Big model, a battle iFLYTEK cannot afford to lose

![]() 08/23 2024

08/23 2024

![]() 447

447

Source: BohuFN

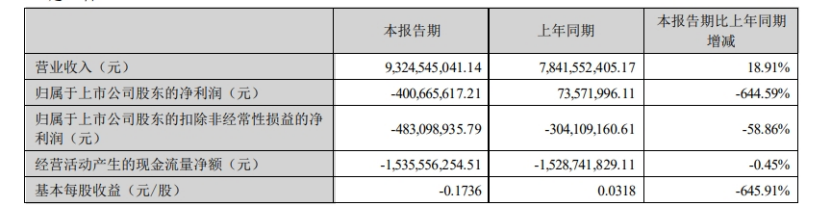

On August 21, iFLYTEK released its 2024 half-year report. Despite achieving revenue of 9.325 billion yuan in the first half of the year, a year-on-year increase of 18.91%, the company suffered a net loss of 401 million yuan, a decrease of 644.59% year-on-year. After excluding non-recurring items, the net loss continued at 483 million yuan, a decrease of 58.86% year-on-year, compared to a loss of 304 million yuan in the same period last year, indicating a further widening of the loss.

From its listing in 2008 to 2021, iFLYTEK maintained double-digit revenue growth. This is the first time since its listing that the company has reported a half-year loss. iFLYTEK attributed this to additional investments exceeding 650 million yuan in areas such as large model research and development, core technology autonomy, supply chain control, and the commercialization of large models.

At the end of 2022, the wave of generative large model research and development swept the globe, fueled by ChatGPT.

On one hand, there are rapid user growth and promising technological prospects, while on the other, there are significant cost pressures and investment needs. In this wave of AI technological transformation, AI companies are both 'enjoying' and 'enduring' the challenges.

Yet, among them, iFLYTEK, as the "national team" of the AI industry, perhaps feels this situation most acutely.

On one hand, iFLYTEK has reaped the benefits of AI, with its share price doubling in the short term as it capitalized on the popularity of large AI models. Its traditional businesses have also been empowered, giving it the aura of a "hexagonal warrior." On the other hand, its financial statements show escalating losses, particularly in its emerging large AI model business, illustrating the phrase "money burns like water."

Lei Jun once said, "When the wind blows, even a pig can fly."

Lei Jun's remark was heartfelt, but for iFLYTEK, standing firmly in this windstorm poses significant challenges.

01 Focus on Large Models

From a temporal perspective, speed is the immediate impression iFLYTEK's Spark Cognitive Large Model has left on the industry.

In just over a year, iFLYTEK's Spark Cognitive Large Model has progressed from its initial release to version 4.0.

Notably, on June 27 this year, iFLYTEK unveiled Spark Cognitive Large Model V4.0, marking a significant enhancement in capabilities. According to official claims, the upgraded Spark V4.0 comprehensively benchmarks GPT-4 Turbo in terms of underlying capabilities, surpassing it in 8 out of 10 English evaluations (HumanEval, WinoGrande, GPQA, etc.) and 2 Chinese evaluations (C-Eval, CMMLU).

The phrase "benchmarking GPT-4" sounds familiar.

A year ago, the "Hundred Models War" raged, with various players sharpening their swords and voicing ambitious claims.

iFLYTEK was among them.

On May 6 last year, iFLYTEK released the 1.0 version of its Spark Cognitive Large Model, with CEO Liu Qingfeng vowing to benchmark ChatGPT by October, surpassing it not only in Chinese but also in English, despite GPT-4's emergence in March of that year.

This ambitious declaration ignited market enthusiasm, driving iFLYTEK's share price to surge and set new highs, with its market value briefly exceeding 170 billion yuan.

Fast forward to today: After a year, iFLYTEK unveiled Spark Cognitive Large Model V4.0 in Beijing, along with its applications in healthcare, education, business, and other sectors. Based on China's first domestically produced "Feixing 1" supercomputer cluster, Spark V4.0 comprehensively benchmarks GPT-4 Turbo and surpasses it in text generation, language understanding, knowledge-based question answering, logical reasoning, and mathematical abilities.

Remarkably, Spark V4.0 outperformed GPT-4 Turbo in 8 out of 12 mainstream large model evaluations, both domestic and international.

Liu Qingfeng further revealed that Spark's app downloads have surged to 131 million, attracting a loyal user base and spawning popular assistant applications. With Spark's empowerment, sales of some smart hardware products have grown significantly, up over 70% year-on-year, with monthly usage exceeding 40 million times.

02 The Inevitable Challenge of Burning Cash

In 2024, iFLYTEK remains ambitious.

At its 2023 annual meeting, Chairman Liu Qingfeng and President Wu Xiaoru stated that iFLYTEK had joined the first tier of China's large model landscape in 2023, with goals for 2024 including "1 million ecosystem partners, 10 million hardware terminals, and 100 million software users."

Undoubtedly, the OpenAI wave propelled related industries to new heights, positioning iFLYTEK as one of China's few core players with large model technology.

However, despite this extensive AI large model business layout, iFLYTEK failed to enter a high-growth trajectory, still grappling with the dilemma of rising revenue but stagnant profits.

In 2023, iFLYTEK's performance resembled a rollercoaster: quarterly net profits were -57.8953 million yuan, 131 million yuan, 25.7901 million yuan, and 558 million yuan, respectively. The full-year non-recurring net profit decreased by 71.71% year-on-year. The Q1 2024 financial report showed that while revenue grew 26.3% year-on-year to 3.65 billion yuan, losses widened – with net parent company losses reaching 300 million yuan and non-recurring losses hitting 440 million yuan.

Especially after the half-year report's release, iFLYTEK experienced its first post-IPO loss, significantly impacting its share price.

Compared to its peak market value after the release of Spark Cognitive Large Model a year ago, iFLYTEK's current total market value has nearly halved, shrinking by nearly 100 billion yuan.

In iFLYTEK's AI investment strategy, substantial investments in large models have directly contributed to its losses. Statistics show that in 2023, iFLYTEK invested over 2 billion yuan in Spark Cognitive Large Model research and development, with total R&D investment exceeding 3.837 billion yuan. In early 2024, the company invested approximately 300 million yuan in large model research and development, core technology autonomy, and supply chain control.

Large models are expensive, with computing power being a significant cost. In 2023, iFLYTEK purchased 1.7 billion yuan worth of server equipment, despite having less than 300 million yuan in its account. While iFLYTEK anticipates a smaller increase in computing power investments compared to R&D, the depreciation period specified in its annual report necessitates amortizing over 300 million yuan annually from the new 1.73 billion yuan investment.

Against this backdrop, Liu Qingfeng reiterated the necessity of increased R&D investment during the Q1 2024 earnings call. "Facing immense industry opportunities, iFLYTEK will invest aggressively," he said. "Last year marked the inaugural year of Spark, and this year will see its flames spread. Market investments are bound to increase." Clearly, continuous capital injection remains the main theme of iFLYTEK's 2024 strategy.

However, objectively speaking, Spark has empowered many of iFLYTEK's businesses, linking them to its model's capabilities and delighting the market, as evidenced in its financial reports. Furthermore, its free software applications have gained increasing user recognition.

Since its full launch in September last year, Spark's app has amassed 131 million downloads on Android, ranking among the top large model apps in China. Popular assistants such as Copywriter Master, Writing Assistant, and PPT Outline Assistant have emerged, satisfying users' needs in work, study, and daily life. On the App Store, user ratings and scores lead domestic competitors, with a steady user base ranking top in the industry.

03 The Harsh Reality

Before Spark's emergence, Liu Qingfeng set ambitious goals for iFLYTEK in 2021: "100 million users, 100 billion yuan in revenue, and a trillion-yuan ecosystem." He stated, "We aim to achieve these milestones within the next five years, during the 14th Five-Year Plan period." However, 2022 revenue fell short of 19 billion yuan, with minimal growth.

Moreover, iFLYTEK has long faced criticism for being adept at securing funding (government subsidies) but less so at generating profits. Therefore, Spark has been viewed as iFLYTEK's savior since its inception.

Multiple institutions argue that large models will usher in a new era of growth. Goldman Sachs predicts that generative AI will drive global GDP growth by 7% over the next decade, equivalent to nearly $7 trillion. Gartner anticipates that over 80% of enterprises will adopt generative AI by 2026.

However, in the short term, it's unrealistic for iFLYTEK to rely solely on large models to achieve its 100 billion yuan revenue target.

Firstly, large models are a costly and prolonged battle. iFLYTEK's investments in large models have continuously increased its R&D expenditures, exacerbating financial pressures amidst weak primary business performance. The market is questioning whether iFLYTEK's heavy investments in AI large models are the right path.

Secondly, current domestic large model products face challenges: insufficient technological intelligence and intense competition before groundbreaking breakthroughs.

For instance, compared to OpenAI, the frontrunner in large models, iFLYTEK still lags technologically.

Although iFLYTEK repeatedly claims that Spark will surpass ChatGPT in functionality, Chairman Liu Qingfeng admits, "Domestic large models still lag behind GPT-4 in complex knowledge reasoning, rapid learning from small samples, processing of ultra-long texts, and cross-modal understanding." Meanwhile, OpenAI continues to optimize ChatGPT. According to Mira Murati, OpenAI's CTO, GPT-5 may achieve "doctoral-level" intelligence in specific tasks by late 2025 or early 2026."It's evident that as long as competition exists, investments in large models will continue indefinitely. iFLYTEK's bet on large models is undoubtedly a risky gamble. Amidst the technological melee, iFLYTEK's path to profitability with Spark remains uncertain.

Moreover, as domestic and international large model vendors compete, price wars in the large model market intensify. ByteDance, Alibaba Cloud, Baidu, Tencent, and other companies have joined the fray, driving prices down further. Some insiders even joke that the next company may have to pay customers to use their large models!

In May this year, ByteDance's cloud platform Volcano Engine announced that its self-developed Doubao Large Model was officially available, offering pricing significantly lower than industry standards. Subsequently, Alibaba, Baidu, Tencent, iFLYTEK, and other vendors followed suit with price cuts.

Behind the price wars lie decreasing computing costs from technological advancements and survival anxiety amid intensified market competition. Vendors compete to lower the cost of using large model APIs to capture market share.

At the nascent stage of this costly business, this is not a good sign.

Furthermore, iFLYTEK faces severe challenges in promoting the commercialization of large models. While Spark has achieved numerous technological breakthroughs, translating these into actual productivity and commercial success is a complex and lengthy process.

Securing funding and maximizing revenue are crucial questions for AI companies in the era of large models.

iFLYTEK's Chairman once outlined three commercialization paths for Spark in 2024: empowering C-end hardware for sustained growth, serving B-end industries like education, healthcare, automotive, finance, energy, and telecom through customized models, and selling APIs through the iFLYTEK Open Platform.

Since iFLYTEK officially launched Spark in May 2023, its monetization strategies can be summarized as empowering existing businesses, licensing APIs, and offering customized enterprise models. Notably, only C-end hardware under existing business segments has shown notable results, with smart hardware revenue reaching 1.617 billion yuan, up 22.35% year-on-year, and smart automotive business surging 49.71% to 695 million yuan. Clearly, the latter two models are not profitable.

Earlier, rumors circulated that Huawei would terminate many collaborations with iFLYTEK. iFLYTEK denied these rumors, emphasizing its strong partnerships with Huawei in areas like Ascend computing power, smart devices, HarmonyOS ecosystem, and sports health.

For iFLYTEK, its all-in bet on Spark Cognitive Large Model represents a risky and uncertain gamble filled with challenges.

*The cover image and accompanying images belong to their respective copyright holders. If the copyright owner believes their work is inappropriate for public viewing or should not be used without compensation, please contact us promptly, and we will make the necessary corrections immediately.