Will the rise of solid-state batteries mark the 'end' of extended-range electric vehicles?

![]() 08/27 2024

08/27 2024

![]() 602

602

Original by New Energy Perspectives (ID: xinnengyuanqianzhan)

Driven by innovations in new energy technologies, electric vehicles have become an irreversible trend. The automotive industry is accelerating its transition towards electrification, and the emergence of solid-state batteries could revolutionize the future of electric vehicles in this process.

Meanwhile, as one of the key types of new energy vehicles, extended-range electric vehicles (hereinafter referred to as 'EREVs'), as a transitional product, will inevitably face challenges to their market position with advancements in solid-state battery technology. Solid-state batteries could very well be the final straw that breaks the camel's back for EREVs.

In the future, as solid-state battery technology continues to mature and large-scale commercialization becomes a reality, the driving range and performance of battery electric vehicles (BEVs) will significantly improve. This will undermine the rationale for EREVs, leading to a gradual decline or even disappearance of their market share.

1. Solid-state Batteries

A Major Breakthrough?

News about solid-state batteries always stirs up excitement in the automotive industry, and this time it's Guangzhou-based Penghui Energy leading the charge.

On August 21st morning, Penghui Energy announced via its official Weibo account that it would hold a technology conference on August 28th to unveil a series of groundbreaking new products, teasing, "A major breakthrough in Penghui Energy's all-solid-state batteries! Live debut!" The capital market responded immediately, with Penghui Energy's share price surging at the opening bell, triggering a trading halt due to the share price limit-up rule, and driving up the entire solid-state battery sector.

Image/Penghui Energy promoting solid-state batteries

Source/Screenshot from New Energy Perspectives, sourced from the internet

Since their inception, lithium-ion batteries have been an integral part of portable electronic devices and electric vehicles. However, as the electric vehicle industry has rapidly developed, the limitations of traditional lithium-ion batteries have become increasingly apparent, particularly in terms of energy density, safety, and longevity.

Against this backdrop, solid-state batteries, as the rising stars of the battery industry, have long been a key area of competition among major companies due to their advantages of high energy density, high safety, and fast charging capabilities.

Toyota was one of the first companies to invest in solid-state battery technology research and development. In 2021, Toyota announced plans to commercialize solid-state batteries around 2025 and apply them to electric vehicles from 2027 to 2030.

According to Toyota's projections for solid-state batteries, their energy density will be more than 50% higher than that of existing lithium-ion batteries. More importantly, their safety is significantly enhanced due to the absence of liquid electrolytes, reducing the risk of thermal runaway.

Furthermore, solid-state batteries offer fast charging capabilities, with reported charging times of less than 10 minutes. Their cycle life is typically longer than that of traditional lithium-ion batteries, providing a more extended service life.

Despite their numerous advantages, solid-state batteries still face challenges such as high costs and technical difficulties in large-scale production. However, as research deepens and investments increase, these issues are gradually being resolved. This year, multiple companies have announced significant progress in their all-solid-state battery research, attracting significant industry attention.

Image/Advantages of solid-state batteries

Source/Screenshot from New Energy Perspectives, sourced from the internet

CATL, a global leader in power batteries, first disclosed its progress in all-solid-state battery research in April this year, planning to achieve small-scale mass production by 2027. CATL's Chief Scientist Wu Kai revealed that the company has been working on solid-state battery research for over a decade, assembling a research team of nearly 1,000 people focused on solid-state batteries and new battery systems.

At the Guoxuan High-Tech Technology Conference held in May, Guoxuan High-Tech unveiled its all-solid-state battery technology in the form of the Jinshi battery. Pan Ruijun, Chief Engineer of Guoxuan High-Tech's all-solid-state battery project, stated at the time that the company planned to conduct small-scale vehicle tests with its all-solid-state batteries in 2027 and expected to achieve mass production by 2030 if testing went smoothly and the supply chain was established.

Sunwoda plans to achieve mass production of all-solid-state batteries in 2026, with its first-generation all-solid-state batteries boasting an energy density of 400 Wh/kg. EVE Energy also plans to launch all-solid-state batteries targeted at the hybrid power sector in 2026.

Since last year, up to the end of June this year, China has seen more than 11 proposed investments in semi-solid and all-solid-state battery projects, totaling 66.43 billion yuan in investments. This figure does not include plans by Taiwan's EEStor, which intends to build a new solid-state battery factory in France with an estimated investment exceeding 40 billion yuan.

2. Extended-Range Electric Vehicles

A Transitional Product with a Built-in 'Power Bank'

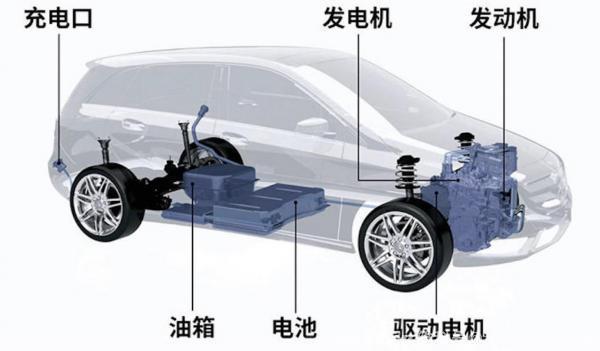

Extended-range electric vehicles (EREVs) are a unique type of hybrid vehicle. Simply put, an EREV is like a BEV with a built-in 'power bank' in the form of an additional engine (range extender) and generator. This design was initially proposed to alleviate range anxiety in BEVs.

EREVs operate in four modes: 1) Directly powered by the traction battery pack; 2) Powered by electricity generated by the range extender and generator; 3) Simultaneously powered by the range extender, generator, and traction battery; 4) Powered by electricity generated by the range extender and generator, while simultaneously charging the traction battery.

As we all know, EREVs emerged to address some of the current shortcomings of BEVs. What are the main drawbacks of BEVs? First, their large-capacity traction batteries have low energy density and are expensive. Second, there are insufficient charging stations in urban and highway areas, resulting in slow charging speeds and time-consuming charging processes. Third, the driving range does not meet the needs of long-distance driving, leading to range anxiety, which is a persistent issue for BEVs.

Thus, EREVs came into being. Their advantage lies in their versatility, as they can be fueled by either gasoline or electricity. When it's inconvenient to find a charging station while traveling, drivers can simply fill up at a gas station.

Image/Simplified illustration of an EREV

Source/Screenshot from New Energy Perspectives, sourced from the internet

In the domestic market, during the new era of smart electric vehicles, new players such as Lixiang, Wenjie, Shenlan, NIO, Leapmotor, and YITO have entered the EREV market, adopting the extended-range technology route for new energy vehicles. However, some automakers remain cautious about EREVs.

BYD Chairman Wang Chuanfu has publicly stated that "EREVs are transitional products, and the true path to electrification lies in BEVs." He believes that as battery technology advances, the driving range of BEVs will continue to increase, gradually reducing the market space for EREVs.

Similarly, NIO's founder Li Bin has also expressed that "EREV technology is not the future direction, and we are more optimistic about the prospects of BEVs."

Even Li Xiang, founder of Lixiang, has bluntly stated that EREVs are transitional products with a lifespan of only 3-5 years. He believes that as battery technology improves and costs decrease, BEVs will gradually become mainstream, while EREVs will lose their market.

These views reflect a consensus within the industry regarding future development directions. However, what is the current situation in the automotive consumer market? Sales figures are surprising, as EREVs are not showing signs of decline but rather expanding rapidly.

3. Future Outlook

Solid-State Batteries Will Spell the End for EREVs

According to monthly sales data released by the China Passenger Car Association, a total of 1.72 million passenger cars were retailed nationwide in July, with 878,000 of these being new energy vehicles.

Image/Passenger car market sales in July 2024

Source/China Passenger Car Association, screenshot from New Energy Perspectives

The key takeaway here is that among BEVs, plug-in hybrids, and EREVs, EREVs recorded the largest year-on-year and month-on-month growth in sales, indicating a rapidly expanding market.

Taking wholesale sales as an example, EREV sales in July reached 122,000 units, up 115% year-on-year and 5% month-on-month, standing out as a clear leader. Moreover, in terms of the share of new energy vehicles sold that month, EREVs increased from 8% in 2023 to 13%.

This presents a paradox in China's new energy vehicle industry: on the one hand, EREV technology is considered non-mainstream and EREVs are viewed as transitional products; on the other hand, consumers favor them, and sales figures continue to grow. How should we interpret this?

In reality, it's simply a matter of time. In a nutshell, the iconic newcomer that will signal the end of EREVs as a transitional product has yet to truly step onto the historical stage. That iconic newcomer is solid-state batteries, as mentioned earlier.

EREVs are currently a temporary substitute for the immaturity of BEV technology. Once BEVs achieve the following advancements, EREVs will lose their relevance:

Stable battery performance regardless of impact or high temperatures, eliminating the risk of spontaneous combustion or explosion and ensuring battery safety; significantly increased battery energy density, leading to noticeably longer driving ranges and greatly alleviating range anxiety; and less challenging charging under low temperatures, mitigating severe battery degradation in cold weather.

All these issues can be addressed by solid-state batteries, the future stars of power batteries.

Solid-state batteries' higher energy density and longer driving range will make BEVs more competitive, accelerating their popularization. For instance, if a BEV adopts solid-state batteries, its actual driving range could easily exceed 600 kilometers, significantly reducing range anxiety among consumers.

The BMW i3 REx, an early EREV model, featured a small gasoline engine as a range extender. This model received positive reviews in the market, particularly for addressing range anxiety. However, with advancements in battery technology and increased driving ranges, BMW has announced the discontinuation of the i3 REx to focus on BEV development.

Image/BMW i3 REx

Source/Screenshot from New Energy Perspectives, sourced from the internet

Tesla has always been a leader in the electric vehicle industry, with continuous advancements in battery technology, including the adoption of cobalt-free batteries, improved battery chemistry, and new manufacturing processes to reduce costs. These technological improvements will further enhance Tesla's electric vehicle performance and driving range, reducing the need for range extenders. Tesla CEO Elon Musk has publicly stated that with advancements in battery technology, Tesla no longer considers introducing a range-extended version of the Model S.

As Li Xiang of Lixiang Auto aptly put it, EREVs are merely transitional products. When solid-state batteries achieve large-scale commercialization, EREVs will complete their historical mission, becoming a relic of the past. As technology continues to advance, future electric vehicles will become safer, more reliable, and more efficient, offering an even better driving experience for users. In this process, solid-state batteries will be a crucial force driving the electric vehicle industry into a new stage of development.