55 Chinese iPhone Users Initiate Class Action Lawsuit, 'Apple Tax' Under Scrutiny Once Again

![]() 10/23 2025

10/23 2025

![]() 442

442

Recently, 55 Chinese iPhone and iPad users, represented by legal counsel, lodged a complaint with China's State Administration for Market Regulation. They accused Apple Inc. of abusing its dominant market position in China. This was done through mandatory in-app purchase (IAP) system restrictions, which limit app distribution and payment channels, and impose excessive commissions. All these actions severely infringe upon consumer rights.

The complaint clearly points out three main illegal practices by Apple in the Chinese market:

1. Restricted transactions and bundling: Apple forces users to purchase digital goods solely through its IAP system. It prohibits developers from directing users to third-party payment methods via 'anti-steering clauses.'

2. Monopolized app download channels: Apple exclusively controls iOS app distribution through the official App Store. It bans sideloading or the use of third-party app stores.

3. Unfairly high commissions: Apple charges up to 30% on in-app purchases, a rate significantly higher than those in the U.S. and European markets.

The complaint draws a comparison between Apple's policies in different countries, revealing 'discriminatory practices' in China. In April 2025, the U.S. District Court for the Northern District of California ruled that Apple must allow users to be redirected to third-party payment platforms via in-app links without charging any commissions.

EU Market: After being fined €500 million, Apple relaxed its third-party payment restrictions in June 2025. It reduced commissions to 12% in the first year and 10% thereafter. In contrast, China still mandates the use of the App Store and IAP system, with a 30% commission rate and 'anti-steering clauses' still in effect.

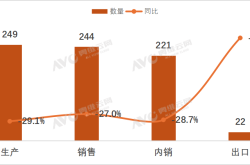

Further data indicates that Chinese users bear a disproportionately higher 'Apple Tax' burden compared to users in the U.S. and EU. In 2024, Chinese users paid $6.44 billion in 'Apple Tax,' accounting for 19% of Apple's global revenue in this category, second only to the U.S. ($14.8 billion). However, as a proportion of Apple's revenue in China, the 'Apple Tax' reached 10%, exceeding the 8.8% in the U.S. and 4.6% in the EU. A complainant stated, "For every $10 Apple earns in China, $1 comes from the 'Apple Tax,' while in Europe, it's less than $0.50."

This complaint is not an isolated case. In recent years, regulatory authorities in multiple countries have launched investigations into Apple's App Store policies. The Japan's Fair Trade Commission demanded that Apple open up third-party payments by December 2025. The Australian Federal Court ruled that Apple abused its market dominance by restricting alternative payment methods. Russia's revised law requires iPhones sold in the country to allow third-party payments and app distribution. Colombia's Superintendency of Industry and Commerce initiated an antitrust investigation to assess whether Apple restricts alternative app stores.

Chinese Consumers' Long-Standing Discontent with 'Apple Tax'

Since Apple formally labeled its in-app purchase commission as the 'Apple Tax' in 2017, Chinese consumers have expressed dissatisfaction with the policy for years. From individual consumers to legal professionals, and from social media outcry to collective administrative complaints, resistance to Apple's 'discriminatory national policies' has intensified.

In June 2017, Apple updated its App Store terms, explicitly classifying virtual currency tips as in-app purchases and mandating a 30% commission. This sparked widespread backlash in China, where consumers found that membership services, game recharges, and live-stream tips for the same apps were priced 20-30% higher on iOS than on Android.

For instance, a video platform charged iOS users ¥198 for an annual membership, compared to ¥148 for Android users. In live-stream tipping, iOS users received 7 virtual gifts per ¥1, while Android users received 10. Sensor Tower data shows that in 2023, 'Apple Tax' revenue in China exceeded ¥40 billion, accounting for nearly a quarter of Apple's global revenue in this category.

More controversially, China's 30% commission rate far exceeds those in the U.S. and EU. The U.S. standard rate is 27% (12% for small businesses), the EU's rate has dropped to 17% (standard) and 10% (small businesses), and South Korea's rate is 26%. "For every ¥100 Chinese consumers pay, Apple takes ¥30, while European users pay only ¥17," noted Li Ming (pseudonym), a consumer representative in the 2025 class action. "This double standard is blatant discrimination against the Chinese market."

Over the years, Chinese consumers' resistance to the 'Apple Tax' has evolved from individual voices to legal action. In 2021, consumer Jin sued Apple for abusing its market dominance by mandating the IAP system and charging a 30% commission. In May 2024, the Shanghai Intellectual Property Court dismissed the case but acknowledged Apple's dominant position in China's iOS software market.

In October 2025, 55 consumers jointly submitted a complaint letter to the State Administration for Market Regulation. They demanded an investigation into Apple's 'restricted transactions' and 'unfairly high prices,' along with orders to open third-party payments and app stores. The letter highlighted that China's 'Apple Tax' accounts for 10% of Apple's revenue in China, far exceeding the 8.8% in the U.S. and 4.6% in the EU.

On platforms like Weibo and Bilibili, topics related to the 'Apple Tax' have garnered over 5 billion views. Netizens point out that prices for game recharges, knowledge payments, and other services on iOS are typically 30% higher than on Android, stating, "Chinese users are subsidizing Apple's global profits."

Why Does China Remain an Exception Amid Global Regulatory Crackdowns? Despite legal and judicial pressures from the EU, U.S., Japan, and South Korea forcing Apple to reduce commissions, China still maintains the highest 30% rate. The exorbitant 'Apple Tax' not only burdens consumers but also directly impacts developers. A live-streaming platform executive revealed, "iOS tipping revenue is subject to a 30% Apple commission, reducing streamer earnings by 30%. To offset costs, we raised iOS gift prices, further driving user loss."

The gaming industry has been hit even harder. Statistics show that in-app purchases on iOS in China are priced 25% higher than on Android, prompting many players to switch to Android. A game developer stated, "With a 30% commission and marketing costs, we barely break even and have to abandon the iOS market."

Amid mounting controversies, the State Administration for Market Regulation responded to consumer complaints in September 2025, stating it would "verify monopolistic behaviors in the platform economy in accordance with the law." Previously, Japan, Australia, and other countries had compelled Apple to adjust its policies through antitrust investigations.

Chinese consumers' discontent with the 'Apple Tax' fundamentally represents a protest against multinational corporations' 'double standards.' Against the backdrop of global digital governance reforms, this controversy not only concerns the 30% commission rate but also tests China's resolve to uphold market fairness and promote high-standard opening-up.

Apple Faces Renewed Antitrust Scrutiny Amid Global Regulatory Storm

Fifty-five Chinese iPhone and iPad users have jointly submitted a complaint to China's State Administration for Market Regulation. They accused Apple of abusing its market dominance through mandatory in-app purchases, restricting third-party payments, and charging excessive commissions, thereby harming consumer rights.

This action aligns with global antitrust investigations in the EU, U.S., Australia, and elsewhere, signaling unprecedented international regulatory pressure on Apple's 'closed ecosystem' model.

In April 2025, the EU fined Apple €500 million under the Digital Markets Act (DMA), alleging it used technical restrictions and policies to prevent developers from directing users to purchases outside the App Store, constituting unfair competition. Although Apple adjusted its policies in June to allow developers to promote external payment channels and introduced tiered commissions, developers resisted due to complex rules. Apple has appealed the fine.

In April 2025, the U.S. District Court for the Northern District of California ruled that Apple cannot block developers from directing users to third-party payment channels and reduced commissions to 0%. This decision ushered in a 'tax-free' era for U.S. developers, with platforms like Patreon now offering in-app credit card and PayPal payments.

In August 2025, the Australian Federal Court ruled that Apple abused its market dominance in iOS app distribution and payments, banning sideloading and alternative payment methods. Although Apple plans to appeal, the ruling has triggered class actions by local developers. Japan's Mobile Software Competition Act, taking effect in December, requires Apple to open third-party app downloads and payment channels, while South Korea has legislated against mandatory use of specific payment systems by app stores.

The class action by 55 users is seen as an escalation of Chinese consumers' discontent with the 'Apple Tax.' The complaint explicitly identifies three illegal practices by Apple: mandating the IAP system, restricting app downloads to the App Store, and charging a 30% commission. Wang Qiongfei, the legal representative, stated that administrative complaints may be processed faster than civil lawsuits, and regulators can impose fines of 1-10% of sales under the Antimonopoly Law.

As global regulatory storms intensify, Apple's 'closed ecosystem' model faces collapse risks. Analysts note that if major markets like China, the EU, and the U.S. require Apple to open third-party payments and sideloading, its App Store business—which accounts for 18% of service revenue and boasts a 75.7% gross margin—will suffer severe blows.

Industry experts warn that Apple must balance global policy uniformity with local compliance. Otherwise, its market capitalization exceeding ¥3.9 trillion could shrink under regulatory pressures. The ongoing legal tug-of-war between global regulators and Apple is reshaping the landscape of fair competition in digital markets.