iFLYTEK generated RMB 9.3 billion in revenue in 6 months

![]() 08/28 2024

08/28 2024

![]() 557

557

Large models may be one of the keywords in iFLYTEK's 2024 half-year report.

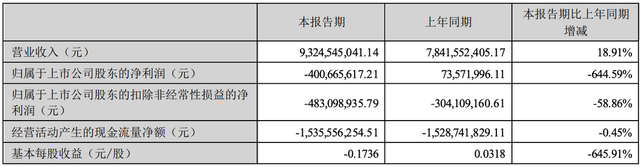

According to financial reports, the company achieved revenue of RMB 9.325 billion in the first half of the year, an increase of 18.91% year-on-year; net loss was RMB 400 million.

In fact, reviewing iFLYTEK's financial reports, it is not difficult to find that the main reason for its increasing revenue without increasing profits is the company's continued heavy investment in "cultivating" large AI models in the first half of this year. This means that iFLYTEK is concentrating all its resources on this critical battle, which can be seen as a second venture.

Successful commercialization is an important criterion for evaluating the success of large AI models. At this point in time, iFLYTEK's commercialization of large models is accelerating, increasing the chances of success for its second venture.

A critical battle

On the evening of August 21, iFLYTEK released its 2024 half-year report, which showed that the company achieved revenue of RMB 9.325 billion in the first half of the year, an increase of 18.91% year-on-year; net loss was RMB 400 million, compared to a net profit of RMB 73.57 million in the same period last year.

The financial report shows that in the first half of 2024, iFLYTEK achieved a gross profit of RMB 3.748 billion, an increase of 19.08% year-on-year, with total sales collections reaching RMB 9 billion, an increase of RMB 1.5 billion or 20.04% over the same period last year.

The increase in gross profit may be related to the strong sales of C-end hardware. According to the half-year report, driven by the Spark large model, the company's office hardware such as translators, office notebooks, and voice recorders increased revenue by RMB 900 million, an increase of 56.61% year-on-year. In addition, iFLYTEK's sales of learning machines have increased even more significantly.

In fact, reviewing iFLYTEK's financial reports, it is not difficult to find that the main reason for its increasing revenue without increasing profits is the company's continued heavy investment in "cultivating" large AI models in the first half of this year.

According to the financial report, iFLYTEK's R&D investment reached RMB 2.19 billion in the first half of this year, an increase of 32.23% year-on-year, accounting for 23.5% of revenue.

In this regard, iFLYTEK stated in its financial report that in order to actively seize the new historical opportunity of general artificial intelligence, it increased investment by more than RMB 650 million in the first half of 2024 in areas such as large model research and development, independent controllability of core technologies and industrial chains, and the commercialization of large models.

This means that iFLYTEK is still investing heavily in large AI models.

Growing pains

How long will this investment continue? iFLYTEK has also provided an answer. The company stated that in the coming years, with the support of relevant policies for large model research and development, it will not make large investments in computing power from its own funds and can maintain its industry-leading position in large model performance.

As we all know, cultivating large AI models is very expensive, and the computing power investment in buying "cards" is a very important part of it.

It is expected that for some time to come, iFLYTEK will continue to invest heavily in large models, but computing power investment will be relatively reduced. On the other hand, strategically, iFLYTEK will tilt towards C-end business, and future market-related expenses are likely to increase.

At this point in time, iFLYTEK acknowledged that the current economic and market situations are more severe than expected at the beginning of the year, and performance has not fully met year-end expectations.

As mentioned in iFLYTEK's financial report, there are many uncertainties in the industrialization and marketization of AI technology, and there is a risk that R&D investments may not achieve the expected results, affecting the company's profitability and growth potential.

From an industrial perspective, on one hand, there are rapidly growing user benefits and technological explosion potential, while on the other hand, there is cost pressure. This has led AI players to be "enjoying" the wave while also "suffering" through it.

Some estimates suggest that OpenAI, the American AI research company, is projected to lose US$5 billion this year, with total annual operating costs reaching US$8.5 billion.

The current challenge of "hematopoiesis" faced by all AI companies is undoubtedly an opportunity to calm down from the fever and return to the starting point of business.

There is a growing consensus in the industry that successful commercialization is an important criterion for evaluating the success of large AI models.

Reviewing each wave of technological change, almost every wave of innovative technology follows the pattern of commercialization becoming a critical node of competition after crazy money burning.

Dawn

iFLYTEK is a very pragmatic company.

Currently, iFLYTEK is paying increasing attention to cash flow and the hematopoietic capacity of its AI business. While fully increasing R&D investment, iFLYTEK is also accelerating the commercialization of its large models.

On August 22, Liu Qingfeng, Chairman of iFLYTEK, stated at the 2024 Half-Year Earnings Conference that the key work of commercializing large models currently focuses on the following three levels:

First, accelerating large-scale deployment in existing scenarios such as education, healthcare, and automobiles:

Second, externally empowering large models;

Third, the company is actively investing in exploring large model C-end applications represented by the Spark APP, while paying attention to transformative innovation opportunities based on the integration of large model hardware and software products.

Liu Qingfeng said that based on iFLYTEK's solid foundation in large model deployment scenarios such as education, healthcare, and automobiles, the company can achieve large-scale monetization in its existing businesses. Large models are permeating the company's "7+3" strategic business, enhancing the competitive barriers of related businesses.

It should be noted that the "7" refers to strategically focused businesses, which mainly include key products in sectors such as education, consumers, and smart cars that have the potential to reach billions to tens of billions in value; the "3" refers to exploratory businesses with a focus on exploring the Spark large model in both C-end and B-end applications, as well as exploring operational business models for the Spark large model in the medical field.

Regarding external empowerment of large models, Liu Qingfeng introduced that iFLYTEK has become a large model partner for leading enterprises in various key industries such as State Power Investment Corporation, China National Petroleum Corporation, China Energy Conservation and Environmental Protection Group, China Mobile, PICC Property and Casualty Company Limited, China Pacific Insurance (Group) Co., Ltd., Bank of Communications, Chery Automobile, FAW Group, Volkswagen Group, China Resources, Haier Group, and Midea Group.

According to the "China Large Model Bidding Project Inspection Report (July 2024)" compiled by the media, iFLYTEK became the player with the highest number of successful large model bids in the first half of the year. Central state-owned enterprises are typical representative customers for the implementation of iFLYTEK's Spark business. Meanwhile, a total of 112 large model bidding projects were publicly announced in July, with iFLYTEK leading in the number of successful bids and showing a steadily increasing trend.

Liu Qingfeng said that as the only large model trained based on a domestically produced computing power platform in China, Spark is fully independent and controllable. iFLYTEK has undertaken multiple national strategic tasks from the National Development and Reform Commission, Ministry of Industry and Information Technology, Ministry of Science and Technology, and Chinese Academy of Sciences. With confidence in its general large model foundation, iFLYTEK aims to represent China in comparison with the United States and work with central state-owned enterprises to orderly promote the benefits of large models in various industries.

Significant progress has also been made in exploring C-end commercial applications. Liu Qingfeng introduced at the earnings conference that as of August 2024, the Spark APP had been downloaded 169 million times on Android devices, ranking among the top in domestic general large model APPs for tools. iFLYTEK Health is also actively exploring operational services for the iFLYTEK XiaoYi APP and extending B2B2C business models based on cooperation with hospitals in patient services and post-consultation management.

Liu Qingfeng revealed that in the future, Spark will focus on robots, VR, wearable devices, and other areas, relying on the iFLYTEK Robot Super Brain platform to enhance embodied intelligence capabilities such as robot dialogue and understanding, significantly improving multimodal interaction capabilities and realizing greater commercial value. Currently, the market coverage of domestic service robots has reached 90%.

In fact, the results of iFLYTEK's commercialization of large models have begun to be reflected in its financial reports. Driven by large AI models, iFLYTEK's core businesses such as education, healthcare, automobiles, open platforms, and consumers are accelerating their growth.

The financial report shows that in the first half of this year, the education business contributed RMB 3.012 billion in revenue, an increase of 24.41% year-on-year; the healthcare business contributed RMB 228 million in revenue, an increase of 18.80% year-on-year; the open platform contributed RMB 2.34 billion in revenue, an increase of 47.92% year-on-year; smart hardware contributed RMB 900 million in revenue, an increase of 56.61% year-on-year; and the automobile business contributed RMB 350 million in revenue, an increase of 65.49% year-on-year.

Liu Qingfeng introduced that focusing on large models to penetrate the "7+3" strategic business, the company has formulated a three-year plan (2024-2026) to continuously promote the industrialization and commercial closed-loop of large models.

Conclusion

Currently, the wave of artificial intelligence is sweeping through various industries worldwide, and with the emergence of many commercialized deployment scenarios, people are realizing that the future has arrived.

However, on the eve of large-scale commercialization, all technology companies involved are facing critical decisions: on one hand, there are explosive technological dividends, and on the other hand, there is cost pressure.

For iFLYTEK, its all-in bet on the "Spark large model" is undoubtedly fraught with challenges and uncertainties.

Successful commercialization is increasing the chances of success in this uncertain challenge. As can be seen from the latest "report card" disclosed, the commercialization process of iFLYTEK's Spark large model is accelerating.

"After the mud comes the smooth road," and the wave of AI is destined to be the future of the era. Many institutions claim that large models will usher in a new era of growth. Goldman Sachs predicts that generative AI will drive a 7% increase in global GDP over the next 10 years, equivalent to nearly US$7 trillion; Gartner expects that more than 80% of enterprises will use generative AI by 2026.