Identifying the Most Lucrative Among DeepSeek's Large Model Companies

![]() 01/31 2025

01/31 2025

![]() 451

451

DeepSeek, formally known as Hangzhou DeepSeek Artificial Intelligence Basic Technology Research Co., Ltd., is an avant-garde technology firm dedicated to pioneering advanced large language models (LLMs) and associated technologies. Profitability, typically gauged by the amount and level of corporate earnings over a specific period, involves a thorough examination of a company's profit margin. This article serves as the [Profitability] segment of the Enterprise Value series, scrutinizing 17 DeepSeek large model enterprises. It employs return on equity, gross profit margin, net profit margin, and other metrics as evaluative indices. Note that the data is historical and does not predict future trends; it serves as a static analysis and should not be construed as investment advice.

Top 10 Most Profitable DeepSeek Large Model Enterprises:

No.10 Jingyeda

- Industry Segment: IT Services

- Profitability: Return on Equity 4.25%, Gross Profit Margin 46.47%, Net Profit Margin 10.92%

- Performance Forecast: Highest ROE in the past three years was 8.66%, with the latest forecast average of 3.22%

- Main Products: Sales revenue, accounting for 60.99% of revenue with a gross profit margin of 56.92%

- Company Highlights: Jingyeda specializes in providing industry informatization products and solutions for education informatization, urban rail transit security, and smart cities, maintaining connections with the DeepSeek large model.

No.9 iFLYTEK

- Industry Segment: Horizontal General Software

- Profitability: Return on Equity 6.08%, Gross Profit Margin 41.54%, Net Profit Margin 4.86%

- Performance Forecast: ROE fluctuated between 3%-11% in the past three years, with the latest forecast average of 3.29%

- Main Products: Education products and services, accounting for 28.31% of revenue with a gross profit margin of 56.59%

- Company Highlights: iFLYTEK excels in core AI technology research, including speech and language, natural language understanding, machine learning reasoning, and autonomous learning. Its educational scenarios are integrated with the DeepSeek-Math model.

No.8 Paratera

- Industry Segment: IT Services

- Profitability: Return on Equity -124.93%, Gross Profit Margin 29.30%, Net Profit Margin -29.53%

- Performance Forecast: ROE has been negative for the past three years, with the latest forecast average of 0.21%

- Main Products: Supercomputing cloud services, accounting for 94.64% of revenue with a gross profit margin of 33.10%

- Company Highlights: Paratera offers supercomputing cloud services, system integration, software, and technical services. The company provides DeepSeek with various parallel computing techniques.

No.7 Huajin Capital

- Industry Segment: Asset Management

- Profitability: Return on Equity 11.67%, Gross Profit Margin 41.26%, Net Profit Margin 24.95%

- Performance Forecast: ROE has steadily declined to 5.59% in the past three years, with the latest forecast average of 5.66%

- Main Products: Investment and management, accounting for 42.92% of revenue with a gross profit margin of 57.08%

- Company Highlights: Huajin Capital's operations include investment and management, electronic device manufacturing, sewage treatment, and technology parks. The company indirectly participated in DeepSeek's Pre-A funding round through the Huajin Lingyue Fund.

No.6 TRS

- Industry Segment: Vertical Application Software

- Profitability: Return on Equity 5.40%, Gross Profit Margin 64.74%, Net Profit Margin 14.00%

- Performance Forecast: ROE has steadily declined to 1.13% in the past three years, with the latest forecast average of 4.91%

- Main Products: Big data software products and services, accounting for 53.57% of revenue with a gross profit margin of 78.36%

- Company Highlights: TRS's portfolio includes big data and AI software products and services, security products, and system integration. The company collaborated with DeepSeek to develop a large financial public opinion model.

No.5 Meige Intelligence

- Industry Segment: Communication Terminals and Accessories

- Profitability: Return on Equity 13.61%, Gross Profit Margin 18.63%, Net Profit Margin 4.80%

- Performance Forecast: ROE has steadily declined to 4.80% in the past three years, with the latest forecast average of 7.26%

- Main Products: Wireless communication modules and solutions, accounting for 94.64% of revenue with a gross profit margin of 16.83%

- Company Highlights: Meige Intelligence is expediting the development of DeepSeek-R1 model applications on the client side and integrated solutions bridging client and cloud.

No.4 Sugon

- Industry Segment: Other Computer Equipment

- Profitability: Return on Equity 10.02%, Gross Profit Margin 25.42%, Net Profit Margin 12.27%

- Performance Forecast: ROE has steadily risen to 10.30% in the past three years, with the latest forecast average of 10.58%

- Main Products: IT equipment, accounting for 89.74% of revenue with a gross profit margin of 24.72%

- Company Highlights: Sugon is vigorously expanding into digital infrastructure, intelligent computing, and other domains. The company constructed the liquid cooling system for DeepSeek's Hangzhou training center.

No.3 Inspur Information

- Industry Segment: Other Computer Equipment

- Profitability: Return on Equity 12.12%, Gross Profit Margin 10.89%, Net Profit Margin 2.91%

- Performance Forecast: ROE fluctuated between 9%-14% in the past three years, with the latest forecast average of 11.29%

- Main Products: Servers and components, accounting for 99.57% of revenue with a gross profit margin of 7.65%

- Company Highlights: Inspur Information provides AI server clusters for DeepSeek's intelligent computing center in Yizhuang, Beijing.

No.2 Kingsoft Office

- Industry Segment: Horizontal General Software

- Profitability: Return on Equity 14.05%, Gross Profit Margin 85.74%, Net Profit Margin 30.18%

- Performance Forecast: ROE fluctuated between 13%-15% in the past three years, with the latest forecast average of 13.79%

- Main Products: Domestic personal office service subscription business, accounting for 63.40% of revenue with a gross profit margin of 82.45%

- Company Highlights: Kingsoft Office is a leading domestic provider of office software and services. WPS intelligent writing is integrated with the DeepSeek-Writer API.

No.1 Runze Technology

- Industry Segment: Communication Application Value-Added Services

- Profitability: Return on Equity 30.67%, Gross Profit Margin 50.84%, Net Profit Margin 42.25%

- Performance Forecast: Highest ROE in the past three years was 38.80%, with the latest forecast average of 21.81%

- Main Products: AIDC business, accounting for 57.46% of revenue with a gross profit margin of 22.14%

- Company Highlights: Runze Technology's operations include IDC and AIDC businesses, offering over 3,000 cabinet resources in the Langfang data center.

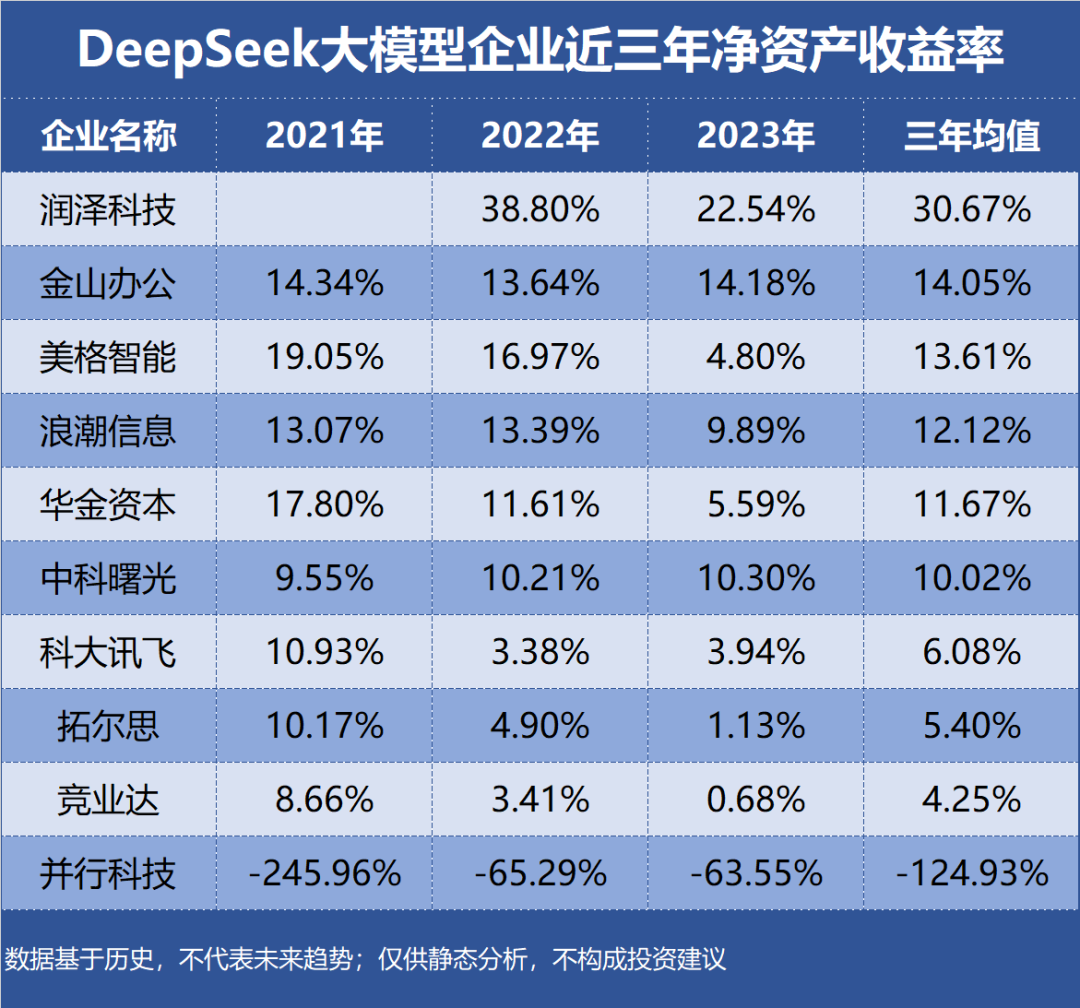

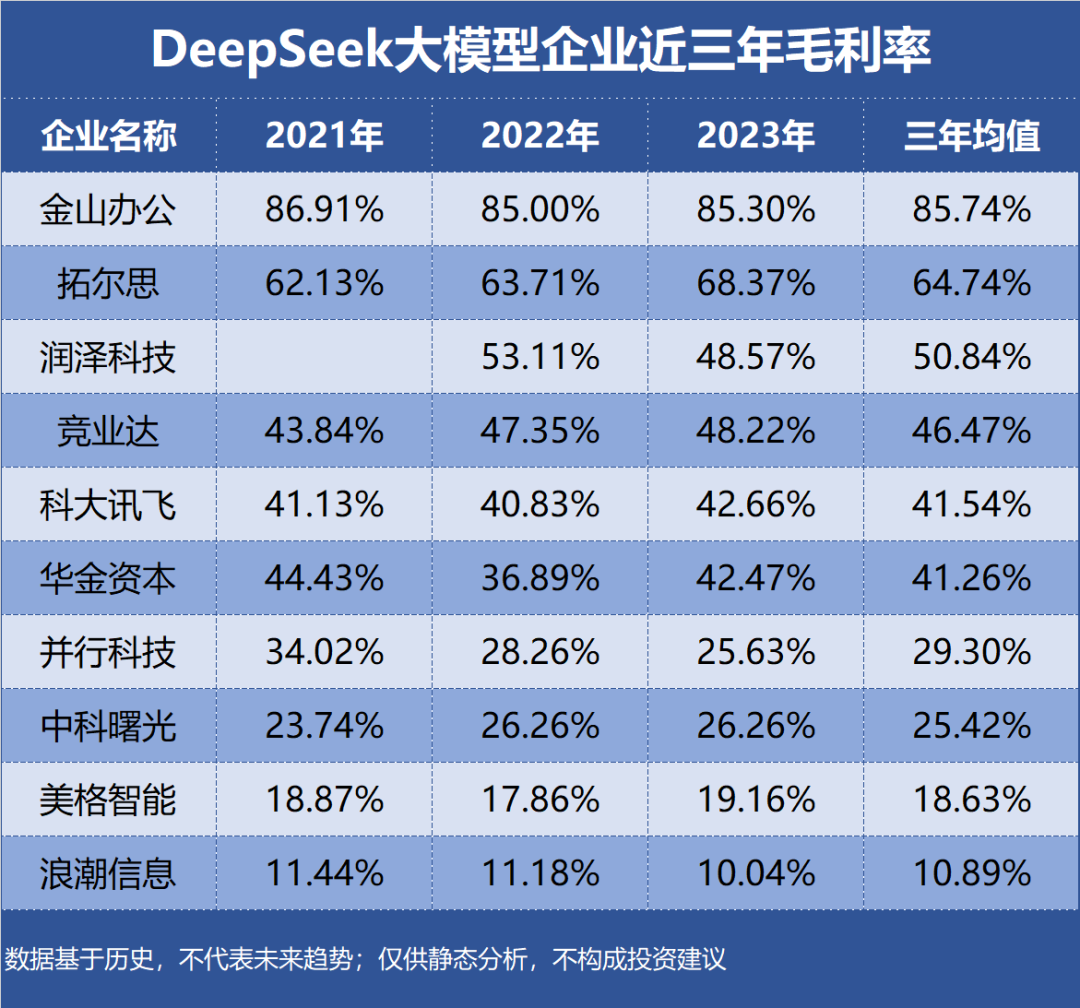

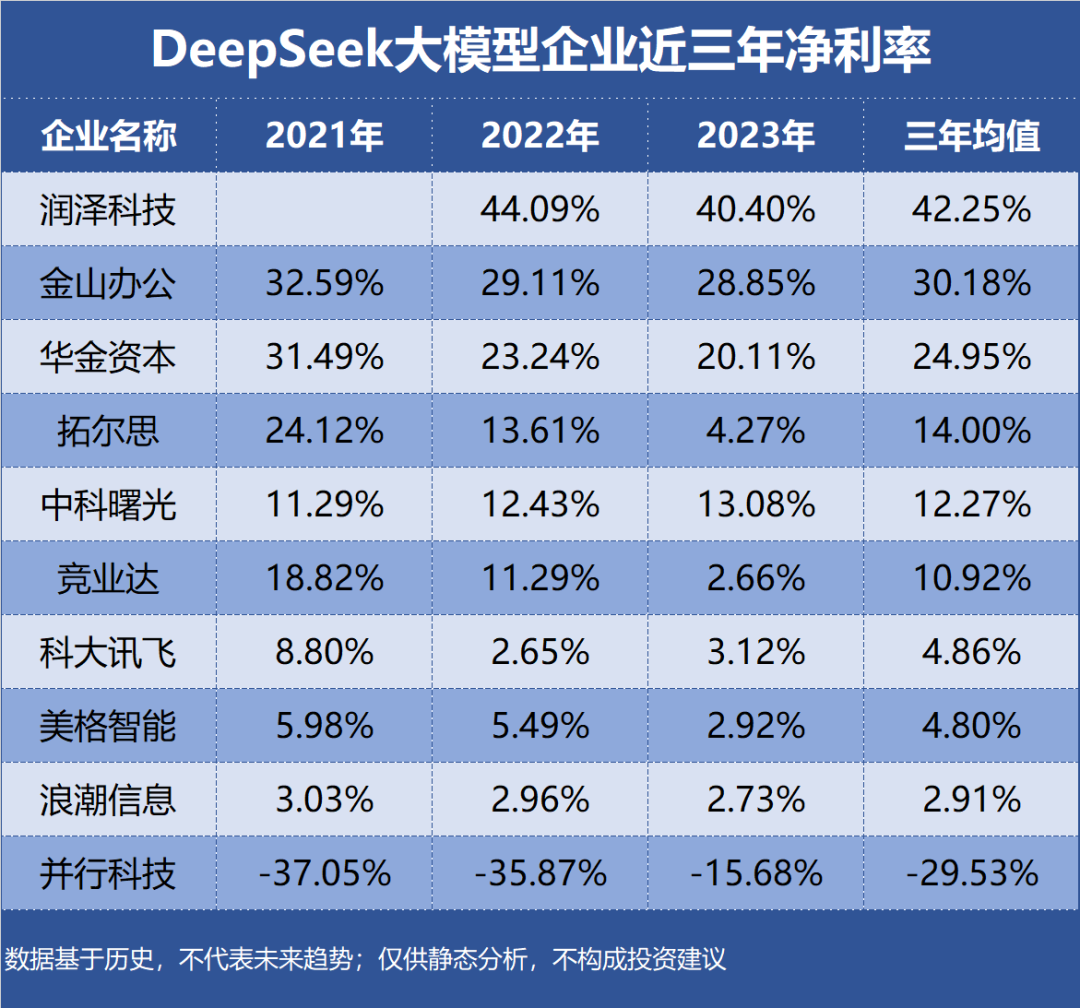

Return on equity, gross profit margin, and net profit margin of the top 10 most profitable DeepSeek large model enterprises over the past three years: