In Comparison to Apple, What Aspects Is Xiaomi Still Lacking?

![]() 10/08 2025

10/08 2025

![]() 631

631

Lei Jun's Personal Appeal: A Double-Edged Sword

Which garners more attention: Lei Jun's speech, Xiaomi's new product launch, or Andy Lau's concert?

This seemingly unrelated query recently became a trending topic on Weibo.

The reason is that Xiaomi's 17 series launch event, Lei Jun's annual speech with the theme of 'Change,' and Andy Lau's Douyin online concert all occurred simultaneously.

Netizens who wished to watch both found themselves in a bind, having to choose between the two. Some opted for Lei Jun, others couldn't bear to miss Andy Lau, while some attempted to watch both—Xiaomi on their phones and Andy Lau on their computers.

Ultimately, Andy Lau's concert slightly surpassed in popularity, though Lei Jun's speech also performed well. In contrast, the Xiaomi 17 series products seemed to be overshadowed in terms of discussion热度 (Chinese for 'heat' or 'buzz') on their launch day.

Originally scheduled for June of this year, Lei Jun's speech was postponed to generate more buzz for the Xiaomi 17 series. While it somewhat overshadowed the product launch, it did spark increased discussions about Xiaomi's brand and products.

This isn't the first time Xiaomi has employed such a promotional strategy.

In May of this year, Xiaomi announced the Xuanjie O1 and Xiaomi YU7 together, sparking a wave of discussions about domestically developed chips.

Looking back, the Xuanjie O1 seemed to serve more as a hype generator for the Xiaomi YU7, which was the real focus.

Such a design may reflect Xiaomi's commitment to establishing itself as a premium brand.

I. Premium Branding as a Value Proposition

Premium branding can be discussed in terms of both tangible and intangible strengths.

Tangible strengths require products to have no weaknesses across the board, balancing functionality and aesthetics.

Mid-to-low-end phones may sacrifice cooling for performance or battery life for power, but premium products must excel in both.

The Automobile News Agency once discussed the premiumization of new energy vehicles, suggesting that pure electric products are better suited for cost-conscious and individualistic young consumers but face challenges in moving upmarket.

The reason is that cost-conscious consumers are willing to accept range limitations for electric driving features, while premium market users demand a stable, compromise-free driving experience.

Tangible strengths lay the foundation for premium branding, while intangible strengths elevate its value ceiling.

A Porsche costing over a million yuan may not offer significantly better functionality or comfort than a 500,000-yuan car on the market. Similarly, a backpack with the same craftsmanship and materials can vary drastically in price depending on whether it bears the Prada or Puma logo.

Intangible strengths, though seemingly intangible, are difficult to accumulate.

The direct production cost of a bottle of Feitian Moutai is only 85-105 yuan, yet it sells for over a thousand yuan. While one may argue that Moutai is overpriced, building market recognition and added value for the Moutai brand is no simpler than chip R&D.

Intangible strengths, in essence, are emotional value. Consumers buy not just a product but also a set of values.

This determines that marketing for premium brands requires a unique style, not just blunt street-level promotion.

When Huawei faced 5G and high-end chip restrictions, it didn't overemphasize its products but elevated its brand story to a grander level.

He Tingbo, President of Huawei HiSilicon, wrote an open letter about 'all backup chips going mainstream overnight,' which went viral on social media.

Documentaries or promotional videos showcasing Huawei's R&D team working under extreme pressure (such as 'Huawei's 100 Faces') also spread online.

Ren Zhengfei, usually reserved, frequently gave interviews at the time, discussing not phone specifications but the importance of basic education, scientific research, and global cooperation.

These efforts firmly tied Huawei's brand to 'China's tech struggle,' crafting a heroic narrative filled with pathos.

These foundational efforts led to the later phenomenon where the Mate 60 became highly sought-after even before its official release.

As a leader in premium branding, Apple naturally understands this approach.

Its classic ad '1984' portrayed Apple as a warrior rebelling against George Orwell-style totalitarianism, alluding to its challenge to IBM's monopoly in the personal computer market at the time.

Later, 'Think Different' conveyed values of rebellion and innovation by paying tribute to historical 'mavericks,' making Apple synonymous with uniqueness in many people's minds.

While Huawei tells 'China's tech struggle,' and Apple promotes 'Think Different,' both aim to infuse their brands with values, sparking emotional resonance among users. The more resonance, the higher the brand premium.

Lei Jun's emphasis on 'personal struggle' and 'growth' in his speeches likely serves this same goal. For Xiaomi to move upmarket, it must craft a unique brand story beyond just stacking specs.

However, compared to Huawei and Apple, Xiaomi may carry heavier historical baggage.

First, its cost-effective image is deeply ingrained. Many Xiaomi fans once self-deprecatingly referred to themselves as 'diaosi' (a term for low-status individuals), which was both a foundation for Xiaomi's rise and a difficult label to shed.

According to CounterPoint Research and other institutions, phones priced above $600 (around 4,356 yuan) are considered premium.

While Huawei and Apple offer numerous models in this price range, Xiaomi's pre-17 series products mostly had only their top flagship models reaching this threshold.

In the automotive sector, the Xiaomi SU7 and YU7 don't primarily focus on cost-effectiveness, yet their launch events still highlighted price advantages compared to Tesla.

Once a label sticks, it's hard to remove. We can't imagine Xiaomi without cost-effectiveness, just as we can't fathom what would happen to the e-commerce landscape if Pinduoduo stopped being affordable.

Second, Lei Jun's personal brand may overly influence Xiaomi, posing another obstacle to its premium branding.

Many follow Xiaomi not for its products but for Lei Jun himself, as evidenced by his annual speech overshadowing the Xiaomi 17 series products.

The issue is that even perfect individuals make mistakes. Relying on personal charm for brand value is highly unstable.

After the Xiaomi SU7 crash incident, the public first expected Lei Jun's response rather than the company's official statement.

When Xiaomi announced Wang Teng's dismissal for disciplinary violations, the public first speculated about Lei Jun's relationship with Wang Teng rather than treating it as a company matter.

In contrast, Apple has transitioned from Steve Jobs' personal charm to product charm, while Huawei has always emphasized its technological identity without relying on individuals.

Thus, while Xiaomi's premium branding shows initial success, there may still be a long road ahead.

II. Tiered Communication

In the long run, Lei Jun's speeches tell Xiaomi's brand story of 'growth and struggle.' In the short term, they simply drive traffic to the Xiaomi 17 launch.

The results have been positive, with Xiaomi's brand and products gaining significant exposure. The hashtag #LeiJun'sAnnualSpeech exceeded 13 billion views on Weibo, while video clips from the launch event were ubiquitous on Bilibili and Douyin.

However, this indiscriminate traffic-driving approach may not always yield positive value for Xiaomi.

For instance, comments on Douyin and WeChat Channels included criticisms like 'too long-winded' or 'overly theatrical.' While rational, positive comments existed, emotional outbursts tended to have greater influence.

The day after the launch, Xiaomi's stock price dropped 8%, contrasting with the previous day's enthusiasm. According to Tianyancha APP, as of September 26, 2025, Xiaomi's market capitalization stood at 1,422.316 billion HKD.

This highlights the weakness of a 'traffic-only' approach. Different platforms have distinct atmospheres and styles. Applying a one-size-fits-all marketing strategy across all networks will inevitably cause discomfort in many areas.

Especially with the rise of social media marketing, brand communication should consider tiered marketing strategies.

For example, Xiaomi's launch event received relatively positive feedback in Bilibili's tech section but faced more criticism on entertainment-focused Douyin. Marketing priorities should differ accordingly.

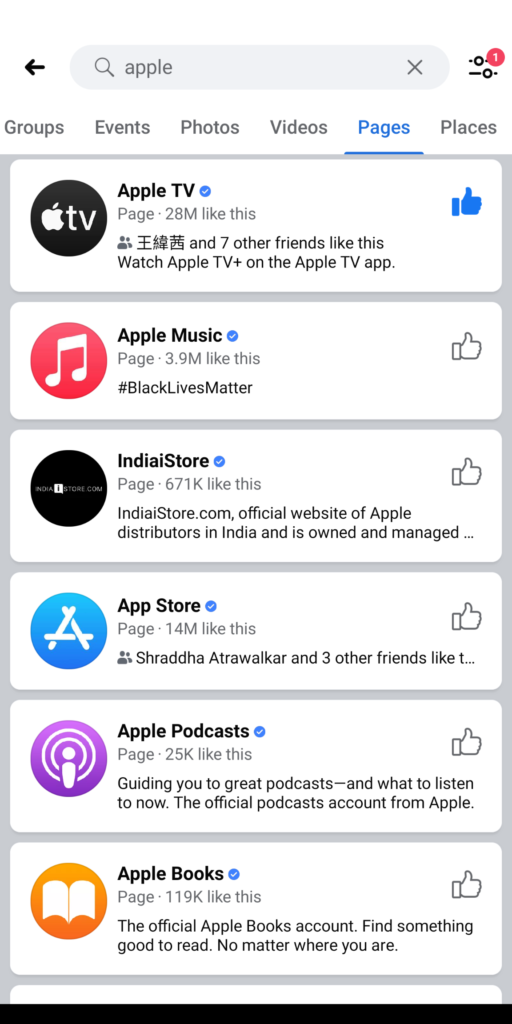

Apple's official social media accounts on foreign platforms, such as X (formerly Twitter) with over 9 million followers and Facebook with over 13 million, post zero times. This isn't arrogance but a strategy to maintain a minimalist experience by dispersing content to sub-accounts with different functions.

For product features, users can follow Apple Support; to check if Adam Lambert's new album is on iTunes, they can @Apple Music.

This ensures that messages from one account don't disturb users of another.

Moreover, Apple tailors its content style to each platform.

For the same theme, Twitter posts feature short, lively sentences with occasional emojis, while Facebook focuses on long-form, official content.

In short, Apple adapts its strategies to each platform's rules and characteristics.

While personalized marketing is often emphasized in China, its practical implementation seems lacking. Many brands still prioritize maximizing utility by distributing the same content across multiple platforms.

Though Xiaomi isn't short on traffic, its communication still feels like a broad, untargeted flood.

Recommendation algorithms may filter groups interested in Xiaomi's launch, but distinguishing those who care about the product from those interested in Lei Jun's speech may still require human judgment.

Universal products are likely to be ordinary, and a brand catering to the masses risks becoming mediocre.

Sam's Club requires membership for shopping, inherently limiting its audience. With only 56 stores in China (about one-tenth of Yonghui Supermarket's count), its 2024 sales nearly reached 1.5 times Yonghui's.

Premium branding needs to resonate only with those who seek it.

Even after crafting such a story, success isn't guaranteed.

Apple resorts to scarcity marketing to maintain price floors; Huawei's IoT ecosystem relies on phone sales but hesitates to fully engage the mid-to-low-end market.

Moutai's premium image is deeply rooted, yet it must control supply to maintain prices during market downturns.

Building a premium image is hard; maintaining it may be even harder.

Apple faces yearly criticism for 'incremental updates' and diminishing innovation, gradually undermining its premium market position.

Huawei's HarmonyOS 5.0 faced backlash for its limited app selection and functionality, somewhat shaking its technological reputation.

If tangible strengths lag, the better the story, the greater the risk of backlash.

Thus, as Xiaomi fully commits to premium branding, it must ask itself: Is it truly ready?

Disclaimer: This article is based on legally disclosed company information and publicly available data. The author does not guarantee the completeness or timeliness of this information.

Note: Stock markets involve risk; enter carefully. This article does not constitute investment advice. Investors must conduct their own due diligence.