Leapmotor Showcases Ingenious Techniques, FAW Forges a New Soul

![]() 12/30 2025

12/30 2025

![]() 488

488

Lead

Introduction

Exchange capital for technology, and leverage technology to secure the future.

Rumors about FAW Group's 'acquisition' of Leapmotor had been circulating for nearly a year before finally coming to fruition at the end of 2025.

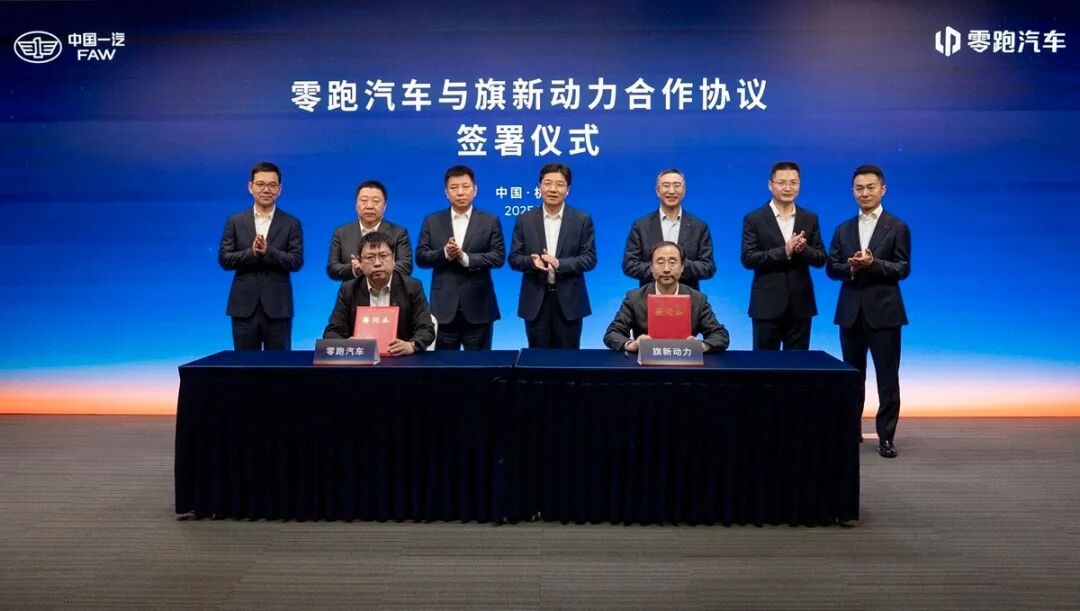

Early yesterday morning, major media outlets reported that FAW Group and Leapmotor had officially signed an equity investment and domestic share subscription agreement on December 28. Two wholly-owned subsidiaries of FAW Group—FAW Equity Investment (Tianjin) Co., Ltd. and FAW Qixin Power (Changchun) Technology Co., Ltd.—signed investment and cooperation agreements with Leapmotor, respectively.

According to the currently disclosed agreement terms, FAW Equity will become a strategic shareholder of Leapmotor through the issuance of additional domestic shares. Leapmotor plans to issue 74.832 million domestic shares, equivalent to RMB 3.744 billion, to FAW Equity at a price of RMB 50.03 per share (equivalent to HKD 55.29), representing 5% of Leapmotor's total enlarged share capital.

Regarding the financing raised by introducing a new strategic shareholder through equity, Leapmotor has stated that approximately half will be used for R&D investment, another 25% for supplementing working capital and general corporate purposes, and the remaining portion for expanding sales and service networks and enhancing brand awareness.

The essence of the collaboration between the two parties, leading them to choose cooperation and ultimately reach this stage, is a mutually beneficial endeavor driven by their respective interests.

01 FAW Group's Crucial Strategic Move

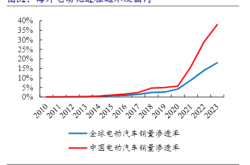

For FAW Group, although its electrification (new energy) transformation has gradually gained momentum and various indicators are improving, the company's unique status—bearing the words 'China' and 'First' in its name—carries both significant political and policy endorsements and unprecedented pressure. FAW Group must not only achieve but excel in its transformation, refusing to settle for merely meeting targets as a 'KPI checkbox.'

It's not just about getting it done; it's about excelling and reaching a superior standard!

This means FAW Group must deliver results not only in terms of data—such as the proportion of new energy vehicles among all its brands, total market share, pricing ranges, and overall reputation—but also address the challenges of ensuring a smooth transition for its important sub-brands during this transitional period and accelerating the development of its proprietary brands.

Undeniably, FAW Group's proprietary brands have made notable strides in relevant construction efforts this year. Take FAW Hongqi, for example.

FAW Hongqi's actions throughout 2025 have been swift, and its progress has been substantial.

Not only has it continued to promote the launch of new energy products from its Hongqi Tiangong series this year, but in the third quarter, it also conducted a significant brand system overhaul following its commercialization, establishing a triple-brand matrix: the 'Hongqi' sub-brand, which inherits the parent brand's genes and focuses on family users; the 'Hongqi Tiangong' sub-brand, targeting younger and trendier demographics; and the 'Hongqi Golden Sunflower' sub-brand, positioned as ultra-luxury.

These adjustments and changes immediately yielded positive feedback in the market. In October and November, Hongqi not only saw significant year-on-year growth in vehicle sales but also achieved over a 60% year-on-year increase in new energy penetration rates.

Another proprietary passenger vehicle brand, FAW Besturn, has not only made rapid strides in the new energy transformation race but also established a new product series, the Yueyi series. By the last week of this year, FAW Besturn's cumulative sales for 2025 had exceeded 190,000 units, setting a 20-year record high for vehicle sales.

Despite achieving commendable overall results this year, FAW Group still faces significant pressure in its new energy transformation. The foremost challenge lies in the 'second half' issue of intelligence—

Integrating and manufacturing vehicle systems have always been FAW Group's strengths. However, intelligence, whether in 'cabin' or 'driving' aspects, is not traditionally a strong suit for automakers.

FAW Group is well aware of this shortcoming. Therefore, in recent years, it has engaged in multiple collaborations, emphasizing both independent R&D and the introduction of external forces to develop new products, ensuring a 'two-legged approach.' Under this premise, acquiring a stake in a domestic new energy vehicle (NEV) startup to gain access to its latest technologies is a common path chosen by large domestic automotive groups.

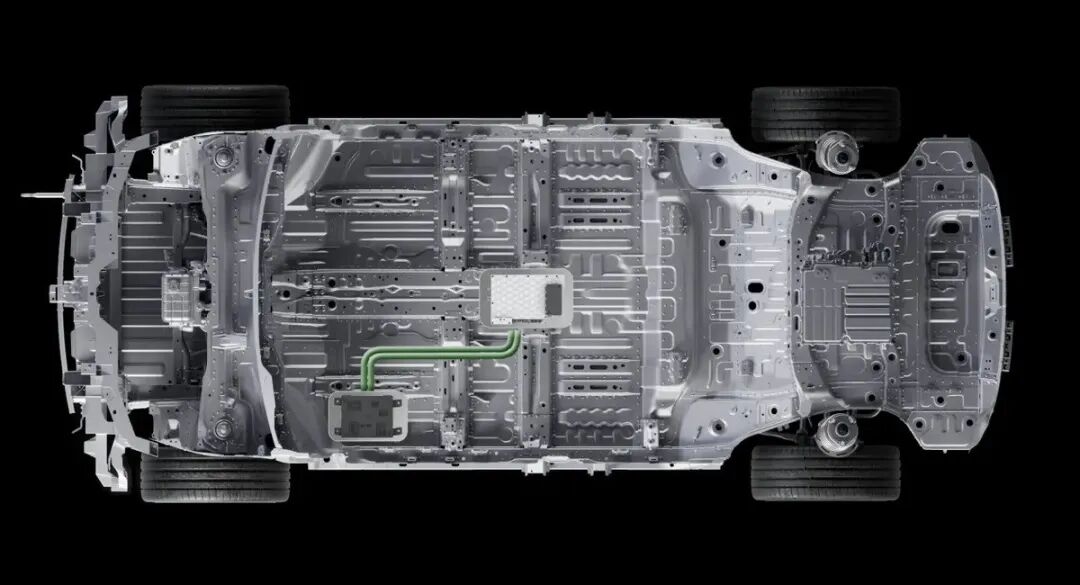

By acquiring a stake in Leapmotor, FAW Group can directly leverage its market-proven, mature, and reliable in-house R&D technology system (covering power electronics, intelligent cockpit, intelligent driving, etc.), significantly enhancing its capabilities in intelligent platforms while further shortening the R&D cycle for new products.

Figure: Leapmotor's latest LEAP 3.5 Central Domain Control Mode Electronic and Electrical Architecture

Moreover, for a giant with the identity of a central state-owned enterprise to acquire a stake in a private automotive company can also be seen as an important attempt to explore mixed-ownership reform and activate its vitality under the current round of central enterprise reforms.

02 Leapmotor's Win-Win Aspirations

'(The cooperation between Leapmotor and FAW Group) at the equity level has been under discussion, and I believe there will be some progress in the future.' In early December this year, Zhu Jiangming, founder, chairman, and CEO of Leapmotor, publicly responded to the capital-level cooperation between FAW Group and Leapmotor in an interview.

He further emphasized, 'We still hope that our founding team remains the actual controller.'

Providing an in-house platform and technology in exchange for resources and policy endorsements to secure long-term development.

For Leapmotor, introducing FAW Group as a strategic shareholder not only provides abundant financial support for R&D and channel expansion but also, more importantly, leverages FAW Group's strong manufacturing capabilities, mature supply chain system, and extensive overseas channel resources. This significantly enhances Leapmotor's risk resistance and scalability. Regarding this cooperation, Zhu Jiangming also explicitly stated that the equity investment would not alter the actual control of the founding team, with FAW Group primarily serving as a strategic investor to safeguard the company's future independence and strategic focus.

From Leapmotor's perspective, without altering its equity structure, sharing technology plus a 5% stake in exchange for a RMB 3.744 billion capital injection is a brilliant capital maneuver. Currently, the competition among domestic automotive groups in the intelligent track (translated as 'sector' or 'field') is reaching its climax.

Despite Leapmotor's outstanding market performance throughout 2025, achieving its annual sales target of 500,000 units by mid-November, it's worth recalling that just two years ago, the company was struggling to the point of 'entering the ICU.' Moreover, according to the currently announced plan, Leapmotor aims to reach annual sales of one million units by 2026. As a 'new force' with shortcomings in supply chain bargaining power, production capacity, and channel penetration, seeking robust support is nothing to be ashamed of.

Through long-term accumulation, FAW Group currently possesses a vast supply chain network, a mature sales system, and even potential idle production capacity resources—all of which Leapmotor urgently needs. Accessing these systems can directly help Leapmotor reduce procurement costs for core components and reserve production flexibility for future sales surges.

Last year's cooperation between Leapmotor and Stellantis successfully opened up a new path as a technology solution provider beyond being a vehicle manufacturer. FAW Group's equity investment further demonstrates to the market that Leapmotor's 'in-house R&D' technology system can not only be used for its own vehicle manufacturing but also serve as a high-value product exported to traditional giants. This opens up a more imaginative profit space through technology licensing fees.

Lastly, in the increasingly fierce domestic new energy market competition, receiving endorsement from a top-tier national team will significantly enhance Leapmotor's credit rating in the eyes of financial institutions, suppliers, and partners, paving the way for subsequent financing and collaborations. Meanwhile, facing potential industry challenges in the coming years, the stable equity structure formed with FAW Group and Stellantis (actual control by the founding team, supported by two strategic shareholders) greatly enhances the company's stability and risk resistance.

We've covered a lot of strategic-level content to illustrate the importance of this cooperation. Now, let's shift our perspective to the tactical level—specific collaborative products—at the end of this article.

Although the finalization of the cooperation was deliberately timed around the end of 2025, the collaboration between FAW Group and Leapmotor had already been progressing.

According to news from late July, the first model jointly developed by both parties, the 'C-NOVA,' a mid-to-large-sized pure electric SUV priced at an estimated RMB 250,000, had already reached the clay model stage by March this year.

Based on subsequent technical details that emerged, this mid-to-large-sized flagship product, built on Leapmotor's latest B platform, is equipped with the new-generation LEAP 3.5 Central Domain Control Mode Electronic and Electrical Architecture. It integrates Leapmotor's in-house intelligent cockpit and incorporates a Level 2 autonomous driving assistance system. On the other hand, FAW Group contributes its independently developed advanced electric drive system.

There's no doubt about the sincerity of both parties in this cooperation, as they have brought their best platforms and technologies to the table from the outset of the product's joint development. A noteworthy detail is that FAW Group's production plan for this flagship product in mid-year is to commence mass production in the second half of 2026 at FAW Besturn's Changchun plant. In other words, through platform technology sharing, both companies can shorten the development and testing cycle to within 24 months or even 18 months.

Undoubtedly, this in-depth cooperation based on the domestic share subscription agreement does not shine in terms of its monetary value or share percentage but will be remembered in industrial history as the most extensive 'hybrid experiment' in Chinese automotive history. If successful, it may reshape the transformation model for state-owned automotive enterprises.

FAW Group's decision-making not only concerns the company's prosperity or decline but also carries the significance of serving as a transformation model for the Chinese automotive industry, shifting from scale dominance to technological triumph. Therefore, its outcome deserves anticipation from us all.

Editor-in-Charge: Cao Jiadong Editor: He Zengrong

THE END