The Battle for the Automotive Market Behind the 2026 Sales Targets of Automakers

![]() 02/03 2026

02/03 2026

![]() 492

492

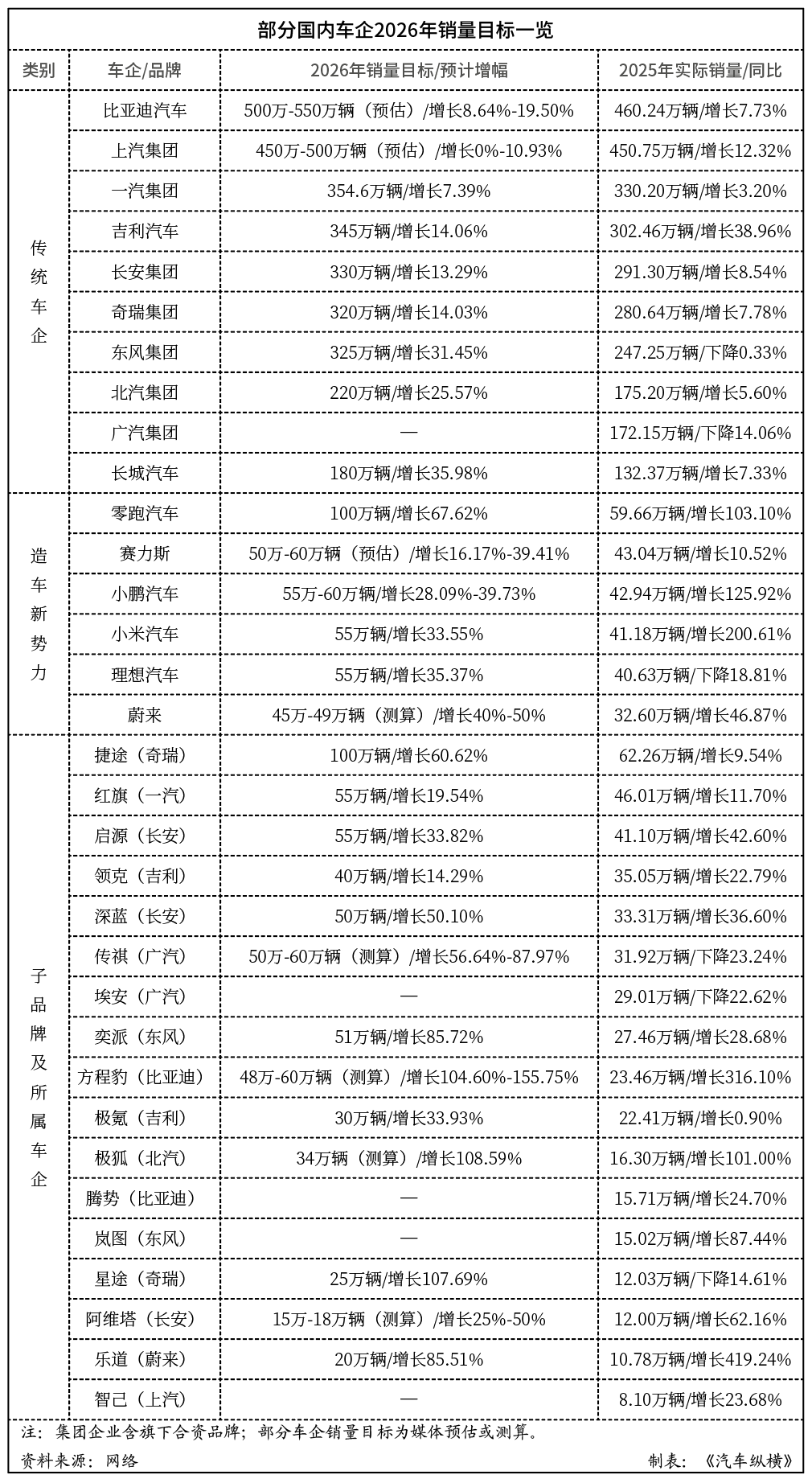

In 2026, China's automotive industry will enter a dual node of policy shifting and market upgrading. Against this backdrop, the sales targets set by domestic mainstream automakers not only demonstrate their respective strategic considerations but also outline a new landscape for high-quality development and global competition in the industry.

At the beginning of 2026, some domestic automakers have successively announced their sales targets for the new year. From the steady growth of traditional automakers to the aggressive expansion of emerging EV makers, and then to the differentiated breakthroughs of subsidiary brands, the targets set by each camp are based on their own development needs and also reflect their judgments on future market trends.

Through a review of the 2026 sales targets of major automakers, 'Auto Review' found that there is a severe divergence in the sales targets of domestic mainstream automakers. Among them, emerging EV makers and some subsidiary brands of automakers have become the vanguards of growth, while traditional automakers have consolidated their market positions with their systemic advantages, jointly driving China's automotive industry towards the mid-to-high end of the global value chain.

Traditional Automakers Proceed Steadily to Secure Their Core Business

Among traditional automakers, leading companies, leveraging their full industry chain layout (translated as 'layout' but kept as is for context) and deep market accumulation, have set relatively stable sales targets, showcasing the confidence of industry leaders.

BYD Auto, the newly crowned 'big brother' in the past two years, although not announcing its overall sales target for 2026, is estimated by the industry to have an overall sales target of around 5 to 5.5 million units based on its announced overseas target of 1.6 million units. The expected growth rate is around 10%, which is relatively low compared to other companies and indicates a more pragmatic approach. As a benchmark enterprise in the new energy vehicle sector, BYD's continuous investment in battery technology, product matrix, and production capacity layout provides solid support for its steady sales growth. Its target setting takes into account factors such as intensified market competition and reserves space for technological iteration and production capacity release.

SAIC Group and FAW Group also belong to the pragmatic camp, with both industry estimates and their own announced sales targets expecting growth rates of less than 10%. As established giants in China's automotive industry, both companies possess complete joint venture and independent brand systems, with target settings leaning towards stability, focusing on consolidating market share and improving profit quality. Among them, the Hongqi brand under FAW Group has returned to the growth track in recent years, with a 2026 target of 550,000 units, expected to grow by 19.5%, continuing its strong momentum of high-end transformation and becoming the core engine for the group's sales growth.

Geely, Changan, and Chery, the three leading independent brands, exhibit stronger growth aspirations, setting sales target growth rates of over 10% for 2026, at 3.45 million, 3.3 million, and 3.2 million units respectively, with year-on-year growth rates all exceeding 13%. Among them, Geely Auto, driven by its dual strategies of new energy transformation and global layout, not only strengthens its main Geely brand line but also covers different market segments through subsidiary brands such as Zeekr and Lynk & Co; Changan Group continues to expand its market share in the new energy sector by relying on product innovations from brands like Deepal and Avatr; Chery Group achieves steady sales growth by leveraging its deep accumulation in overseas markets and hybrid technology advantages, with its Jetour subsidiary brand setting a target of 1 million units to become an important pillar for the group's growth.

Notably, Dongfeng Group, BAIC Group, and Great Wall Motor have set more aggressive growth targets, with their 2026 sales targets at 3.25 million, 2.2 million, and 1.8 million units respectively, all achieving year-on-year growth rates of around 30%. Breaking it down, Dongfeng Group hopes to accelerate its transformation towards the new energy vehicle market through the rapid growth of subsidiary brands like Epi and the collaborative efforts of joint venture brands, with its target setting showcasing its determination to break through growth bottlenecks; BAIC Group's confidence comes from the strengths of BAIC Arcfox and Beijing Off-Road, as well as collaborations like the Xiangjie model jointly built with Huawei; Great Wall Motor's continuous investment in the new energy and intelligent sectors is gradually entering the harvest period, with a continuously enriching product matrix expected to drive its sustained growth.

Emerging EV Makers Launch Large-Scale Sprints

The emerging EV maker camp that remains 'in the game' collectively enters a phase of large-scale sprints in 2026, with sales targets generally showing high growth rates, reflecting their urgent need to seize market share and achieve profit breakthroughs.

Leapmotor is not only the biggest winner among the new forces in 2025 but also significantly advances in 2026, setting an annual target of 1 million units to become the 'growth vanguard' among the new forces, with a growth rate of 67.6% compared to its actual sales of 597,000 units in 2025. Leveraging its advantages in intelligent driving technology, cost control, and product cost-effectiveness, Leapmotor quickly expands its market coverage, becoming one of the fastest-growing enterprises among the new forces.

The early co-named 'Weixiaoli' (NIO, XPeng, and Li Auto) have survived until now but face strong rivals—Seres and Xiaomi, especially Xiaomi Auto, which is catching up rapidly. From the actual sales in 2025, among these five new forces, except for NIO slightly exceeding 300,000 units, Seres, XPeng Auto, Xiaomi Auto, and Li Auto all exceed 400,000 units with small gaps. More coincidentally, the sales targets set by these automakers for 2026 are also as if by prior agreement (translated as 'coincidentally' but kept the original phrase for context), with NIO expecting growth of 40-50% and projecting sales of less than 500,000 units based on calculations, while the other four automakers set targets in the range of 550,000-600,000 units, all with growth rates exceeding 30%.

Among them, Seres, as a representative enterprise deeply collaborating with Huawei, continuously enhances its product competitiveness with technological empowerment from Huawei in intelligent driving and smart cockpit fields, becoming an important growth pole in the new force camp. The core driving force for Seres' performance growth comes from the continuous popularity of new AITO models and the effective implementation of its high-end strategy. This blockbuster logic is expected to extend to subsequent new models and facelifted versions, driving further sales growth for the company. With the Gradually launched (translated as 'gradual launch' but kept the original phrase for context) of new models in 2026, the AITO product matrix will become more complete, driving brand strength and new model cycles to resonate.

XPeng, Xiaomi, and Li Auto are almost in step. After experiencing product iteration and strategic adjustments, XPeng Auto is expected to achieve steady sales recovery with the technological advantages of its XNGP intelligent driving system and a complete product matrix; Xiaomi Auto, as an 'latecomer' in the industry, quickly sets its target at 550,000 units after achieving impressive results with its first model, showcasing strong market explosiveness by leveraging its technological accumulation and ecological resources in the consumer electronics sector; Li Auto continues to deep cultivation (translated as 'deeply cultivate' but kept the original phrase for context) the family user market and, despite a year-on-year sales decline in 2025, still sets its target with a growth rate of 35.4%, hoping to drive sales rebound with a new product cycle.

NIO, supported by its battery swap model and high-end brand image, continuously improves its product matrix, expands its service network, and sets targets that balance scale growth and brand value enhancement. 2026 is a crucial year for NIO's 'high-quality growth phase III,' with the core goal of achieving a sales growth rate of 40-50% and full-year Non-GAAP profitability. Through the collaboration of the 'NIO-Leapmotor-Firefly' three brands, technological cost reduction, market sink (translated as 'penetration' but kept the original phrase for context to lower markets), and global expansion, NIO aims to complete the transformation from scale growth to profit growth.

Subsidiary Brands of Automakers Hope for Differentiated Breakthroughs

To achieve market dominance, the 'multi-brand strategy' has been prevalent in the automotive industry in recent years. The subsidiary brands of major automakers fully exert their strength in 2026, intending to become the core driving forces for their parent companies' sales growth with precise market positioning and differentiated product strategies. Some subsidiary brands' growth targets even far exceed the overall growth rate of their group companies.

Chery has always adhered to the strategy of 'having many children to fight in a group,' possessing numerous subsidiary brands. Among them, Jetour sets a target of 1 million units to become the 'leader' among subsidiary brands of automakers, with a year-on-year growth rate as high as 60.6%. Leveraging Chery's advantages in hybrid technology and overseas channels, Jetour quickly expands its market and becomes a model for the large-scale development of independent subsidiary brands. Another higher-positioned subsidiary brand, 'Exceed,' shows its determination to 'overtake on a curve' with a growth rate exceeding 100%, positioning 2026 as the 'year of value decisive battle' and initiating a comprehensive transformation covering four dimensions: technology, design, products, and globalization strategy.

Subsidiary brands such as Changan Deepal, Dongfeng Epi, and GAC Trumpchi also set high growth targets, all exceeding 500,000 units with growth rates exceeding 50%. Deepal, with its precise positioning of new energy products and affordable pricing strategy, becomes the core force for Changan Group's new energy transformation; Epi quickly rises to the mainstream new energy market by relying on Dongfeng Group's manufacturing advantages and product innovations; Trumpchi accelerates its transformation towards new energy and high-endization with strategic support from GAC Group.

In addition, subsidiary brands such as Geely Zeekr, GAC Aion, and Changan Avatr, regardless of their performance in the past 2025, will continue to exert their strength in their respective market segments in 2026. Zeekr focuses on the high-end pure electric market and should find it easy to steadily expand its market share with its product strength and user experience advantages; Avatr, jointly empowered by Huawei and Changan, becomes an important participant in the high-end intelligent electric vehicle market; although Aion has not explicitly announced its 2026 target, as the core carrier for GAC Group's new energy transformation, its market performance is still worth anticipating.

Strategies to Break Through Amid Intensifying Industry Competition

The overall increase in domestic automakers' sales targets for 2026 is driven by multiple factors. At the policy level, the parallel implementation of purchase tax halving and trade-in subsidies, although causing short-term increases in car purchasing costs, guides the industry towards mid-to-high-end and high-quality transformation through differentiated subsidy policies, providing development opportunities for technologically advanced automakers. At the market level, the continuous release of potential in lower-tier markets, where the new energy penetration rate in third-tier and below cities is still less than 30%, becomes an important growth engine for automakers. Companies like BYD and Leapmotor are promoting their channel extensions to county-level areas and launching cost-effective models suitable for lower-tier markets. At the technological level, technological iterations such as blade batteries, long-range plug-in hybrids, and intelligent driving continuously enhance product competitiveness, driving market demand transformation from policy-driven to product-driven.

According to data from the China Association of Automobile Manufacturers, domestic new energy vehicle sales reached a staggering 16.49 million units in 2025, accounting for 47.9% of total vehicle sales. With continuously increasing consumer acceptance of new energy vehicles, the improvement of charging infrastructure, and ongoing technological progress, the new energy vehicle market will maintain a relatively high growth trend in 2026, providing vast space for automakers to achieve their sales targets.

However, the industry also faces numerous challenges. Policy rollbacks trigger short-term market pain, causing demand fluctuations at the beginning of 2026 and intensifying consumer wait-and-see sentiment. Price wars escalate comprehensively, with joint venture brands like BMW taking the initiative to reduce prices and new energy automakers launching diversified preferential packages. Industry competition is transforming from 'price wars' to 'value wars,' putting small and medium-sized automakers under dual pressure of funds and sales and accelerating industry reshuffling. Although overseas markets have become key growth areas, trade barriers and localisation layout challenges coexist, requiring automakers to shift from 'product exports' to 'ecosystem overseas expansion' and build global R&D, production, and service systems.

On the one hand, market competition continues to intensify, with traditional automakers, emerging EV makers, subsidiary brands of major automakers, and overseas brands competing on the same stage. Price wars, technological wars, and service wars are comprehensively upgrading, and some enterprises may face pressure to achieve their targets. On the other hand, issues such as supply chain stability and technological R&D investment pressure will still constrain industry development, testing the comprehensive strength of enterprises. In addition, some automakers set relatively aggressive targets and need to be cautious of risks such as overly rapid channel expansion, striving to balance the relationship between scale growth and profit quality.

Overall, the layout of domestic automakers' sales targets for 2026 not only showcases optimistic expectations for market prospects but also reflects the accelerating differentiation of the industry's competitive landscape. Traditional giants proceed steadily with their scale and systemic advantages, emerging EV makers strive to break through relying on technological innovations, and subsidiary brands of automakers open up new tracks through precise positioning, jointly driving China's automotive industry towards in-depth transformation towards electrification, intelligence, and globalization. In the fierce market competition, only those enterprises that can continuously focus on product innovation, technological R&D, and user experience are expected to achieve their set targets, seize opportunities in the global automotive industry transformation, and accelerate China's transition from an automotive powerhouse to an automotive superpower.

Note: This article was first published in the 'Hot Topic Tracking' column of the February 2026 issue of 'Auto Review' magazine. Please stay tuned.

Image: Auto Review

Article: Auto Review

Layout: Auto Review