When Even Porsche Can't 'Afford' to Build Its Own Charging Stations, the Charging Industry Needs a Breakthrough Moment

![]() 12/24 2025

12/24 2025

![]() 458

458

The construction of charging infrastructure has shifted from a mere competition in quantity to a dual competition in quality and efficiency.

On December 22, 2025, when Porsche China issued the 'User Notice on the Discontinuation of Porsche Premium Charging Services,' the luxury automaker, renowned for its racing pedigree, unexpectedly hit the 'brakes' on its charging pile endeavors. Starting from March 1, 2026, approximately 200 self-built charging stations nationwide will gradually cease operations. This decision, like a stone thrown into a calm lake, has rippled through the new energy industry.

'We conducted both qualitative and quantitative assessments,'

Behind Porsche China's statement lie harsh data: the average daily charging volume at its self-built stations is merely 30% of the industry average, with supercharger utilization consistently below 15%, while annual maintenance costs per station soar to 25,000 yuan.

In contrast, Tesla has tripled the average daily revenue per station through its 'charging + lounge + retail' model, while NIO's battery swap stations, combined with 'coffee + lounge' offerings, have doubled user dwell time.

Porsche's exit is not an isolated case. The joint charging network established by Mercedes-Benz and BMW has shifted from self-construction to collaboration with energy giants like Shell, while Audi has opted to integrate into State Grid's 'Ten Vertical, Ten Horizontal, Two Loops' charging network. This transformation reflects automakers' upgraded perception of charging infrastructure from a 'vanity project' to an 'efficiency-first' endeavor.

The Awkwardness of 'Noble Charging Stations'

'These stations are like islands, accessible only to Porsche owners, while other electric vehicle brands can only watch from afar,' remarked a new energy industry analyst.

Unlike Tesla and NIO's 'open and shared' models, Porsche's charging network has maintained an 'exclusive' stance, rejecting access for electric vehicles from other brands except Audi. This 'closed ecosystem' has led to persistently low utilization rates, with some stations even experiencing the embarrassment of 'idle piles basking in the sun.'

Porsche's decision was not impulsive.

As early as 2023, Oliver Blume, then Chairman of Porsche's Executive Board, stated, 'Charging infrastructure is a crucial part of Porsche's electrification strategy, but we must ensure its economic viability.' The 200 stations being discontinued represent Porsche's decisive cut of 'inefficient assets.'

'A single charging station can cost up to a million yuan, including site rental, power system upgrades, and equipment maintenance,' revealed a Porsche dealer. 'With only the Taycan and Macan as pure electric models, and the Panamera as the sole hybrid, while the pure electric Cayenne won't be delivered until late summer 2026, the limited number of owners naturally results in low charging demand.'

Porsche clarified in its statement, 'This adjustment only targets premium charging scenarios. Other charging scenarios, including stations within Porsche Centers, destination charging stations, and third-party brand stations integrated into the Porsche Charging Map, will continue normal operations.' This means Porsche owners will increasingly rely on third-party charging networks rather than brand-exclusive stations.

'We aim to leverage extensive, efficient, and convenient third-party charging resources to break scene limitations and enhance the breadth and flexibility of charging services,' said a Porsche China representative.

This strategy aligns with the 'open cooperation' models of Tesla and NIO. Tesla has integrated into third-party networks like State Grid and China Southern Power Grid, while NIO's 'battery swap + charging' dual model covers more scenarios. Data shows NIO has accumulated over 80 million battery swap services, optimizing operational efficiency; its virtual power plant model generates revenue through energy dispatch to support network expansion.

This model not only enhances the stability of its energy replenishment network but also expands value through open cooperation. With 1.2 million third-party charging piles integrated and collaborations with multiple brands, non-NIO users can also share the network. Currently, over 80% of charging volume comes from external users, serving over 110 brands and driving collaborative development of the industry's energy replenishment ecosystem.

Porsche's exit reflects a profound transformation in China's charging pile industry from 'scale expansion' to 'efficiency prioritization.'

Data shows that as of November 2025, China's total charging infrastructure reached 8.616 million units, but public charging pile utilization stands at only 18.7%, with superchargers accounting for less than 10%. With 800V high-voltage platform models making up 15% of the market, the competition for charging speed has entered the '5-minute era,' with user experience becoming the new battleground.

'Charging piles are no longer a 'vanity project,' but an 'efficiency project,'' remarked a new energy industry expert. 'In the future, charging networks will evolve toward 'PV-storage-charging-inspection' integration and V2G (vehicle-to-grid) interactions to achieve efficient energy utilization.'

Dilemmas and Breakthroughs Behind Leadership

While China boasts the world's largest public charging pile network, the industry is trapped in a 'speed vs. passion' paradox.

Data shows that as of late August 2025, China's electric vehicle charging infrastructure (guns) totaled 17.348 million, up 53.5% year-on-year. This includes 4.316 million public charging facilities (guns), a 37.8% increase, with a total rated power of 196 million kW and an average power of approximately 45.48 kW; private charging facilities (guns) reached 13.032 million, a 59.6% increase, with a reported installed capacity of 115 million kVA.

During the '14th Five-Year Plan' period, China built the world's largest electric vehicle charging network, with two charging piles for every five electric vehicles. It also constructed the world's largest and fastest-growing renewable energy system, with renewable energy generation capacity rising from 40% to around 60%.

While China's charging pile count dwarfs that of Europe, the U.S., Japan, and South Korea, the overall glory masks weaknesses at critical nodes.

First is the geographical imbalance creating a 'charging divide.' In the Pearl River Delta, 650,000 charging piles form a dense energy network, while in some central and western cities, charging stations are as rare as oases in a desert.

This stark disparity is reshaping the consumption landscape of new energy vehicles.

More concerningly, the growth rate of charging piles in some second- and third-tier cities lags behind the issuance of new energy vehicle licenses. Some stations even become 'orphaned piles'—neglected by operators and without manufacturer warranties, turning into electronic wastelands in urban corners.

With new energy vehicle market penetration surpassing 50%, the shortcomings of charging infrastructure are subtly influencing consumer decisions. A third-party survey reveals that in third- and fourth-tier cities with scarce charging facilities, nearly 40% of potential consumers delay purchase plans due to charging concerns.

This 'chicken-and-egg' paradox is creating a Matthew effect in new energy vehicle adoption—regions with complete charging networks see sustained sales growth, while those with weak infrastructure struggle.

Notably, the 2025 Central No. 1 Document incorporated rural charging infrastructure construction into the rural revitalization strategy for the first time, marking a policy shift from 'quantity first' to 'quality and quantity.' The National Development and Reform Commission's latest guidelines propose a 'urban area, highway line, rural point' layout, reshaping the underlying logic of charging infrastructure.

A charging operator revealed, 'We now use big data on new energy vehicle ownership and travel patterns to deploy superchargers in high-frequency scenarios like large communities and commercial complexes, while building PV-storage-charging integrated stations in suburban areas.'

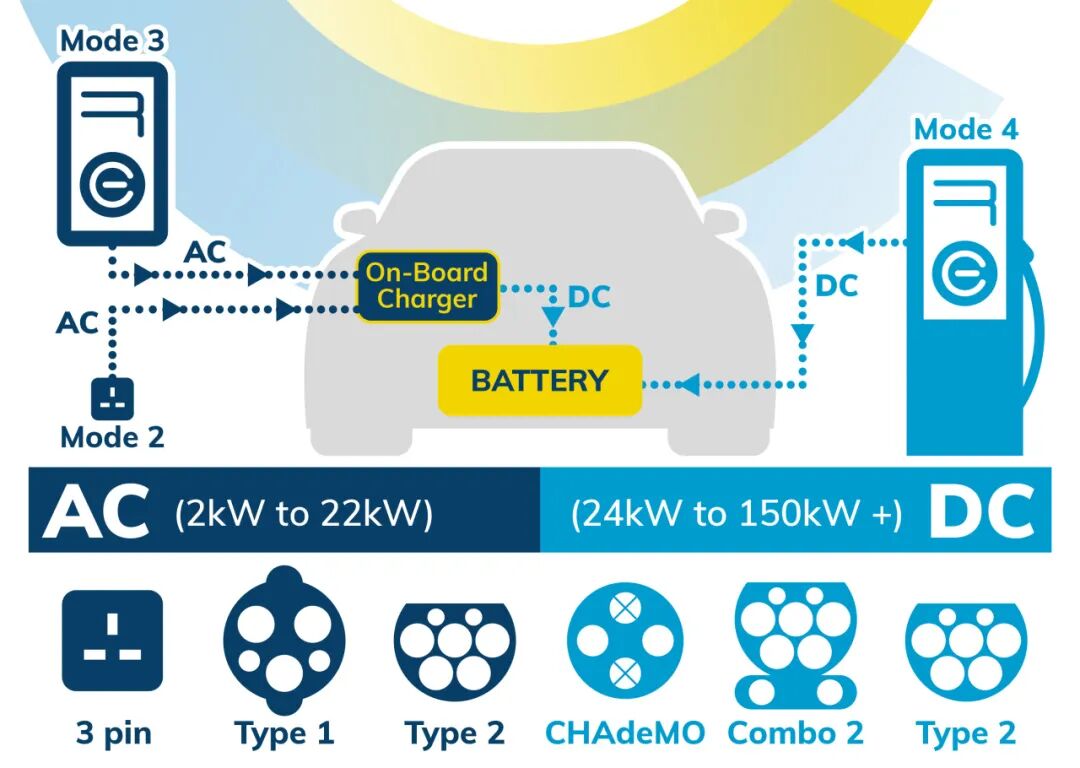

From 'Usable' to 'User-Friendly': Overcoming Pain Points Through Innovation. Facing challenges like inconsistent charging interface standards and low operation and maintenance efficiency, the industry is breaking through dilemmas with technological innovation. More excitingly, breakthroughs in solid-state battery technology are rewriting the competitive landscape of charging infrastructure.

Latest laboratory data shows that electric vehicles equipped with solid-state batteries can achieve 400 km of range after just 10 minutes of charging, fundamentally transforming the user experience of charging wait times. As an industry expert put it, 'When charging times approach those of refueling, the logic of existing charging network layouts will be completely refactor (restructured).'

Porsche's brake-tapping is not the finish line but the starting point of industry awakening.

Standing at the 2025 threshold, the construction of charging infrastructure has shifted from a mere quantity competition to a dual competition in quality and efficiency. This infrastructure revolution, crucial for the future of the new energy vehicle industry, requires not only top-level policy design but also collaborative innovation across the industrial chain. When charging truly becomes seamless, the widespread adoption of new energy vehicles may usher in (usher in) its true turning point.

As an industry expert remarked, 'True wisdom lies not in piling up numbers but in building a charging network that thinks.'

Note: Some images are sourced from the internet. If there is any infringement, please contact us for deletion.

-END-