replicate the success of WeChat's red packets.

Second, beyond continued spending, Tencent leveraged its core strength: "social networking." At the same annual meeting, Pony Ma mentioned that Yuanbao would launch a social product called Yuanbao Pai, claiming it was a top-secret project. Positioned as a social space for AI and users to entertain and collaborate, Yuanbao Pai allows users to interact simultaneously with friends and AI through group chats.

Functionally, this bears some similarity to the AI assistant already integrated into Douyin groups. However, Yuanbao Pai's features will continue to upgrade, with plans to launch "watch together" and "listen together" functionalities, leveraging Tencent Meeting's underlying audio and video capabilities to further enrich the AI social space. This means that, following Qianwen's integration into Alibaba's ecosystem resources, Yuanbao is also advancing its ecosystem layout. Leveraging ecosystems to radiate multi-platform capabilities and resources is currently a weakness for Doubao.

Baidu also has no choice but to "fight hard." After Yuanbao announced its red packet gameplay, Baidu declared it would distribute 500 million yuan in cash red packets to Wenxin Assistant users during the Spring Festival, with individual amounts reaching up to 10,000 yuan.

Notably, unlike Baidu's enterprise-focused Wenxin Yiyan, this major campaign targets Wenxin Assistant, the AI entrance integrated into Baidu's search ecosystem, i.e., a consumer-facing product. A recent Wall Street Journal report revealed that Wenxin Assistant's MAUs have surpassed 200 million.

However, Baidu is also cutting off its own arm while investing heavily. After integrating the AI assistant, most of the top search results are now AI-generated content, yet Baidu's core search monetization relies on paid advertising. The intervene (intervention) of AI results has further narrowed its advertising revenue space. Financial reports show that in Q3 2025, Baidu's core marketing revenue was 15.3 billion yuan, down 18% year-on-year, marking its sixth consecutive quarter of negative growth. Nevertheless, Baidu's move to distribute 500 million yuan in red packets indicates its clear choice.

Thus, as the key battle for a national-level AI application coincides with the Spring Festival's massive traffic window, all players are compelled to give their all. Whether the industry landscape will be rewritten after this battle remains to be seen.