Another Japanese TV Behemoth “Forges a New Alliance” with China

![]() 01/26 2026

01/26 2026

![]() 507

507

"

In the real business world, it's never a simple “winner-takes-all” scenario. Instead, it's about how to “thrive more gracefully.”

Cover photo source: Unsplash

Another Japanese “TV Behemoth” is quietly making its exit.

On the evening of January 20, TCL Electronics announced in a filing with the Hong Kong Stock Exchange that it had signed a memorandum of intent with Sony to establish a joint venture. This venture will take over Sony's home entertainment business, with TCL Electronics holding a 51% stake and Sony holding a 49% stake.

Sony has entrusted the leadership of its global home entertainment business to TCL. Going forward, the new company will operate on a full-chain basis worldwide, covering development, design, manufacturing, sales, and services.

Netizens lamented, “Sony” has now become “Tony”. The Japanese giant, which once dominated China's high-end TV market with its superior picture quality and style, has ultimately succumbed to the passage of time.

However, is Sony's decision to hand over its TV business to TCL truly a tragic finale?

It's important to note that after its “rebirth,” Sony will possess a more robust “armor” of Chinese manufacturing capabilities, while TCL will gain a “passport” to enter the high-end home entertainment markets in Europe and the United States.

One sheds its burdens, while the other climbs higher, leveraging the situation. The story doesn't end here; it's just that the protagonists have shifted their strategies.

1

Japanese TVs Can't Keep Pace

Following the announcement of the TCL-Sony cooperation, consumers mourned the departure of another “TV Behemoth” from the market. However, in reality, these Japanese home appliance giants had already quietly exited the historical stage when no one was paying attention.

In the 1980s and 1990s, Japanese TVs were the “prestigious choice” for countless Chinese households. Sony, Panasonic, Toshiba, and Sharp were known as the “Four Heavenly Kings,” with Sony's core Trinitron technology setting the benchmark for color TV picture quality.

Beyond TVs, Sony showcased its strong technological innovation capabilities in photography, audio, consumer electronics, and other fields. By continuously launching industry-leading consumer electronics products, it gradually built an unshakable “Sony Ecosystem” in consumers' minds.

However, with the rise of Chinese TV brands, they gradually overcame technical barriers in display technologies and image processing chips, offering similar or even superior experiences at lower prices and with more advanced technologies.

For consumers, nostalgia ultimately couldn't compete with reality, and thus began the “long goodbye” for Japanese TVs.

In 2016, Sharp TV came under Taiwan's Foxconn; in 2017, Toshiba sold its TV business to Hisense; last year, Panasonic announced the sale of its marginal business units, including TVs, but had yet to find a suitable buyer.

The turning point in the fortunes of these Japanese home appliance giants became apparent a decade ago:

On one hand, with the booming development of streaming services and video-sharing platforms, digital entertainment products like smartphones and tablets were gradually replacing TVs as the core of home entertainment.

According to Loctek Technology data, in 2025, the shipment volume of branded TV sets in the Chinese market reached 32.895 million units, down 8.5% year-on-year, marking a new low in the market over the past 16 years. The domestic color TV market has entered a “freezing point.”

On the other hand, competition in the domestic TV market has become increasingly fierce. In 2025, Sony's market share in China fell below 2%, while the combined global TV shipment share of TCL, Hisense, and Xiaomi reached 31.3%, surpassing South Korea's Samsung and LG at 28.4% for the first time.

Notably, in 2010, Sony's TV shipments peaked at 21.5 million units, ranking third globally. Over the past fifteen years, how did Sony's TV business gradually slip into the “Others” category?

The key lies in Chinese companies seizing control of “display technologies,” including upstream display panels and image processing chips. The former is the foundation of display, while the latter can create performance gaps through picture quality adjustments.

As the most critical component in a TV, the display panel accounts for over 70% of the total TV cost. However, in the last century, the domestic color TV industry faced long-term constraints in upstream industrial chains such as picture tubes and semiconductors.

Since the panel industry is a typical capital-intensive, technology-intensive, and highly cyclical business, with investments often reaching billions, newer generation lines repeatedly outcompete older ones, making it uncertain how long technological advantages can last.

However, for the domestic panel industry, the choice was between remaining “stifled” or taking a gamble on new technology generation lines. Local panel manufacturers like TCL CSOT and BOE opted for the latter.

Currently, Chinese companies dominate over 60% of the global market share in mid-to-low-end LCD production, while high-end technologies like OLED, Mini LED, and Micro-LED are a two-way race between Chinese and South Korean companies.

Without technological moats, Japanese TV companies have also lost pricing power over their products.

Today, Sony has become an “assembly brand,” with its display panels supplied by LG and TCL, and its picture quality chips sourced from MediaTek. Essentially, it is now a contract-manufactured TV bearing the Sony logo.

Against this backdrop, selling its TV business seems to be Sony's best option.

2

Sony Bets on Creative Entertainment

In fact, Sony's idea of selling its TV business emerged as early as a decade ago. In 2014, Sony spun off its continuously loss-making TV business into a wholly-owned subsidiary, coinciding with the period when Sharp and Toshiba were also selling off their assets.

After that, Sony made no significant investments in the panel industry. In 2004, Sony and Samsung jointly established the LCD panel factory “S-LCD,” a strategy of indirectly abandoning in-house research and development. However, by the end of 2011, Sony sold its 50% stake in the company to Samsung, marking its complete withdrawal from LCD panel production.

Behind Sony's decision lay the reality of persistent losses. Between 2003 and 2013, Sony's TV business accumulated losses nearing 800 billion yen (over 35 billion yuan), and it wasn't until the 2014 spin-off that Sony escaped the quagmire of losses.

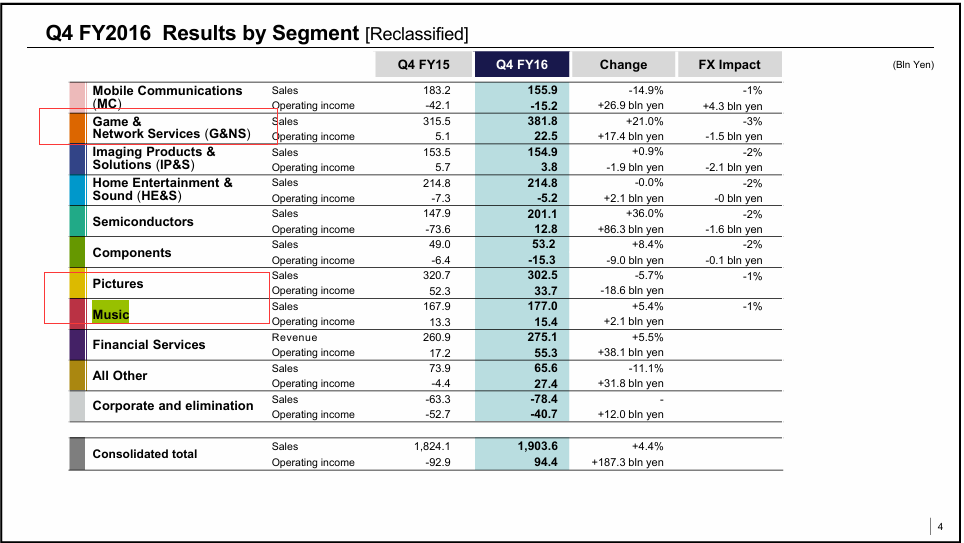

Meanwhile, Sony's focus quietly shifted toward the entertainment sector. By the fiscal year ending March 2025, Sony's three major entertainment businesses (film, music, and gaming) accounted for over 60% of the group's total sales revenue, compared to around 40% in the 2016 fiscal year.

In recent years, the gaming business has become Sony's most profitable segment. In 2024, its gaming division generated 4.67 trillion yen (approximately 210 billion yuan) in revenue; the music business saw the strongest growth, rising 14% year-on-year to 1.8426 trillion yen (approximately 81 billion yuan); while in the film sector, Sony Pictures remains one of the top five global film studios.

Kenichiro Yoshida, President of Sony China, stated bluntly that Sony is undergoing a transformation from a hardware giant to a creative entertainment company: “Looking at global consumer electronics hardware giants, they lack their own entertainment and creative products; while the world's largest film and music production giants lack corresponding hardware support. Only Sony possesses both hardware technology and entertainment content globally, which is key to our differentiated operations.”

For Sony to double down on creative entertainment while maintaining its influence in consumer electronics hardware, partnering with TCL is clearly a strategic choice that aligns with its core capabilities.

Moreover, Sony still holds a “trump card” in the imaging field—the CMOS image sensor (CIS). As a core component in smartphones, high-end cameras, and autonomous driving cameras, Sony has maintained a market share of over 50% in the global CIS market for three consecutive years, with CIS chips becoming one of Sony's highest-margin businesses.

Therefore, even if Sony hands over its TV business to TCL, it will still hold a significant position in the consumer electronics market. From this perspective, the cooperation between TCL and Sony is not a contest of “who submits to whom,” but rather a win-win scenario.

Du Juan, Chairman of TCL Electronics, stated: “This strategic cooperation with Sony presents an excellent opportunity for both sides to integrate superior resources and jointly build a foundation for further business growth. In the future, both parties will leverage complementary business strategies, share technological expertise, and achieve deep operational synergy to elevate brand status, enhance scale effects, and optimize supply chains.”

In the real business world, it's never a simple “winner-takes-all” scenario. Instead, it's about how to “thrive more gracefully.”

Through this cooperation, Sony can retain its brand influence while entrusting TV manufacturing and operations to a more efficient partner, allowing it to focus more on product innovation and creative power.

Meanwhile, TCL gains a “passport” to the high-end home entertainment markets in Europe and the United States, further driving brand elevation while receiving support from Sony in terms of technology and content. Both sides have found ecological niches that better suit them.

3

Chinese Home Appliances Explore a New Future

Coinciding with the signing of the cooperation memorandum between Sony and TCL, TCL Technology Group announced a personnel change: Founder Li Dongsheng stepped down as CEO, retaining only the chairman role, with Wang Cheng, a seasoned executive in his 70s, taking over as CEO.

As TCL's “soul figure,” Li Dongsheng's resignation drew external attention. Although he stepped down as group CEO, he retained the chairman role, indicating his continued involvement in shaping the company's strategic direction.

Wang Cheng's appointment carries the implication of “mentoring the new.” As TCL's business continues to expand, Li Dongsheng's dual roles as chairman and CEO inevitably divided his attention. Wang Cheng's addition not only shares the workload of implementing group strategies but also brings a fresh global management perspective through his experience in overseas multimedia business.

These two major events reflect a turning point—TCL stands at a critical juncture of internal and external transformation, mirroring the “microcosm” of China's home appliance industry after three decades of rapid growth.

Over the past 30 years, China's home appliance industry has evolved from a follower to a leader, now dominating the global market. However, “global presence of Chinese home appliances” does not equate to “global recognition of Chinese home appliance brands.”

According to TF Securities data, China's global manufacturing share in home appliances has exceeded 45%, but its retail share for proprietary brands remains below 20%. This data highlights a long-standing pain point for China's home appliance industry.

Although Chinese home appliance companies have captured the global market through OEM models and price advantages, brand premium and technological discourse power remain weak spots. Even for white goods giant Midea, its overseas market share for proprietary brands is merely around 3%.

However, moving forward, Chinese home appliance companies are clearly unwilling to remain mere “world factories.”

On one hand, the increasing uncertainty of the global trade environment is eroding the cost advantages in labor and manufacturing that Chinese companies rely on, as other emerging manufacturing nations rapidly catch up.

On the other hand, the global home appliance industry is now at a critical juncture of transitioning from hardware sales to ecosystem services. To conquer global consumers, home appliance products not only require hardware advantages but also increasingly depend on software differentiation.

These changes have disrupted the previous competitive logic of the home appliance industry. If technological leadership was once the core competitiveness, then in the future, the ability to implement differentiation and deliver more mature smart ecosystem experiences will determine how far a brand can go.

This TCL-Sony cooperation also serves as a paradigm example of Chinese home appliance companies exploring globalization.

Today, the global consumer electronics industry is entering an era of competition and cooperation. As Chinese home appliance companies engage in global competition, they must also learn to “leverage external forces”—capable of standing alone while also collaborating to truly shed the “OEM factory” label and achieve brand elevation.

As the tides of time surge forward, only those who can adapt will find renewal.