Cloud School lists on US stock market, SaaS enterprises listed in succession with "losses"?

![]() 08/20 2024

08/20 2024

![]() 437

437

Recently, Cloud School, China's largest digital enterprise learning solution provider, rang the bell on Nasdaq and became the "first Chinese digital enterprise learning stock" with the ticker symbol "YXT". On its first day of trading, Cloud School closed at $10.02, an 8.91% decline from its issue price, with a total market value of $5.95 billion.

Image source: Weibo screenshot

According to the official website, Cloud School is an AI-powered digital enterprise training platform that provides digital enterprise learning solutions, including software SaaS services, content solution services, and digital enterprise learning operation services. Since its establishment in 2011, Cloud School has established branches in over 20 cities, including Shanghai, Guangzhou, and Shenzhen, and has served numerous leading enterprises as clients, such as Schneider Electric, Shanghai General Motors, Yunnan Baiyao, Easyhome, MINISO, and more.

Founder Lu Ruize (also known as Lu Xiaoyan) played a pivotal role in Cloud School's establishment and Nasdaq listing. Tianyancha shows that Lu Ruize is the actual controller and controlling shareholder of Cloud School, holding a 66.8485% stake. Other shareholders, such as Suzhou Xinzhiyun Business Management Consulting Center (limited partnership), Suzhou Dazhi Qihong Business Management Consulting Center (limited partnership), and Shanghai Himalaya Technology Co., Ltd., each hold less than 10% stakes.

Image source: Tianyancha

Beyond software operation services, Cloud School's business scope extends to the sports and health industries. Its invested Shanghai Zhuosu Sports Development Co., Ltd. focuses on sports, while Shenzhen Feitengshidai Health Management Co., Ltd.'s business scope includes fitness services, health and wellness management consulting, fitness app development and sales, hot food production and sales, among others.

According to Frost & Sullivan, Cloud School is China's largest digital enterprise learning solution provider based on total revenue, subscription revenue, and number of subscription customers in 2023. Nonetheless, Cloud School faces challenges such as declining revenue, shrinking customer base, and profitability difficulties.

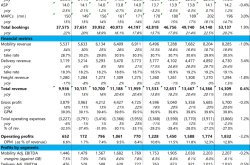

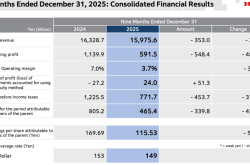

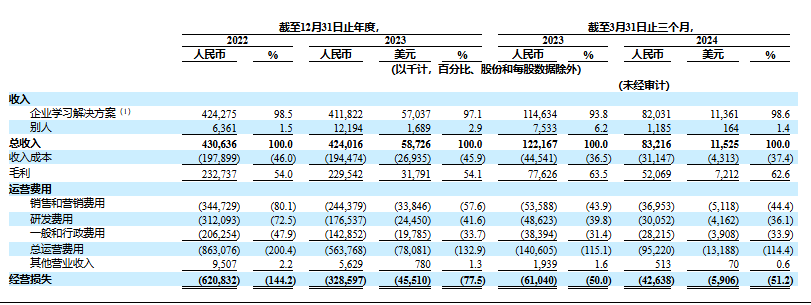

The prospectus reveals that Cloud School's total revenue was RMB 431 million, 424 million, and 83 million in 2022 and the first three months of 2023 and 2024, respectively. Notably, Cloud School's total revenue in 2023 declined by 1.6% from 2022, and in the first three months of 2024, it fell by 31.97% year-on-year from the same period in 2023 (RMB 122 million).

Image source: Prospectus

Concurrent with the decline in total revenue, Cloud School's number of subscription customers and net revenue retention rate of subscription customers have also decreased. In 2022 and 2023, Cloud School had 3,439 and 3,230 subscription customers, respectively, with net revenue retention rates of 118.1% and 101.4%. In the first three months of this year, these figures dropped to 2,434 customers and 106.1%, respectively, from 3,433 customers and 111.1% in the same period of 2023. Cloud School attributed this to its focus on large enterprise needs, leading to some small and medium-sized customers opting out.

Under these circumstances, Cloud School incurred losses of RMB 640 million and 230 million in 2022 and 2023, respectively. Although Cloud School turned a profit in the first three months of this year, some argue that this might be due to cost reductions, as its sales and marketing expenses, R&D expenses, and other costs have decreased.

According to the "China Enterprise SaaS Industry Development Research Report (2024)," China's SaaS industry, though starting late, has been steadily growing in scale. In 2023, China's SaaS market reached RMB 58.1 billion, with a growth rate of approximately 23.1%. iResearch predicts that this market will reach RMB 137 billion by 2026. As domestic competition intensifies, many SaaS enterprises are seeking listings to alleviate funding issues through capital raising.

Since 2023, Beisen Holdings has listed on the Hong Kong Stock Exchange, becoming "China's first HR SaaS stock," while Qiniu Cloud, Duodian Zhishu, Jushuitan, and other SaaS enterprises have also embarked on IPO journeys. One reason for the clustering of SaaS enterprises listings is to alleviate funding issues through capital raising. In fact, profitability challenges plague not only Cloud School but also many SaaS enterprises. From 2021 to 2023, Jushuitan incurred cumulative losses of RMB 700 million, while Qiniu Cloud incurred cumulative losses of approximately RMB 757 million. The losses incurred by many SaaS enterprises are closely related to their heavy investment in R&D and marketing. Many SaaS enterprises choose the Hong Kong Stock Exchange primarily due to its lenient listing conditions and policy support for technological innovation enterprises.

Image source: Xiaohongshu

However, listing is not necessarily a "cure-all" for SaaS enterprises. Last year, Ronglian Cloud, known as "China's first SaaS enterprise to list in the US," was delisted from the US stock market due to delayed annual report submission. Weimob Group, which listed on the Hong Kong Stock Exchange in 2019, is still incurring losses, with cumulative losses exceeding RMB 4.5 billion. This demonstrates that while listing can raise funds, enhancing profitability is crucial for long-term sustainability.

Currently, Cloud School has joined the ranks of listed SaaS enterprises, but this may only be the beginning. It remains to be seen whether Cloud School can sustain profitability and lead the domestic SaaS industry post-listing.