Profit-Seekers Face Ruin: Global Leader Falls Amidst Fierce Rivalry. Is There Any Hope for This Industry?

![]() 10/10 2025

10/10 2025

![]() 690

690

This marks the 1202nd original article from 'New Energy Frontier.' Click 'New Energy Frontier' above to follow and star this account. This article solely reflects the thoughts of 'New Energy Frontier' and does not serve as investment advice. The author does not manage investment groups, offer paid stock recommendations, or handle client finances.

This year, the new energy vehicle (NEV) sector has once again descended into a price war. Despite top-tier calls to avoid internal competition, numerous manufacturers persist in engaging in price battles, either by directly slashing prices, enhancing specifications without raising costs, or providing subsidies. Ultimately, prices have plummeted significantly. Crucially, the NEV price war has also ensnared fuel vehicles, sparking a price war across the entire automotive industry, much like the scenario of the previous year.

01 Whoever Profits, Perishes

For consumers, the current automotive market is incredibly accommodating, offering a plethora of choices. However, for original equipment manufacturers (OEMs), it's a challenging period. As previously articulated by 'New Energy Frontier,' 'The initial phase of the NEV era is far from over, and the market will penalize every automaker pursuing profits, particularly exorbitant ones.'

The notion that the market will penalize automakers for pursuing profits, especially hefty ones, may seem politically incorrect and counter to business logic, given that a company's primary mission is to generate profits. Nonetheless, this is the current reality of China's NEV market.

Consider Tesla, BYD, and Li Auto, the top performers in recent years and the only three NEV manufacturers to achieve profitability in the past few years. This year, all three have encountered sales growth hurdles after establishing initial competitive advantages and seeking profits. Tesla, overly confident, maintained high prices for two models nearing a decade old. Li Auto adopted a 'copycat' strategy, expecting high returns from pure electric vehicles akin to its extended-range models. BYD disregarded user demands; despite being a major battery manufacturer, its hybrid models featured significantly smaller batteries than competitors, and it neglected user-centric aspects like exterior and interior design.

Ultimately, the market responded decisively, delivering a harsh lesson. Tesla and Li Auto have heeded the warning. Tesla commenced updating and launching the Model Y L, while Li Auto began reducing profit margins for its pure electric models. The i6, Li Auto's model with the lowest profit margin in its history, shows signs of success based on recent orders. However, considering that while the i6 boasts comprehensive specifications and an appropriate price, its appearance is not particularly striking, I believe it will struggle to become a blockbuster and will likely fall short of internal company expectations. This will be verified in due course.

In contrast, XPeng and NIO, which faced difficulties earlier, have shown signs of recovery since adopting a 'just survive' mindset and heavily betting on new models.

Additionally, Leapmotor, often dubbed the 'half-price Li Auto,' though not widely discussed, has actually been one of the best-performing manufacturers in terms of sales in recent years. This year, it continues to set new records, thanks to its affordability. Offering a balance of appearance, specifications, and, crucially, intelligent driving capabilities at a sufficiently low price, Leapmotor lacks standout features but also no significant shortcomings. This affordability has made it a quintessential representative of cost-effectiveness, explaining why it thrives even when the market believes it faces the greatest risk after BYD's price cuts.

02 The NEV Era is Far from Over

The market previously believed that the initial phase of the NEV era would conclude by 2024, with the subsequent phase, characterized by intelligence, commencing in 2025.

Currently, whether the initial phase is defined by electrification and the subsequent phase by intelligence, or the initial phase by fierce competition among many and the subsequent phase by oligopoly, both perspectives have been disproven.

The era of intelligence is indeed advancing rapidly, with manufacturers making significant strides. However, true autonomous driving remains some distance away, and determining the industry's competitive landscape seems even further off.

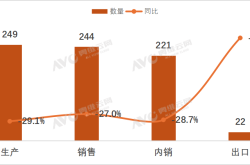

Considering that the penetration rate of NEV sales in China reached 45% from January to July 2025 and is expected to hit 50% by year-end, with the retail penetration rate of new energy passenger vehicles rising to 55.2% in August 2025, a record high. With penetration exceeding half, future increases will decelerate. Coupled with the gradual phase-out of NEV subsidies, penetration growth will slow further, intensifying competition and making it even harder for manufacturers to turn a profit.

Observing the fierce competition in China's NEV market, 'New Energy Frontier' has been pondering: When will the NEV market resemble the smartphone market, with global competition dominated by a handful of oligopolies?

03 Insights from Smartphone Development

Reviewing the history of the smartphone industry, before 2007, the market was dominated by feature phones, with Nokia, Motorola, Samsung, Siemens, and LG monopolizing most of the global market share. Nokia alone accounted for 35% of shipments in 2007.

Although Nokia and Motorola began introducing smartphones with preliminary intelligent functions, such as the classic Nokia N95, these did not become mainstream until 2007 when Apple released the first-generation iPhone. With its capacitive touchscreen, iOS operating system, and app ecosystem, the iPhone redefined smartphones and propelled the industry into the smartphone era. Google's subsequent launch of the Android system further accelerated this transition.

From 2007 to 2015, the smartphone industry experienced rapid growth. Traditional feature phone giants like Nokia, BlackBerry, and Motorola fell behind, while Apple and Samsung quickly rose to the top with their flagship models and extensive product lines, respectively. Meanwhile, Chinese brands began to emerge on the international stage. Early adopters like 'Zhong Hua Ku Lian' (ZTE, Huawei, Coolpad, Lenovo) rapidly grew through operator channels, followed by the rise of Xiaomi and the increasing strength of Oppo and Vivo.

After 2016, the market gradually saturated, and the industry landscape stabilized, forming a 'two superpowers and many strong players' scenario. Apple and Samsung consistently ranked among the top two in global shipments, capturing most of the industry's profits. Chinese brands like Xiaomi, Oppo, Vivo, Huawei, and Honor became the backbone, while some brands, like Tecno Mobile, focused on overseas markets.

However, even with a relatively stable industry landscape, competition remained fierce. Apart from Apple, which captured most profits through its closed ecosystem and brand premium, the Android camp never ceased competing, with shipment rankings frequently changing and various configurations being rolled out. Overall, though, the competitive landscape remained relatively stable.

In recent years, as the automotive industry, especially China's automotive market, has entered the NEV era, the consumer electronics-like traits of NEVs have become evident, with updates and iterations comparable to those of smartphones. So, when might the NEV market reach a stable competitive landscape?

04 When Will the NEV Market Landscape Stabilize?

Looking back, the smartphone industry basically solidified its landscape in about eight years. Will the NEV industry take less or more time?

Undoubtedly, it will take longer. Compared to smartphones, automotive demands are more diversified. The entertainment and functional diversity of smartphones completely overshadowed those of feature phones, leading to a rapid replacement. However, although NEVs have made significant progress in comfort and intelligence compared to fuel vehicles, this progress does not match the evolution from feature phones to smartphones. Moreover, as a tool, a car's core function is to solve the problem of displacement. While NEVs have improved comfort, especially with intelligent driving, these improvements are not absolute necessities, determining that the replacement of fuel vehicles by NEVs will not be so rapid.

The popularization of NEVs is also affected by infrastructure, namely charging station construction, and the challenges posed by winter to range. Unless battery technology makes greater progress, it will also hinder the global penetration rate, especially in countries at higher latitudes.

The automotive industry is one of the most critical sectors for any country. Most automotive industry powerhouses are developed countries. With the largest market space, China and the United States, especially China, are at the forefront in the NEV sector. As Chinese automakers expand overseas, they will inevitably face geopolitical issues, with market entry barriers posing a significant problem.

All these factors determine that the stabilization of the competitive landscape in the NEV industry may take much longer than that of smartphones.

Unless battery technology and intelligence make significant progress within a few years, particularly autonomous driving, and the business model of NEVs undergoes a complete transformation compared to the traditional automotive industry, it remains questionable how high the global penetration rate of NEVs can reach.

If breakthroughs cannot be achieved overseas soon and domestic competition intensifies, it is easy to fall into a 'stock war' (inventory war). With hardware profit margins limited and software-side revenues not rising quickly, the market is unlikely to assign high valuations. This may explain why the performance of OEMs this year has fallen far short of other tech sectors.