Tencent, Alibaba, and ByteDance Launch a New "New Year Offensive": Who Will Strike First?

![]() 02/06 2026

02/06 2026

![]() 377

377

The "New Year Offensive" is not fought on mobile phones but in the cognitive realm of people's minds, where the mind is the battlefield.

Written by | Blue Hole Business Zhao Weivei

With only two weeks left until the 2026 Spring Festival, ByteDance, Alibaba, and Tencent have all begun launching their "New Year Offensives."

Tencent Yuanbao will launch a RMB 1 billion cash red envelope incentive campaign on February 1, paired with AI-driven social gameplay through "Yuanbao Club."

Alibaba's Qianwen is the focal point of its AI efforts. Alipay's annual tradition of collecting five blessings is expected to introduce more gameplay features involving Ant Group's Afu this year.

ByteDance's Volcano Engine is the exclusive AI cloud partner for this year's Spring Festival Gala, and Doubao, under ByteDance, will also introduce various interactive gameplay features...

This is an unavoidable "New Year Offensive" for tech giants, with the super AI entry point as the target.

However, a more famous "New Year Offensive" (Tet Offensive) took place on the Vietnamese battlefield 58 years ago when North Vietnam launched an unprecedented large-scale assault. Over 80,000 North Vietnamese regular troops and guerrillas attacked nearly all cities and towns in South Vietnam.

This battle directly shook U.S. public opinion. When North Vietnamese commandos briefly occupied the courtyard of the U.S. Embassy, the intense on-site combat was reported and televised in real-time, completely shattering the narrative myth of "U.S. control." Anti-war sentiment surged domestically in the United States, making global headlines at the time.

The "New Year Offensive" has been a topic of fascination for years because battlefield victory is one thing, and the war's outcome is another. North Vietnam lost the battle but turned the tide of the war. Despite heavy casualties, with over half of their forces lost, North Vietnam achieved victory in spirit and propaganda, later forcing a U.S. strategic retreat and seeking peace talks.

"Perception is reality," summarized Jack Trout, the father of positioning theory.

The "New Year Offensive" serves as a reference case for Trout to analyze business competition because, like battles on the battlefield, a single win or loss in business is not as important as who can win in people's minds. Marketing is not a contest of products but of perceptions. Even with a superior product, falling behind in user perception can still lead to defeat.

In today's reality, this is not a simple battle over red envelope traffic but a crucial campaign for internet giants to seize the next-generation super AI entry point. Will Tencent, Alibaba, or ByteDance achieve cognitive victory in the 2026 "New Year Offensive"? The sign of victory is whether users think of Yuanbao, Qianwen, or Doubao first when AI is mentioned.

From Trout's perspective on marketing warfare, Tencent is now waging a "defensive battle," with RMB 1 billion in red envelopes safeguarding its dominant position in social and traffic. ByteDance's appearance on the Spring Festival Gala is an "offensive battle," embedding the perception of the "super AI entry point" into a broader user base. Alibaba may launch a "flanking battle," having learned from WeChat Pay's "sneak attack" experience, and will likely innovate again with AI health assistant "Afu" and other gameplay features...

The billions in red envelopes are the ammunition of the giants, but this "New Year Offensive" is not fought on mobile phones but in people's cognitive perceptions of AI. In other words, the mind is the battlefield.

Will Tencent's defensive battle succeed?

Pony Ma's expectation for Yuanbao during this year's Spring Festival is to replicate the success of WeChat's red envelopes back in the day.

The 2015 Spring Festival Gala red envelope battle allowed WeChat Pay to launch a surprise attack on Alipay overnight. This is a repeatedly told case of Spring Festival Gala business warfare. At that time, WeChat distributed RMB 500 million in cash red envelopes through "shake," with a total of 11 billion user interactions on WeChat on New Year's Eve, achieving overnight popularity for WeChat Pay. This was later described by Jack Ma as a "Pearl Harbor attack."

During this year's Spring Festival, the Yuanbao app will distribute RMB 1 billion in red envelopes and introduce a new AI-driven social gameplay feature called "Yuanbao Club."

The gameplay of Yuanbao Club aims to explore multi-person social scenarios. In group chats, there will always be an online-interactive Yuanbao, and screen sharing will be available for simultaneous viewing and listening, similar to Tencent Meeting's AI exploration.

Pony Ma said he is also testing it internally, "Yuanbao Club may introduce additional communication features in the future. We will first leverage our strengths in social communication and our relationship chains to create a good atmosphere."

But why is Tencent waging a "defensive battle" this year? Because, just as WeChat was to the Spring Festival Gala 11 years ago, this year's exclusive AI cloud partner for CCTV's Spring Festival Gala is ByteDance's Volcano Engine, and Doubao will introduce innovative gameplay features like "AI deskmate watching the Spring Festival Gala."

Tencent's RMB 1 billion in red envelopes is not aimed at seizing a larger market but at hedging against the massive traffic drainage effect that the Spring Festival Gala may bring, launching a defensive offensive in advance.

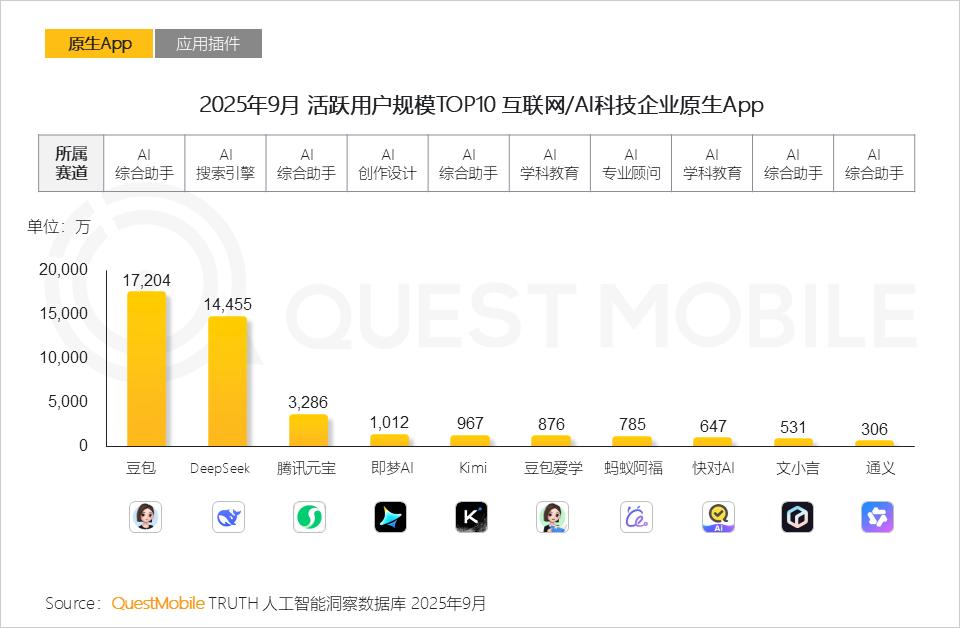

According to the latest annual trend report by QuestMobile, Doubao leads in user scale by a wide margin, whether in apps or PC clients, followed closely by Tencent Yuanbao and then ByteDance's Jimeng AI.

According to Yicai, Jimeng's positioning differs from Kuaishou's Kling, which focuses on tools. Jimeng aims to be a social platform, with AI generation serving as the underlying technology.

Social capabilities are Tencent's core strength. Given Doubao's traffic and Jimeng's ambitions, Tencent cannot underestimate ByteDance's momentum in this year's Spring Festival Gala. Therefore, Tencent faces a defensive battle, and a crucial principle of defensive warfare is to be always prepared to stop competitors' strong marketing offensives.

So why is Yuanbao, rather than WeChat, Tencent's main player in this defensive battle?

Tencent's integration of social features into its AI-native product Yuanbao aligns with the principle of defensive warfare: The best defensive strategy is the courage to attack oneself. After all, WeChat and Douyin are already national-level internet products. Today, AI-native apps have greater potential for user acquisition and transformation, ultimately becoming daily essential entry points rather than isolated apps.

Over the past year, WeChat integrated Yuanbao in the first half of the year, enabling Q&A functions in search. Users could also add Yuanbao to their contacts to parse official account articles, images, and documents. In the second half of the year, Tencent Meeting integrated Yuanbao to introduce AI hosting capabilities, allowing AI to attend meetings on behalf of users and generate real-time meeting summaries. QQ users can achieve AI summaries of unread messages in groups.

It is evident that AI's transformation of Tencent's products is progressing step by step, from light to heavy. This is not an overnight project, as Pony Ma said, Tencent's style is steady and solid.

No matter how popular AI-native apps become, users still cannot live without WeChat after the hype settles. This is the starting point for Tencent's preventive defense, and WeChat's AI transformation is Tencent's true "ace in the hole."

Is Doubao's offensive battle worth anticipating?

The position of true social leader is irreplaceable. So, what is ByteDance's offensive battle during the "New Year Offensive"?

ByteDance is replicating Douyin's success in the short video sector, using Doubao's product and engineering capabilities to create the first perception of the "super AI entry point." Leveraging Douyin's billion-level traffic pool, it achieves viral user acquisition and retention through algorithm-preferred recommendations of Doubao content, search results, and interactive entry points.

"Steady and solid" is also ByteDance's strategy for AI products. In many short video scenarios, Doubao optimizes across multiple domains, such as education, creation, and companionship, continuously popularizing the concept of "getting smarter with use" and reinforcing the perception of being the "most practical AI."

This year's Spring Festival, with Volcano Engine as the exclusive AI cloud partner for the Spring Festival Gala and Doubao interactions, represents a traffic breakthrough for this offensive battle. It enhances the perception: How can AI address the essential needs of the broadest user base?

According to the principles of offensive warfare, the attacker must find and exploit weaknesses in the leader's strengths and launch the attack on as narrow a front as possible.

For example, AI hardware is an area Tencent rarely touches. Pony Ma has publicly emphasized multiple times over a decade ago that Tencent should focus on software-level products. However, in the AI era, Alibaba's Quark glasses and ByteDance's Doubao phone have made forward-looking layout in the hardware sector, forming differentiated advantages.

According to the latest news from "Emerging Intelligence," ByteDance initiated the official version project of the Doubao phone assistant at the end of 2025, with the new device expected to be released in the mid-to-late second quarter of 2026. Additionally, ByteDance has high expectations for the new device, significantly improved from the first-generation test version. In terms of mode, the second-generation Doubao phone will continue to collaborate with ZTE Nubia, with ZTE responsible for hardware and Doubao for AI.

Similar to DingTalk's recording card product, Feishu recently launched an AI recording bean developed with Anker Innovations. Compared to the popular card-style recording devices in the industry, the bean-shaped design resembles the recent popular AI companion hardware, emphasizing unobtrusive wear and all-day portability, also supporting recording, meeting minutes, and AI summaries.

Whether it's the recording bean or the Doubao phone, both are powered by ByteDance's self-developed Doubao large model. As AI enters the physical world, enabling AI to have eyes, ears, and even the brain to operate mobile phones, ByteDance has begun to differentiate itself in this battle.

What is even more anticipated is this year's Spring Festival, where over 2 billion New media platform touchpoints will allow Doubao and its underlying Volcano Engine technology to reach the broadest lower-tier markets . If real-time interaction and other gameplay features perform well, they will dominate the post-festival Public opinion market , significantly increasing user mindshare, becoming the leader in the super AI entry point, and forcing other giants to adjust their strategies subsequently.

The specific gameplay features of Volcano Engine and Doubao during this year's Spring Festival have not been officially announced, but industry insiders reveal that Doubao will make several groundbreaking major releases before the Spring Festival.

This is the most anticipated part of this year's Spring Festival, not just about the winner. It is a stress test for all internet giants. If a red envelope battle reminiscent of the past unfolds, it means this year's "New Year Offensive" marks a crucial campaign for internet giants to seize the next-generation super AI entry point. This could be a turning point for AI in China's internet sector, potentially solidifying the landscape of AI-native products and putting greater pressure on the losers.

Alibaba Will Not Be Absent

Over the past six months, Alibaba has intensified its AI efforts and will undoubtedly participate in this year's "New Year Offensive."

Alibaba's strategy is a "flanking battle," as evidenced by its AI health assistant "Afu." Since renaming "AQ" to "Afu" in 2025, this AI application has been heavily promoted in the market. Leveraging its existing bound medical insurance users, Afu has exceeded 15 million monthly active users, becoming a leading player in the health vertical sector.

An excellent flanking battle must significantly influence users' choices. From this perspective, Afu has become one of the samples of flanking battles in the current AI landscape.

Since its renaming, Alibaba Qianwen has become the project with the most significant resource investment across the group. With integration into products like Gaode Maps, Qianwen has penetrated various life scenarios, including office, shopping, and mapping. Qianwen serves as Alibaba's AI assistant and AI life entry point for C-end users, with over 100 million monthly active users, becoming a rising contender catching up to Doubao and Yuanbao. Accompanying the Qianwen app are C-end AI hardware products like Quark AI glasses.

Alibaba has undergone the most significant changes in the AI landscape in 2025, forming a direction of AI-native apps as universal entry points + deep cultivation in AI vertical sectors.

Based on current information, Alibaba has not yet announced its specific tactics for the "New Year Offensive." However, as Pony Ma acknowledged, Alibaba's attempt to deeply integrate its AI model, Tongyi Qianwen, into its internal ecosystem is commendable, and internal ecosystem synergy is also reasonable.

Therefore, it can be imagined that Alibaba's "New Year Offensive" this year will inevitably continue its previous systematic approach, focusing on Qianwen and Afu, penetrating various business lines within Alibaba's commercial ecosystem, seizing AI mindshare in health, life, and e-commerce—three high-frequency scenarios—and firmly locking users within Alibaba's ecosystem.

The true AI leader is the one whose ecosystem is the hardest to replace. Therefore, the most crucial aspect to observe about Alibaba is that, regardless of how intense competitors' actions are, after the Spring Festival, Afu's penetration rate in health scenarios and the linkage data of Alibaba-affiliated apps will determine the success of this flanking battle.

Position determines strategy, and long-term mindshare determines victory. If the historical "New Year Battle" can offer any inspiration to the current three giants, the most significant lesson is not about the size of red envelopes or user scale but the need to launch a localized offensive that shatters public perception, eliminating the "invincible" image of the perceived leader in users' minds.