Five "Bidding Kings" Industries and Hexagonal Warriors in Large Model Deployments

![]() 01/14 2025

01/14 2025

![]() 479

479

Bidding Kings and Hexagonal Warriors in Large Model Deployments

2024 marked a year of exponential growth in large model projects.

In the open bidding market, the number of large model projects surged almost every month. According to Digital Intelligence Frontline's incomplete statistics, in Q1 2024, over 70 related winning bids were recorded, doubling to over 200 in Q2, with projections to exceed 500 by Q4.

Among these projects, which five sectors invested the most in large model implementations?

Based on Digital Intelligence Frontline's insights, these sectors are internet and pan-technology, energy, finance, automotive, and education. These five industries can be dubbed the "Bidding Kings," with their major players embodying the essence of hexagonal warriors.

01

Five "Bidding Kings" Industries

Pan-Technology: Internet and Mobile Phone Companies Leading the Charge

Internet and pan-technology were the largest industries for large model implementations in 2024 and will continue to dominate the market in 2025. Representative enterprises in this sector include medium to large internet and mobile phone companies.

"The internet has scenarios, data, and technology, making it the first group to implement large models," said a person from iSoftStone to Digital Intelligence Frontline. Major companies like Tencent, Baidu, and Alibaba have revamped their entire product suites using large models. Mid-tier internet companies have also deployed their own enterprise large models, such as NetEase Youdao's Ziyue, TAL Education's MathGPT, and Ke.com's BELLE.

In the pan-technology sector, one of the current largest users of large model inference is mobile phones. Throughout 2024, mainstream mobile phone brands were very active in deployment and implementation. Samsung launched flagship models equipped with large models, Apple Intelligence went online, Huawei phones introduced the Pangu large model, OPPO officially announced the establishment of an AI center, vivo released the "Blue Heart Intelligence" AI strategy, and Xiaomi established an AI lab with over 3,000 employees...

AI expert Owen ZHU from Inspur Information told Digital Intelligence Frontline that the assistant functions (similar to OPPO's Xiao Bu, vivo's Jovi, and Huawei's Xiao Yi) launched by domestic top mobile phone companies already have significant real-world applications and are also major consumers of intelligent computing power. "Mobile phone manufacturers are a sector that has invested heavily and decisively in large models." These companies have also assembled top domestic talent for inference applications.

Energy: A Trillion-Dollar Market with Enormous Potential

In 2024, whether in terms of the number of public bidding projects or the breadth of implementation, the energy sector was at the forefront. "Energy and finance are sectors with relatively large budgets and well-developed digital infrastructure, so they have been the fastest to adopt large models," said Jin Jianhua, founder and CEO of iResearch.

"The 'three oils and one network' of CNPC, Sinopec, CNOOC, and the National Pipeline Network have an annual output value of several trillion yuan. There is enormous potential in seeking market space for large model implementations here," Wang Jinchang, deputy director of the iFLYTEK Research Institute, analyzed for Digital Intelligence Frontline. Together, State Grid and China Southern Power Grid have an output value of 4 trillion yuan.

The energy sector's investment in large models has entered a wide range of scenarios. For example, China Southern Power Grid released its enterprise large model, "Da Watt," in 2023. Since 2024, in just Q3 alone, it has completed at least 20 large model-related project bidding and procurement work and selected a large language model for its core business department, the Southern Power Grid's General Dispatching Center.

In August and November 2024, CNPC jointly released the Kunlun large model with China Mobile, Huawei, and iFLYTEK. In December, State Grid partnered with Baidu and Alibaba to officially announce the Guangming Power large model, both involving extensive scenario planning and exploration. A person from CNPC's Digital Intelligence Research Institute told Digital Intelligence Frontline that CNPC has established nine special AI work teams at the group level to develop application scenarios, forming 214 application scenarios and over 1,100 sub-scenarios.

Finance: Beyond Major Banks, Mid-Tier Financial Institutions Begin to Initiate

In the second half of 2023, state-owned major banks and some leading joint-stock banks began to lay out and experiment with large model implementations.

"In 2024, implementation took a big step forward," said a person from Huawei's Financial Army to Digital Intelligence Frontline. Digital Intelligence Frontline learned that in 2023, Industrial and Commercial Bank of China (ICBC) was still conducting small-scale pilot projects involving thousands of people in customer service assistant and counter assistant scenarios. In 2024, these functions were officially launched in several major customer service centers nationwide. In September, the daily active users of ICBC's large model reached tens of thousands. China Construction Bank has internally launched a large model since May 2024, providing assistant services for various positions.

At Baidu's Cloud Intelligence Conference in September this year, the Postal Savings Bank of China introduced that it is exploring the implementation of large models in the risk control field. After introducing large models, the accuracy rate of capturing suspicious transactions in anti-fraud exceeded 90%, and the efficiency of producing suspicious reports increased by one-third.

In 2024, in the open bidding market, in addition to leading major banks, city commercial banks, rural commercial banks, as well as securities and insurance institutions across the country began to initiate procurement. Peng Bo, the application product manager of the Ronglian Cloud Industry Intelligence Cloud large model, told Digital Intelligence Frontline that small and medium-sized financial institutions that were waiting and seeing in the first half of 2024 began to actively seek solutions that have been successfully implemented in leading enterprises in the second half of the year, hoping to replicate them in their own businesses.

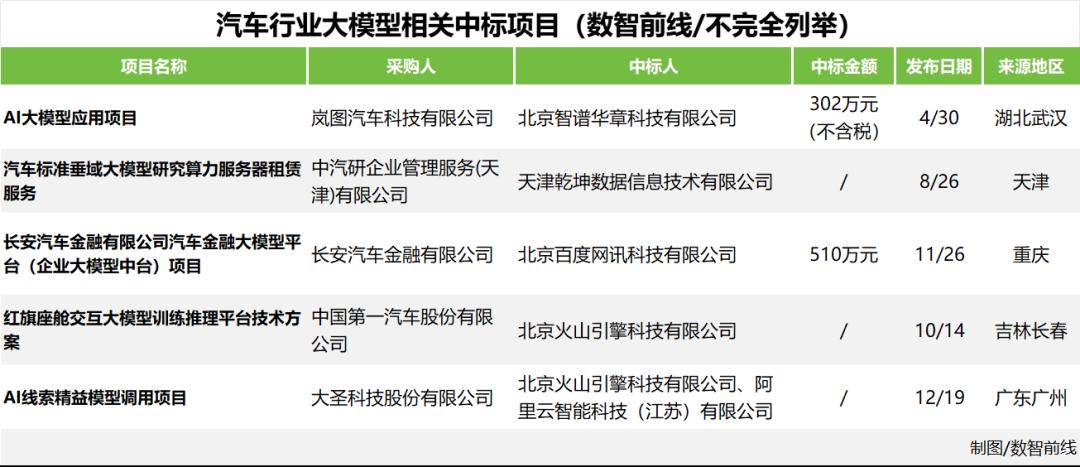

Automotive: Intelligent Computing Procurement, Second Only to the Internet

In 2024, automakers were the guests of honor for domestic large model vendors. This year marked the first year of large model implementations in vehicles. Zhu Min, director of the Intelligent Automobile Market and Solutions Department at iFLYTEK, told Digital Intelligence Frontline that starting from Q1 and Q2, automakers have been striving to "implement large models in vehicles."

Many automakers have launched intelligent cockpits using large models, such as Li Auto's self-developed Mind GPT large model; NIO's NOMI GPT, which combines Baidu's ERNIE Bot; Xiaomi's SU7, which is equipped with SenseTime's "Ririxin" large model; Chery's Star Era ES, which is equipped with iFLYTEK's Spark large model; and AITO and HiPhi, which are equipped with Huawei's Pangu large model...

In addition to rolling out large models for vehicles, end-to-end intelligent driving technology based on large models has become a clear direction for the industry, making automakers more willing to invest. Digital Intelligence Frontline observed that Li Auto was an early adopter of end-to-end large models for intelligent driving. In recent months, more companies have announced their entry into the end-to-end large model intelligent driving market, such as Huawei, NIO, Xiaomi, Geely, BYD, etc. It is expected that a batch of products will be mass-produced in 2025.

Automakers have been major buyers of intelligent computing procurement for three to four years, with procurement scales second only to internet companies. A person from Changan Automobile believes that with the training of large models, the intelligent computing power of automakers will double again in the next 1-2 years.

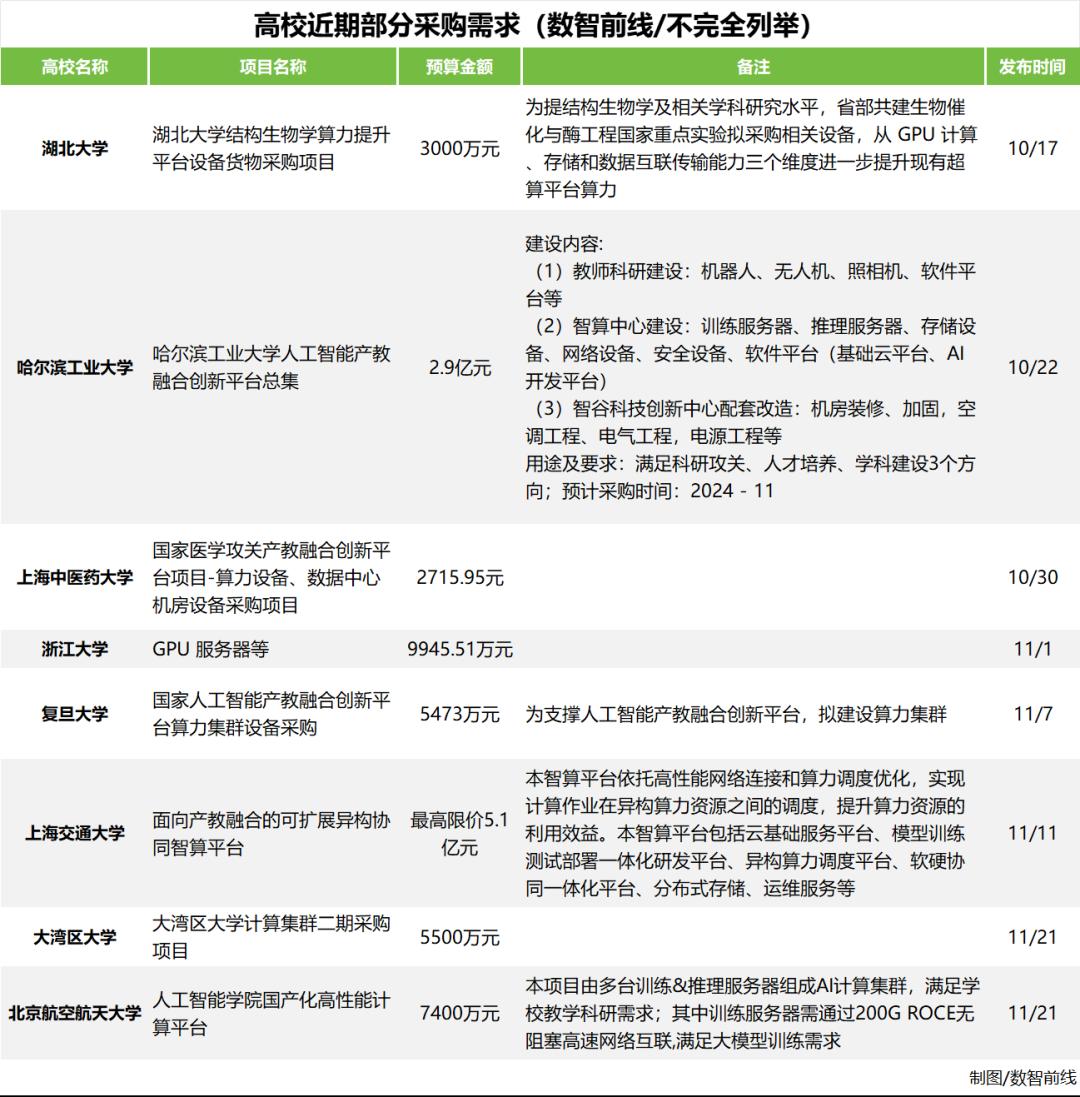

Education: Nobel Prize Inspires Universities to Increase Investment

In 2024, in the open bidding market, from the beginning to the end of the year, education was one of the industries with the most bids, with universities, vocational colleges, and middle schools across the country participating.

According to Digital Intelligence Frontline's incomplete statistics, in Q3 2024 alone, there were at least 80 large model projects from the education industry, accounting for about one-fifth of the total number of projects for that quarter. The procurement of these projects not only included various computing power hardware, basic large models, and application scenarios but also included many large model talent training projects, with amounts ranging from hundreds of thousands to millions of yuan.

After the Nobel Prize announcement in October 2024, AI for Science became a hot topic, further stimulating universities' enthusiasm for further investment in large models and intelligent computing.

"What excites everyone the most is that originally, AI for Science required various different models, but now those studying proteins, mathematics, etc., can all be 'integrated' into the large model approach, with the core architecture even entirely being transformers," Wang Yanpeng, an outstanding system architect at Baidu, told Digital Intelligence Frontline.

Wang Yanpeng observed that with this wave of enthusiasm, university budgets are rapidly increasing, with hundreds of millions of yuan being allocated to build intelligent computing infrastructure. In Q4 2024, on the open bidding market, many universities have already released computing power procurement requirements ranging from tens of millions to hundreds of millions of yuan.

02

How Do Active Companies Operate in Industry Implementation?

In industry implementation, customers' procurement has become increasingly rational and cautious. A procurement person from a state-owned enterprise in the transportation industry told Digital Intelligence Frontline that due to the high procurement and operation and maintenance costs of large models, they need to conduct various evaluations and PoC work, as well as comprehensively examine the capabilities of large model enterprises, including top-level design, later-stage operation and maintenance, talent cultivation, etc.

To excel in this market, large model enterprises exhibit five traits:

Hexagonal Warriors, End-to-End, and Full-Chain

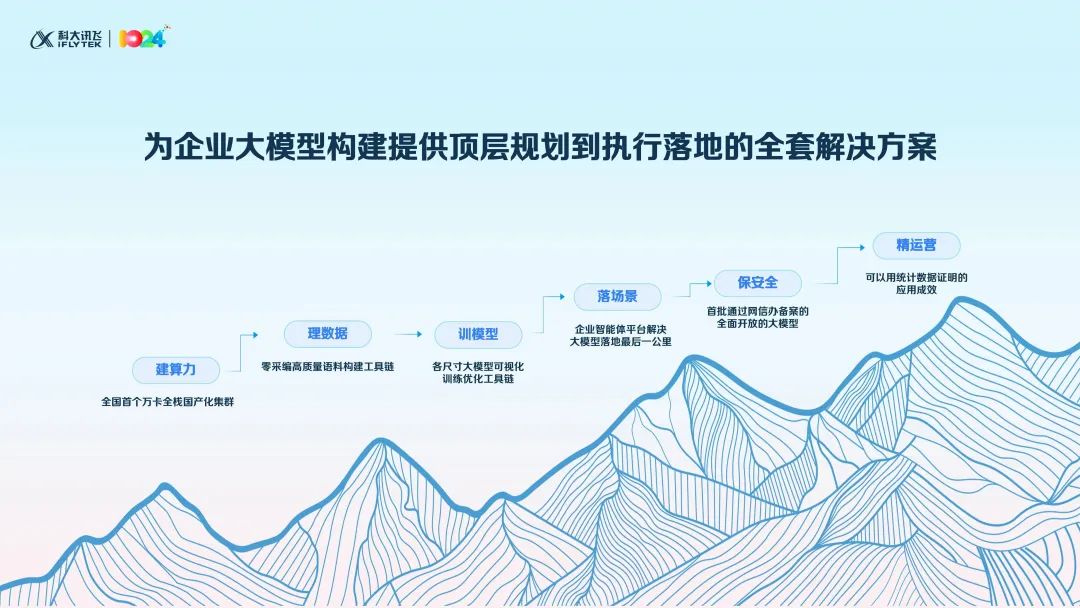

Throughout 2024, observing Baidu and iFLYTEK, it is evident that they have almost entirely built end-to-end, full-chain systems to meet users' needs for overall solutions.

Feedback from ecological partners suggests that Baidu's ecosystem is relatively open and adopts a systematic approach, possibly due to Robin Li's call to "not compete in models but in applications." Baidu Intelligent Cloud established a Channel Ecosystem Department and held a large-scale ecosystem conference in early 2024. In addition to the large model base, the Qianfan platform provides full-chain development tools and standardized products such as digital humans, intelligent customer service, and code assistants. Ecological partners provide corresponding industry application development, and Baidu supports joint solution creation and customized product adaptation.

Liu Qingfeng, chairman of iFLYTEK, emphasized at the 2024 Global 1024 Developer Festival that full-chain investment is the core reason why iFLYTEK has won a large number of projects. iFLYTEK is not afraid of customization and adopts an approach of providing overall solutions, offering customized industry large models plus application clusters. The application clusters include code, official document writing, bidding assistants, etc. They believe that these applications are needs that basically exist in every central and state-owned enterprise.

In addition to major model companies, a batch of large model technology application service providers have emerged, such as Zhongguancun Kejin in the financial industry, Zhongshuxinke in government and education, and Zhonggonghulian in the industrial field.

These companies are also striving to realize overall solutions and services. For example, Zhongguancun Kejin recently released a "three-tier engine strategy" for large models. Yu Youping, CEO of Zhongguancun Kejin, proposed that platform + application + service is the best path for enterprise large model implementation and will also be the future direction of enterprise intelligent upgrading.

Model Quality: A Crucial Factor in Procurement Decisions

In 2024, when users make procurements, they pay more attention to model quality, choosing models that are more proficient in different scenarios. Pan Xin, former Google Brain and current partner at SparkX, said that model quality is currently dynamic. In the US market, Google's model also caught up in 2024, and OpenAI still has some advantages in the strongest complex reasoning models. "Alibaba's Tongyi Qianwen was one of the earliest to achieve TOP performance in China, and ByteDance's Doubao model is also developing rapidly. We will continue to observe and evaluate the capabilities of various models."

In the tech world, Alibaba's Tongyi Qianwen, Zhipu, and Deepseek have garnered significant recognition. According to Digital Intelligence Frontline, as of September 2024, the Tongyi Qianwen series surpassed 40 million downloads, frequently appearing on trending lists on HuggingFace and Github. Across domestic and international open-source communities, Tongyi Qianwen's derivative models exceeded 78,000, outpacing Llama derivatives to become the world's largest generative language model family.

When integrating into various industries, it necessitates the collaboration of large language models with other specialized models. For instance, Huawei Cloud's Pangu large model was among the pioneers in introducing AI for industrial applications. Rather than emphasizing a single large language model, Pangu stresses the importance of multiple models, including prediction, CV, multimodal, and their integration with large language models.

Digital Intelligence Frontline has learned that at Baowu Steel Group, the Pangu large model tackled the blast furnace, considered the "toughest AI implementation challenge" in the steel industry. By leveraging a combination of general and specialized models, it garnered widespread recognition among central and state-owned enterprises.

Enterprise-Level Market, Armed with Dedicated Industry Organizations

In 2024, among the "Six Little Tigers," Zhipu secured the most enterprise-level projects. Digital Intelligence Frontline reports that Zhipu made an early commitment to focus on the enterprise-level market, investing in commercial organizations early on. Its focus encompasses four key areas: technology and internet, top vertical industries, large state-owned and central enterprises, as well as automotive and mobile phone companies.

Based on Baidu's public information, in the enterprise-level market, it prioritizes sectors such as pan-technology, finance, automotive, energy, and industry, with dedicated industry organizations in place.

iFLYTEK's large model deployment is concentrated in sectors like central and state-owned enterprises, education, healthcare, and automotive. In the central and state-owned enterprise market, iFLYTEK established the Spark Army, a first-tier organization, in 2023 to deliver holistic solutions, with a particular focus on industries like energy and aviation. In vertical industries, corresponding companies have also been set up, such as in the energy and power sector, where investments have been made in Lingyang Industrial Internet Company, deeply participating in projects like CNPC's Kunlun large model.

At the 2024 World Internet Conference held in Wuzhen, Shi Jilin, President of Huawei Cloud's Global Marketing and Sales Services, proposed that China, with its strong capabilities in both the internet and traditional industries, presents an opportunity for the AI industry to adopt a dual-pronged approach and forge a path of differentiation. In September 2024, Huawei held its Huawei Connect conference in Shanghai, showcasing industry army groups to the public.

'Money Bag', Fueling Price Wars

From the beginning of 2024 to the end of the year, the large model market has been inextricably linked to price wars. ByteDance has repeatedly ignited these wars. Despite entering the enterprise-level large model market only in May 2024 and having zero statistically significant large model projects in Q1 2024, ByteDance quickly secured large model projects in Q2 following the price war initiated by Volcano Engine in May.

Digital Wisdom Frontline has learned that ByteDance is currently aggressively promoting its intelligent agent platform, HiAgent, also known as the Kouzi privatization version. It adopts a pricing strategy aimed at initially penetrating enterprises with the platform and training them to use it independently. However, many customers are currently unable to utilize it independently and must revert to ecosystem enterprises for application development. Nonetheless, this strategy enables rapid market penetration and establishes an initial presence within enterprises.

Alibaba, Baidu, Tencent, and other major companies swiftly followed suit with various forms of price wars. These wars brought theHundred ' Model War' to a swift conclusion. For the large model market to sustain its development, it requires the support of substantial funding but ultimately needs to establish a self-sustaining mechanism.

The Ultimate Battleground for Large Models: Cloud Computing?

There is a prevailing industry view that the ultimate competition in large models revolves around cloud computing. For instance, Alibaba's approach to large models bears some resemblance to Microsoft's. On one hand, it invests in numerous large model startups, such as Dark Side of the Moon, MiniMax, and BaiChuan, which in turn rent computing power from Alibaba Cloud. On the other hand, Alibaba's Tongyi large model attracts users through open-source models, driving its MaaS platform and cloud business.

Starting around 2018, Baidu Intelligent Cloud gradually migrated its search, advertising, and promotion business to GPU clusters, pioneering the exploration of intelligent computing systems. Currently, major cloud vendors are all transitioning towards 'Cloud for AI'.

Digital Wisdom Frontline has learned that Zhipu, a large model software enterprise, has increased its investment in MaaS this year. Unlike the MaaS defined by cloud giants, which tends to lean towards software, Zhipu's MaaS encompasses both IaaS and PaaS and can be simply viewed as an intelligent cloud, leveraging both self-built and rented underlying computing power.

China Telecom Tianyi Cloud and other enterprises are also vigorously promoting their AI infrastructure services, upgrading the Xirang integrated intelligent computing service platform in September.

Looking back at 2024, the large model market witnessed intense competition, with leading enterprises rapidly building their technical capabilities and strategies. In 2025, large model projects will continue to expand and diversify, and the market landscape will also undergo new transformations.