Europe and the United States' pure electric vehicle market cools down, and they cannot do without engines

![]() 08/13 2024

08/13 2024

![]() 493

493

Introduction

Introduction

Compared to China's "same price for gasoline and electric vehicles", foreigners still have a long way to go.

In 2024, the automotive industry in Europe and the United States witnessed the continued downturn in the pure electric vehicle market, leading to a core challenge faced by many automakers: declining demand for products crucial to achieving global and industry net-zero emissions targets.

In response to this change in market demand, companies such as Ford, Renault, Kia, Hyundai, Porsche, and Stellantis have adjusted their strategies, shifting their focus away from the research and development of pure electric vehicles and towards the development of hybrid power systems as a transitional technology.

A spokesperson for Porsche remarked, "The transition to pure electric vehicles has been longer than we anticipated five years ago. During this transition period, having a flexible drivetrain system that can adapt to changes is particularly important, as external environmental conditions evolve, and the pace of development varies across different regions of the world."

Recently, Ford postponed the launch of its new SUV and electric pickup truck at its Ontario plant, originally scheduled for April this year, and instead focused on producing fuel-powered trucks to meet the persistent high demand in the market.

In June, Ford Chairman Jim Farley bluntly stated that he believed large electric vehicles like trucks "will never be profitable," citing the initial cost of large battery packs alone as high as $50,000. Consequently, Ford has chosen to prioritize smaller electric vehicles, reflecting the market's concerns about the economics of electric vehicles.

Data from French automotive parts supplier OPmobility further corroborates the challenges facing the electric vehicle market. It is revealed that electric vehicle production by US, French, and German automakers is currently 40-45% lower than expected, and automakers are facing overcapacity issues as demand cools. This phenomenon is not limited to individual companies but is prevalent across the entire industry.

This perspective mirrors the prevailing sentiment in the market, with several automakers recently announcing plans to reduce production of pure electric vehicles, further validating this market trend.

Cooling of the Pure Electric Vehicle Market

Relevant institutions point out that in mature markets, the high purchase cost of pure electric vehicles is the main factor limiting sales, while inadequate charging infrastructure poses another significant obstacle in many markets, jointly contributing to the slowdown in the growth of the pure electric vehicle market.

General Motors' CEO abandoned the company's 2025 electric vehicle production target, citing insufficient production capacity. Porsche, on the other hand, stated that its goal of achieving an 80% electric vehicle lineup by 2030 now depends on consumer demand. Stellantis even suspended electric vehicle production at its Mirafiori plant in Italy due to a 63% decline in production during the first half of 2024.

In response to this situation, Renault's CEO called on the European Union to establish a more flexible transition timeline to address the 2035 ban on all new diesel and gasoline vehicles. This call reflects automakers' concerns and discomfort with rapid transformation.

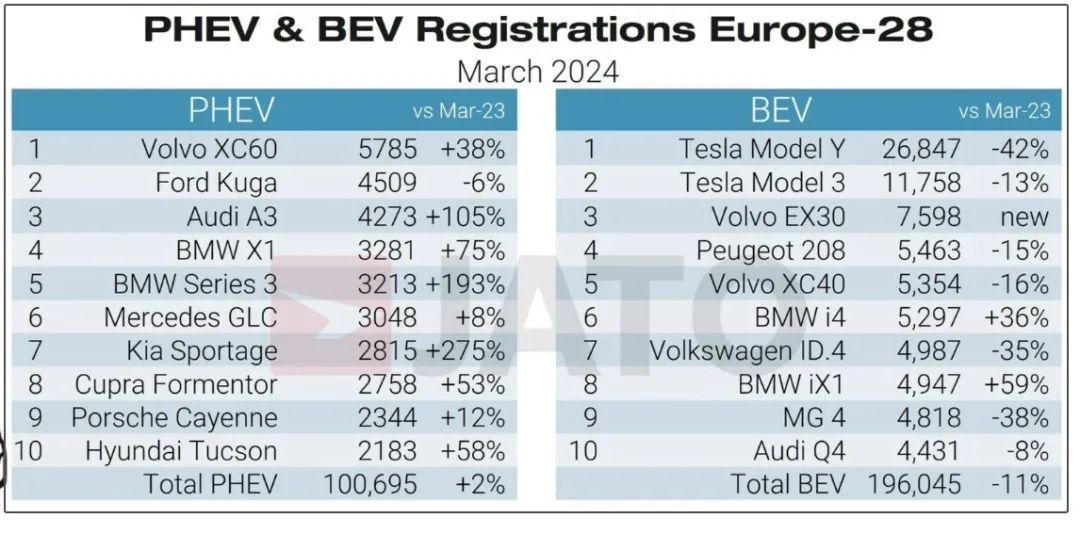

Meanwhile, hybrid vehicles (including Full Hybrid Electric Vehicles (FHEVs) and Plug-in Hybrid Electric Vehicles (PHEVs)) are gaining traction in the market.

As the pure electric vehicle market cools in North America and Europe, people are turning to these technologies that save fuel and do not require significant upfront costs. In March this year, the target for electric vehicle adoption in the US was revised downward from 67% by 2032 to 35%, reflecting a change in market expectations for the future pace of electric vehicle development.

Randy Park, CEO of Hyundai Motor America, noted that hybrid vehicle sales grew by 42% compared to the second quarter of last year, while total sales of pure electric vehicles in the US market increased by only 15%. He pointed out that sales of Hyundai's Tucson PHEV surged by 280% in February 2024, with a rapid recovery in hybrid and plug-in hybrid sales.

Hybrid vehicles currently hold the largest market share in the global electric vehicle sector. According to relevant reports, hybrid vehicles accounted for the largest share (60.1%) of all electric vehicles in 2023 and are expected to decrease to 46.1% by 2028. In contrast, pure electric vehicles accounted for 39.8% in 2023 and are projected to increase to 53.7% by 2028.

This trend indicates that while the market share of pure electric vehicles is gradually growing, hybrid vehicles will continue to play a significant role in the near and medium term.

The EU market also exhibits similar trends. According to the latest report from the European Automobile Manufacturers' Association (ACEA), the only powertrain category to register growth in June 2024 compared to the previous year was hybrid vehicles, with a 26.4% increase in registrations. Double-digit growth was observed in markets such as France, Italy, Spain, and Germany.

Honda's spokesperson further confirmed the market demand for hybrid vehicles: "Our popular hybrid models, including the Accord, CR-V, and now the Civic, offer higher fuel efficiency and are more accessible entry-level electric vehicles. This has led to strong customer demand for our hybrid models."

Global FHEV market growth is projected to increase year over year, peaking at 10.5% growth in 2030. This forecast suggests that hybrid vehicles will continue to play a crucial role in the coming years, particularly as pure electric vehicles face challenges related to cost and market acceptance.

However, the situation in the Chinese market differs. As pure electric vehicles have achieved parity with gasoline vehicles in terms of price, China remains a leader in pure electric vehicle sales. Although Japan leads the world in hybrid vehicle manufacturing, China demonstrates greater strength and market potential in promoting the popularization of pure electric vehicles due to their lower prices.

Hybrids Become a Recognized Transition Solution

With the continued surge in the hybrid vehicle market, a plethora of new models have emerged, injecting new vitality into the market.

At Kia's CEO Investor Day in April, the company announced an ambitious plan to expand its Hybrid Electric Vehicle (HEV) lineup from 6 models in 2024 to 9 models by 2028, enhancing its resilience to industry uncertainties.

This move underscores Kia's firm belief in hybrid technology, and most of the brand's major models will offer HEV powertrain options, further enriching consumer choices. Additionally, Kia shared plans to expand flexible production capacity for HEV and Internal Combustion Engine (ICE) models to adapt to evolving market demands.

Japan and South Korea's focus on hybrid vehicles has also contributed to the increase in the availability of Full Hybrid Electric Vehicles (FHEVs) in the market. Several Western automakers are actively expanding their product ranges to accommodate this trend, with Renault being a notable example.

Japanese automakers are actively exporting more hybrid models to Southeast Asian markets, particularly Indonesia, where they occupy over 90% of the market share. Renowned brands such as Toyota and Nissan have introduced their latest hybrid models in the Indonesian market to seize market opportunities.

For Toyota, a veteran hybrid vehicle manufacturer, the rising demand for hybrid vehicles is undoubtedly a beneficial supplement. Before launching its electric SUV at the end of 2022, Toyota faced criticism for its lack of electric vehicle offerings. However, as demand for pure electric vehicles cools and demand for hybrid vehicles rises, Toyota's hybrid technology once again highlights its market value.

Honda has also emphasized the importance of hybrid vehicles in its electrification strategy. A Honda spokesperson stated, "Hybrid vehicles serve as a bridge for customers transitioning from gasoline-powered vehicles to pure electric vehicles." Honda's new electric vehicle center in Ohio will feature a flexible production line capable of producing gasoline, hybrid, and pure electric vehicles, enabling it to effectively adapt to changes in market demand.

Earlier in 2024, Ford also expressed its intention to strengthen its hybrid product offerings and hopes to offer hybrid systems across all its models. This move further underscores the crucial role of hybrid technology in the current automotive market.

It is worth noting that Genesis, Hyundai's premium brand, previously stated its focus solely on pure electric vehicle production but now also expresses interest in launching hybrid vehicles. Hyundai believes that the transition to electric vehicles has "short-term and long-term requirements," hence offering a diversified product line to meet the needs of different consumers.

Hybrid vehicles, as a crucial transitional technology, continue to receive widespread market recognition. Global FHEV sales are expected to continue growing, albeit constrained by regulatory requirements for the transition to zero-emission vehicles. Nevertheless, many automakers still view hybrids as a transitional technology to meet current market demands and are actively developing hybrid product lines.

In the Asia-Pacific region, pure electric vehicles are expected to replace hybrids and dominate the market, with this transition anticipated to begin in 2024. However, in the European market, this scenario is not expected until 2029. Even by 2028, hybrids will continue to hold several times the market share of pure electric vehicles in South America, the Middle East, and Africa.