Zhou Hongyi's 'Chasing the Wind' and 360's 'Transformation'

![]() 08/15 2024

08/15 2024

![]() 654

654

Source | BohuFN

Author | Kai Kai

Not long ago, at the 30th Anniversary Dinner of the Internet, Zhou Hongyi and Pony Ma exchanged smiles. Pony Ma joked that Zhou Hongyi was "red as an internet celebrity.""In the past period, Zhou Hongyi was the only "walking traffic" that could match Lei Jun. Whether it was auctioning Maybachs, holding the '360 Auto Show', climbing onto the roof of the car show, or participating in the test drive of Xiaopeng Huitian's flying car, he managed to stand out on social networks.

Behind the frequent appearances, 360's ambition in large models is highlighted.

360 has long passed its peak years. In 2017, 360 listed on the A-share market through a backdoor listing, with a valuation of nearly 500 billion yuan, but today it is only worth 51 billion yuan. Over the years, 360 has tried many new businesses, but most of them did not pan out. According to the financial report for the first quarter of this year, 360's net profit is still declining.

After years of chasing trends, Zhou Hongyi has placed his bets on large models. As early as last March, 360 launched its first general-purpose large model, '360GPT,' and recently released China's first free security large model, as well as a new generation of 'AI Assistant' in collaboration with 15 other large models. From general-purpose large models to exploring their application scenarios, Zhou Hongyi leads 360 to every trend.

However, it's worth pondering: is the large model the right choice?

01 360's 'Chasing the Wind' Speed with Large Models

At the end of 2022, ChatGPT, a product of OpenAI, emerged, ushering in the AI era. 360 responded quickly, launching the 1.0 version of the 360 Brain large model just two days after Baidu Wenxin's announcement.

Zhou Hongyi stated that this was not a genuine product launch but merely a demonstration of the current prototype to the audience. Nevertheless, he invited the audience to ask questions about '360 Brain' during the event.

Despite imperfections in the question-and-answer quality, 360's share price still opened higher by about 7% after the event. Compared to Baidu Wenxin's 'prerecorded' announcement, 360's 'live' announcement garnered more attention. Perhaps this is why Zhou Hongyi, knowing that '360 Brain' was still immature, still chose to 'show it off to everyone.'

360's pursuit of large models may have set the tone from this point on. Three months later, the '360 Brain' large model had iterated to version 4.0, and 360 successively launched AI products such as 360 AI Search, 360 AI Browser, and the 360 AI Digital Human Platform.

These large model applications received good market feedback. According to the June ranking on aicpb.com, '360 AI Search' continued to lead the domestic AI application market in user visits, ranking first in domestic and global growth rates for three consecutive months since April.

Another AI product of 360, '360 Soda Office,' ranked 11th in domestic growth, with visits even surpassing the established office software WPS at one point.

Zhou Hongyi has always preferred to focus on large model applications themselves. During last year's World Internet Conference Wuzhen Summit, he stated that general-purpose large models train on general knowledge, and future competition will focus on application scenarios.

He believes there are two paths for large models: becoming more specialized or expanding in scale. The latter is OpenAI's development path, while the former deserves exploration by domestic enterprises.

As expected, entering 2024, 360 introduced several more versatile large model applications. In April, 360 launched '360 AI Office,' containing over 100 AI applications covering five core scenarios: image processing, writing assistance, document editing, video production, and document templates, fully meeting users' various office needs. It is reported that '360 AI Office' had nearly 20 million user visits on its launch day.

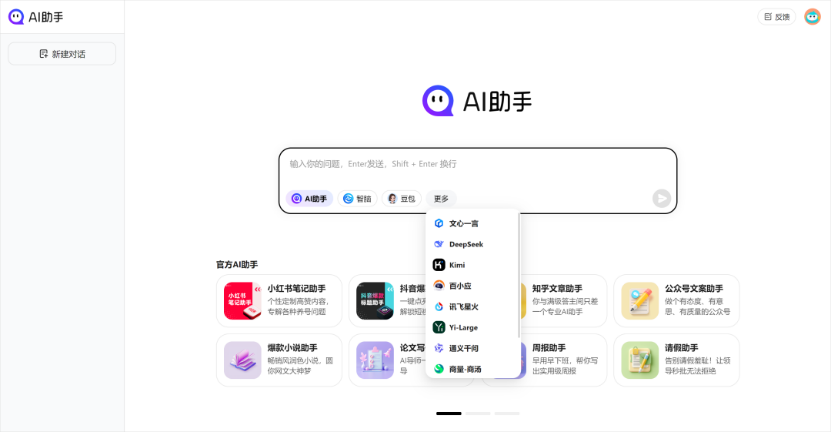

In July, Zhou Hongyi announced at the 12th Internet Security Conference that the '360 Security Large Model' would be officially free, signifying that internet security would officially enter the AI era. Additionally, 360 announced a collaboration with 15 large models to jointly release a new generation of 'AI Assistant' and integrate it into 360's national-level entry products.

In Zhou Hongyi's view, AI large models are not products but capabilities that must be combined with scenarios to unleash their value. Although 360's large model products may not be the most technically advanced in the industry, they undoubtedly have the broadest coverage and faster implementation speeds. Zhou Hongyi excels at chasing trends, and 360 builds products at a 'chasing the wind' speed.

02 AI Version of '360 Software'

However, judging from 360's series of large model products, its ability to 'chase the wind' is largely due to directly replicating its past operational experience and successful paths into large model products, which is precisely 360's most proficient approach.

First, 360's advantage as a leading search engine service provider in China allows it to find application scenarios closest to users through search as an entry point.

Since this year, large model manufacturers have unanimously bet on search scenarios, with Tencent, Alibaba, Baidu, Zhihu, and even OpenAI releasing AI search products or functions. Recently, OpenAI also launched the AI search engine SearchGPT.

Zhou Hongyi believes that OpenAI initially created ChatGPT and now SearchGPT. It's still unclear whether Search or Chat is more useful, but it demonstrates that AI search has become an important scenario for large models.

In the era of information explosion, search engines are crucial tools for people to obtain information, whether for learning, work, or even entertainment. Users have long developed search habits.

The shift from 'Chat' to 'Search' in large models reflects that users are still less receptive to 'asking questions' than 'searching,' possibly due to difficulties in framing questions or a preference for more direct answers from searches, thereby fostering the 'Search + AI' development path.

Compared to exploring new application areas, AI transformation of existing applications has the potential to create greater and faster commercial value. According to QuestMobile, over 40% of AIGC applications experienced traffic declines in the past year, with some high-traffic apps seeing uninstall rates as high as 70%. Zhou Hongyi's strategy of 'targeting familiar territories first' is clearly a clever move.

Second, 360's large model products continue the concept of 'mutual assistance and win-win cooperation.' In '360 AI Office' and '360 AI Assistant,' we can see the influence of 360 Security Guard.

While 360 Security Guard is a cybersecurity software, it also integrates products from different software developers. In 360's philosophy, this involves jointly exploring the market through an open platform with partners, essentially leveraging the platform for paid promotion of other software to monetize traffic and achieve profitability.

For 360, this model offers numerous benefits. For example, 360 can integrate all software with a single click without independent development, and the same applies to large model applications.

Currently, no single large model can claim to be the best at all tasks. In Zhou Hongyi's view, if there is no 'super app' in the market, 360 should be the 'aggregator.'

Only by expanding the market cake together with partners can 360 potentially share a larger piece, reflecting traditional internet thinking. Currently, the 360 AI Premium Membership system is available for 216 yuan per year. Besides subscription fees, as 360 AI products are poised to become new traffic entry points, they may generate additional traffic revenue.

Lastly, there's the free offering. Recently, Zhou Hongyi announced that the 360 Security Large Model, launched in March, would be officially free. He boldly stated his intention to dethrone large models and make them accessible and useful for every enterprise, rather than a tool for a few vendors to profit from.

It's worth noting that the 'free model' was also responsible for 360 Antivirus's rapid market penetration. When the Chinese internet was emerging, many people experienced malware and website virus attacks, creating a high demand for antivirus software, most of which were paid.

At this time, 360 chose a different path, leveraging a free model to achieve a breakthrough for 360 Antivirus. Now, it seems that 360 aims to replicate this success with the security large model.

However, the internet's 'free model' is no longer a secret, and the 'free then charge' strategy is ubiquitous. Even 360 Antivirus's so-called free offering was based on ad pop-ups and driving traffic to other software. Whether the security large model can achieve 'zero charges' remains questionable.

Nevertheless, with 360's three 'trump cards'—free traffic, the momentum of a 'large model aggregator,' and the search engine entry point, coupled with Zhou Hongyi's 'performance-oriented' speeches, 360's large model has clearly gained momentum.

03 Zhou Hongyi's 'Money-Making Ability'

Looking back at Zhou Hongyi's appearances over the past two years, whether in public speeches, brand endorsements, or live streaming promotions, each has been a noteworthy scene. His 'effective appearances' have gradually improved 360's performance.

According to 360's 2023 annual report, the company reported revenue of 9.055 billion yuan, a year-on-year decrease of 4.89%; net loss was 492 million yuan, a year-on-year narrowing of 77.65%. Operating cash flow net was 924 million yuan, a significant year-on-year increase of 65.84%.

360 mentioned in its financial report that with the support of the '360 Brain' large model, the 'AI content' of its products has continuously increased. Taking internet value-added services as an example, annual user payments increased by 50% year-on-year, and material production increased by 200% compared to non-AI, corresponding to revenue growth to approximately 1.1 billion yuan. Additionally, revenue from all internet products increased by 65.58% year-on-year to 138 million yuan.

Judging from these performance figures, 360's performance last year can only be described as 'barely profitable,' far from significantly boosting revenue. According to the company's 2024 interim results forecast, net profit attributable to shareholders is expected to be a loss of 240-350 million yuan, with the loss widening further.

Since its listing in 2018, 360's performance has been unsatisfactory, with only 2018 seeing positive growth in both revenue and net profit. Since then, revenue has declined since 2019, and net profit attributable to shareholders has declined since 2020, turning into a loss in 2022.

The main reason for 360's poor performance lies in its rigid business model and lack of new revenue sources. According to its 2023 annual report, internet advertising and services are 360's primary revenue source, but the overall market environment has been sluggish in recent years, affecting internet advertising revenue, which declined by 4% last year for 360.

360's second largest revenue source is security and other businesses, but its security product user base has continued to decline, with the average monthly active users of PC products dropping from 515 million in 2017 to 470 million at the end of last year.

The decline in these two major businesses is also related to users' growing aversion to forced pop-ups and installations. With the continuous improvement of internet laws and regulations, 360 has been called out by multiple departments for 'obnoxious pop-ups' and required to rectify the issue in recent years.

Therefore, 360's large model business is highly anticipated as a 'lifesaver' for the company. Zhou Hongyi revealed in a live stream that the '360 AI Office' product, launched this year, plans to generate 100 million yuan in revenue in its first year.

Of course, 100 million yuan in revenue is merely a drop in the ocean for 360 at present, but it's the best option given that old products have little new stories to tell.

However, how far 360's large model business can go remains uncertain. First, domestic users' habit of 'paid subscriptions' needs to be cultivated. Second, the revenue model for search engines needs to be explored, and inserting ads into them is more challenging than before.

Apart from revenue pressure, developing large models is also costly. 360's R&D expenses last year were 3.104 billion yuan, accounting for 34.28% of revenue. Moreover, the marginal cost of large models does not decrease with scale but increases, posing challenges in storage, reasoning, and management costs for companies.

Nonetheless, perhaps because Zhou Hongyi has always been high-profile in the spotlight, 360's performance remains relatively low-key, which may be Zhou Hongyi's strategy—'stirring up trouble' for himself to buy more time for 360 to explore different scenarios and business models for large model products, enabling AI large models to become the company's second growth curve.

Recently, 360 has begun making inroads into smart terminals, launching a large model children's watch. It is said that Zhou Hongyi has also changed his past stance of 'not promoting products' and may now promote his own products.

After years in the internet industry, most of Zhou Hongyi's contemporaries have retreated behind the scenes, but he has persisted as the 'Red Shirt Pope' turned 'Red Shirt Uncle,' remaining active in the spotlight, deserving recognition and respect for this alone.",

* The copyright of the cover and pictures of the article belongs to the copyright owner. If the copyright owner believes that his works are not suitable for browsing by everyone or should not be used free of charge, please contact us in time, and the platform will immediately correct it.