Survive in adversity: High-precision map in the midst of leak controversy

![]() 10/22 2024

10/22 2024

![]() 573

573

"The overall loss of the industry reflects the difficult development situation of high-precision maps in recent years. Map providers have realized that they cannot rely solely on high-precision maps and have stepped up research and development of new technologies and business models to survive in this difficult winter."

@Science and Technology News Original

A reminder from the State Security Department about a leak pushed the long-silent high-precision map vendors to the forefront of attention.

In simple terms, it is alleged that foreign companies, in cooperation with Chinese companies with surveying and mapping qualifications, have illegally conducted geographic information surveying and mapping activities in China under the guise of conducting research on autonomous driving for automobiles. The reason given is also clear: the lure of economic interests.

Although many companies that have been brought to the forefront have responded to this incident, we can still see the predicament faced by domestic autonomous driving, especially high-precision map vendors, from this incident.

In fact, autonomous driving has been the focus of attention in the industry in recent years, with endless debates over whether to use or not use high-precision maps. Since the news broke last year that Tesla's FSD would enter China, many automakers have also come forward to express their disdain for high-precision maps.

A year after the vigorous "removal" of high-precision maps, the living environment of map vendors has continued to deteriorate. And the industry seems to be on the verge of disappearing, but is this really the case? Are high-precision maps really on their way out? What opportunities do map vendors have in the future? And what risks do they need to face?

01.

Acceleration of 'Map Removal', from Favorite to Outcast

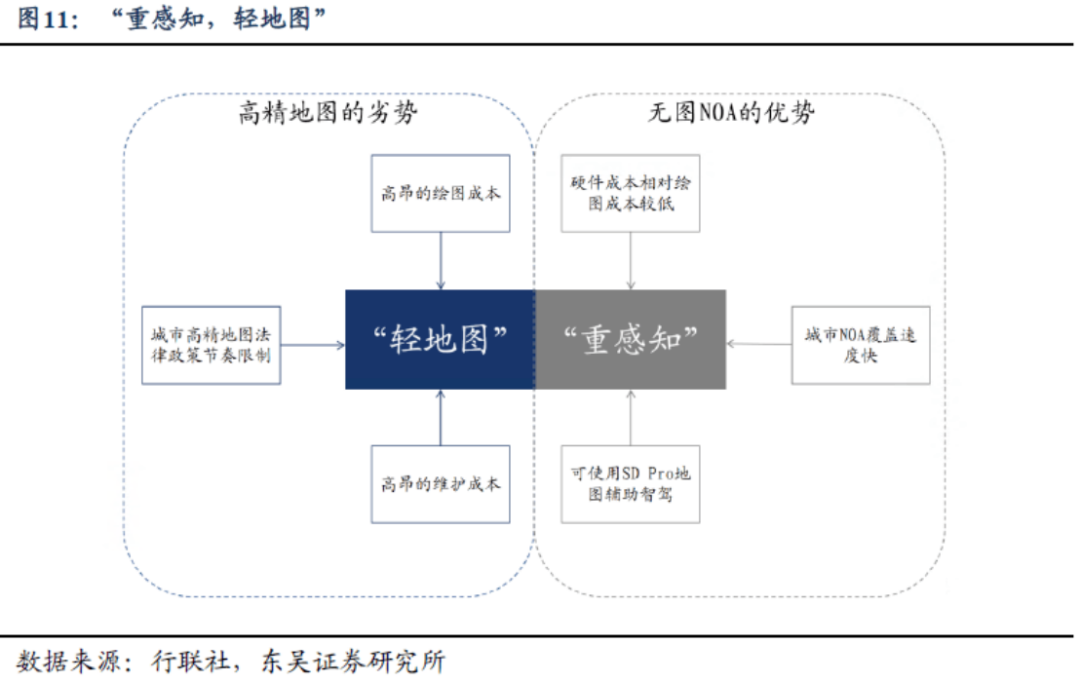

Since last year, the industry has experienced a round of intense propaganda about "emphasizing perception over maps," leading to the idea that "the faster the process of removing high-precision maps, the better the autonomous driving capability and experience" gradually spreading.

If we look back to this time last year, this view was not solidly grounded. Because at that time, automakers used the same phrase when promoting their autonomous driving solutions: "not relying on high-precision maps." It was evident that automakers at the time did not want to completely write off high-precision maps.

However, the turning point came at the 2023 Shanghai Auto Show. With the launch of the AITO M7 equipped with ADS 2.0, Huawei announced that its city-level Navigated Chauffeur Assistant (NCA) would be available nationwide and could operate without high-precision maps by the end of 2023.

Huawei's move to "remove maps" quickly alerted map vendors. Cheng Peng, CEO of NavInfo, even publicly criticized that some automakers emphasized the "no-map" technical route mainly because they lacked mapping qualifications, intellectual property rights, and respect for safety.

However, the "struggles" of map vendors could not slow down the pace of automakers removing maps. In March of this year, Yu Chengdong of Huawei stated that due to the slow update of high-precision maps, Huawei's city-level NCA would no longer rely on them. Since then, many automakers have joined the ranks of not relying on high-precision maps, with more radical automakers like XPeng and LIXIANG even directly proposing slogans of "removing maps" and "no maps" this year.

For automakers, high-precision maps came and went quickly. In 2021, map vendors and automakers were still in their honeymoon phase, with high-precision maps offering lane-level mapping services by providing road topology information. At that time, the industry had not yet realized the limitations of high-precision maps, and problems only began to emerge when working on city NOA.

Not to mention the increasingly difficult-to-obtain Class A surveying and mapping qualifications, the update frequency and cost of city high-precision maps simply could not meet the needs of automakers. While high-precision maps on highways could be updated quarterly, this was not feasible for urban roads. One-third of a city's 1,000 kilometers of roads would change within a year.

Without guaranteed freshness, forcibly using high-precision maps in cities would only increase costs without enhancing effectiveness and could not guarantee accuracy.

To keep up with the pace of the "city opening race," the only option was to remove high-precision maps and raise the banner of no maps.

However, it cannot be denied that high-precision maps are still an indispensable ultra-long-range sensor for the advancement of autonomous driving capabilities at this stage and in the future. To truly go "mapless," the system's "addiction" to sensors and high-performance computing platforms would need to be further increased, ultimately leading to increasingly uncontrollable overall costs.

For example, for an autonomous vehicle to navigate intersections smoothly relying solely on real-time perception, Tesla previously provided an answer by specifically training a neural network called "Lanes Network" with 75 million parameters. This model consumes approximately 10% of the peak computing power of the platform during operation, and its sole purpose is to "make the vehicle understand where each lane leads."

But this is merely theoretical, and the complexity of reality may be even higher. Large intersections in bustling cities are filled with various markings, traffic lights, and road connections that can confuse even experienced human drivers, let alone autonomous vehicles just entering the city.

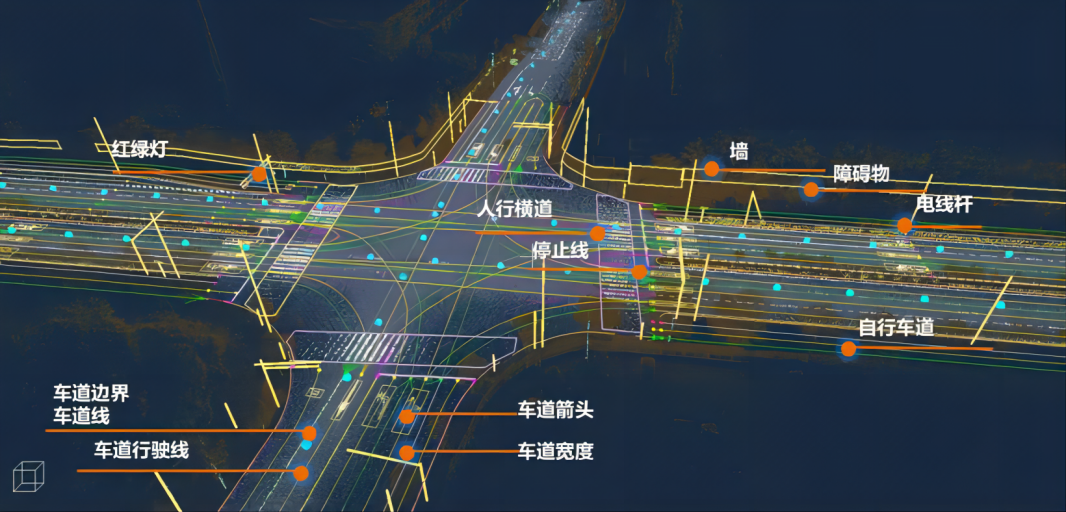

Furthermore, for autonomous vehicles, the precise representation of static traffic elements and road connections in high-precision maps can reduce the burden on the perception system, saving computing resources that can be used to better perceive dynamic objects. On the other hand, the prior information and saved computing power it provides also reduce the difficulty of prediction and control modules in autonomous driving algorithms.

Due to these characteristics, high-precision maps are even more necessary at this stage for traditional automakers that have not yet made high-level autonomous driving their core competency. Some automakers, such as GAC Motor, have even invested heavily in high-precision maps themselves. Therefore, on the question of "removing or keeping maps," they choose to remain silent, giving map vendors some confidence to continue.

02.

'Slimming Down' Revolution: Compromise or Innovation?

Although map vendors have never left the autonomous driving stage, the fact that they are struggling to survive is undeniable, and automakers' reduced reliance on high-precision maps is irreversible.

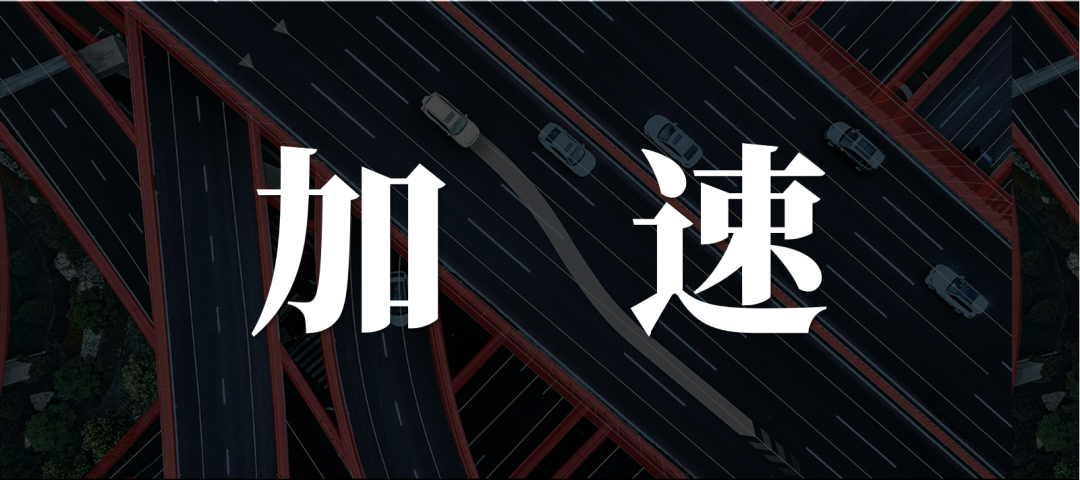

However, faced with the rapid evolution of autonomous driving algorithms and the intense competition to bring autonomous driving into cities, mainstream domestic map vendors have changed their strategies, unanimously choosing "lightweight high-precision maps," giving "emphasizing perception over maps" another layer of meaning.

It's like the contrast between "great victory and great defeat." These two seemingly opposite phrases can actually express the same idea. How should "lightweight maps" be understood: as a public opinion frenzy of "dismissal" or as an industry consensus of "lightweighting"? "Emphasizing perception over maps" should never be interpreted as having to choose one side over the other but rather as a redistribution and rebalancing of both parties involved.

Compared to the certainty that autonomous driving can be "mapless," map vendors have been quicker to criticize and self-criticize their high-precision map products. In response to the biggest drawbacks of high-precision maps, they have successively introduced lightweight products. Lightweight maps, simply put, can provide lane-level services but lack positioning layers and have decimeter-level accuracy. Low-precision maps mainly provide road-level information and topology.

Traditionally, high-precision maps are created using high-specification sensor-equipped collection vehicles that conduct multiple collections to reduce errors. However, lightweight high-precision maps slightly lower the accuracy requirements (but still remain sub-meter level) and upgrade algorithms, thereby improving tolerance for errors and enabling single-collection mapping, eliminating the additional costs associated with multiple collections.

In addition, lightweight high-precision maps have also moderately trimmed the accuracy and element richness of the maps.

For example, while traditional high-precision maps would mark the precise location of every traffic light and which light controls which lane, lightweight high-precision maps only need to indicate the general location of traffic lights, and the vehicle's own perception capabilities can achieve the same effect as traditional high-precision maps.

Of course, this also significantly reduces the cost of high-precision maps. In a previous interview, a NavInfo executive stated that their scene maps could reduce the cost of high-precision maps from "tens of thousands of yuan directly to hundreds of yuan." Against this backdrop, real-time mapping supported by perception and high-precision maps will have a certain degree of ebb and flow, but it is difficult to say which is a non-essential product.

Undoubtedly, map vendors have already embarked on a path of change. As for whether high-precision maps will disappear, from a technical perspective, even if automakers' perception technology becomes more advanced and even achieves end-to-end autonomy in the future, they cannot bypass basic navigational maps. In this regard, map vendors have kept pace with automakers. Regardless of how automakers phrase it, having basic prior information is indeed much better.

On the regulatory front, there are still variables. Some technicians have noted that the national policy on Class A navigation and surveying maps will only tighten, not loosen. Theoretically, only enterprises with surveying and mapping qualifications have the right to collect and manage data. This means that even if automakers collect a large amount of data, they must still find a third-party map vendor for "custody."

It is worth mentioning that apart from internet-gene automakers like NIO, XPeng, LIXIANG, and Huawei, traditional automakers like BYD, Great Wall Motor, SAIC Motor, and GAC Motor have not truly mastered the core capability of mapless NOA. This means that there is still ample room for map vendors to do business.

Amap predicts that by 2025, six to seven million vehicles will need high-precision maps. However, for traditional automakers, whether or not there are maps does not seem to matter much. XPeng, which has achieved mapless driving, still struggles to sell cars. Meanwhile, BYD, which last year dismissed the idea of autonomous driving as "nonsense," has managed to sell 400,000 vehicles per month thanks to its comprehensive strength, including DM-i technology.

Perhaps map vendors are temporarily unable to see the upper limit of algorithms, which is why they say, "The essence of BEV+Transform is to get rid of LiDAR and enable autonomous driving functions with cheaper sensors, not to get rid of high-precision maps." However, it is highly likely that in the future, high-precision maps will gradually fade out of the spotlight, a trend determined by the technological advancements in autonomous driving.

The defeat of map vendors by algorithms may be the ultimate outcome of autonomous driving.

03.

Collective Losses: Transform or Die?

A sense of crisis often accelerates technological progress, and map vendors are not without contingency plans for the possibility of being "abandoned." Rather than wallowing in self-pity, they are stepping up research and development to prepare for unforeseen circumstances.

In fact, map vendors have long realized that they cannot put all their eggs in the basket of high-precision maps. In 2017, NavInfo acquired Hefei Jiefa Technology, extending its business for the first time into the field of automotive electronic chips and gradually forming four major business segments over the following years: Zhiyun, Zhixin, Zhicang, and Zhijia, comprehensively laying out the smart racecourse.

However, over the years, these map vendors have not been able to stem their losses. NavInfo's revenue in 2023 was 3.122 billion yuan, a year-on-year decrease of 6.72%. Among them, autonomous driving revenue was 376 million yuan, a year-on-year increase of 187.28%; Zhiyun revenue was 1.748 billion yuan, a year-on-year decrease of 15.14%. The reason lies in the decline in navigation map revenue and the increase in labor costs due to increased customer customization demands.

Entering 2024, although the first half of the year saw revenue of 1.667 billion yuan, the overall loss amounted to 356 million yuan. Among them, Zhiyun, Zhixin, and Zhicang businesses all achieved revenue growth, while only the Zhijia business saw a revenue decline of 13.7% year-on-year.

Taking a closer look at the autonomous driving business, financial reports show that from the end of 2022 to the end of June this year, NavInfo shipped nearly 740,000 Horizon J2 chip-based all-in-one units. The J2 chip-based all-in-one units and J3 chip-based domain controllers newly secured official designations from several leading domestic automakers, with the J2 chip-based solution scheduled to enter mass production and delivery in the second half of this year.

In August of this year, NavInfo responded to investor inquiries by stating that the company's cooperation with customers has gradually expanded from low-level to high-level autonomous driving and from driving to parking domains. The specific volume would depend on the sales performance of the corresponding models. Some analysts believe that the decline in NavInfo's autonomous driving revenue in the first half of the year may be related to the poor market performance of downstream customers' vehicle products.

Turning to the Zhixin business, NavInfo's Zhixin business revenue in the first half of this year was 253 million yuan, a year-on-year increase of 13.55%. However, due to a larger increase in costs, the Zhixin business's gross margin decreased by 16.08 percentage points compared to the same period last year.

Among the four major businesses, only the Zhicang business achieved double-digit growth in the first half of the year, with revenue of 265 million yuan, a year-on-year increase of 9.37%, and a gross margin of 21.24%, an increase of 6.43 percentage points compared to the same period last year.

If even the leader in high-precision maps is struggling, it goes without saying that smaller players are facing even greater challenges. Relying on SAIC Motor, Cennavi had a revenue of 154 million yuan in 2023 and a net loss of 392 million yuan. In the first half of 2024, its revenue was 55.3871 million yuan, with a loss of 38.6467 million yuan. Meanwhile, Cennavi's net assets turned negative, and its short-term borrowings amounted to 217 million yuan. In a sense, the already insolvent Cennavi better represents a microcosm of the domestic high-precision map startup wave in recent years.

"The impact of going mapless on map vendors is still significant. We are considering transformation and adapting to this trend," said an insider from Cennavi, which cooperates closely with SAIC Motor. The company currently mainly provides technical support based on mapless technology, but the insider remained silent on specific business developments.

Although under the changing times, high-precision maps are being abandoned by automakers, it is still too early to assert that "high-precision maps are dead", after all, regardless of intelligent driving systems, LiDAR or chips, almost every company in the intelligent driving industry chain is losing money. From a commercial perspective, map providers are using various methods such as management innovation and technological innovation to improve freshness and reduce costs, thereby finding their own commercial value in the process of mass production of autonomous driving.

But in the difficult winter, some people can't wait for spring.