Final Verdict: January Auto Sales Unveiled, SAIC Motor Leads the Pack

![]() 02/04 2026

02/04 2026

![]() 410

410

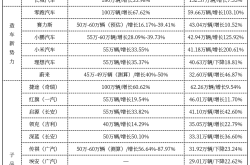

In China's auto industry, releasing sales figures in the first month of the year has long been a well - established tradition. These figures not only mirror the outcomes of automakers' market strategies from the previous year but also act as a vital barometer for the competitive landscape in the upcoming year. In January 2026, the domestic auto market as a whole was sluggish, experiencing both year - on - year and month - on - month declines. Nevertheless, some automakers, especially those with a substantial share of fuel - powered vehicles, delivered exceptional performances.

As January 2026 drew to a close, amidst the wave of sales data released one after another by various automakers, industry leaders presented a mixed bag of results. SAIC Motor claimed the top spot in January sales with impressive numbers, with Geely Holding following closely in second place. BYD witnessed a sales decline due to a downturn in its new energy segment, while mainstream automakers such as Chery, GAC, and Great Wall exhibited resilience in the face of market adjustments.

SAIC's All - Round Growth Cements Its Top Position

As the January sales champion, SAIC Motor delivered an outstanding performance. It achieved a 23.9% year - on - year growth, with 327,000 wholesale vehicles and 363,000 retail vehicles sold. This made SAIC the sole automaker in the industry to surpass the 300,000 - unit sales mark. Its growth was propelled by strong performances in three key areas: self - owned brands, new energy, and overseas markets, demonstrating its robust systemic competitiveness. Among them, self - owned brands emerged as the core pillar of SAIC's leadership. January sales of self - owned brands reached 214,000 units, a remarkable 39.6% year - on - year increase, accounting for 65.3% of total sales. SAIC Passenger Vehicles, SAIC - GM - Wuling, and SAIC MAXUS all achieved significant growth, reducing their reliance on joint - venture brands and transitioning from scale expansion to quality enhancement.

Against the backdrop of a cooling new energy market, SAIC sold 85,000 new energy vehicles, a 39.7% year - on - year increase. IM Motors and SAIC Passenger Vehicles' new energy models experienced rapid growth, with increases of 66% and 576.9% respectively. SAIC - GM - Wuling led the low - end new energy market with 36,000 units sold. Breakthroughs in core technologies such as solid - state batteries and intelligent chassis enabled SAIC to cover all price segments with its products.

The overseas market served as another growth engine for SAIC. In January, it sold 105,000 units, a robust 51.7% year - on - year increase. The MG brand secured its 11th consecutive year as the top - selling Chinese brand in Europe, even surpassing Tesla in Germany to become the best - selling Chinese auto brand there. The combination of localized operations and technological empowerment drove SAIC's upgrade from "Made in China" to "Intelligently Made in China."

Geely Holds Firm at Second Place: Multi - Pronged Growth Drives Dual Increases

Geely Auto Group ranked second in January sales with 270,200 units. It was the only mainstream automaker to achieve both year - on - year and month - on - month growth, with increases of 1.29% and 14.08% respectively, laying a solid foundation for its annual sales target of 3.45 million units. Geely's growth stemmed from multi - brand synergy and deepened globalization. In the new energy segment, it sold 124,000 units in January, a 2.63% year - on - year increase. The Zeekr brand nearly doubled its sales year - on - year with 23,852 units, while 60% of Lynk & Co's models were new energy vehicles. Geely Galaxy continued to gain momentum with its star models, achieving success in both premium and new energy transitions.

In the fuel - powered vehicle market, Geely's China Star series secured its ninth consecutive year as the top - selling Chinese brand in the fuel passenger vehicle segment. Classic models like the Boyue family, Bin Yue, and Emgrand family performed steadily, continuing to meet the market demand for high - quality fuel - powered vehicles. Geely's explosive growth in overseas markets was another highlight. In January, it exported 60,500 units, a 121% year - on - year increase. New energy vehicles accounted for 53% of overseas sales, as brands like Zeekr and Lynk & Co accelerated their entry into European and Southeast Asian markets. A localized research, production, sales, and service system propelled Geely's globalization into a high - quality development phase.

BYD Faces Market Adjustments Due to Multiple Factors

BYD sold 210,000 units in January, a 30.11% year - on - year decrease and a 50.04% month - on - month decrease. The main reason for the decline was a sharp drop in China's new energy vehicle segment. Its battery electric passenger vehicle sales reached 83,200 units, a 33.60% year - on - year decrease, while plug - in hybrid passenger vehicle sales stood at 122,300 units, a 28.53% year - on - year decrease. Domestic market sales totaled only 109,600 units, a year - on - year decline exceeding 50%. It's undeniable that the decline in the new energy segment was caused by multiple short - term factors. Starting from January 1, 2026, the purchase tax exemption for new energy vehicles was reduced from full exemption to a 50% reduction. This led many consumers to purchase vehicles in December 2025, resulting in significant demand overdraft. Additionally, the misalignment of the 2026 Spring Festival holiday reduced the effective sales days in January, shortening the pre - holiday sales peak and further exacerbating sales volatility.

Meanwhile, intensified competition in the new energy market also impacted BYD. Price cuts and new product strategies from brands like Tesla and Xiaomi, along with surging sales of Huawei ADS - equipped brands like Aito and Avatr, diverted users within BYD's main price segments. The discontinuation of some short - range plug - in hybrid models due to policy requirements also necessitated structural adjustments to BYD's product lineup. Nevertheless, BYD's overseas performance was outstanding. In January, it exported 100,500 new energy vehicles, a 51.47% year - on - year increase, serving as a crucial buffer against domestic market pressures and showcasing the initial success of its globalization strategy. Besides the top three automakers, mainstream players like Chery, GAC, and Great Wall also showcased unique strengths in January. Chery sold a total of 191,000 units, while GAC Group achieved an 18.47% year - on - year increase with 116,600 units sold. Among Great Wall's 90,000 units sold, the WEY brand grew 57.24% year - on - year. Among emerging powerhouse brands, HiMo delivered 57,900 units, and Xiaomi Auto delivered over 39,000 units. Despite month - on - month fluctuations due to the market environment, both brands achieved significant year - on - year growth.

Overall, the January 2026 auto sales data reflects short - term market adjustments driven by policy changes and seasonal factors, while also highlighting automakers' long - term strategic achievements in new energy transitions, globalization, and brand premiumization. SAIC's all - round breakthrough and Geely's steady progress underscore the importance of systemic competitiveness and diversified layouts. Meanwhile, BYD's overseas market breakthrough offers new growth insights for the industry. As post - Spring Festival market demand gradually releases, new energy policy details are implemented, and automakers launch new products, the domestic auto market is expected to emerge from the adjustment phase. The January sales data has also set a new trajectory and competitive landscape for the year ahead.(End)