AI Hardware Prices Plummet to "10% of Original Cost": Ten-Yuan Earphones, Hundred-Yuan Glasses—Can the "Rural Penetration Dream" of AI Hardware Hinge Solely on Pinduoduo?

![]() 02/04 2026

02/04 2026

![]() 399

399

Inexpensive smart hardware fails to retain users through superior experience.

In January 2026, Chinese AI hardware brands stole the show at CES, leaving global media astounded. However, from Leitech's vantage point, AI hardware that makes it to CES is a rarity; to truly gauge the intensity of AI hardware competition, one must look to Pinduoduo.

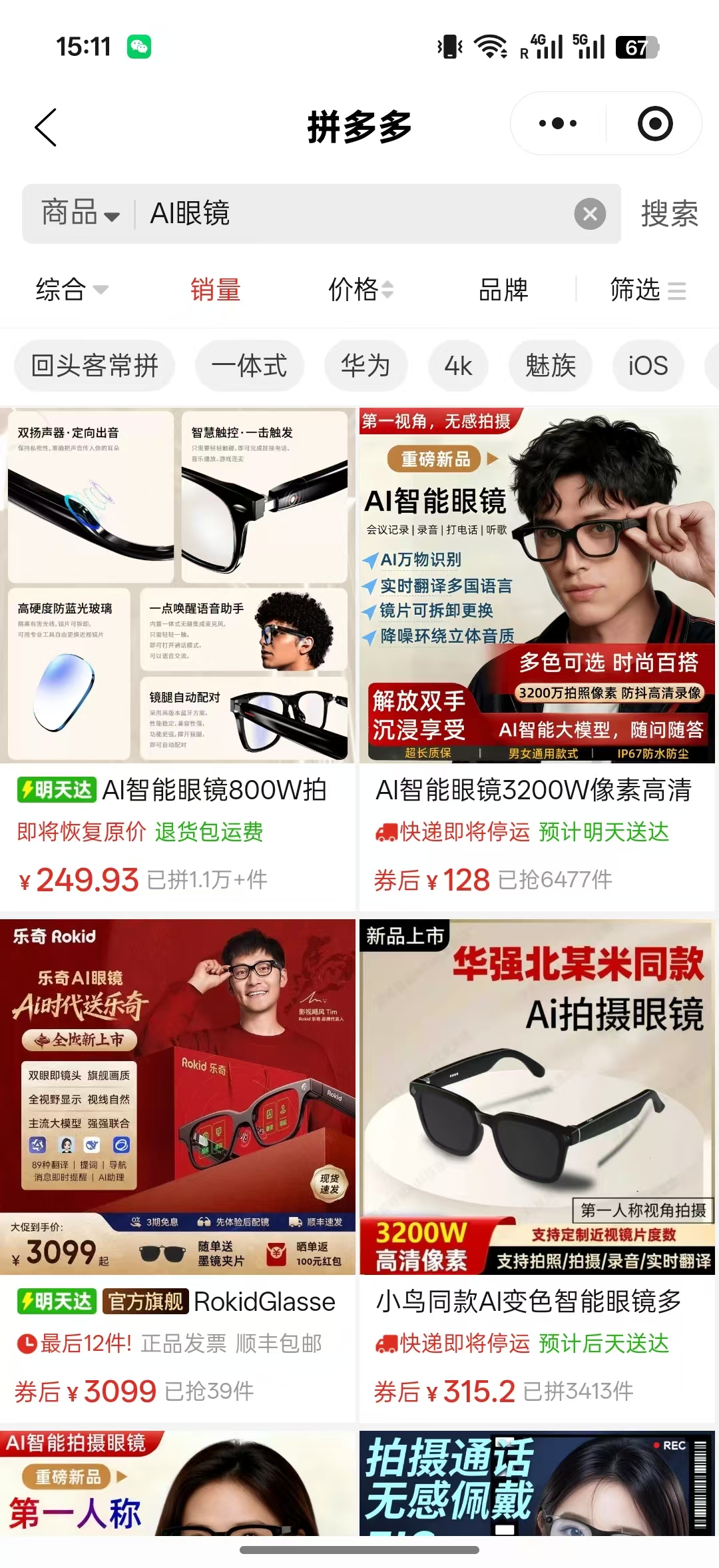

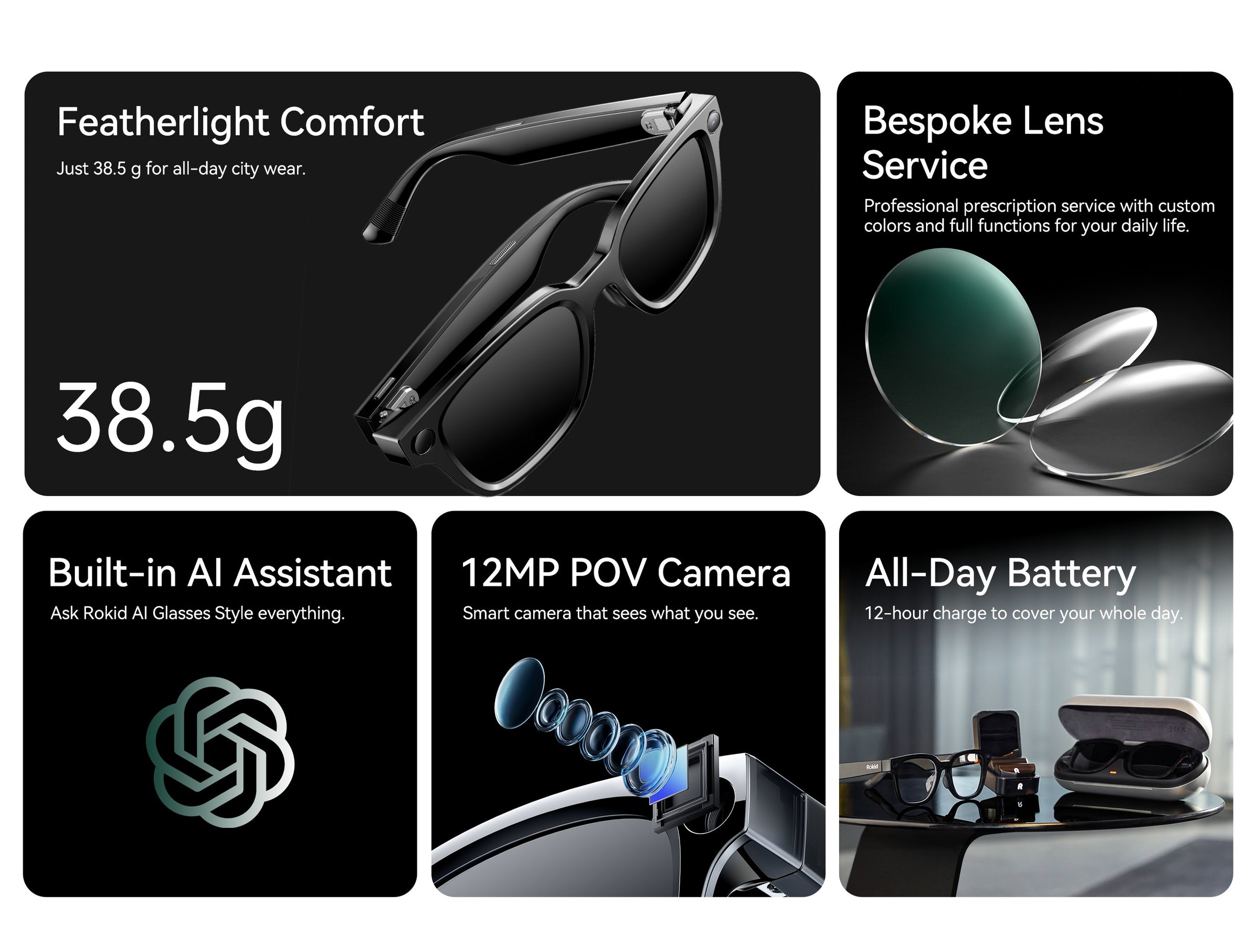

Take CES 2026 as an illustration: Rokid, the AI glasses brand with the longest queues, was priced at $299 overseas. On Pinduoduo, the top-selling AI glasses cost a mere 249 RMB. Yet, 249 RMB is far from the bottom; when sorted by price, we discovered AI shooting glasses priced under 100 RMB and even AI video glasses with double-digit price tags.

Image Source: Leitech

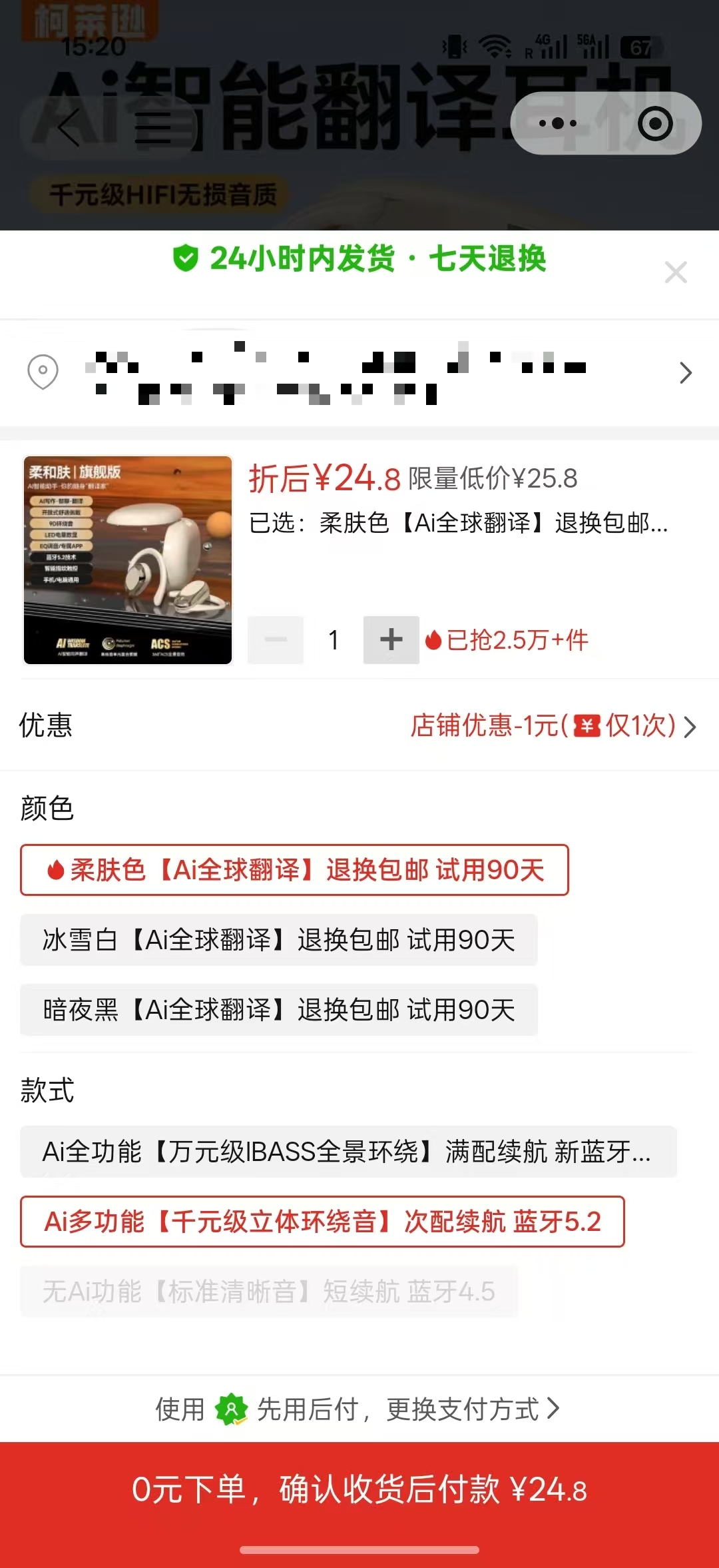

It's not just AI glasses—Pinduoduo's AI earphones are equally budget-conscious. A 199 RMB AI earphone is considered "premium" there, with basic ear-hanging models plummeting to 24.8 RMB...

Pinduoduo has undoubtedly played a crucial role in popularizing AI hardware. However, the question arises: what does it signify when AI hardware prices drop to such levels?

Do AI hardware devices priced at "10%" of their original cost offer vastly different experiences?

From Leitech's perspective, this downward pricing strategy (downmarket expansion) is not indicative of AI hardware's mainstream adoption but rather a supply chain's early embrace of the "AI" concept.

Objectively, such price disparities inevitably reflect product differences. Low-cost AI earphones struggle to match established brands in sound quality, comfort, and stability. Similarly, low-cost AI glasses fall short in image quality, dynamic range, and build details.

Image Source: Leitech

However, in Leitech's view, these budget products are not aiming to differentiate through experience.

Whether AI earphones or glasses, their core functionalities revolve around voice input, voice alerts, simple recording, and assisted interactions. In other words, they are not striving for "superior experiences" but rather validating the "minimum viable product."

Or, more bluntly: these products exist to establish the "product baseline" for AI hardware.

As long as voice is clearly captured, commands are accurately recognized, and results are seamlessly relayed to smartphones, the product has fulfilled its purpose. Under this premise, sound quality, image quality, and comfort are secondary considerations, not deal-breakers.

From a product design standpoint, the true cost advantage of these low-cost AI hardware does not stem from groundbreaking hardware innovation. Most AI hardware sold on Pinduoduo and 1688 today follows a uniform strategy:

Extreme device-side lightweighting, with AI computations centralized on smartphones or the cloud. The hardware itself is responsible only for data collection and output, avoiding complex computations.

Image Source: Rokid

This model directly caps their cost ceiling: there is no need for high-performance SoCs, complex cooling systems, or high-spec storage, drastically reducing power and heat issues. AI's "weight" shifts entirely from devices to software and ecosystems.

Under this architecture, the gap between AI hardware and traditional Bluetooth peripherals narrows rapidly. With a mature supply chain, AI earphones and glasses should not cost significantly more than their non-AI counterparts.

AI Hardware's Rural Penetration Requires "Right Timing, Location, and Synergy"

Yet, if these low-cost AI hardware can attract some users, why don't overseas companies replicate this "low-margin, high-volume" approach?

The answer lies in China's unique market characteristics.

Firstly, China's consumer electronics supply chain is highly modularized, scalable, and adaptable to low-margin products. From SoCs and Bluetooth modules to audio components and assembly, many solutions are designed for "extreme cost compression." For suppliers, creating an AI earphone or glasses is merely a matter of rearranging "pre-made ingredients."

In contrast, overseas markets—especially the U.S. and Europe—lack such manufacturing networks. Even with simple designs, without rapid scaling, per-unit costs remain high. This explains why overseas AI hardware, despite limited features, still commands premium prices.

A more critical difference lies in the structure of the AI ecosystem.

Image Source: Deepseek

Domestic low-cost AI hardware thrives because it does not need to "maintain its own AI." Voice recognition, translation, and summarization are standardized as services, allowing hardware makers to simply integrate them via apps. For devices, AI is an outsourcable utility, not a core asset.

Overseas, the landscape is far more complex. AI service costs are higher, while data compliance and privacy regulations significantly raise long-term operational expenses. When AI services themselves lack low marginal costs, hardware pricing cannot be reduced.

In essence, domestic low-cost AI hardware succeeds not because the hardware is cheap, but because the system's most expensive components—compute power and models—have been industry-wide scaled and diluted.

This model is hard to replicate overseas. China's mature manufacturing and affordable, scalable AI services form the bedrock of its low-cost AI hardware ecosystem.

AI Hardware Cannot Follow Smart Bracelets' "Rural Route"

Given the price declines of AI products, could these "AI-flavored" devices follow the rural penetration path of smart bracelets and watches? Leitech believes not.

Low-cost earphones and bracelets achieved mass adoption not because they were cheap, but because their core value was recognized before prices dropped. Wireless earphones solved usability issues; bracelets addressed long-term health tracking. Once these values were established, adoption became inevitable.

Image Source: Xiaomi

Current AI hardware falls short in this regard.

Whether double-digit AI earphones or 249 RMB AI glasses, none offer an "indispensable" use case. Voice transcription, translation, and AI assistants are technically mature but do not require standalone hardware. For most users, a smartphone with AI apps suffices.

In other words, low-cost AI hardware may attract curious buyers but will not retain long-term users. Users might dabble but will not form sustained usage habits—a stark contrast to how bracelets and earphones naturally integrated into daily life early on.

Thus, Leitech argues that low-cost AI hardware will not become true "rural penetration" products anytime soon.

However, that does not mean they are worthless. For manufacturers, these devices serve as experiments to identify promising differentiation strategies.

Ultimately, while low-cost AI hardware cannot define the future, they pave the way for "serious" AI hardware. By helping established brands avoid pitfalls, they have already fulfilled their purpose.

Smart Glasses & AI Earphones

Source: Leitech

Image Credits: 123RF Licensed Library