Investing 50 Billion Yuan in 'Chip' Development: A Sobering Insight Behind Xiaomi's Ambitious Rise

![]() 10/09 2025

10/09 2025

![]() 475

475

Recently, Lei Jun made a significant announcement at the 2025 Annual Lecture. Xiaomi has earmarked a minimum investment of 50 billion yuan over the next decade to develop its proprietary smartphone SoCs (System-on-Chip). Simultaneously, the introduction of Xiaomi's self-developed flagship chip, the 'Xuanjie O1,' swiftly captured the tech community's attention.

Image Source: Pixabay Library

However, beneath this seemingly fervent 'chip' narrative, capital markets have exhibited a hint of caution and skepticism. The day following the announcement, Xiaomi's stock price continued its downward trajectory, nearing a 10% decline. This raises a profound question: Why did a grand plan aimed at overcoming challenges fail to fully ignite market enthusiasm?

Perhaps the challenge of 'catching up from behind' is formidable, or maybe Xiaomi should allocate its limited resources more judiciously to key areas, rather than engaging in fierce competition with giants in the already saturated smartphone chip market.

The Smartphone SoC Market's Giant Battle and Xiaomi's 'Impossible Trinity'

It's undeniable that Xiaomi's decision to develop its own high-end smartphone SoCs is a 'heroic endeavor' laden with both prestige and risk. With a planned investment of 50 billion yuan, Xiaomi still confronts a near-cruel 'impossible trinity'—balancing ultimate performance, enormous costs, and massive sales volumes.

Firstly, the smartphone SoC market is a classic oligopoly characterized by high technical barriers and robust ecosystem defenses. Qualcomm, MediaTek, and Apple have long dominated the global market, while Huawei HiSilicon has established a formidable technical barrier and ecosystem moat through its deep self-development capabilities and 'Kirin' chips.

This implies that new entrants must not only surmount technical hurdles across the entire supply chain, from design and tape-out to packaging and testing, but also confront decades of accumulated patent walls and ecosystem alliances constructed by the giants.

Image Source: Xiaomi's Official Weibo Account

For instance, Xiaomi's 'Xuanjie O1,' launched in May this year, adopted an ARM architecture and an external baseband solution. While widely regarded as a prudent and cost-effective choice for the current stage, it also underscores the difficulty of building a fully autonomous architecture and integrated baseband from scratch.

As Canalys analysis points out, adapting baseband chips to global patents in real-world, complex communication environments is a massive undertaking that spans years and costs billions of dollars.

Secondly, economies of scale in the chip industry remain a 'make-or-break' factor. During the announcement, Lei Jun stated that the development cost for a 3nm chip generation is approximately $1 billion. If the final shipment volume is 1 million units, the per-unit development amortization reaches $1,000.

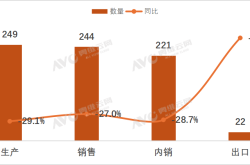

This far exceeds the current hardware cost of a high-end flagship smartphone, indicating that Xiaomi needs to achieve sales exceeding 10 million units to break even. However, according to IDC data, Xiaomi's total smartphone shipments in China for the first quarter of 2025 were 13.3 million units, a 39.9% year-over-year increase.

This implies that achieving 10 million unit sales solely from flagship models priced above 5,000 yuan (not all models) in China's fiercely competitive market is undoubtedly a daunting goal. It requires Xiaomi to substantially surpass Apple and Huawei in terms of premium brand image and differentiated product experience—a challenge no less daunting than chip design itself.

Thirdly, the bottomless pit of investment and the pressure of iterative development. Currently, the smartphone chip industry's rapid pace of 'one iteration per year' means that enormous R&D investment is not a one-time cost but an ongoing expense.

Moreover, Xiaomi has already invested 13.5 billion yuan in chip development over the past four years, with a team exceeding 2,500 people. This underscores that it is a strategic project requiring continuous corporate 'blood transfusion.' The sudden shutdown of OPPO's ZEKU division serves as a cautionary tale, proving that even with substantial financial resources, market realities and prolonged return cycles can shake resolve.

Intelligent Automotive Chips: The 'Lifeline' Aligned with the Future

In stark contrast to the 'red ocean' nature of smartphone chips, intelligent automotive chips represent a burgeoning 'blue ocean' that highly aligns with Xiaomi Group's strategic vision of a 'Human-Car-Home Ecosystem.' The market may be more optimistic about Xiaomi's foray into this field due to its unparalleled strategic synergy and clear commercial prospects.

Firstly, Xiaomi has clearly anchored its strategy in the 'Human-Car-Home Ecosystem.' Within this framework, intelligent electric vehicles serve as the core hub connecting personal devices and smart home scenarios.

Earlier in June, Lei Jun revealed at an investor conference that Xiaomi anticipates launching automotive chips soon. This move, seemingly a side branch, is actually a critical maneuver. Self-developed automotive chips (such as those for smart cockpits and autonomous driving) can free Xiaomi's core automotive business from absolute dependence on external supply chains, enabling deep optimization of hardware-software integration and building a true moat in user experience.

This also aligns perfectly with Xiaomi's ultimate goal in vehicle manufacturing: creating a 'tech-ecosystem vehicle.' Chips define hardware, hardware carries the ecosystem, and the ecosystem creates value—a clear value chain.

Image Source: Xiaomi's Official Weibo Account

Secondly, the automotive electronics chip market is on the verge of explosive growth, offering substantial dividends. According to QYResearch, the global automotive electronics chip market is expected to surpass $160 billion by 2025, growing at an annual rate exceeding 10%.

As the world's largest automotive market, China has a particularly enormous demand for automotive electronics chips, with the market size reaching approximately 82.08 billion yuan in 2023. The driving force behind this growth is the widespread adoption of L2+ and higher-level autonomous driving functions and upgrades in smart cockpit experiences.

Moreover, this market has not yet solidified into a pattern like that of smartphone chips, providing a window of opportunity for new players like Xiaomi to enter and define the rules.

Furthermore, while automotive sales volumes are measured in 'millions' compared to the 'billions' of smartphones annually, the BOM (Bill of Materials) cost share of chips is relatively low for high-priced vehicles, yet the premium-generating capability from performance improvements is significantly higher.

In this context, an excellent self-developed chip can significantly enhance vehicle performance and user experience, supporting higher product pricing and brand premium. This means automotive chips do not need to pursue 'tens of millions' in shipment volumes like smartphone chips to achieve profitability, resulting in a healthier business model.

According to Xiaomi Auto's Weibo announcement, the full-year delivery volume of the Xiaomi SU7 exceeded 130,000 units in 2024, successfully entering the first tier of new energy vehicle manufacturers. With the launch of new models like the YU7, its proprietary vehicle platform will provide a stable and growing shipment base for self-developed chips.

'Fighting on Two Fronts' Demands Strategic Wisdom: How Should Xiaomi Proceed?

In the long run, Xiaomi does not necessarily have to choose one path over the other, but resource allocation demands immense wisdom. Market concerns about smartphone SoCs essentially question Xiaomi's strategic priorities and resource allocation efficiency.

After all, 'fighting on two fronts' inevitably leads to enormous resource consumption. If Xiaomi simultaneously pursues smartphone SoC and automotive chip development, it means challenging two capital- and technology-intensive fields at once.

In June this year, Xiaomi Group announced at its 'Human-Car-Home Ecosystem Launch' that it plans to invest 200 billion yuan over the next five years (2026-2030). While this is a substantial sum, dividing it between two 'bottomless pits' still leaves it stretched. Balancing resource allocation between the two and avoiding mutual constraints poses the greatest challenge for management.

The market may prefer to see Xiaomi focus more strategic attention and top-tier R&D resources on the automotive chip sector, which is directly tied to its future growth engine (automotive and AIoT) and remains an undefined market landscape.

Looking back, Xiaomi's investment portfolio reveals its potential focus. Over the past eight years, Xiaomi has made over 110 investments in the semiconductor sector, with a layout extending far beyond smartphones to cover power management, third-generation semiconductors (such as silicon carbide), automotive MCUs, and more. These investments are constructing a robust supply chain ecosystem for its intelligent automotive and AIoT businesses.

This 'investment + self-development' combination punch demonstrates Xiaomi's ambition extends far beyond smartphone chips. Self-developed automotive chips will serve as the final and most crucial piece in completing the technological integration of its invested companies and closing the ecosystem loop.

Despite the pressures, Xiaomi's profitability expectations provide it with confidence and decision-making space. On one hand, Xiaomi's core smartphone business provides the confidence for chip development. According to Sina Tech data, Xiaomi's smartphone shipments in China surpassed Huawei in the first quarter of 2025, reclaiming the top spot in market shipments.

On the other hand, the IoT and lifestyle consumer products business continues to provide stable cash flow, especially as the automotive business accelerates. Lei Jun also stated that Xiaomi Auto anticipates achieving profitability in the third and fourth quarters of 2025.

This means the money-burning chip development business will soon have a powerful internal 'blood-generating' source. The profitable automotive business will better support R&D and provide more ample resources for 'fighting on two fronts.'

However, this also clarifies the resource flow: prioritizing automotive chip development, which can generate positive cycles faster and has stronger synergy with core businesses, may be a more efficient choice.

Conclusion

For Xiaomi, developing its own smartphone SoCs is a climb that showcases technological ambition and elevates brand stature. However, from a commercial standpoint, the most ideal path may be to use smartphone SoC development to hone technical capabilities and talent while prioritizing strategic focus and resources on automotive chips, building it as a solid foundation for the 'Human-Car-Home Ecosystem.'

After all, the 'Xiaomi' of the future may well be a great intelligent mobility and smart living company, and its 'heartbeat' should pulsate for its most core future businesses.

Source: Hong Kong Stocks Research Society