H200 Chip Gets Green Light for Export to China + CPU/GPU Price Surges: Semiconductor Market Braces for Significant Disruption

![]() 12/09 2025

12/09 2025

![]() 555

555

The semiconductor market in December is set for a turbulent ride.

On one front, AMD and NVIDIA have successively set off waves of CPU and GPU price hikes, driving up the costs for consumers building systems. On the other, significant geopolitical policy developments have emerged — on December 8 (local time), Trump announced the approval of NVIDIA's export of H200 AI chips to China, with the condition that 25% of sales revenue be remitted to the U.S. government. The U.S. Department of Commerce is finalizing the relevant details.

Will the relaxation of H200 export restrictions ease the pressure of chip price hikes? Are these hikes driven by costs or strategic maneuvers? How should enterprises, distributors, and consumers respond?

01

CPU/GPU Price Hike Wave Hits

Recent signs of price hikes in the semiconductor market have shifted from mere speculation to concrete actions, affecting the two core hardware segments: CPUs and GPUs.

In the GPU sector, AMD has taken the lead, informing partners such as ASUS, GIGABYTE, and PowerColor of plans to implement a second round of price increases across its entire GPU lineup, with a minimum hike of 10%. The new pricing is expected to take effect in the coming weeks. This means that gamers hoping to purchase the latest Radeon RX 9000 series graphics cards, featuring the RDNA 4 architecture, at the original suggested retail price (MSRP) will have even fewer opportunities.

NVIDIA, meanwhile, has opted for a phased price increase strategy to minimize market impact. Partners reveal that the first round of adjustments may begin with a modest increase in December 2025, followed by a second round in January 2026. Currently, NVIDIA's graphics card prices are already on an upward trajectory.

One of the primary drivers of these price hikes directly points to memory cost pressures.

Industry insiders note that memory costs account for roughly 30%-40% of total graphics card costs, and this across-the-board increase marks the first in nearly three years.

To address this pressure, reports indicate that NVIDIA is considering abandoning its long-standing bundled sales strategy, no longer requiring graphics card partners to purchase GPU chips and memory modules simultaneously. Instead, board manufacturers will be allowed to procure memory independently. This strategic shift will intensify industry differentiation: for top-tier AIC manufacturers like ASUS, MSI, and GIGABYTE, direct negotiations with memory OEMs such as Samsung, SK Hynix, and Micron could yield more competitive pricing while enhancing supply chain autonomy. However, smaller AIC manufacturers may face greater cost pressures and survival challenges due to their limited purchasing volumes and weaker bargaining power. It's worth noting that NVIDIA's GDDR memory is currently primarily supplied by Samsung, Micron, and SK Hynix, while the HBM memory used in AI accelerators also relies on these three giants. The delegation of memory procurement rights essentially redistributes cost pressures and competitive initiative to downstream manufacturers.

The CPU market has also embarked on a parallel upward trajectory. On December 1, tech media outlet OverClock3D confirmed that AMD had notified channel partners of processor price increases effective at 0:00 on December 2, covering the latest Ryzen 9000 series and select older models. While AMD did not disclose the reasons for the hike, and OC3D emphasized that this adjustment was not directly tied to graphics card or memory price increases, the market widely interprets it as a price realignment following the "Black Friday/Cyber Monday" promotional period.

Intel has also been rumored to implement price hikes. In the fourth quarter of 2025, Intel is reportedly set to raise global prices for its 12th to 14th-generation Core processors, with certain mid-range and entry-level models, such as the i5-14400F, seeing increases of up to 20%. This unusual move — raising prices on older chips while reducing prices on newer ones — has drawn widespread attention from consumers and the industry.

CPUs represent the core category of logic chips, with their production reliant on advanced-node wafer fabrication (e.g., TSMC's 3nm/5nm processes), rather than DRAM or NAND capacity or costs. The current central contradiction in the CPU industry lies in the "squeeze on consumer-grade capacity by AI's high-profit margins."

From a wafer capacity perspective, foundries like TSMC and Samsung have allocated substantial 3nm/5nm advanced-node capacity to AI chips (e.g., H200) and high-end CPUs, relegating consumer-grade CPU capacity to lower priority. In terms of packaging capacity, global CoWoS packaging demand is projected to reach 1 million units in 2026, with AI chip giants like NVIDIA and Broadcom securing over 85% of this capacity. Notably, NVIDIA's Vera CPU also consumes a portion of CoWoS capacity, diverting advanced packaging resources away from consumer-grade CPUs.

Recently, Intel executives reiterated the challenge of insufficient supply for their client and data center processors, unable to meet full market demand. John Pitzer, Intel's Vice President of Corporate Planning and Investor Relations, stated, "If we had more Lunar Lake wafers, we could sell more Lunar Lake; if we had more Arrow Lake wafers, we could sell more Arrow Lake."

02

Major Disruption: H200 Approved for Export to China

Amidst consumer-market anxiety over price hikes, a relaxation in geopolitical policies has injected new variables into the semiconductor market — the U.S. government's announcement allowing NVIDIA to export H200 AI chips to China marks a stark contrast to the Biden administration's previous blanket restrictions.

The H200 chip, unveiled by NVIDIA on November 13, 2023, represents an upgraded iteration of the H100, still built on NVIDIA's Hopper superchip architecture and primarily targeting hyper-scale large model training and inference workloads.

Equipped with an HBM high-bandwidth memory architecture and HBM3e technology, the chip delivers 141GB of memory capacity and 4.8TB/second bandwidth, representing a 1.8x increase in memory capacity and 1.4x increase in bandwidth compared to the H100. Its memory bandwidth is 2.4x that of the A100. Single-precision floating-point performance has improved by 60%-90% over the H100. Additionally, the DGX H200 system features eight H200 GPUs with 1,128GB of memory and bidirectional GPU bandwidth of 7.2TB per second. The chip is compatible with H100 systems, enabling cloud service providers to deploy it without modifying existing infrastructure.

Previously, this chip was included on the U.S. ban list for China due to its performance density exceeding thresholds, forcing NVIDIA to develop a "downgraded" H20 chip specifically for the Chinese market. Sources reveal that allowing the export of the slightly less powerful H200 chip represents a compromise to NVIDIA's push for selling more advanced Blackwell chips. NVIDIA had previously lobbied the Trump administration to permit sales of its Blackwell and subsequent Rubin chips to Chinese customers, but these efforts ultimately failed.

This decision is seen as a significant lobbying victory for NVIDIA, potentially helping it reclaim billions of dollars in lost business in the critical Chinese market. However, a report from the Institute for Progress cautions that even with H200 approval, the U.S. could still undermine its practical impact by controlling supply volumes, raising prices, and restricting technical support. Additionally, Chinese procurement costs are expected to be 1.5-2x higher than international markets, testing enterprises' capital strength and strategic resolve.

NVIDIA's fiscal Q2 2026 earnings report (ending July 27) revealed a 24.5% year-over-year decline in revenue from China (including Hong Kong) to $2.769 billion, accounting for approximately 5.9% of total revenue. In fiscal Q3, revenue from the region plummeted by 63.5% year-over-year, with its share of total revenue dropping to roughly 5.2%.

Notably, this approval comes with stringent conditions: as mentioned earlier, 25% of sales revenue from relevant chips must be remitted to the U.S. government. From a policy perspective, this appears to be a compromise balancing "national security" and "industrial interests" — avoiding the loss of U.S. chip companies' competitiveness due to exclusion from the Chinese market while attempting to extract economic benefits through revenue sharing and maintaining technological barriers by excluding more advanced chips like Blackwell and Rubin from approval.

03

H200 Approval May Intensify Consumer-Grade CPU/GPU Price Pressures

Returning to the market's primary concern: will the approval of H200 exports to China alleviate current consumer-grade CPU/GPU price hikes? The answer is likely negative, and it may even exacerbate supply chain tensions in the short term.

Two main reasons support this view:

First, the H200's core demand lies in the AI sector, with significant market divergence from consumer-grade GPUs and CPUs. Given the current global supply shortage of H200 chips, Chinese internet giants and AI labs are expected to procure them aggressively, further straining HBM memory capacity at manufacturers like Samsung and SK Hynix. While H200's HBM3e memory and consumer-grade GPUs' GDDR memory belong to different categories, they share upstream capacity and supply chain resources. HBM capacity constraints could indirectly drive up costs across the entire memory market, providing support for consumer-grade GPU price increases.

Second, NVIDIA may prioritize high-margin AI chips like the H200. With significantly higher gross margins than consumer-grade graphics cards, NVIDIA is likely to allocate production capacity to ensure H200 supply first, potentially squeezing consumer-grade graphics card production. Combined with memory cost pressures, this suggests that price hike trends are unlikely to reverse in the short term.

Secondly, from a supply chain perspective, the current CPU and GPU price hikes are not isolated events but stem from the broader memory chip market. Prices for mainstream DRAM memory modules, including DDR5 and DDR4, have surged by over 100% within a single month, with some manufacturers suspending external quotes and causing downstream procurement difficulties and tightening market supply.

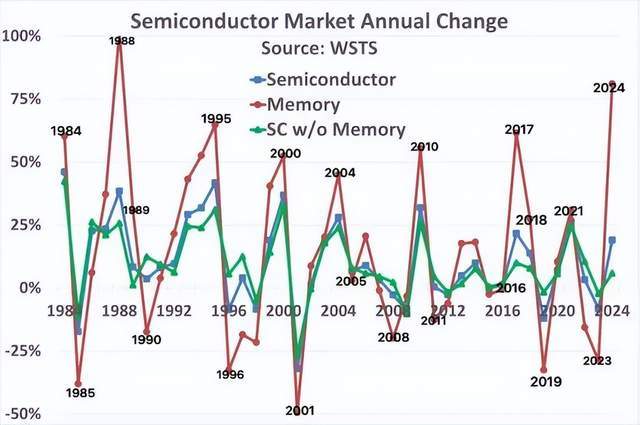

Unlike other semiconductor segments, the memory market exhibits more pronounced cyclical fluctuations and elasticity. The chart below, based on WSTS data, illustrates the memory market's cyclical volatility over the past four decades.

The chart compares trends in total semiconductor volume, the memory market, and the semiconductor market excluding memory. Clearly, the memory market displays extreme volatility, with historical peaks of 102% growth and troughs of 49% declines. In contrast, the non-memory semiconductor market has remained relatively stable, fluctuating between 42% growth and 26% declines.

Over the past 40 years, the memory market has followed a discernible pattern: whenever annual growth exceeds 50%, the following year often sees a significant slowdown or decline. Prior to 2024, this rapid growth occurred six times, with four instances (1988, 1995, 2000, 2010) followed by market declines the next year. The remaining two instances (2004 and 2017) saw continued growth, but at a markedly slower pace, with market downturns occurring two years after the peaks.

The memory market began facing headwinds in the second half of 2024. By March 2025, subtle shifts emerged in the market.

Starting in April, companies like SanDisk, Micron, Samsung, and SK Hynix began issuing price hike notices to customers. By September, memory chip prices had risen across the board, with the pace accelerating in Q4. Downstream manufacturers scrambled to secure inventory, with some production lines operating at full capacity yet still unable to meet demand. Industry sources indicate that spot market prices for memory chips have increased by 60%-80%, with certain popular models seeing 100% hikes.

The current memory chip price surge stems from robust demand for AI servers driven by the AI wave, prompting manufacturers to shift more capacity toward high-end products required for AI systems.

Currently, the DRAM price hike trend has gradually spread to consumer-grade DDR5 memory and memory chip sectors, with some manufacturers' DDR5 memory module prices more than doubling. Given that game graphics cards rely heavily on DRAM chips for their GDDR memory (with AMD and Intel primarily using GDDR6 and NVIDIA's new RTX 50 series adopting GDDR7), the persistent DRAM supply shortage continues to exert cost pressures on graphics card production, directly driving up GPU prices.

04

Pricing Pressures to Persist in 2026

Facing the dual challenges of "price hikes and policy relaxations," the market's primary concern is whether CPUs and GPUs will continue to see price increases in 2026, and how long these pressures will persist. Based on industry cycles, capacity trends, and cost dynamics, CPU and GPU price hike pressures are expected to continue in the first half of 2026, potentially stabilizing in the second half.

From a continuity perspective, the core driving factors remain largely unchanged.

On one hand, memory cost pressures will persist. Counterpoint Research recently reported that the global memory market is under significant upward pricing pressure. After surging by 50% this year, DRAM prices are expected to rise by another 30% in Q4 2025 and a further 20% in early 2026, potentially reaching a cumulative 50% increase by Q2 2026.

On the flip side, the demand for AI chips is continuously exerting pressure on production capacity. Manufacturers such as Samsung and Micron are dedicating a substantial portion of their capacity to the production of HBM (High Bandwidth Memory) and AI-grade DDR5 memory. This allocation further strains the production of consumer-grade GDDR (Graphics Double Data Rate) memory. Coupled with the anticipated supply chain constraints in the HDD (Hard Disk Drive) market in 2026, which are expected to result in lead times of up to 52 weeks, there will be a significant surge in demand for high-density SSDs (Solid State Drives). This surge will, in turn, indirectly drive up costs across the entire storage supply chain. In the CPU (Central Processing Unit) sector, with global semiconductor revenue projected to grow by 26.3% in 2026, reaching close to $1 trillion, the strong demand for logic and memory chips leaves limited room for substantial price reductions in processors.