When switching to the Hong Kong Stock Exchange, Wendtong fell into the vicious circle of "increased revenue but no increased profits

![]() 08/16 2024

08/16 2024

![]() 654

654

Under the smart city trend, Wendtong also needs to lay a good foundation for growth

The continuous release of the demand for making cities 'smarter' has accelerated the development of some enterprises.

For example, Wendtong recently submitted a prospectus to the Hong Kong Stock Exchange and plans to list on the main board, with SinoLink Securities International and Capital Quest Capital as joint sponsors.

It is worth mentioning that in February this year, the Qingdao Securities Regulatory Bureau accepted Wendtong's application for counseling and filing for the initial public offering and listing on the Beijing Stock Exchange. However, considering the uncertainty of A-share listing, Wendtong decided to switch to the Hong Kong Stock Exchange.

According to Tianyancha, Wendtong is from Qingdao, Shandong, and was established in 2001, specializing in the research and development of artificial intelligence and big data technologies for smart city construction. Currently, it has formed a relatively diversified development path, with business segments covering information system integration solutions, property services, community lifestyle services, and other areas.

Among them, information system integration solutions refer to providing integrated information system solutions for communities, government agencies, and industrial parks; property services refer to providing housing and facilities maintenance, environmental management, greening maintenance, security management, order maintenance, conference services, and customer services for residential properties, commercial properties, government properties, public facilities, hospitals, schools, industrial parks, etc.; community lifestyle services mainly include new retail and catering services.

Such a diversified layout also helps enterprises open up greater growth space, especially against the backdrop of a high industrial boom.

According to Frost & Sullivan's report, Shandong Province's GDP ranked third nationwide in 2023, and its comprehensive smart city solutions industry revenue grew from 3.5 billion yuan in 2019 to 6.4 billion yuan in 2023, with a compound annual growth rate of 16.3%. It is expected that the industry size will increase from 7.5 billion yuan to 13.3 billion yuan from 2024 to 2028, with a compound annual growth rate of 15.5% during this period.

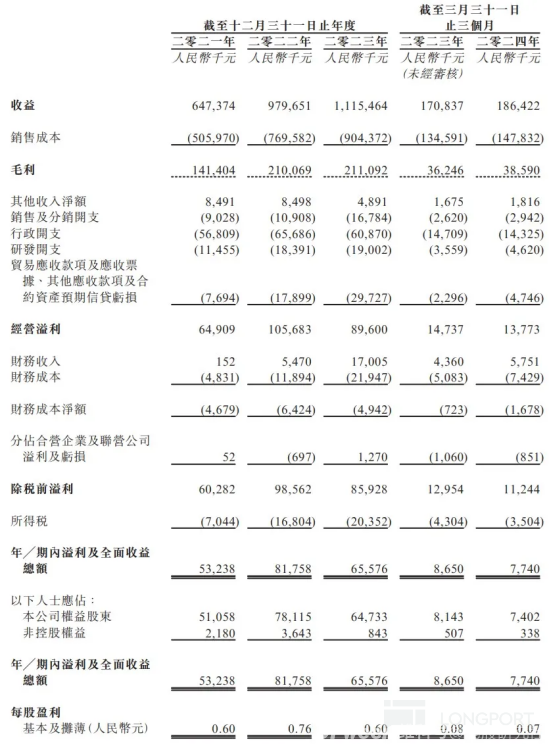

Against this backdrop, Wendtong's revenue growth has been relatively significant. According to the prospectus, Wendtong's revenue was approximately 647 million yuan, 980 million yuan, 1.115 billion yuan, and 186 million yuan in 2021-2023 and the first three months of 2024, respectively. However, in terms of profitability, Wendtong still has significant room for improvement.

The prospectus shows that Wendtong's net profit was approximately 53 million yuan, 82 million yuan, 66 million yuan, and 8 million yuan in 2021-2023 and the first three months of 2024, respectively, indicating a small overall scale and significant fluctuations. This also suggests that the enterprise has encountered certain obstacles in its development.

The company has stated that there is a possibility that property management services may be terminated or not renewed, which could adversely affect the company's financial position. In addition, delayed payments and arrears from customers will also put considerable operational pressure on the company. The prospectus data actually reflects these issues.

It is reported that from 2019 to 2023, Wendtong's accounts receivable turnover days have increased from 70.19 days to 118.46 days; net cash flow from operating activities was -27.9416 million yuan, 36.4869 million yuan, -24.1944 million yuan, -267.3029 million yuan, and -221.3041 million yuan, respectively. Overall asset liquidity is relatively weak.

At the same time, China's comprehensive smart city solutions industry is relatively fragmented and competitive. According to Frost & Sullivan's report, there are approximately 400-500 participants in this industry, including 250-300 private participants, posing significant development challenges for enterprises.

Although Wendtong has a prominent position in Shandong Province, according to Frost & Sullivan's data, Wendtong ranked second among innovative private enterprises in Shandong Province's comprehensive smart city solutions industry in terms of revenue in 2023. However, there are more powerful enterprises nationwide.

Taking Poly Property Services as an example, it has demonstrated significant scale advantages by actively exploring the in-depth application of digital technology in smart communities, public services, social governance, and other areas. Financial reports show that in 2023, Poly Property Services achieved revenue of 15.062 billion yuan, up 10% year-on-year; attributable profit was 1.38 billion yuan, up 24% year-on-year; and basic earnings per share were 2.505 yuan.

Against this backdrop, Wendtong undoubtedly needs to actively tap into its own business potential. Regarding future development, Wendtong also has specific plans. For example, it has disclosed that the proceeds from this IPO will be mainly used to enhance smart city solutions capabilities, upgrade products and technologies; expand business through strategic alliances, investments, and acquisitions; and expand the new retail service network.

It can be said that the company has come to an important energy storage period.