Robotaxi Renaissance: Pony.ai Poised for Single-Vehicle Profitability

![]() 05/29 2025

05/29 2025

![]() 651

651

Produced by ChiNeng Tech

In the first quarter of 2025, Pony.ai unveiled a financially intricate yet momentous report: revenues surged 12% year-over-year, with core Robotaxi business revenues skyrocketing 200%, including an 800% leap in passenger fares, cementing itself as the primary driver of growth.

The current financial report underscores Pony.ai's validation of Robotaxi commercialization, ushering in a pivotal 'mass production breakthrough' phase. Despite a near-80% year-over-year expansion in net losses, this signifies a 'trial by fire' ahead of the widespread deployment of the seventh-generation Robotaxi platform.

With hardware costs declining, system operational efficiency enhancing, and core technologies progressively integrating, Pony.ai stands on the cusp of achieving single-vehicle profitability.

01

Robotaxi Business Boom:

Commercialization Taking Root

In Q1 2025, Pony.ai's total revenues hit RMB 102 million, marking a 12% year-over-year increase.

However, the Robotaxi business exhibited even more robust growth, with revenues soaring to RMB 12.3 million, a 200% year-over-year jump. Notably, passenger fare revenues surged 800%, emerging as the primary engine of growth.

This substantial revenue surge is attributable to Pony.ai's intensified operations in first-tier cities, with Robotaxi services encompassing airports, high-speed rail stations, and core urban areas, gradually permeating real-world travel scenarios.

User behavior and market feedback rapidly affirm the travel value of Robotaxi, with registered user numbers rising over 20% quarter-over-quarter.

Currently, China's L4 autonomous driving travel services transcend mere 'proof of concept', evolving into tangible consumer products. This transformation is fueled by critical advancements in technology, cost, efficiency, and other factors.

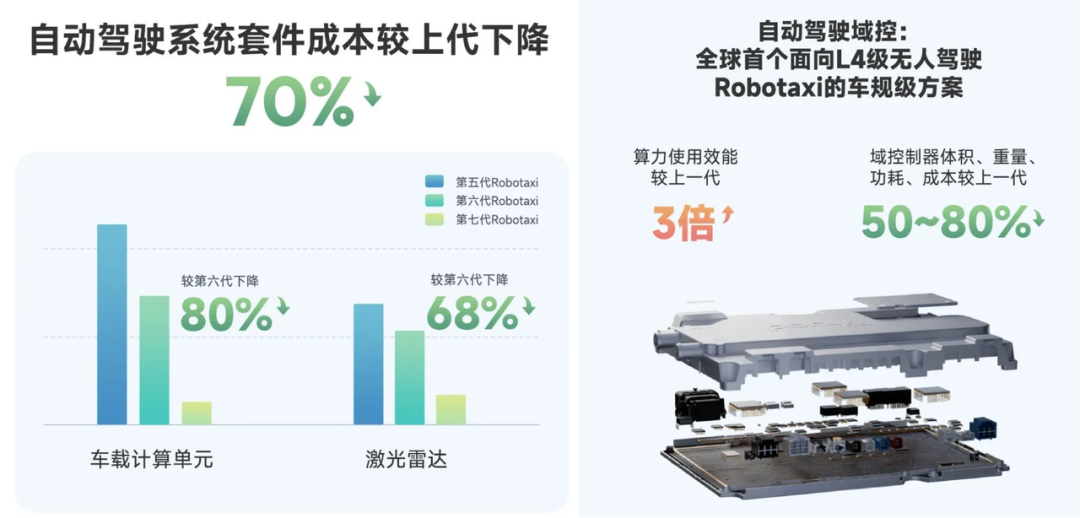

The official launch of the seventh-generation Robotaxi platform represents a significant milestone. This platform not only significantly enhances safety and reliability but also pioneers the full adoption of automotive-grade autonomous driving kits, reducing BOM costs by 70% compared to the previous generation without compromising functionality.

These changes underscore Pony.ai's vertical integration prowess in autonomous driving software and hardware stacks, a 'prerequisite' for breakthroughs in large-scale commercialization.

Driven by cost reductions and improved operational automation, Pony.ai's Robotaxi business gross margin structure is gradually improving.

While the overall gross margin dipped to 16.6% this quarter due to revenue structure changes and non-recurring expenses, it is anticipated to rebound substantially in subsequent quarters with accelerated fleet deployment and order growth.

Pony.ai's average daily orders exceed 15, with a fleet size of over 250 vehicles. According to plans, the fleet will expand to 1,000 vehicles by year-end, approaching the single-vehicle break-even point.

As CEO Peng Jun stated, 'Every deployed vehicle aims for at least break-even.' This embodies the underlying logic of the Robotaxi business model. Globally, China presents a 'hard mode' scenario, making business models in other countries relatively easier.

02

Capital and Technology Clash on the Eve of Mass Production

While the surge in Robotaxi passenger fare revenues signifies the nascent implementation of autonomous driving commercialization, high R&D expenditures reflect Pony.ai's enduring pain points for 'true mass production'.

In Q1 2025, Pony.ai's R&D expenses reached RMB 295 million, a 38% year-over-year increase. The adjusted net loss stood at RMB 206 million, expanding 10.5% year-over-year.

The uptick in R&D expenditures is primarily due to the advancement of the seventh-generation Robotaxi platform, including large-scale automotive-grade hardware introduction and system validation. Additionally, IPO-related employee stock rewards contributed to the rise. Although these short-term expenses widened losses, they are essential strategic investments for future positive production capacity and technological moats.

From a technical standpoint, Pony.ai has constructed a highly sophisticated and forward-looking system architecture:

◎ The 'World Model' (PonyWorld) generates over 10 billion kilometers of virtual data weekly for 3D semantic environment modeling and traffic behavior prediction.

◎ The 'Virtual Driver' simulates human driving behavior leveraging reinforcement learning and game theory strategies, capable of autonomously recognizing traffic police gestures or passenger boarding and alighting states.

Through iterative real-world testing in multiple cities, Pony.ai has also achieved significant hardware-level cost control. For instance, domestic GPUs reduce costs by approximately 75% compared to previous iterations, and LiDAR costs have plummeted to the thousand-yuan range.

These technological and supply chain breakthroughs underpin Pony.ai's bold large-scale Robotaxi deployment. In Q1, Pony.ai completed mass production line modifications and will officially launch the seventh-generation Robotaxi in Q2.

This underscores why company executives repeatedly emphasize, 'Now is the critical window for scaling up.'

The Robotaxi business's revenue share has consistently risen, from 4.8% in the same period last year to 12.1% this year. Pony.ai's profit model has shifted from primarily 'selling solutions and components' to 'operating and securing orders' as the core. This structural transformation aligns closer with a business model prototype poised for future positive cash flow.

2025 marks a year of multi-faceted breakthroughs for driverless technology.

◎ Elon Musk announced Tesla's upcoming Robotaxi release, and Waymo partnered with Uber to launch services in multiple U.S. cities.

◎ In China, Pony.ai has delivered the most significant response, with the Robotaxi commercialization window now wide open. Passengers are willing to pay, cities are receptive, and companies dare to deploy on a large scale. Furthermore, profit pathways are emerging, cost structures are improving, and the single-vehicle break-even point is within reach.

Summary

The Robotaxi battleground has shifted from a technology showcase to an industrial game. Operational density, passenger conversion rates, hardware BOM, and system stability are now the core variables determining future success.