Musk is right, Tesla killers can only rely on 'Daddy'

![]() 08/12 2024

08/12 2024

![]() 454

454

Introduction

Introduction

Finding a powerful patron is also a kind of ability.

Recently, there has been a high-profile executive change in China's auto industry that has attracted widespread attention.

Genesis, a Korean luxury brand, announced that Zhu Jiang has become the new CEO of its China sales company. Looking at this star executive's resume, it is extremely impressive.

BMW, MINI, Lexus, NIO, Ford, he has worked for them all.

One of the most surprising facts is that before joining Genesis, Zhu Jiang worked at Lucid, known as the 'Tesla killer,' as its first Managing Director in China since June 2023.

At that time, there were widespread speculations that this American new energy vehicle (NEV) company was planning to enter the Chinese market in full force.

However, contrary to expectations, over the past year, due to various internal and external challenges, Lucid has not made many substantial moves. To make matters worse, with Zhu Jiang's departure, it is speculated that Lucid's expansion plans have been shelved.

Of course, rationally speaking, given the current intensity of competition in China's auto market, even if Lucid were to enter, it would likely face an uphill battle. In other words, this land, which still holds significant "dividends," will not give any opportunities to latecomers with weak risk resistance capabilities.

Naturally, someone might ask: What happened to the protagonist of today's article? The answer can be glimpsed from Lucid's recently released second-quarter financial report.

A boring report card

Let's get straight to the results.

In the second quarter, Lucid's revenue was $200 million, an increase of 32% year-on-year. Further breakdown shows that revenue from North America was $155 million, compared to $138 million in the same period last year; revenue from the Middle East was $40.65 million, compared to $0.608 million last year; and revenue from other international markets was $0.484 million, compared to $0.727 million last year.

Correspondingly, Lucid's operating loss in the second quarter was $787 million, compared to $838 million in the same period last year; net loss was $643 million, compared to $764 million last year. As of June 30, 2024, Lucid held $1.354 billion in cash and cash equivalents.

Looking back at the first half of the year, Lucid's revenue was $373 million, an increase of 24% year-on-year. Of this, revenue from North America was $270 million, a decrease of 5.6% from $286 million in the same period last year; revenue from the Middle East was $95.23 million, compared to $0.675 million last year; and revenue from other international markets was $0.824 million, compared to $0.727 million last year.

Lucid's cost and expense expenditure in the first half of the year was $1.891 billion, compared to $1.91 billion last year. Operating loss was $1.517 billion, compared to $1.61 billion last year; net loss was $1.324 billion, compared to $1.544 billion last year.

Meanwhile, it is worth noting that Lucid delivered only 2,394 vehicles in the second quarter and 4,361 vehicles in the first half of the year. Facing such a boring report card, it can only be said that the protagonist of today's article is still stuck in a quagmire.

Looking back at Lucid's past, like Tesla, it was born in California, a place that has nurtured many American startups in the automotive industry.

Its predecessor, Atieva, was founded as early as 2007, specializing in producing batteries and power systems for other automakers. In October 2016, it officially changed its name to 'Lucid Motors,' turning its focus to the development of an all-electric, high-performance luxury vehicle.

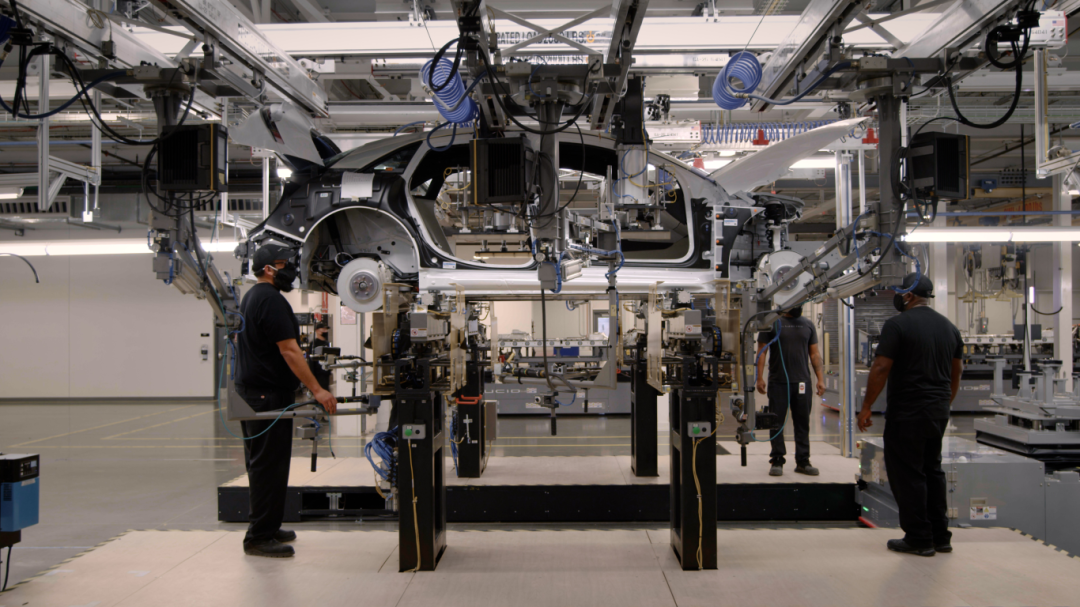

At the same time, Peter Rawlinson, who had previously served as Vice President of Engineering at Tesla, was appointed CEO of Lucid. That same year, Lucid began building its own factory in Arizona.

Since then, after a long period of development, 2021 was a crucial milestone for Lucid.

It successfully went public through a merger and listing on NASDAQ at the beginning of the year, achieving a transformation at the capital level. At the end of the year, Lucid delivered its first mass-produced model, Lucid Air, which directly competed with Tesla's Model S in terms of specifications and pricing.

However, this high point did not last long.

The brutal reality soon dealt a heavy blow to the protagonist of today's article. Since 2022, Lucid has faced increasing pressure tests.

Musk once gave a piece of advice that aptly described Lucid's subsequent situation: "Starting a new auto company is incredibly painful, and turning a profit is extremely difficult. What I see from these companies is that they are jumping into the abyss and trying to ramp up production without ever having built a car before. It's crazy."

Looking back, after several years of development, like most of its peers, Lucid cannot support itself and still relies on external funding to survive.

However, compared to brands that are gradually fading away, Lucid is undoubtedly lucky.

'Relying on Daddy' is also a kind of ability

Why is Lucid lucky? It's because it has found a powerful 'sugar daddy' in the turbulent market environment.

In fact, as early as the first quarter of this year, Lucid announced an agreement with its major shareholder, the Public Investment Fund (PIF) of Saudi Arabia, through its subsidiary Ayar Third Investment Company, to purchase $1 billion in convertible preferred stock. This funding will be used for Lucid's general corporate purposes, including capital expenditures and operating funds.

In response, Lucid's CEO Peter Rawlinson said, "As we strive to solidify our position as a global leader in electric vehicle technology, we are delighted to receive continued strong support from PIF."

He soon added, "We will continue to invest long-term in technology and vertically integrated manufacturing capabilities. PIF's support is a key advantage for us. With their backing, we will remain focused on accelerating growth through vehicle deliveries, executing our key business plans, maintaining a sharp focus on cost, and launching the game-changing Gravity SUV later this year."

Undeniably, those are beautiful words. However, as an observer, we are acutely aware of Lucid's difficult situation, given its financial state. With the $1 billion in funding secured, Musk once again commented sarcastically, "Saudi money is the only reason they're still alive."

Indeed, that is a harsh reality.

Surprisingly, and to the envy of many competitors, Lucid announced that its largest shareholder, the PIF, would provide an additional $1.5 billion in funding alongside the release of its second-quarter financial report.

In this round of funding, the PIF will purchase $750 million in convertible preferred stock and provide a $750 million term loan through its affiliate investment company, Ayar Third Investment Company. According to relevant statistics, the cumulative investment from this "sugar daddy" has reached a staggering $8 billion to date.

The latest $1.5 billion will primarily be used by Lucid to mass-produce the SUV Lucid Gravity, as mentioned by Rawlinson.

However, with a price tag of around $80,000 and a high-end market positioning, it still appears difficult for Lucid to alleviate its pressing difficulties. In the long run, Lucid is designing a smaller, more affordable model, planned to be produced at a new factory in Saudi Arabia in 2026.

Additionally, in the second-quarter financial report, Rawlinson also stated that the company plans to produce 9,000 new vehicles this year. For reference, Lucid produced around 8,500 vehicles last year.

The progress is almost negligible. Nevertheless, with the continuous support of its "sugar daddy," the protagonist of today's article at least doesn't have to worry too much about finding funds.

Last month, another heavily loss-making American NEV maker, Rivian, also announced the formation of a joint venture with Volkswagen Group and received a $5 billion investment from the latter.

In terms of 'relying on Daddy,' their exceptional abilities are undeniable.