Analysis丨Panoramic vs. Sky: Why Insta360 and DJI Are Both Entering Each Other's 'Territory'?

![]() 10/09 2025

10/09 2025

![]() 540

540

Foreword: In the sweltering summer of 2025 in Shenzhen, a business battle spanning the [ground] and the [sky] quietly unfolds. DJI and Insta360, two Shenzhen-based tech companies with headquarters less than 10 kilometers apart—one the [ruler of the skies], the other the [definer of panoramic imaging]—have suddenly abandoned their respective [thrones] to invade each other's long-established core territories. This seemingly accidental [bidirectional crossover] is, in fact, an inevitable outcome of the consumer electronics industry entering an era of [boundaryless competition]. It is also a new narrative written by these two giants with technology, ecosystems, and ambition amid growth ceilings.

Dilemma: The [Anxiety of a King Without Further Gains]

Before their crossovers, DJI and Insta360 had already built formidable barriers in their respective domains. However, this [absolute dominance] also made them the first to hit market ceilings.

For Insta360, panoramic cameras are both its foundation and growth constraint.

According to Frost & Sullivan data, the global panoramic camera market was merely 5.03 billion yuan in 2023, projected to grow to only 7.85 billion yuan by 2027, with a compound annual growth rate (CAGR) below 12%.

Insta360's market share in this sector had already surpassed the monopoly threshold, reaching 67.2% in 2023 and soaring to 81.7% in 2024. For every five panoramic cameras sold globally, four come from Insta360.

This absolute market leadership, however, brought a [sense of suffocation] in growth.

The 2025 semi-annual report showed that Insta360's net profit attributable to shareholders of listed companies was only 520 million yuan, a slight year-on-year increase of 0.25%.

Non-recurring net profit was 492 million yuan, with a mere 0.06% growth, revealing a clear fatigue in revenue growth without proportional profit increases.

More critically, revenue from its core business, panoramic cameras, had reached 4.789 billion yuan, just a step away from the global market ceiling of around 6 billion yuan.

[Our greatest misfortune today is having DJI in the same track (translated as 'sector'), but our greatest fortune is also having DJI here,] said Liu Jingkang, founder of Insta360, encapsulating the helplessness of a [king in a small track ].

To sustain a valuation of hundreds of billions and avoid stagnation, Insta360 must find a [bigger pond], and the drone market is precisely that.

According to IMARC, a global business information consulting firm, the global consumer drone market was approximately $5.2 billion in 2024, projected to grow to $13.9 billion by 2033, with a CAGR of 10.32%—several times larger than the panoramic camera market.

More importantly, drone users heavily overlap with Insta360's core users—both are content creators passionate about outdoor activities and creativity. The extension of user needs from [ground-level panoramas] to [aerial panoramas] is a natural progression.

If Insta360's dilemma is a [too-small track ], DJI's anxiety stems from a [too-familiar track ].

As the [definer] of consumer drones, DJI has maintained a stable global market share exceeding 70%, with core markets like North America and Europe surpassing 85%.

In 2024, DJI's revenue exceeded 80 billion yuan, with a net profit of 12.056 billion yuan—more than eight times that of Insta360. However, behind this massive scale, growth momentum is weakening.

On one hand, market growth is slowing. Reports predict that the Chinese consumer drone market's growth rate will drop to 8% in 2025. For DJI, which already commands 70% of the market, [snatching cake from rivals] is becoming increasingly difficult.

On the other hand, product innovation faces [incremental upgrade] criticisms. The Mavic 4 Pro, launched in May 2024, still features a 28mm primary focal length, with users complaining about [insufficient wide-angle views].

The Osmo Mobile 7P smartphone stabilizer, released in February 2025, offered few upgrades over its predecessor.

More challenging is that core drone technologies like flight control, image transmission, and obstacle avoidance are nearing physical limits after over a decade of iteration. Achieving disruptive breakthroughs now requires exponentially higher R&D investment.

DJI founder Frank Wang predicted as early as 2016: [Drone revenue might peak at 20 billion yuan.] While this figure has been far surpassed, the urgency to find a second growth engine has intensified.

Panoramic cameras have become a critical choice for DJI. Though small, this track aligns closely with drones' [imaging DNA].

The imaging processing algorithms, stabilization technologies, and sensor calibrations required for panoramic cameras are precisely DJI's core strengths honed over years in the drone sector.

More importantly, panoramic cameras can form an [imaging ecosystem loop] with DJI's existing drones, action cameras, and handheld gimbals, covering full-scene creation needs from aerial to ground and from fixed to omnidirectional perspectives.

Confidence: The [Crossover Code] of Technology Reuse

The courage of DJI and Insta360 to invade each other's territories lies in technology reuse.

By migrating core competencies from their original domains to new sectors, they achieve dimensional strikes or differentiated breakthroughs.

For DJI, entering the panoramic camera market was never starting from scratch but a technological transfer.

The core competitiveness of its first panoramic camera, the Osmo 360, almost entirely stems from accumulations in the drone sector.

① Sensors and Imaging Algorithms: The Osmo 360 features dual 1/1.1-inch square CMOS sensors, significantly larger than the 1/1.28-inch rectangular CMOS in Insta360's flagship X5.

A larger sensor area means stronger light sensitivity, while the underlying image processing algorithms derive from DJI's ISP technology refined over years in drones like the Mavic and Avata, effectively reducing low-light noise and optimizing color reproduction.

② Stabilization and Gimbal Technology: The core pain point of panoramic cameras is stitching stability. DJI, having launched the world's first three-axis direct-drive gimbal (Zenmuse Z15) in 2012, has since miniaturized and cost-reduced its three-axis stabilization technology.

Though the Osmo 360 lacks a physical gimbal, its electronic stabilization algorithms originate from the inverse correction logic of drone gimbals, capable of real-time compensation for handheld shakes.

③ Ecosystem Synergy: The Osmo 360's battery is interchangeable with DJI's Osmo Action series action cameras, and its quick-release system is compatible with Action accessories.

This ecosystem reuse not only reduces user switching costs but also allows DJI to rapidly mobilize existing channel and supply chain resources for cost-effective scaling.

More critically, DJI's technology migration extends beyond hardware. Flight big data accumulated in the drone sector can feed back into AI functionalities of panoramic cameras.

If DJI emphasizes technological prowess, Insta360 opts for experiential innovation, avoiding DJI's absolute advantages in flight control and image transmission by crafting [atypical drones] with panoramic technologies.

The core logic of Insta360's first panoramic drone, the YING A1, is [shoot first, frame later].

① Panoramic Shooting Frees Creativity: Traditional drones require users to precisely control camera angles during flight. Missing a shot means re-flying.

The YING A1, equipped with dual fisheye lenses, captures 360° panoramic footage in real time. Users focus solely on flying, later freely selecting perspectives via Insta360 Studio editing software, even enabling lossless horizontal/vertical screen switching and multi-perspective synchronized exports. This drastically lowers the barrier to aerial photography.

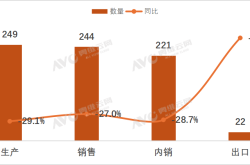

③ Lightweight and Compliance: The YING A1 weighs 249g, just below the regulatory threshold for [micro-drones] in most global regions.

This design enhances portability and enables rapid market entry in overseas regions, which contribute 76% of Insta360's revenue.

③ Software Ecosystem Reuse: Insta360's years of accumulated AI editing tools, such as FlashCut and multimodal large model-based auto-editing, are directly ported to the drone system.

After shooting, AI automatically identifies people and landscapes in footage, generating cinematic movements, bullet-time effects, and even supporting text-to-edit script generation.

This [hardware + software + community] closed loop (translated as 'loop') is precisely the key to Insta360's success in the panoramic camera sector.

Insta360's cleverness lies in not competing with DJI on [flight control precision] but on [creative experience].

Clash: Strategic Gambits of Two Genes

DJI's strategic logic has never been about chasing trends but waiting for maturity.

From defining consumer drones with Phantom to pioneering foldable designs with Mavic and entering the FPV track with Avata, DJI only strikes when technology, supply chains, and user demand are [triple-ripe].

This approach extends to its foray into panoramic cameras and drones.

① Long R&D Cycles: Reliable sources indicate DJI's panoramic drone project initiated in 2022, undergoing three years of polishing before entering testing—nearly two years ahead of Insta360's panoramic drone project.

② Tight Technological Closure: DJI's flight control system comprises over 10 million lines of code, backed by cumulative global flight data exceeding 1 billion hours.

Its O4 image transmission system enables 20km HD low-latency transmission, with antennas upgraded from [one-transmit, two-receive] to [two-transmit, four-receive].

These technologies are not mere feature stacks but systemic innovations deeply integrated into DJI's ecosystem.

③ Precise Product Positioning: Leaked photos of DJI's panoramic drone reveal it inherits Avata's fully enclosed propeller guards, dual-front obstacle avoidance, and imaging features like a 1-inch CMOS, 8K shooting, and D-Log M professional color grading.

This design prioritizes [being a reliable drone first, then a panoramic camera], contrasting sharply with Insta360's [prioritizing panoramic experience, then flight capabilities].

Unlike DJI's systemic approach, Insta360's DNA is geek-style innovation.

Founder Liu Jingkang initially disrupted the panoramic camera market from Samsung and Ricoh with invisible selfie sticks and bullet-time effects.

This pain-point-solving, differentiation-driven mindset permeates Insta360's crossover strategy.

① Rapid Product Iteration: Insta360 launches 3–5 core products annually, updating three and five models in 2023 and 2024 respectively—far exceeding industry averages.

Its Ace series action cameras, launched in November 2023, accounted for 10.4% of revenue within a year, showcasing keen market responsiveness.

② Accurate User Targeting: Aware of being a [latecomer] in drones, Insta360 avoids direct competition with DJI's [professional users] and instead targets [ pan- creators] (translated as 'pan-creators'), such as travel bloggers and families.

By offering [low-barrier, high-fun] panoramic experiences, it sidesteps head-on clashes with DJI.

Epilogue:

DJI needs to address software ecosystem gaps, making panoramic camera editing more accessible to average users. Insta360 must overcome flight control bottlenecks to match DJI's drone stability.

For users, this competition means superior products: DJI's panoramic cameras make professional quality more affordable, while Insta360's panoramic drones simplify aerial photography.

For the industry, their technological cross-pollination has spawned new categories like panoramic drones, expanding the smart imaging market.

Panoramic drones are projected to form a multi-billion-dollar market within five years, becoming a new growth engine for consumer electronics.

For Shenzhen, this [local derby] underscores the resilience of its industrial ecosystem, hinting at the potential emergence of more DJI- or Insta360-scale global enterprises.

References: Qingcheng Finance: [DJI, Insta360, and RoboMasters 'Infiltrate' Each Other's Territories: A 'Three-Way War' in the Billion-Dollar Drone Market], Zhengjie Bureau: [Two Shenzhen Companies Ignite a 'World-Class Business Battle'], Tencent Finance: [Insta360 Aspires to Be the Next DJI], Narrowcast: [DJI vs. Insta360: A Second-Curve Gambit Between 'Kindred Spirits'], Songguo Finance: [The Battle of Dual Kings: Insta360 and DJI Target Each Other's 'Achilles' Heel'], Industrial Technology: [Founder Celebrates with 'Cash Shower': Insta360 and DJI Invade Each Other's Territories], KeyPoints: [DJI Descends to Earth, Insta360 Soars to Sky]