Identifying the Most Lucrative Players in Humanoid Robot Reducer Market

![]() 02/08 2025

02/08 2025

![]() 719

719

Humanoid robot reducers serve as the backbone of robotic joint systems, transforming high-speed, low-torque motor outputs into low-speed, high-torque motions while enhancing motion control precision and stability. The industry predominantly relies on three types of reducers: precision planetary reducers, harmonic reducers, and RV reducers.

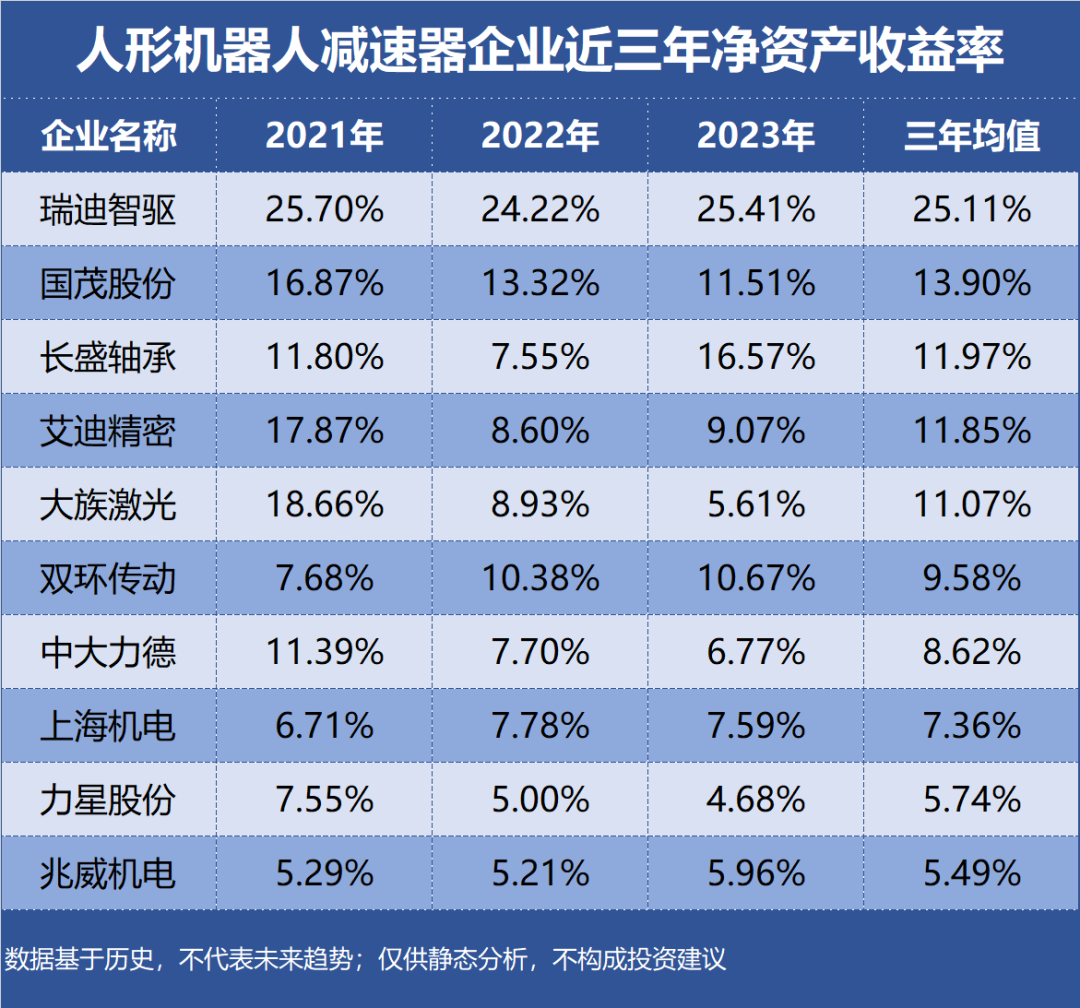

This article, part of our [Profitability] enterprise value series, delves into the profitability of 30 humanoid robot reducer enterprises. We evaluate these companies using metrics such as Return on Equity (ROE), Gross Margin, and Net Profit Margin. Note that our analysis is based on historical data, providing a static view and not intended as investment advice.

Top 10 Most Profitable Humanoid Robot Reducer Enterprises:

10. Han's Laser

Industry Segment: Laser Equipment

Profitability: ROE 11.07%, Gross Margin 35.90%, Net Profit Margin 9.26%

Performance Forecast: ROE has dipped to 5.61% over the past three years, with a latest forecast average of 10.70%

Main Products: Other smart manufacturing equipment accounts for 75.38% of revenue, with a gross margin of 35.22%

Company Highlights: Han's Laser specializes in smart manufacturing equipment and components, including research and development projects on harmonic reducers for intelligent robots.

9. Zhaowei Machinery and Electric

Industry Segment: Motors

Profitability: ROE 5.49%, Gross Margin 29.51%, Net Profit Margin 13.64%

Performance Forecast: ROE has fluctuated between 5%-6% in the past three years, with a latest forecast average of 6.69%

Main Products: Micro transmission systems contribute 63.99% of revenue, with a gross margin of 29.67%

Company Highlights: Zhaowei Machinery and Electric focuses on precision planetary reducers, renowned for their compact size, high precision, low noise, and lightweight design.

8. Shanghai Electric

Industry Segment: Building Equipment

Profitability: ROE 7.36%, Gross Margin 15.95%, Net Profit Margin 6.08%

Performance Forecast: ROE has ranged between 6%-8% in the past three years, with a latest forecast average of 7.90%

Main Products: Elevator business generates 93.69% of revenue, with a gross margin of 16.24%

Company Highlights: Shanghai Electric's precision reducer business caters to renowned industrial robot enterprises like Fanuc, Yaskawa, Kuka, and ABB, while actively expanding its domestic market.

7. Zhongda Lide

Industry Segment: Metal Products

Profitability: ROE 8.62%, Gross Margin 24.41%, Net Profit Margin 7.57%

Performance Forecast: ROE has declined to 6.77% in the past three years, with a latest forecast average of 7.65%

Main Products: Smart execution units contribute 40.77% of revenue, with a gross margin of 25.35%

Company Highlights: Zhongda Lide's integrated business platform includes precision reducers, geared motors, and smart execution unit components, forming a cohesive offering in reducers, motors, and drives.

6. Lixing Co., Ltd.

Industry Segment: Metal Products

Profitability: ROE 5.74%, Gross Margin 19.41%, Net Profit Margin 7.21%

Performance Forecast: ROE has dipped to 4.68% in the past three years, with a latest forecast average of 6.60%

Main Products: Steel balls account for 86.24% of revenue, with a gross margin of 17.43%

Company Highlights: Lixing Co., Ltd. specializes in precision bearing steel balls and rollers, directly supporting bearing manufacturing enterprises. Some products find use in robot terminal rotating units.

5. Guomao Co., Ltd.

Industry Segment: Metal Products

Profitability: ROE 13.90%, Gross Margin 26.62%, Net Profit Margin 15.23%

Performance Forecast: ROE has declined to 11.51% in the past three years, with a latest forecast average of 9.78%

Main Products: Reducers contribute 96.17% of revenue, with a gross margin of 22.65%

Company Highlights: Guomao Co., Ltd.'s core business is reducers. Its subsidiary, Guomao Precision Transmission, specializes in harmonic and RV reducers.

4. Aidite Precision

Industry Segment: Construction Machinery Components

Profitability: ROE 11.85%, Gross Margin 31.52%, Net Profit Margin 14.09%

Performance Forecast: ROE has fluctuated between 8%-18% in the past three years, with a latest forecast average of 10.14%

Main Products: Hydraulic components account for 47.06% of revenue, with a gross margin of 29.39%

Company Highlights: Aidite Precision's subsidiary Aidiai Chuang focuses on industrial robots and RV reducer products, offering complete industrial robot sets and integrated automation solutions.

3. Redi Intelligent Drive

Industry Segment: Other General Equipment

Profitability: ROE 25.11%, Gross Margin 29.52%, Net Profit Margin 14.46%

Performance Forecast: ROE has fluctuated between 24%-26% in the past three years, with a latest forecast average of 12.00%

Main Products: Electromagnetic brakes contribute 58.93% of revenue, with a gross margin of 37.26%

Company Highlights: Redi Intelligent Drive's harmonic reducers are in mass production and recognized by leading domestic robot manufacturers.

2. Double-Ring Gear

Industry Segment: Chassis and Engine Systems

Profitability: ROE 9.58%, Gross Margin 20.95%, Net Profit Margin 8.49%

Performance Forecast: ROE has risen to 10.67% in the past three years, with a latest forecast average of 11.66%

Main Products: Passenger car gears account for 54.67% of revenue, with a gross margin of 23.40%

Company Highlights: Double-Ring Gear's applications include automotive powertrains, transmissions, gearboxes, transfer cases, and power drive units for new energy vehicles.

1. Changsheng Bearing

Industry Segment: Metal Products

Profitability: ROE 11.97%, Gross Margin 30.95%, Net Profit Margin 15.71%

Performance Forecast: ROE has fluctuated between 7%-17% in the past three years, with a latest forecast average of 14.96%

Main Products: Metal-plastic polymer self-lubricating rolled bearings contribute 35.03% of revenue, with a gross margin of 49.33%

Company Highlights: Changsheng Bearing's products are used in construction machinery, automobiles, energy (both traditional and renewable), port machinery, plastic machinery, agricultural machinery, and other industries, including robot joints and reducers.

Top 10 Most Profitable Humanoid Robot Reducer Enterprises: ROE, Gross Margin, and Net Profit Margin Over the Past Three Years: