Perspective on the Wave of "Humanoid Robots"

![]() 12/24 2024

12/24 2024

![]() 560

560

This article is based on publicly available information and is intended solely for informational purposes. It does not constitute investment advice.

In just three months, the A-share robot index surged nearly 80%, emerging as a star in the capital market. Companies like Efut rose over 350%, Topstar and Sanfeng Intelligent surged over 210%, Kelei Sensing surged 180%, and Beite Technology and Siling shares both surged over 120%. What are the key drivers behind this explosive growth? And are there even greater market opportunities on the horizon?

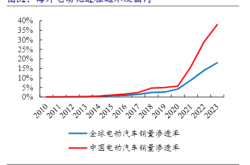

01 The Dream Becomes Reality

The explosion in the robot sector is closely tied to the sharp rise in the overall A-share market and the market's preference for small-cap stocks favored by speculative capital. However, beyond the seemingly conceptual and narrative nature of these companies lies a hidden industrial logic—humanoid robots are transitioning from the conceptual incubation phase to mass production, mirroring the explosion of new energy vehicles, photovoltaics, and wind power in 2020. According to Mao Botun Investment, an industry's lifecycle can be divided into five stages based on penetration rate and acceleration: 1) Introduction phase (0%-5% penetration) with slow growth and minimal profitability. 2) Accelerated growth phase (5%-25% penetration) with leading enterprises often achieving profit growth rates exceeding 100%, ROE reaching 25%-35%, and dynamic PE rising to 60-120X. 3) Decelerated growth phase (10%-50% penetration) with increased competition, higher investment risks, and profit growth rates falling to around 50%, with PE returning to a range of 15-45X. 4) Maturity phase (50%-80% penetration) with slow growth, stabilized competition, mature product development, profit growth rates of 20-30%, and PE stabilizing at 15-25X. 5) Decline phase (80%-100% penetration) with profit growth rates falling to around 10% and PE stabilizing at 10-20X. Clearly, different stages offer varying valuations and market drivers. The humanoid robot sector is projected to enter the second stage by 2025, supported by a surge of robot industry news since the second half of this year. On October 10, Tesla held the "WE, ROBOT" event, showcasing new solutions for Optimus' dexterous hands and significant advancements in human-machine interaction. On November 28, Tesla announced new developments: the second-generation Optimus robotic arm, with double the degrees of freedom compared to the previous generation. Domestically, the humanoid robot industry has evolved rapidly. From October 14-18, Kepler released the pioneer humanoid robot K2. On the 24th of the same month, Zhongqing Robotics unveiled its first full-size humanoid robot SE01. On November 16, XPeng Motors launched the AI humanoid robot Iron. In terms of applications, Unitree Walker S1 has been deployed at BYD's factory, marking the world's first industrial scenario where a humanoid robot collaborates with unmanned logistics vehicles. Most excitingly, Huawei signed agreements with 16 companies, including LeapMotion, Zhaowei, Han's Laser Technology, Moyi Technology, Topstar, and Zibian Robotics, on November 15 to collaborate on various application scenarios. On November 19, 21st Century Business Herald reported that Huawei had established a subsidiary in Dongguan with an investment of 7.2 billion yuan to build an industrial park, planning to release and pilot produce on a certain scale by 2025. This news ignited market expectations for Huawei robots, with Topstar's share price surging 20% daily, Efut surging 17%, and Kelei Sensing surging 10%. In summary, a series of industrial news indicate that humanoid robots will enter pilot production in 2025, marking their entry into an accelerated growth phase. Hence, it is inevitable for robot-related companies to receive a round of valuation upgrades.

02 Varying Values Within the Industrial Chain

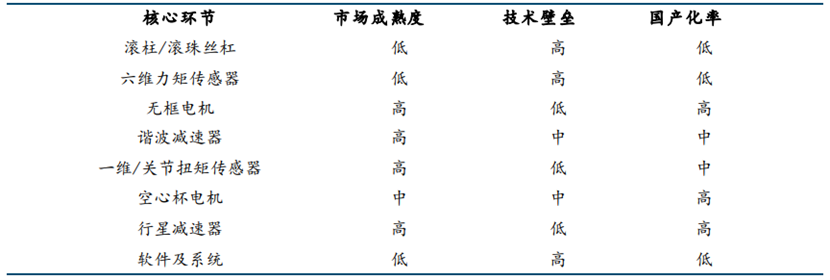

Humanoid robots have penetrated various scenarios, ranging from TOB to TOC, covering factory applications, elderly companionship, and household management. According to GGII's forecast, the market size of humanoid robots in China will reach 2.158 billion yuan in 2024 and nearly 38 billion yuan by 2030, with a compound annual growth rate exceeding 61% from 2024 to 2030. Sales of humanoid robots in China will increase from approximately 4,000 units to 271,200 units during this period. The humanoid robot industrial chain generally includes motion modules, control modules, perception modules, dexterous hands, batteries, etc. Breaking down the cost of Tesla's Optimus, structural components account for 17%, torque sensors and roller/ball screws both account for 14%, harmonic reducers account for 13%, coreless motors account for 9%, frameless torque motors account for 8%, controllers account for 6%, and others account for 19%. Currently, the roller/ball screw and torque sensor markets are characterized by low maturity, high barriers, and low localization rates, offering greater value and opportunities.

Figure: Comparison of Various Core Components of Tesla's Humanoid Robot, Source: GF Securities

In terms of ball screws, Tesla's robots use planetary roller screws (other mainstream types include ball screws and sliding screws), primarily in the elbows, hips, thighs, and calves, serving as the soul of the robot's motion control. Due to high requirements for precision, reliability, and stiffness, the technical barriers are significant. Currently, the global leaders in roller screws include Schaeffler, SKF, and Exlar, which dominate the market. Domestic brands have a lower market share, with key players such as Hanjiang Machine Tool, Nanjing Technology, and Kate Precision Machinery. Additionally, new enterprises are involved in research and development, including Best, Hengli Hydraulic, and Beite Technology. A torque sensor converts force and torque into usable output signals. From a measurement dimension perspective, it can be classified into one-dimensional and multi-dimensional (three-dimensional, six-dimensional) force sensors, with increasing difficulty and grade as the dimension rises. Currently, the global tier-one suppliers include domestic Yuli Instruments and overseas ATI, both possessing six-dimensional torque sensor technology. Tier-two suppliers include Ruierte, Kunwei Technology, and Kelei Sensing. Kelei Sensing primarily produces one-dimensional sensors and is actively promoting six-dimensional sensors, having completed product development and provided samples to multiple domestic collaborative robot and humanoid robot customers. Reducers are crucial in rotating joints and dexterous hand joints, but the product's technical route remains uncertain. Tesla's robots use harmonic reducers, while most domestic robots use planetary reducers, with harmonic reducers serving as a supplement. In 2021, the major global players in reducers included Harmonic Drive of Japan, with a market share of up to 82%, followed by domestic player Green Harmonic in second place with a share of 7%, and other manufacturers accounting for 11%. In the domestic market, Harmonic Drive had a market share of 38% in 2022, followed by Green Harmonic with 26%. Domestic enterprises such as Laifu Harmonic, Tongchuan Technology, and Han's Laser Transmission achieved breakthroughs, capturing market shares of 8%, 6%, and 4%, respectively. In summary, before large-scale mass production of humanoid robots, the market landscape and technical routes of multiple sub-sectors remain highly variable, implying investment opportunities.

03 Huawei vs. Tesla

Domestically, Huawei began researching AI+robot technology seven years ago and has obtained patents related to robot arms, safety protection methods, human-computer interaction, model updates, obstacle avoidance systems, among others. Huawei's core competencies lie in operating systems, artificial intelligence, and chip technology. In November this year, Huawei signed cooperation agreements with 16 robot-related enterprises, covering partners in complete machines, coreless motors, harmonic reducers, sensors, PEEK materials, and more. This cooperation layout suggests that Huawei aims to empower its partners to build better robots through its technology, similar to how it empowered Thalys, BAIC, Chery, and JAC in the new energy vehicle sector, making them pivotal players in the mid-to-high-end new energy vehicle market. Therefore, Huawei's entry into the humanoid robot sector holds great promise for becoming the locomotive of the entire industrial chain. Among major overseas players, Tesla has a strong siphon effect, and its partners will also benefit from growth dividends. Comparing Huawei's robots to Tesla's, which domestic industrial chain will benefit more? In my view, Huawei's industrial chain holds greater potential, with more efficient product technology iteration and implementation capabilities. In fact, Huawei and Tesla have competed in intelligent driving, with Huawei now surpassing Tesla's FSD in capabilities. Yu Chengdong stated in June this year that even Huawei's intelligent driving version without lidar is superior to FSD, with lidar-enabled performance being even better. In the new energy vehicle sector, Tesla was once the global leader, but its product iteration and implementation capabilities were lacking, with sales still relying on the Model 3 and Model Y (eight-year-old products, with new product delays), resulting in a significant market share decline. This illustrates certain points. As humanoid robots are poised to enter an accelerated growth phase, both Huawei's and Tesla's related industrial chains will benefit. However, Huawei's industrial chain holds greater return potential. Since late September, the humanoid robot sector has continued to surge, with related companies generally doubling in value, creating valuation bubbles and the risk of share price volatility. However, post-2025's small-scale pilot production, truly excellent robot manufacturers and suppliers will once again reap market dividends, presenting ample opportunities.