High-level autonomous driving reaches a turning point: leading autonomous driving technology company Horizon Robotics IPOs

![]() 10/11 2024

10/11 2024

![]() 562

562

Produced by | Entrepreneur Frontline

Designed by | Xing Jing

Edited by | Song Wen

High-level autonomous driving will no longer be limited to high-end models! Data from the State Information Center shows that the penetration rate of high-level autonomous driving systems in new energy vehicles priced above 300,000 yuan in China has nearly reached 100%. Nowadays, high-level autonomous driving hardware and software are being integrated into more price segments, and the democratization of autonomous driving may arrive sooner than expected.

On August 8, the industry welcomed significant news as autonomous driving technology company Horizon Robotics passed the listing hearing of the Hong Kong Stock Exchange and is poised to enter the Hong Kong stock market. According to CIC, since 2021, Horizon Robotics has been the largest Chinese company providing front-loaded mass-produced advanced driver assistance systems (ADAS) and high-level autonomous driving solutions, measured by total installed capacity of solutions.

For Entrepreneur Frontline, Horizon Robotics' acquisition of the listing key at this time is not only a testament to its technological and commercial prowess but also a crucial signal of the democratization of high-level autonomous driving.

1. Laying the technological foundation for the industry

Why is Horizon Robotics' development inseparable from the high-level autonomous driving industry? Firstly, it is essential to highlight the company's role as the technological cornerstone of the industry.

At its inception in 2015, Horizon Robotics' founder and CEO Yu Kai stated, "We aim to seize not just one or two opportunities but a trend. We aspire to be the Intel of the robotic era."

At that time, with the rise of artificial intelligence technology, a significant amount of capital had begun to focus on its application in transportation, fostering the emergence of numerous star companies in the industry. Yu Kai's ambitious statement did not generate much attention at the time. However, Horizon Robotics seems to have never forgotten this pledge, consistently proving its strategic correctness and technological prowess through action.

While the industry shied away from chip manufacturing, Horizon Robotics chose the more challenging business path of deep learning algorithms combined with intelligent chips for terminal devices. This strategy enabled them to stand out.

In August 2019, Horizon Robotics announced the mass production of China's first automotive-grade AI chip, Journey 2, marking a breakthrough in deploying chips in mass-produced vehicles. In 2020, the Changan Uni-T, the first model equipped with Journey 2, was launched and became a best-seller with monthly sales exceeding 10,000 units.

In September 2020, Horizon Robotics officially introduced Journey 3, the industry's first 8MP front-facing ADAS automotive-grade AI chip. The following year, this chip was mass-produced and installed in the 2021 edition of Li Auto ONE, making it the first model to feature the chip.

In July 2021, Horizon Robotics unveiled Journey 5, China's first 100 TOPS automotive-grade AI chip. Upon its release, it was mass-produced in popular models such as Lixiang L series and BYD Han Glory Edition.

At last year's Guangzhou Auto Show, BYD further announced that it had become the first batch of partners with intent to mass-produce Horizon Robotics' latest automotive-grade AI chip, Journey 6. With the launch of six Journey 6 series computing solutions and the high-level urban autonomous driving solution SuperDrive in April this year, BYD joined SAIC Motor, Volkswagen Group China, Li Auto, GAC Group, ARCFOX, Beijing Automotive Group, Chery Automobile, EXEED, Voyah, and other automakers as the first batch of mass-production partners.

From the support of these star automakers and Tier 1 suppliers, it is evident how crucial Horizon Robotics' product innovation and iteration are to the development of China's intelligent driving industry.

2. Ushering in the era of mass-produced autonomous driving

Upon closer inspection, it becomes clear that Horizon Robotics has emerged as the largest Chinese company providing front-loaded mass-produced ADAS and AD solutions every year, thanks to its outstanding technological capabilities.

According to data from Gaogong Intelligent Automobile Research Institute, in the first half of 2024, Horizon Robotics ranked first in the market with a 28.65% share based on its Journey series computing solutions, covering low, medium, and high-level autonomous driving needs for mass production. Simultaneously, the company led the market for front-view integrated computing solutions in independent brand passenger vehicles (L2 ADAS) with a 33% share, surpassing Mobileye to take the top spot.

Looking at last year's full-year data, Horizon Robotics was the only company that could compete on par with NVIDIA. In 2023, the combined market share of the two companies in the NOA computing solution market further expanded to 84.48%, with Horizon Robotics' annual market share rising to 35.49%, making it one of the two suppliers with increasing market share.

It can be said that Horizon Robotics has played an invaluable role in the large-scale mass production of high-level autonomous driving. As a Tier 2 supplier, it has provided strong support to many automakers and Tier 1 suppliers. Over nine years, its Journey series has shipped over 5 million chips, empowering over 110 mass-produced models. Additionally, its solutions have been adopted by over 30 automakers, with collaborations covering over 230 designated models.

Notably, Horizon Robotics has also established mass-production collaborations with top Tier 1 suppliers from China, Japan, Europe, and other regions, positioning itself as the preferred strategic partner for international Tier 1 suppliers expanding in China.

Why has Horizon Robotics been able to outperform Mobileye? The answer lies in its position as the "greatest common divisor" of China's autonomous driving industry.

In the view of Entrepreneur Frontline, Horizon Robotics can be considered the CATL of the intelligent driving sector. Just as CATL manufactures batteries, a core component of new energy vehicles, Horizon Robotics specializes in the fundamental hardware (chips) and autonomous driving software, which are crucial fortresses in the intelligent driving industry. Although both companies have chosen paths with high upfront R&D investment and technical barriers, it is precisely such enterprises that fundamentally drive significant industry advancements and enjoy immense growth potential as the industry matures.

Upon closer examination, it becomes apparent that the two companies share several similarities, foremost among them being their exceptional local service capabilities. As industry insiders observe, while NVIDIA offers a mature CUDA ecosystem, relatively comprehensive technical documentation, and toolchain support, Horizon Robotics excels in being physically close to customers. When Tier 1 suppliers and automakers encounter engineering issues, Horizon Robotics can deploy a large team of technicians to work on-site around the clock, a feat that Mobileye and others struggle to match.

Secondly, as premium industry service providers, both Horizon Robotics and CATL boast flexible business models and outstanding hardware and software capabilities. For instance, they excel at leveraging OEM customer nominations and designated models to expand solution deployments, thereby stabilizing orders in hand. As of September 30, Horizon Robotics had secured designations for 290 models and achieved SOP for 152 models. This year, the company unveiled its hardware-software integrated, full-scenario intelligent driving solution, undoubtedly providing automakers with the most effective approach to mass-producing high-level autonomous driving systems.

3. IPO: A New Starting Point

Examining Horizon Robotics' impressive track record reveals that its achievements extend beyond mass production outcomes. Over the past few years, the company's revenue has consistently grown.

Data shows that the company's revenue was RMB 467 million, 906 million, 1.552 billion, and 935 million in 2021, 2022, 2023, and the first half of 2024, respectively, with a compound annual growth rate (CAGR) of 82.3% from 2021 to 2023. In the first half of 2024, revenue reached RMB 935 million, exceeding the full-year revenue of 2022 by 151.6%.

Simultaneously, Horizon Robotics has maintained a high gross margin, with gross profit increasing from RMB 331 million in 2021 to RMB 628 million in 2022 and further to RMB 1.094 billion in 2023, representing gross margins of 70.9%, 69.3%, and 70.5%, respectively. In the first half of 2024, gross profit reached RMB 739 million, up 225.99% year-on-year, exceeding the full-year gross profit of 2022, and the gross margin increased to 79.0%.

It is evident that Horizon Robotics' capabilities are well-demonstrated by its various performance indicators. However, from the perspective of high-level autonomous driving trends, the IPO is not the end but a new starting point for the company, which still has significant room for growth.

Data indicates that the global market for advanced driver assistance systems (ADAS) and high-level autonomous driving solutions reached RMB 61.9 billion in 2023 and is projected to grow at a CAGR of 49.2% to reach RMB 1,017.1 billion by 2030. Within this, China's ADAS and high-level autonomous driving solutions market stood at RMB 24.5 billion in 2023 and is expected to further expand at a CAGR of 49.4% to RMB 407 billion by 2030. Based on sales volume, China is poised to become the world's largest automotive market and ADAS/high-level autonomous driving market.

Amidst this promising trend, Horizon Robotics boasts irreplaceable first-mover advantages in funding, technology, and services, as well as a formidable product portfolio.

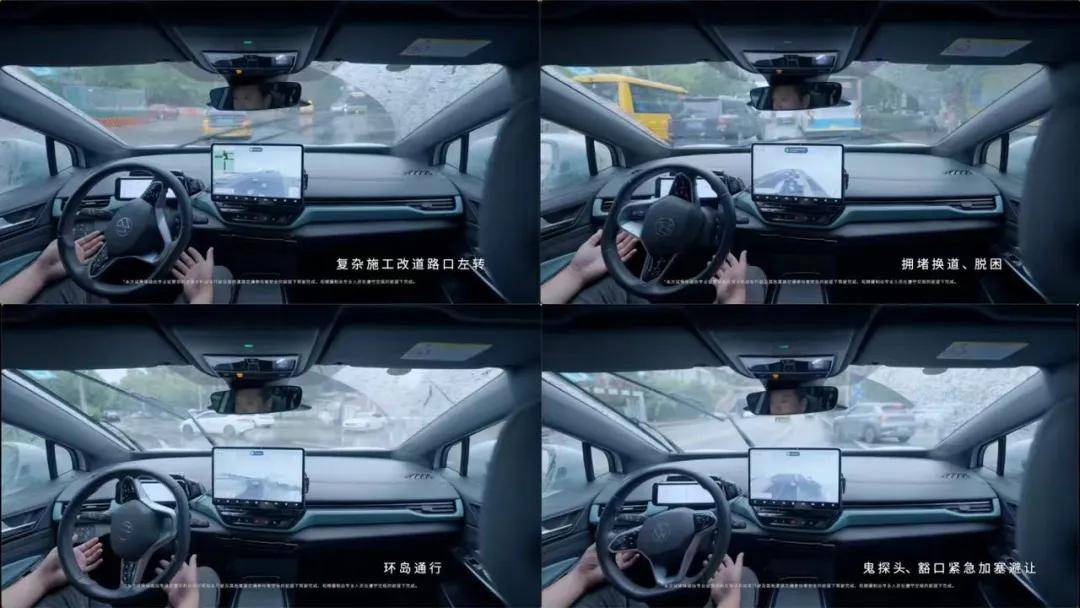

At the World New Energy Vehicle Congress 2024 in late September, Horizon Robotics President Chen Liming showcased the results of the challenge test for the system generalization capabilities of its Horizon SuperDrive™ (HSD) full-scenario intelligent driving solution across 12 cities nationwide.

The HSD generalization roadshow video demonstrated the solution's remarkable adaptability and flexibility across various scenarios, including sharp turns and narrow slopes in Chongqing, narrow streets and ancient alleyways in Xi'an, continuous roundabouts in Datong, cobbled streets in Suzhou, and mixed pedestrian-vehicle traffic in Guangzhou. The HSD system navigated complex intersections with ease and smoothly avoided vehicles and pedestrians, attracting significant industry attention.

It is noteworthy that urban high-level autonomous driving has long been a challenging industry problem, but HSD has broken through this barrier, enabling Horizon Robotics to secure a foothold in the urban autonomous driving market.

Ahead of the crucial competitive year of 2025, Horizon Robotics has unveiled two powerful weapons: Journey 6 series and HSD. Specifically, the combination of Journey 6 Flagship Edition and HSD creates a model of high-level autonomous driving that integrates hardware and software for exceptional efficiency. This not only positions Horizon Robotics as a driving force behind the accelerated mass production and democratization of user-friendly urban NOA products but also enables it to flexibly open up its full-stack technology capabilities, enhancing industry R&D and delivery efficiency, and advancing towards the ultimate goal of high-level autonomous driving.

4. Conclusion

In the booming global autonomous driving market, every automaker aspires to excel in product technology but often struggles to allocate sufficient funds, time, and resources for full-stack autonomous driving R&D, akin to what Tesla and Huawei have undertaken. Faced with significant market opportunities, partnering with outstanding industry players like Horizon Robotics has emerged as the preferred choice for brands.

Especially as "hardware-software integrated" high-level urban autonomous driving solutions enter mass production, this product experience will become a crucial consideration for consumers, potentially propelling Horizon Robotics to become an indispensable pillar in the industry amidst the democratization of high-level autonomous driving.

*Note: The featured image in this article is from Horizon Robotics' official website.