Neural networks, which company has the strongest profitability?

![]() 10/10 2024

10/10 2024

![]() 404

404

Neural networks are computational models that mimic the structure and function of human brain neurons and are used to solve various machine learning and deep learning problems. They consist of a large number of nodes (also known as "neurons") that are interconnected through weighted connections. Profitability is typically measured by the amount and level of a company's earnings over a certain period. Analyzing profitability involves a deep dive into a company's profit margins. This article is part of the "Profitability" series on corporate value, featuring 31 neural network companies as research samples, with key performance indicators such as Return on Equity (ROE), Gross Profit Margin, and Net Profit Margin. The data is based on historical information and does not represent future trends; it is intended for static analysis only and does not constitute investment advice.

Top 10 Neural Network Companies by Profitability:

#10 Jinzitianzheng Industrial Segment: Energy and Heavy Equipment Profitability: ROE 5.57%, Gross Margin 21.76%, Net Margin 6.40% Performance Forecast: No agency forecasts available for this year Primary Product: Industrial computer control systems, accounting for 63.58% of revenue, with a gross margin of 18.75% Company Highlight: Jinzitianzheng holds the computer software copyright for the "Artificial Neural Network Development Platform" and utilizes artificial neural network algorithms in some process model development.

#9 Googol Tech Industrial Segment: Industrial Control Equipment Profitability: ROE 8.23%, Gross Margin 52.08%, Net Margin 15.56% Performance Forecast: No agency forecasts available for this year Primary Product: Motion control core components, accounting for 77.64% of revenue, with a gross margin of 53.22% Company Highlight: Googol Tech has developed a software system for robot applications based on independent research and development.

#8 Guangdao Digital Industrial Segment: Vertical Application Software Profitability: ROE 10.83%, Gross Margin 44.73%, Net Margin 18.10% Performance Forecast: No agency forecasts available for this year Primary Product: Data acquisition products, accounting for 74.98% of revenue, with a gross margin of 42.46% Company Highlight: Guangdao Digital relies on advanced convolutional neural networks and recurrent neural networks to develop target recognition and classification equipment for sonar, laser LD, SAR images, and maritime targets.

#7 Anlian Ruishi Industrial Segment: No agency forecasts available for this year Profitability: ROE 8.98%, Gross Margin 28.93%, Net Margin 11.55% Performance Forecast: Latest average forecast for ROE over the past three years Primary Product: Security video surveillance products, accounting for 99.20% of revenue, with a gross margin of 33.72% Company Highlight: Anlian Ruishi's products are equipped with built-in NPU (Neural Processing Unit), enabling intelligent analysis.

#6 Tangyuan Electric Industrial Segment: Other Computer Equipment Profitability: ROE 10.29%, Gross Margin 47.47%, Net Margin 19.12% Performance Forecast: No agency forecasts available for this year Primary Product: Vanadium-titanium resource development and utilization, accounting for 33.27% of revenue, with a gross margin of 5.87% Company Highlight: Tangyuan Electric utilizes deep learning and neural networks in its intelligent operation and maintenance management system to predict the lifespan of components such as overhead contact lines and vehicles, enabling fault diagnosis and health management.

#5 Zhixin Precision Industrial Segment: Other Automation Equipment Profitability: ROE 18.91%, Gross Margin 43.61%, Net Margin 15.95% Performance Forecast: No agency forecasts available for this year Primary Product: Automation equipment, accounting for 46.40% of revenue, with a gross margin of 29.92% Company Highlight: Zhixin Precision continuously develops AI neural network models for few-shot visual inspection, enhancing the application of defect detection and recognition technology.

#4 Starc Technology Industrial Segment: Other Automation Equipment Profitability: ROE 33.51%, Gross Margin 52.81%, Net Margin 29.99% Performance Forecast: No agency forecasts available for this year Primary Product: Solder paste printing inspection equipment, accounting for 73.66% of revenue, with a gross margin of 50.76% Company Highlight: Starc Technology's proprietary AI algorithms are based on deep learning using convolutional neural networks, enhancing the detection and computing capabilities of its products.

#3 Ruina Smart Industrial Segment: Instrumentation Profitability: ROE 14.48%, Gross Margin 55.17%, Net Margin 26.31% Performance Forecast: ROE has declined consecutively for the past three years to 4.05%, with the latest average forecast at 5.70% Primary Product: Sales of heating energy-saving products, accounting for 47.77% of revenue, with a gross margin of 53.72% Company Highlight: Ruina Smart integrates various AI algorithm models (primarily decision trees and neural networks) to develop intelligent algorithms for secondary network unit balancing and predictive control.

#2 Shenhao Technology Industrial Segment: Robotics Profitability: ROE 0.59%, Gross Margin 49.67%, Net Margin -6.43% Performance Forecast: ROE peaked at 14.68% over the past three years, with the latest average forecast at 6.00% Primary Product: Intelligent monitoring, detection, and control equipment, accounting for 57.36% of revenue, with a gross margin of 18.71% Company Highlight: Shenhao Technology's image recognition technology is primarily used in robots for reading various instruments (e.g., pointers, digital displays, and travel indicators) and identifying the status of equipment such as indicator lights, pressure plates, and switches.

#1 Xingchen Technology Industrial Segment: Digital Chip Design Profitability: ROE 36.83%, Gross Margin 41.40%, Net Margin 20.68% Performance Forecast: ROE has declined consecutively for the past three years to 10.38%, with the latest average forecast at 10.90% Primary Product: Smart security, accounting for 68.66% of revenue, with a gross margin of 33.58% Company Highlight: Xingchen Technology's AI processor technology follows a general-purpose processor approach, developing proprietary instruction sets, hardware IP, and software toolchains tailored for neural network algorithms.

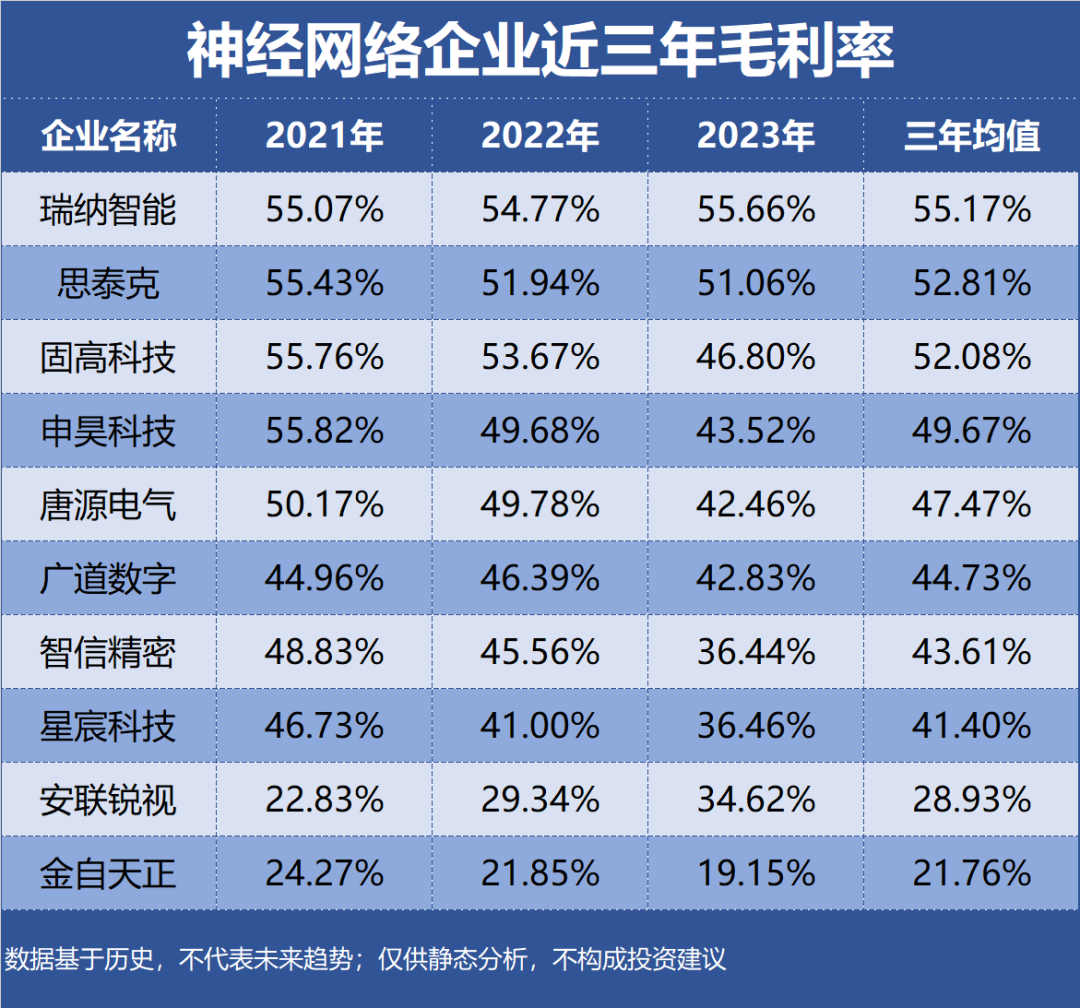

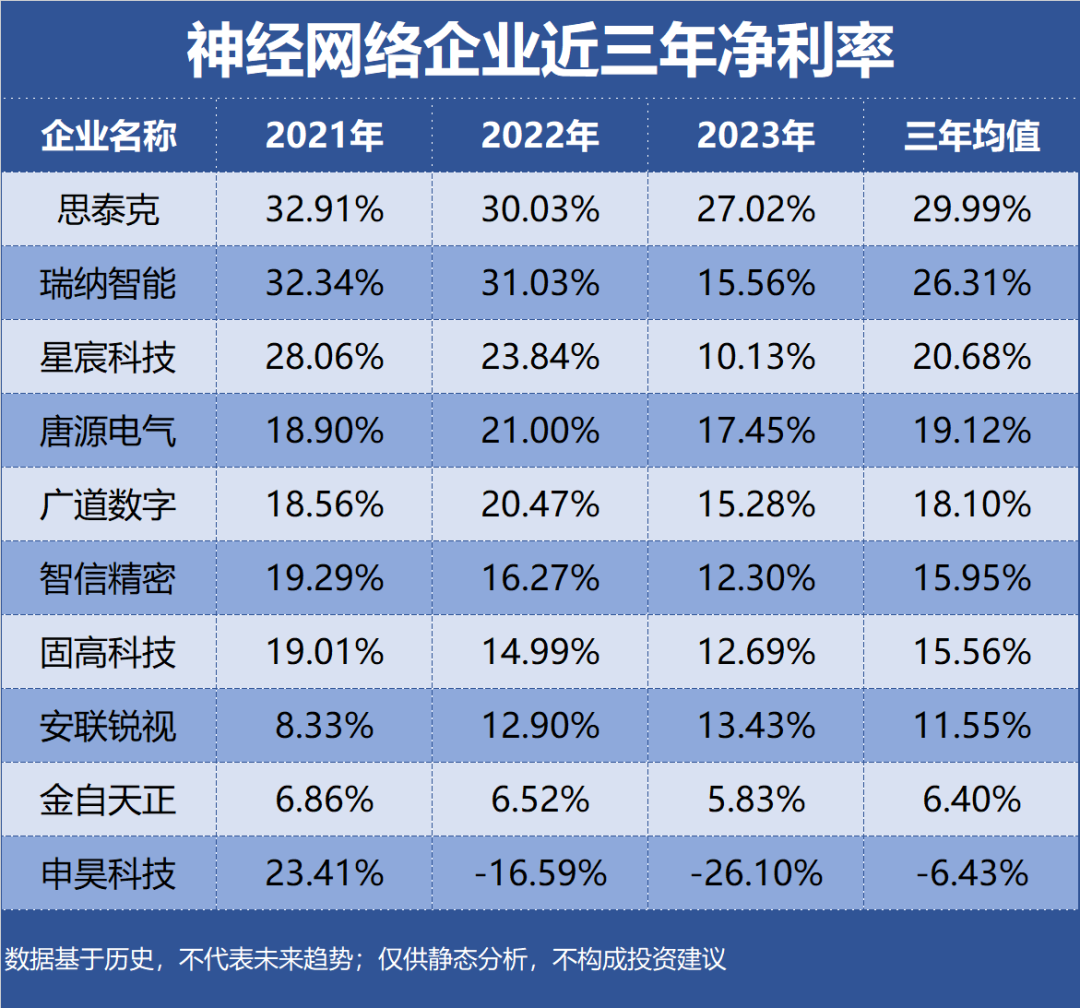

ROE, Gross Margin, and Net Margin of the Top 10 Neural Network Companies by Profitability over the Past Three Years: