["29% Plunge in Domestic Sales in November: New National Standards Chill Electric Bicycle Market by One-Third

![]() 12/10 2025

12/10 2025

![]() 505

505

On December 1, 2025, the formal rollout of the updated "Safety Technical Specifications for Electric Bicycles" (GB 17761 - 2024) marked a definitive turning point for the electric two-wheeled vehicle sector. The new rules impose stricter safety and technical benchmarks in areas like fire resistance, overall vehicle weight, tamper-proofing, and intelligent features. Their aim is to steer the industry towards high-quality, standardized growth. The policy's transition phase has triggered unprecedented market attention, with both industry insiders and outsiders closely monitoring this transformative shift. Yet, in stark contrast to the intense public and industry buzz, the market's post-policy "performance report" has been far from impressive.

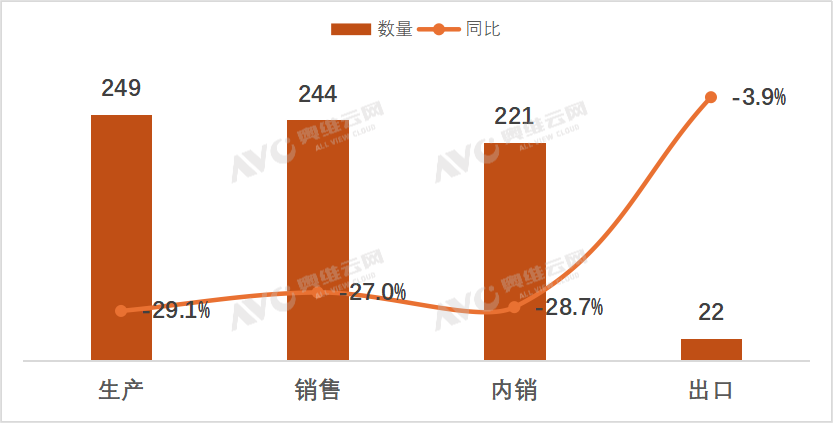

According to AVC (All View Cloud) monitoring data, in November 2025, China's electric two-wheeled vehicle industry produced approximately 2.49 million units, a 29.1% year-on-year decline. Total sales reached around 2.44 million units, down 27% year-on-year. Domestic shipments, which more directly reflect market demand, stood at 2.21 million units, a 28.7% year-on-year drop. Exports totaled 220,000 units, a 3.9% decline. This series of sharp downward trends clearly underscores the significant impact of the initial shift to the new national standards on the market. Notably, amid the overall downturn, the brand "Zeeho," which focuses on high-performance electric motorcycles, achieved nearly 600% counter-trend growth. This makes it a unique bright spot in the otherwise gloomy data and hints at the strong demand for market segmentation.

Production and Sales Performance of Electric Two-Wheeled Vehicles in November 2025 (10,000 units, %)

Brand Performance: Market Reshuffling Amid a General Downturn

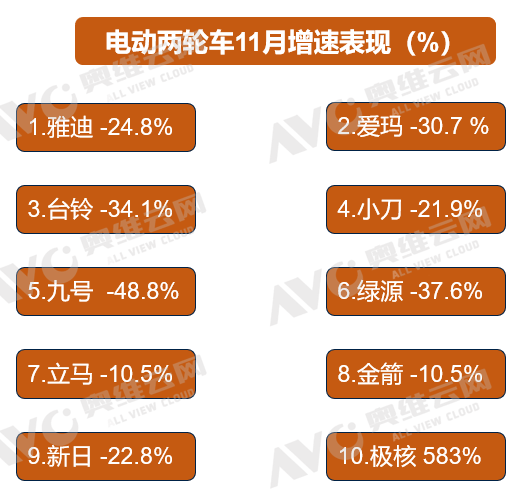

Against the backdrop of a cooling market, major brands haven't been immune, but the extent of their declines varies greatly, reflecting different levels of risk resilience and strategic focus. Yadea, the industry leader, saw a 25% year-on-year drop in domestic shipments in November. Despite facing pressure, its relatively stable performance can be attributed to its extensive distribution network, strong brand reputation, and early product line planning. This has enabled it to maintain its core market position amid the turmoil. Ai Ma experienced a roughly 30.7% decline. Its design-centric models temporarily couldn't fully capitalize on their advantages under the new standards, while also facing significant pressure to clear old inventory. Tailg saw a roughly 34% drop. Its long-standing "energy-saving" technology label lost some immediate appeal to consumers under the new standards' emphasis on lightweight and speed-limited vehicles, resulting in more pronounced transition pains.

Ninebot led the pack in terms of magnitude with a staggering 49% year-on-year decline. This is directly linked to its product mix, which has a high proportion of intelligent electric bicycles. The new national standards impose new compliance requirements on some of the intelligent features and performance settings that have contributed to Ninebot's success. This could potentially affect short-term supply and consumer confidence due to product transitions and certification cycles. Luyuan experienced a roughly 38% decline. Its core technological advantages, such as "liquid-cooled motors," saw their market appeal temporarily diminish during a period when consumers are more focused on basic compliance and pricing. In contrast, Jinjian saw only a 10% year-on-year drop, demonstrating strong resilience. This is closely tied to its consistent "high cost-effectiveness" market positioning. Amid widespread price increases for new standard vehicles, price-sensitive consumers in lower-tier markets may be more inclined to choose products like Jinjian's, which offer basic compliance solutions at relatively affordable prices.

The Triple "Tug-of-War" Behind the Data

The sharp correction in November's production and sales data isn't due to a single factor but rather the combined effects of policies, distribution channels, and consumer psychology. This represents a classic case of "transition period syndrome."

1. The "Inventory Clearance Effect" of Policy Transition: The implementation of the new national standards means non-compliant products can no longer be sold. Throughout the fourth quarter, especially in November, the core task for terminal stores shifted abruptly from "sales" to "inventory clearance." Dealers' capital, energy, and display space were occupied by discounted promotions of old standard models. This naturally reduced their willingness and ability to stock higher-priced, uncertain-market-acceptance new standard models, directly obstructing new vehicle shipments from factories.

2. "Decision-Making Hesitation" Among Dealer Groups: Faced with entirely new product standards, dealers generally adopted a wait-and-see attitude. On one hand, the procurement costs for new standard vehicles rose significantly, while their performance (speed, load capacity) visibly declined. This created immense uncertainty regarding terminal pricing and consumer acceptance. On the other hand, varying new product launch timelines and terminal policy support across brands also forced dealers to "shop around," delaying procurement decisions and causing temporary supply chain disruptions.

3. "Value Hesitation" Among Consumers: For ordinary consumers, the new standard vehicles presented a somewhat contradictory perception: rising prices accompanied by a potential decline in core riding experience. The strict 25km/h speed limit, reduced storage space, shortened saddles, and possible compromises in seat comfort due to the use of fire-resistant materials have sparked widespread discussion and even complaints. When the added value of the products (primarily safety and compliance) fails to align with the costs paid and the convenience sacrificed in consumers' minds, delaying purchases and maintaining a wait-and-see stance becomes the most rational choice, temporarily freezing market demand.

The "Break-In Period" for Products and Markets: New Standard Models Face Real-World Scrutiny

Entering December, new standard products from leading brands have gradually made their way to terminals. However, initial market feedback indicates a "gap" that needs bridging between products and actual user needs.

From a user perspective, complaints are highly concentrated:

1. "Performance Gap": The 25km/h speed limit conflicts with the efficiency demands of urban commuting, particularly affecting specific groups like food delivery riders.

2. "Practicality and Comfort Compromises": To meet overall vehicle weight requirements, adjustments have been made to load capacity, storage space, saddle dimensions, and cushioning materials. This impacts convenience for carrying passengers and goods as well as riding comfort.

3. "Cost-Effectiveness Controversy": Increased manufacturing costs to meet fire resistance and tamper-proofing requirements have been passed on to terminals, leading to widespread price hikes. However, users perceive no simultaneous improvement in core functional value, which may have even weakened.

From a dealer perspective, pressures are more tangible:

1. Increased sales difficulty, requiring more communication costs to explain new regulations and persuade customers to accept new product definitions.

2. Squeezed profit margins, as procurement prices rise but terminal price hikes are limited, thinning out profits.

3. High market education costs, necessitating a shift in consumer understanding from past preferences for "speed and capacity" to embracing new values of "safety and compliance."

This series of feedback collectively poses real-world challenges for new standard products in their initial market launch.

Seeking Balance Amidst Pain, Driving the Future with Innovation

The overall decline in November's production and sales data represents a short-term pain that the electric two-wheeled vehicle industry must endure during the mandatory standard upgrade process. This clearly indicates that the transition from old to new national standards is not merely a simple product iteration but a profound transformation involving consumer perception, product definition, and supply chain adjustments.

The market chill and widespread complaints, in essence, serve as a sobering reminder to the industry: while safety and compliance are non-negotiable baselines, they must not become excuses for sacrificing user experience and practicality. The current "performance gap" and "cost-effectiveness controversy" facing products precisely highlight the key to the next phase of competition: whether enterprises can, within strict regulatory frameworks, maximize the satisfaction of users' genuine and diverse travel needs through technological innovation and design optimization. The industry's healthy development calls for a shift in product thinking from "meeting standards" to "surpassing standards." Leading brands should shoulder the responsibility of guidance, delving deep into materials, structures, and intelligence to create products that are both safe, compliant, and user-friendly. This will help establish a new, positive balance between "compliance costs" and "user value."

The pain period is also an opportunity period. When the tide recedes, only brands truly centered on users and possessing sustained innovation capabilities will win the initiative in the new round of development. This in-depth adjustment initiated by the new national standards will ultimately propel the industry towards a healthier and more mature new stage.

Original content from AVC. Without authorization, no institution or individual is allowed to scrape this content for purposes such as training AI large models.