New Energy Vehicle Sales Plummet Month-on-Month in January, Auto Market Outlook for 2026 Remains Pessimistic

![]() 02/04 2026

02/04 2026

![]() 541

541

Introduction | Lead

On February 1, multiple domestic automakers promptly released their sales figures for January. Amidst the cold wave, many automakers still achieved year-on-year growth, but month-on-month sales declined, with some even experiencing a halving. Why did the 2026 auto market start this way?

This article is produced by Heyan Yueche Studio

Written by Zhang Chi

Edited by He Zi

Full text: 2,893 characters

Reading time: 4 minutes

Several automakers have one after another released their January 2026 performance reports, revealing a complex situation.

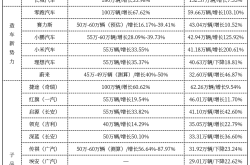

Among the new forces that have released sales figures, Xiaomi and NIO have seen their sales nearly double year-on-year, with the most impressive data, while Li Auto and XPeng have experienced declines. Month-on-month, all automakers saw a drop in sales. Notably, Leapmotor and XPeng experienced the largest declines, with sales falling nearly 50%.

Domestic traditional automakers also had mixed performances in January. BYD sold 210,100 vehicles, a 30.11% year-on-year decline, including 100,000 overseas sales. In contrast, Geely Auto performed more impressively, topping the domestic auto sales charts. Geely sold 270,200 vehicles in January, a year-on-year increase of about 1% and a month-on-month increase of 14%. Great Wall Motors sold 90,300 new vehicles, a year-on-year increase of 11.59% but a month-on-month decline of 27%. For large traditional automakers, maintaining their current market share is no easy task.

△ Geely surpasses BYD to become the January sales champion among domestic automakers

Rankings among new forces continue to change

Among the new forces, Hongmeng Zhixing/AITO, Xiaomi, and Leapmotor emerged as the top three in January.

Undoubtedly, Hongmeng Zhixing/AITO became the biggest winner in January sales. AITO, with over 40,000 deliveries, surpassed Leapmotor and Xiaomi to become the new force sales champion last month. Under AITO's leadership, Hongmeng Zhixing's overall sales also increased by 65.6% year-on-year to 57,900 units. However, since AITO accounts for over 70% of sales, other brands pale in comparison. 2026 will be a significant year for Hongmeng Zhixing's products. In addition to the AITO M7 extended-range long-distance version released on January 13, several new models like the Zhijie V9, Shangjie Z7, and AITO M6 will support Hongmeng Zhixing's sales growth.

△ 2026 will be a significant year for Hongmeng Zhixing's products

Xiaomi Auto delivered over 39,000 vehicles in January, a decline from over 50,000 in December. However, considering the upcoming facelift of the SU7, achieving this result mainly relying on the YU7 is commendable. For Xiaomi Auto, in addition to the upcoming new generation SU7 this year, it is rumored that Xiaomi will release three extended-range models in the second half of the year, along with two other models (including the Xiaomi SU7 extended version) that may be launched within the year. With strong product strength and Lei Jun's adept marketing strategies, Xiaomi Auto's sales target of 550,000 units this year is achievable.

△ Xiaomi secured the runner-up position among new forces in January with just the YU7 model

Leapmotor's performance last month was less impressive. Although it achieved a 27% year-on-year increase, the 46.9% month-on-month decline undoubtedly puts pressure on Leapmotor's sales team. In 2026, Leapmotor has set a sales target of one million units. If achieved, it will be the first time a domestic new force automaker reaches this annual sales milestone. Supporting this goal are four new models, including the A10, A05, D19, and D99, as well as several facelifted models from the B and C series. Notably, the Leapmotor D19, dubbed the "half-price Li Auto L9" by netizens, is scheduled for launch in April 2026. With the launch of new models, Leapmotor's performance this year may not be disappointing.

△ Leapmotor, known as the "half-price Li Auto," will launch the D19, posing a significant challenge to the Li Auto L9

The former first-tier new forces, NIO, XPeng, and Li Auto, seem to be underperforming.

NIO delivered 20,900 vehicles in January, a 163% year-on-year increase that looks promising but is mainly due to low sales in January last year. Notably, NIO's sales rely entirely on the new ES8 model, which delivered 17,600 units, accounting for 65% of the group's sales. Last year's strong performers, Leo and Firefly, have dimmed significantly. Leo sold 3,481 units in January, a 41% year-on-year decline and a 62% month-on-month decline. Firefly sold 2,807 units, a 60% month-on-month decline. Without strong models or more supportive sales policies, these two brands risk being marginalized.

△ NIO's sales rely entirely on the new ES8 model

Li Auto delivered 27,700 vehicles in January, down from 29,900 year-on-year, a 7% decline, and a 37% month-on-month decline. XPeng delivered 20,000 vehicles, a 34% year-on-year decline and a 47% month-on-month decline. 2026 will undoubtedly be challenging for Li Auto, XPeng, and other new forces. They face competition from AITO and Xiaomi at the higher end and pressure from Leapmotor, BYD, and Geely at the lower end. Competition is fierce across all models, whether pure electric or extended-range.

Why did the overall auto market start poorly?

The month-on-month sales decline in January can be attributed to two main reasons:

On the one hand, demand was exhausted in advance. In December of the previous year, automakers often released significant discounts to boost annual sales figures, possibly pressuring dealers to stock up. If demand weakens in January, the year-end sales surge affects whether automakers can achieve a "strong start" in January. Especially considering the adjustment of China's new energy vehicle purchase tax policy from exemption to a 50% reduction starting in 2026, a significant portion of new energy vehicle purchase demand was concentrated at the end of last year.

△ Policy adjustments and delayed implementation became key factors affecting the domestic auto market's January performance

On the other hand, consumers are holding onto their cash. Currently, the application process details and channels for local government subsidies have not yet been implemented. This prevents consumers from enjoying these discounts, leading to a strong sentiment of holding onto cash in the short term. Once relevant policies are implemented, they will stimulate a new wave of consumption.

Another significant factor is the adjustment of the new energy vehicle purchase tax policy, indicating the impending era of "equal rights for fuel and electric vehicles." For automakers like Geely and Chery with a comprehensive range of fuel vehicle models, this shift can be seen as a positive development. Conversely, for BYD and other new forces, mitigating the impact of the purchase tax adjustment policy requires considerable thought.

△ "Equal rights for fuel and electric vehicles" is a positive development for brands like Geely and Chery with fuel vehicles

What is the outlook for the auto market in 2026?

The domestic auto market in 2026 is likely to remain flat compared to 2025. Therefore, increasing sales in the domestic market will require taking market share from competitors. Without sufficient "sincerity" in product strength or pricing, it will be challenging to attract consumers.

As for the overseas markets, which many automakers have high hopes for, resistance is increasing. In December 2025, the Mexican government passed a tariff bill (voted on by Congress in December 2025) imposing a maximum 50% tariff on light vehicles from countries without free trade agreements with Mexico, with China being the primary affected country. In 2025, Mexico just replaced Russia as China's top automotive export destination, with exports exceeding 620,000 units, a year-on-year increase of about 41%. The new tariff policy, effective January 1 this year, will significantly impact Chinese automotive exports to Mexico.

Similarly, the South African government is advance (considering) raising import tariffs on complete vehicles from China and India from the current about 25% to the maximum WTO-allowed rate of 50%, citing increased imports as a impact (threat) to South Africa's domestic automotive manufacturing industry. Although South Africa did not rank among the top ten destinations for Chinese automotive exports, it is the largest importer of Chinese vehicles in Africa and a bridgehead for Chinese automakers entering the African market. If tariffs double to 50%, the prospects for Chinese automakers entering the African market will dim significantly. Additionally, the EU is investigating Chinese exported hybrid models. If China's hybrid models are ultimately deemed to be dumping or receiving unfair subsidies, the EU will impose additional tariffs on them.

Currently, both domestic and international markets are under pressure, with more intense competition in the domestic market. As long as China's automotive overcapacity issue remains unresolved, price wars among domestic automakers will intensify. Even if regulatory authorities intervene to oppose internal competition among automakers, companies will still find ways to engage in price wars when facing survival challenges. Eliminating overcapacity is a major challenge for the automotive industry this year.

Commentary",