AI advertising costs crush entrepreneurs

![]() 09/30 2024

09/30 2024

![]() 513

513

Author|Qi Ming, Editor|Xue Xingxing

Cover|Unsplash

Sam Altman, the founder of OpenAI, believes that the AI era will usher in a new type of startup—one where a single individual can build a billion-dollar unicorn company. However, this era has yet to truly arrive, and AI entrepreneurs are first being blocked by the high costs of advertising. As AI entrepreneur Zhao Tian puts it, "In 2023, everyone was talking about technology, products, and scenarios, but in 2024, it's all about growth and making money." Zhao Tian, who used to work for a major domestic company, started his own business last year, focusing on AI-generated images. His startup initially went smoothly, and he successfully completed Series A funding.

Starting in October last year, he launched some exposure-based promotional campaigns on Bilibili, Xiaohongshu, and Douyin, achieving impressive conversion rates. Calculating the CPM (Cost Per Mille, cost per thousand impressions), it was around five yuan. "I wouldn't say it's because our product is so good, but in 2023, users were full of curiosity about AI tools and willing to try them out. As long as the exposure reached the right people, the conversion rate was high," says Zhao Tian. However, with the entry of prominent players like Yuedian Anmian, the threshold for this game, which was once about leveraging small advantages, suddenly became unattainable. Unicorn companies and internet giants absorbed most of the traffic and attention, driving up advertising costs to unprecedented levels. Ordinary entrepreneurs had to grit their teeth and keep up or quit early. Their anxiety drove them to invest in advertising, which in turn fueled more anxiety.

No one knows whether each plan and confirmation in the advertising bidding system will help them survive longer or bring them closer to failure.

01|"I Haven't Seen Such a Generous Investor Since Pinduoduo"

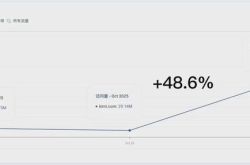

Kimi is one of the most popular AI products after Miaoya Camera, and unlike most fleeting "internet celebrity products," Kimi has maintained a high level of popularity since its launch. In March of this year, Kimi's monthly visitors surpassed Baidu's ERNIE Bot, becoming the leader in monthly active users and visits in the ChatBot sector.

Six months have passed, and this leading position has not changed. According to August data from the AI Product Ranking aicpb.com, Kimi had 23.36 million monthly visitors, still ahead of ERNIE Bot's 19.16 million. Meanwhile, Minimax, another big model startup, had only 513,900 visitors for its Hailuo AI.

Naturally, Kimi's advertising and user acquisition capabilities have become the subject of study for various AI companies. It is widely recognized in the industry that Yuedian Anmian is the most aggressive big model startup in terms of advertising investment. According to AppGrowing data, Kimi's advertising investment was 15 million yuan in March and nearly 50 million yuan in July and August, totaling 140 million yuan in six months.

Screenshot of Yuedian Anmian's official website

Bilibili has become the "home court" of Yuedian Anmian. An UP master told "Shangshan" that he could only take on about two commercial projects per month, and both of the past two months' projects were from Yuedian Anmian. According to him, not only the tech sector but also fields like careers and knowledge have benefited from Yuedian Anmian's generous investments. "I haven't seen such a generous investor since Pinduoduo." In addition to content collaborations, Kimi frequently places information flow ads directly.

Some media outlets have quoted industry insiders as saying that Kimi's CPA (Cost Per Action, cost per acquisition) quote on Bilibili is as high as around 30 yuan, compared to about 10 yuan at the beginning of this year. As Yuedian Anmian's advertising investment soared, other companies quickly followed suit. On Bilibili, Doubao bought competitor keywords, so searching for Kimi would bring up Doubao's ads. On Xiaohongshu, many people are being taught how to plan travel itineraries using Tencent's AI tool Yuanbao. Even podcasts, once considered a niche channel, are hearing more and more AI tool ads.

The advertising war has spilled over from online to offline. Subway stations in Beijing now display ads for Zhipu Qingyan. In Shanghai's Lujiazui, where white-collar workers congregate, Minimax has begun placing ads in elevators. And Doubao, like Feishu, has started telling people at airports how to "drive business growth with AI."

Companies are also embracing these AI "sugar daddies." During Bilibili's Q2 2024 earnings call, CEO Chen Rui proactively mentioned Bilibili's high-quality AI content. Xiaohongshu has also stepped up its AI content operations this year, with some ordinary operational activities receiving direct support from the company's product and technology executives. Focus Media has also increased its sales efforts for AI companies, ultimately persuading some unicorns to place elevator ads. With so many companies investing in advertising, traffic has surged. According to Similarweb statistics, the total visits to the products of the "AI Five Dragons" (Zhipu AI, MiniMax, Baichuan AI, ZeroOne AI, and Yuedian Anmian) soared by 963% in six months.

02|Knowing the Pattern Is One Thing, Replicating the Next Kimi Is Another

Zhou Xian is responsible for product operations at an AI startup related to anime. In the past, her work mainly involved participating in product planning and design, expanding partnerships and channels, etc. However, this year, her job has been reduced to essentially one thing: advertising and growth. "Almost every meeting starts with a discussion of Kimi's recent advertising efforts, followed by our own," says Zhou Xian. "Growth has become the company's top priority."

Zhou Xian says that summarizing the growth pattern isn't difficult. It's essentially about investing heavily in advertising to quickly capture users' attention and achieve downloads and conversions in the simplest and most direct way. However, knowing the pattern is one thing; replicating the next Kimi is quite another. Kimi adopts a CPA (Cost Per Action) advertising model, where Yuedian Anmian pays a fee when a user completes a specific action, such as registration or download. This is a straightforward advertising strategy that directly drives growth. Advertising bids are similar to auctions, where if someone bids too high, those who bid lower will receive less traffic.

Well-funded internet giants and big model unicorns have driven up advertising costs, making it difficult for ordinary entrepreneurs to keep up. Zhao Tian says that entrepreneurs like him can't afford a 30-yuan CPA cost. He calculates that early-stage AI companies typically raise between three and five million yuan. "Let's put it this way, if we spend all that money on advertising, we might get at most 200,000 users, and that doesn't even guarantee retention," he says. As for Douyin, it has become an "AI no-go zone." Zhou Xian says that except for Douyin's own AI product Doubao or AI products with investment partnerships, traffic is restricted, either because the content is deemed "irregular" or because advertising consumption is slow—meaning your content isn't very popular.

As Doubao's advertising costs on Douyin increase, the novelty of AI wears off, and AI companies' customer acquisition costs continue to rise. Some industry insiders say that Kimi's total customer acquisition cost is now around 15 to 20 yuan. Sina Tech previously estimated that Kimi's daily customer acquisition cost reached 200,000 yuan. This means that not only does Yuedian Anmian have to pay increasingly high growth costs, but other AI companies are also forced to get caught up in the advertising bidding war, driving up their advertising costs and deterring many entrepreneurs.

03|The Unsustainable Advertising War

As the war heats up, the unicorns and internet giants that initiated the charge are also becoming anxious about the soaring customer acquisition costs.

Kimi is Yuedian Anmian's only product, and founder Yang Zhilin has said on multiple occasions that they don't have another product in the pipeline and plan to gradually turn Kimi into a "super app." In the mobile internet era, creating a "super app" was the ultimate dream of many entrepreneurs, and it ultimately gave birth to applications like WeChat, Douyin, and Meituan, which are all-encompassing in their respective fields and have the ability to expand into others, enabling the companies to become giants of the new era.

To become a super app, two basic criteria are essential. First, the number of users must be sufficient, and they must use the app frequently. Second, these users should not easily migrate to other platforms, building a high moat. On the surface, advertising aims to increase the number of users. However, improving user metrics like DAU (Daily Active Users) doesn't necessarily enhance a platform's competitiveness. A Yuedian Anmian product manager named "Song'e" posted on the social platform Jike that a high DAU doesn't necessarily crush competitors. "AI provides intelligent value rather than directly providing value through information exchange. Under most current product designs, there isn't much network effect, so DAU growth doesn't bring exponential value enhancement to the product," they wrote.

While user growth may not bring significant scale effects to Kimi, it can help the company obtain data and feedback in a more natural environment, thereby improving the product experience. Yang Zhilin positions Kimi as a "super assistant," saying, "I think in the AI era, the super app will most likely be an assistant. I believe the demand for intelligence is universal, although our current capabilities are still at an early stage."

A crucial step in training Kimi to become a "super assistant" is to gather sufficient data. Yang Zhilin believes that data should not be a fixed dataset but a "variable." "How to use data or obtain user feedback will increasingly become a vital aspect," he says. With this mindset, acquiring sufficient users is also a way to build a data moat. However, for a commercial company, any strategy must consider ROI. According to aicpb statistics, in the last three months, users have used Kimi for an average of four days, with an average session duration of less than two minutes. It's hard to say how much data feedback this level of interaction can provide.

Companies are also starting to reduce their advertising costs. 36Kr reported that Kimi's high marketing costs have made some shareholders concerned about sustainability. An employee at Yuedian Anmian said that in the fourth quarter of this year, the company would seek to reduce advertising costs and increase investment in new channels like video accounts, Weibo, and Zhihu. On these platforms, Kimi's content is more "down-to-earth," with headlines like "Use Kimi to Leave Work Early," "Finish Your Excel in Ten Seconds with Kimi," and "Become a Self-Media Blogger Earning Ten Thousand a Month with Kimi." Some of this content comes from service providers, while much of it is produced by Kimi's market growth department, with some employees even appearing on camera. It's uncertain how many truly valuable users these materials can attract.

When users are attracted by exaggerated headlines but find that AI can't solve all their problems, they may become disappointed. Many small and medium-sized enterprise owners who follow cutting-edge technology have tried AI tools but found that humans are still more convenient and cheaper. Some investors predict that the burning money war may end in six months, when unicorns may not have much money left to invest, and large companies will need to evaluate ROI, leading everyone to gradually become more rational and focus more on commercialization and paying users.

04|Seeking Other Avenues

Zhao Tian says he's in a dilemma. If he doesn't continue advertising, it's hard to sustain growth and secure the next round of funding. But continuing to advertise may only deplete his funds faster. Zhu Xiaohu, the founder of GSR Ventures, has always been skeptical of AI consumer products and firmly opposes "buying users with money." In an interview, he said, "Buying users with money today is difficult. In the past, companies could raise three rounds of funding in a year, but now it's not so easy. The completely different funding environment necessitates not burning money."

Since 2024, various investment institutions have tightened their investments in AI startups. An investor told "Shangshan" that only products with clearer conversion to paying customers, especially B-end products, are likely to receive funding. C-end products are almost impossible to raise above Series A funding at this stage, and for new big model companies, "the qualification round is over, and the elimination round has started early." Zhu Xiaohu goes further, stating bluntly that the only way out for current big model unicorns is to sell to large companies. Entrepreneurs like Zhao Tian are not unaware of the grim situation or unwilling to seek more promising business opportunities with paying customers.

However, when they embarked on AI entrepreneurship, both entrepreneurs and investors were more patient, willing to wait for the market to mature, create small but beautiful products, and tolerate temporary losses. In just a year, when Zhao Tian went to discuss funding again, he was told that either he needed a sufficient user base to validate market feasibility or he had to immediately demonstrate his commercialization prospects. Demonstrating commercialization prospects meant essentially starting a new project from scratch.

For Zhao Tian, the only option seems to be advertising to acquire customers. More large companies have realized that when technology and products are hard to differentiate, it's challenging to retain users acquired through advertising. Doubao, with its advantage on Douyin, can "capture users' minds" at a lower cost. Nowadays, their focus has shifted from marketing to sales, and they're customizing technical solutions for B-end customers. Ali's Tongyi AI only partners with more precise channels. An Ali insider told "Shangshan" that they believe AI should be more like cloud services, targeting "producers" rather than just being an entertainment app.

Zhao Tian says that in today's environment, it's too difficult to create a "small but beautiful" AI application. He plans to focus on overseas markets, where marketing is more cost-effective. Customer acquisition costs on Google and Twitter are roughly half of those in China, and people are more accepting of small products rather than requiring a high user base for funding. The fear of missing out on AI looms over everyone. Many people don't know why they're doing this, but if they don't, they may not stay in the game.

Perhaps both entrepreneurs and investors need more patience, after all, AI is still a child, and the technology, products, talents and markets required for its growth all need time, and it is difficult to force it to ripen. "In fact, AI sells services, so as long as you serve a group of people well, you can survive. The cost of finding this group of people in China is too high, and it is much better abroad." Zhao Tian said, "There is no one there urging you to achieve a hundredfold scale in a short time."

(Zhao Tian and Zhou Xian are pseudonyms.)