Three years after separating from Huawei, Shenzhen's super IPO is accelerating

![]() 08/28 2024

08/28 2024

![]() 465

465

Preface:

The market continues to closely watch whether Honor can become another domestically produced smartphone brand to successfully list on the capital market after Xiaomi and Transsion.

In response, Honor has recently also made a statement, indicating that it will commence shareholding reforms in the fourth quarter and plans to initiate the IPO process at an [appropriate time].

Author | Fang Wensan

Image source | Network

Honor recently received strategic investment from China Mobile

Recently, Honor announced that it has successfully received strategic investment from China Mobile. Previously, there were rumors in the industry that the two companies were negotiating a new round of financing.

In its statement, Honor emphasized that as a leading enterprise in the smart terminal industry, it has a diversified product line.

China Mobile, on the other hand, has significant advantages in channel resources and user base.

There is broad potential for cooperation between the two parties in areas such as innovation in providing integrated solutions for consumers, in-depth development in the Chinese market, and expansion of high-end user groups.

This cooperation will enable both parties to fully leverage their respective advantages and jointly strive to provide consumers with better and more innovative products and service experiences.

China Mobile has strong operator channel resources globally and is actively expanding its international presence, particularly accelerating its overseas market layout.

At the same time, Honor is also actively expanding into overseas markets, especially in Europe and the Americas where operator channels dominate.

Therefore, with the investment from China Mobile, Honor is expected to leverage China Mobile's channel resources to achieve faster development in both domestic and international markets.

Honor IPO is accelerating

In November 2023, Honor issued a statement expressly stating that to promote the company's future strategic development, it would continuously optimize its shareholding structure, attract diversified capital participation, and plan to enter the capital market through an IPO.

Meanwhile, Mr. Wu Hui, who previously served as Chairman of Shenzhen Environmental Water Group under the Shenzhen SASAC, was appointed Chairman of Honor, while former Chairman Wan Biao took on the role of Vice Chairman.

Such personnel adjustments aim to meet the governance and regulatory needs of the company entering a new stage of development.

Honor believes that as the company's public market strategy is gradually implemented, the board of directors will be optimized in accordance with listed company standards, and the board membership will tend to diversify.

The latest confirmation of [shareholding reforms in the fourth quarter], following the November 2023 announcement of [IPO without backdoor listing], is another official confirmation of Honor's listing plans.

As early as April 2022, there were reports that Honor was seeking funding at a valuation of $45 billion.

In November of the same year, the company was rumored to have received billions of yuan in strategic investment from investors including BOE and CICC Capital.

Reuters reported that Honor planned to list this year or early next year and might receive special support from the Shenzhen government.

Two sources familiar with the matter disclosed that the company is seeking a listing on China's A-share market and expects a higher valuation, with a possible listing this year or early next year.

According to IDC's report, smartphone shipments in the Chinese market reached approximately 71.58 million units in the second quarter of 2024, achieving year-on-year growth of 8.9%, continuing the growth trend.

Within this market, Honor ranked fourth with a market share of 14.5%.

According to data provided by Qichacha, Honor currently has 15 shareholders, with Shenzhen Zhixin New Information Technology Co., Ltd. being the largest shareholder.

The company's shareholder composition is diverse, including state capital, private equity funds, and investors related to the industry chain such as BOE.

Taking a step forward towards the capital market after three years of independence

With consumer demand at its core, Honor boasts a rich product line encompassing mobile phones, full-scenario products, and a full-scenario operating system, covering five major application scenarios: mobile office, smart home, sports health, audio-visual entertainment, and smart travel.

In terms of mobile phones, Honor offers a range of models, including foldable flagships, all-around flagships, digital series, and X series; while its full-scenario products include watches, headphones, personal computers, tablets, smart screens, etc.

To ensure timely delivery of products to consumers, Honor has established three regional supply centers in the Netherlands, Dubai, and Shenzhen;

and over 30 provincial integrated warehouses in China, along with warehouses in seven countries, including Mexico, the UK, Malaysia, and South Africa.

According to Huawei's financial reports, one of the reasons for changes in the company's fair value in recent years includes the sale of businesses such as Honor.

Between 2020 and 2023, the fair value changes of this business amounted to approximately RMB 500 million, RMB 57.4 billion, RMB 24.5 billion, and RMB 55.8 billion, respectively.

In 2023, Honor achieved over 200% growth in overseas markets and profitability growth within two years.

Honor boasts billions of yuan in cash flow on its balance sheet, with a cash conversion rate reaching 120% to 130%.

Honor believes that the core of its AI mobile phone strategy lies in reconstructing AI capabilities at the operating system level to achieve AI-ization of terminal operating systems.

Currently, the company has invested RMB 10 billion in AI and plans to further increase its investment in the future.

Earlier this year, Honor officially launched its new operating system, MagicOS 8.0, integrating an AI large model with 7 billion parameters called [Magic Large Model] that was independently developed;

and introduced a new paradigm for intelligent terminal interaction based on intent recognition – Intent Recognition Human-Machine Interaction.

A policy document reveals that the Chinese manufacturer aims to ship 100 million mobile phones annually by 2026, representing a 75% increase from 2023, and plans to rank among the top three global mobile phone suppliers by 2028.

Expanding into overseas markets is undoubtedly a challenging path as well

In the international market, Honor plans to establish the European market as its [second home market] and expects overseas sales to surpass those in the Chinese market within the next three to five years.

According to Canalys, a market analysis firm, Honor successfully ranked among the top five mobile phone brands in Latin America in the first quarter of 2024, with its market share growing to 7% and year-on-year growth reaching 293%.

In February this year, Honor officially unveiled its new AI-enabled full-scenario strategy in Barcelona, introducing platform-level AI empowerment, user-centric cross-OS experiences, and new interaction methods based on intent recognition;

and showcased multiple terminal products, including the Magic6 series, Magic V2 series, and Honor MagicBook Pro16 at the Mobile World Congress (MWC).

However, expanding into overseas markets is undoubtedly a challenging path as well.

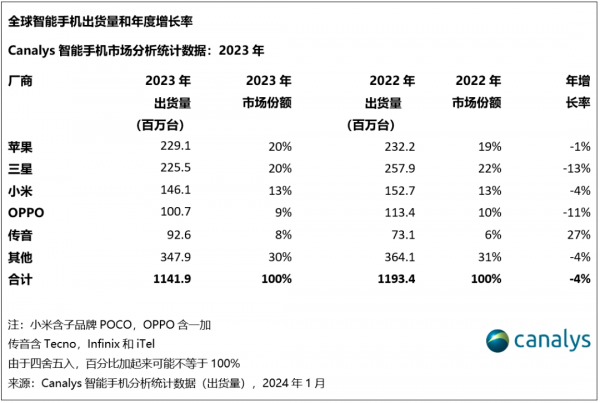

According to Canalys, the total global smartphone shipments in 2023 were 1.14 billion units, representing a narrowed decline of 4% compared to 2022.

In this year, Apple became the annual shipment champion for the first time with a 20% market share and shipments of 229.1 million units.

Followed closely by Samsung, which shipped 225.5 million units, also with a 20% market share.

Xiaomi consolidated its third-place position, maintaining a 13% market share with shipments of 146.1 million units.

OPPO and Transsion ranked fourth and fifth, with market shares of 9% and 8%, respectively.

Honor's achievements are closely related to the support of Shenzhen

Shenzhen witnessed the birth and rapid development of Honor, and in November 2020, Shenzhen Zhixin took over Honor, opening a new chapter in its development.

In December 2023, at the Shenzhen Global Investment Promotion Conference, Wan Biao, Vice Chairman of Honor, recalled the significant challenges faced by Honor during its early days of independence, including resolving office space issues for 3,000 Shenzhen employees.

Honor chose Futian District as its new home and quickly initiated a 7x24-hour continuous renovation plan.

Thanks to the strong support of Futian District, the renovation of over 40,000 square meters of office space was completed in just 27 days, once again demonstrating Shenzhen's efficiency.

In 2021, with the strong support of Pingshan District, Honor's smart manufacturing industrial park completed the renovation and decoration of a 150,000-square-meter manufacturing base in just four months.

The industrial park is not only the only national-level [smart manufacturing demonstration factory] in the smartphone industry but also a symbol of Honor's smart manufacturing strength.

With the assistance of Pingshan District, Honor also established a 30,000-square-meter R&D laboratory in Shenzhen, focusing on basic technological innovation in areas such as new materials, chips, communications, displays, batteries, equipment, artificial intelligence, and system simulation, becoming a crucial support point for Honor in high-end market competition.

Honor has also actively responded to Shenzhen's call to lead the formation of innovation consortia, aiming to break through industry development bottlenecks.

In terms of overseas market expansion, Shenzhen's comprehensive support policies provide solid backing for Honor's high-quality development.

These policies not only facilitate Honor's further expansion into overseas markets but also represent crucial steps towards its goal of becoming a globally iconic technology brand.

Conclusion:

Early Honor products were often seen as [copies] of Huawei's, with sales primarily concentrated in the low-to-mid-end market and insufficient competitiveness in the high-end market to compete directly with rivals.

It can be argued that Honor has completed the initial phase of its independence, but the challenges ahead are even more formidable.

To successfully list on the stock market, Honor must tell a compelling story to the capital market and seek to maximize its valuation.

Some references: e Company: "China Mobile Suddenly Moves! Honor Has Received Investment and Just Announced IPO Plans!", Touzhong Network: "Shenzhen's Super IPO is Coming", China Business Herald: "Honor's Latest Response on IPO Listing!", Jiang Han Vision Observation: "Is Honor Finally Going IPO? Can Honor Surpass Huawei Through Listing?", Lieyun Selection: "A Super IPO is Coming", International Finance News: "How Far is Honor from Listing?", Xinmei Technology Review: "After Four Years of Separation from Huawei, Honor Decides to Sprint Towards IPO", Rongzhong Finance and Economics: "RMB 321.5 Billion, Huawei to [Support] a Super IPO"