To get you to replace your 'beat-up car', Beijing and Hangzhou are spending like crazy

![]() 08/28 2024

08/28 2024

![]() 527

527

Introduction

Introduction

With the arrival of more local subsidy policies, the scale of the vehicle trade-in policy will be larger, more effective, and have a deeper impact.

"Hangzhou's subsidy is only 12,000 yuan, so why wouldn't I choose the national subsidy of 20,000 yuan?"

"Is it just the 20,000 yuan I'm lacking? It's a Beijing license plate I need!"

......

Recently, the online discussion about the vehicle trade-in subsidy policy has continued.

The origin of this discussion lies in the "Notice on Further Improving the Vehicle Trade-In Program" (hereinafter referred to as the "Notice") issued by seven departments, including the Ministry of Commerce, in August. According to the Notice, for individual consumers who scrap their old vehicles and purchase new ones in accordance with the "Detailed Rules for Implementing the Vehicle Trade-In Subsidy Program," the subsidy standards have been raised to 20,000 yuan for the purchase of new energy passenger vehicles and 15,000 yuan for the purchase of conventional fuel passenger vehicles.

Against the backdrop of this broader subsidy policy, in recent days, various localities, including Beijing, Hangzhou, Chengdu, Hainan, and Qinghai, have continuously introduced new trade-in programs. They have increased subsidy amounts, lowered subsidy thresholds, and even provided direct consumption subsidies, all in an effort to strengthen the vehicle trade-in policy and stimulate automotive consumption.

Based on the increased subsidy standards for vehicle trade-ins, netizens have shared their opinions. Some support the policy and plan to participate immediately, while others express difficulty in applying for the subsidy despite wanting to replace their cars. Still, others lament that "the subsidy is just pocket change, but what I lack is the ability to earn money," echoing the sentiment of the Beijing netizen mentioned earlier.

Localities continue to introduce new measures to increase subsidies

It's essential to mention a few key points about the vehicle trade-in program.

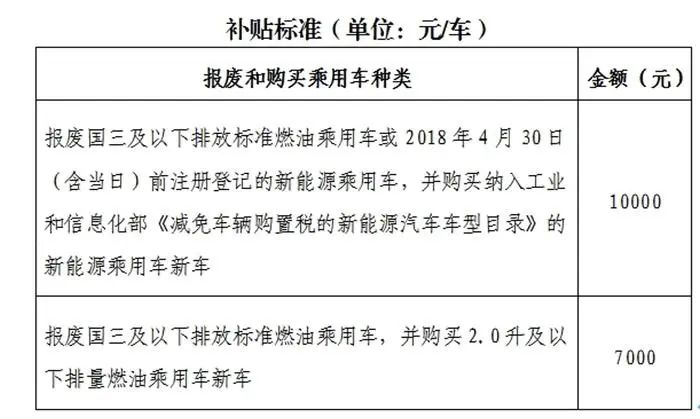

Firstly, the "Two Sessions" in early 2024 emphasized that 2024 would be the "Year of Consumption Promotion," with the country vigorously promoting the trade-in of durable consumer goods such as household appliances and automobiles. Subsequently, in April, the trade-in policy was launched. According to the Detailed Rules, the subsidy standards for individual consumers who scrap their old vehicles and purchase new ones were set at 10,000 yuan for new energy passenger vehicles and 7,000 yuan for conventional fuel passenger vehicles.

The Notice issued in August represented an upgrade to the April trade-in policy.

Firstly, the subsidy standards were increased from 10,000 yuan and 7,000 yuan to 20,000 yuan and 15,000 yuan, respectively. Secondly, retroactive subsidies were implemented for eligible vehicles based on the new standards, with any shortfall in previously issued subsidies to be made up. Thirdly, the subsidy application review and fund disbursement processes were optimized to ensure that consumers received their subsidies as soon as possible.

In my previous article, "Why Haven't You Replaced Your 'Beat-Up Car' Yet? Planning to Keep It for the New Year?," I detailed the upgrade of the relevant subsidy standards and potential changes. Essentially, the country's efforts to encourage people to replace their old or beat-up cars are part of a broader attempt to stimulate automotive consumption and promote industrial transformation and upgrading.

However, within half a month of the new policy's launch, localities such as Beijing and Hangzhou began increasing subsidies and introducing local policies aimed at expanding the scope of subsidies and lowering thresholds to enable more consumers to benefit.

Taking Beijing as an example,

Recently, it was reported that Beijing's municipal departments are studying and formulating an implementation plan to strengthen support for equipment upgrades and consumer goods trade-ins, which will be released soon. This plan raises the subsidy for individuals who scrap eligible old vehicles and purchase new energy passenger vehicles from 10,000 yuan to 20,000 yuan.

Regarding personal vehicle scrapping, the subsidy standards in the "Detailed Rules for Implementing the Beijing Vehicle Trade-In Subsidy Program in 2024" have been adjusted: The subsidy for scrapping eligible old vehicles and purchasing new energy passenger vehicles has been increased from 10,000 yuan to 20,000 yuan, and for purchasing 2.0L or smaller conventional fuel passenger vehicles, the subsidy has been increased from 7,000 yuan to 15,000 yuan.

Moreover, consumers who have already applied for subsidies under the previous Detailed Rules can receive additional subsidies based on the new standards. These two types of old vehicles must be registered under the applicant's name before July 25, 2024.

Simultaneously, Beijing will introduce support policies for replacing personal passenger vehicles with new energy vehicles.

Additionally, Hangzhou has also introduced a new automobile subsidy policy.

The new policy mentions that to further promote vehicle replacements, individual consumers who scrap or transfer (excluding changes) their own passenger vehicles and purchase new 7-seater or smaller passenger vehicles in Hangzhou can apply for a one-time vehicle replacement subsidy.

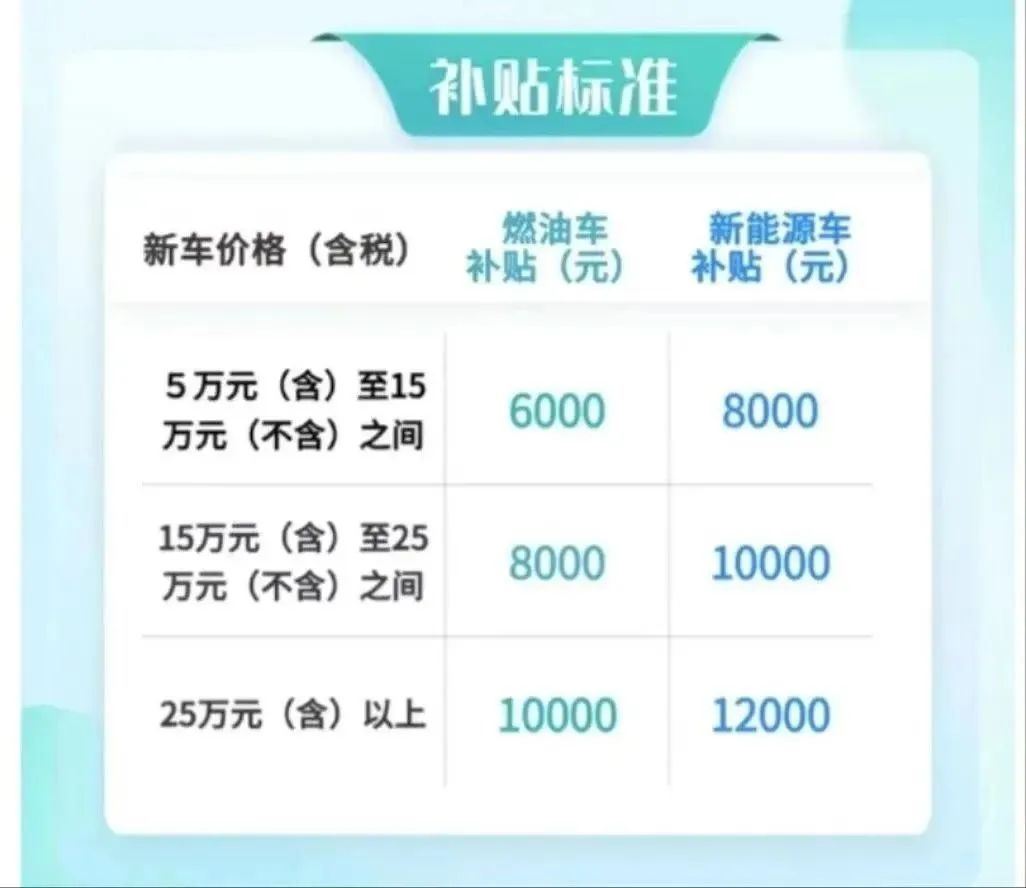

According to the latest subsidy standards, for new vehicles priced between 50,000 and 150,000 yuan (excluding 150,000 yuan), the subsidy for conventional fuel vehicles is 6,000 yuan, and for new energy vehicles, it is 8,000 yuan. For vehicles priced between 150,000 and 250,000 yuan, the subsidy for conventional fuel vehicles is 8,000 yuan, and for new energy vehicles, it is 10,000 yuan. For vehicles priced at 250,000 yuan or more, the subsidy for conventional fuel vehicles is 10,000 yuan, and for new energy vehicles, it is 12,000 yuan.

The policy explicitly states that there are no restrictions on vehicle registration, licensing, or scrapping locations, and vehicles from other provinces can enjoy the policy as long as they are purchased in Hangzhou. However, this policy cannot be combined with national vehicle scrapping and renewal subsidies.

It is evident that Beijing differentiates replacement standards based on vehicle types and price ranges, while Hangzhou has removed the subsidy threshold for vehicles meeting the National III emission standards. From Beijing to Hangzhou, local subsidy policies are being updated from different angles to lower thresholds and expand the scope of subsidies. Additionally, localities like Chengdu and Hainan are directly providing consumption subsidies ranging from 1,000 to 8,000 yuan.

Short-term boost to automotive consumption, long-term promotion of industrial upgrading

Has automotive consumption increased after rounds of updates to the trade-in policy?

In fact, driven by multiple parties, the effects of the trade-in policy began to emerge as early as May, the first full month after its initial launch this year.

Data shows that it took 25 days for the vehicle trade-in information platform to receive over 10,000 applications for vehicle scrapping and renewal subsidies nationwide after receiving the first application. It then took only 7 days to reach 20,000 applications and just 4 days to reach 30,000 applications. By June 25, the platform had received 113,000 applications for vehicle scrapping and renewal subsidies.

Under the influence of the policy, the domestic automotive consumption market has also regained vitality.

In May this year, national automobile retail sales reached 2.271 million units, a year-on-year increase of 8.7%, with new energy passenger vehicle retail sales increasing by 38.5% year-on-year. Used car transactions reached 1.585 million units, a year-on-year increase of 5.9%, and scrapped vehicle collections increased by 55.6% year-on-year to 523,000 units.

According to regular press conferences of the Ministry of Commerce, the number of subsidy applications for vehicle trade-ins has grown rapidly over the past three months, especially in the past two months. By August 23, the vehicle trade-in information platform had registered over 1.1 million users, received over 700,000 applications for vehicle scrapping and renewal subsidies, with over 10,000 new applications per day.

Simultaneously, the vehicle scrapping and renewal policy has driven a surge in scrapped vehicle collections.

Data indicates that from January to July this year, nationwide scrapped vehicle collections totaled 3.509 million units, a year-on-year increase of 37.4%. In particular, collections in May, June, and July increased by 55.6%, 72.9%, and 93.7%, respectively, year-on-year.

It is foreseeable that with the strengthening of local policies, future efforts will further boost new energy vehicle consumption, used car transactions, and scrapped vehicle collections. Apart from stimulating the market, these data will also profoundly impact the transformation and upgrading of the domestic automotive industry.

After all, the automotive industry is a vital pillar of China's national economy, accounting for approximately 10% of total retail sales of consumer goods and contributing around 10% to both total tax revenue and the total urban employment population. The upgrading of the automotive industry is of great significance to the national economy, and the vehicle trade-in policy is a crucial aspect of promoting industrial development.

In this industrial upgrade disguised as a "trade-in" policy, the combination of attractive incentives and latent market demand has led to Stage Victory Stage Victory victories. While enhancing consumers' experience, it has also expanded the market share of China's new energy vehicle industry, laying a solid foundation for its development.

Of course, only tens of thousands of vehicles met the subsidy criteria during the first round of subsidies, far from constituting a success in an economy where over 2 million vehicles are sold monthly. However, the new round of policies, with a maximum trade-in subsidy of 20,000 yuan, has brought new consumer benefits. In the future, with the arrival of more local subsidy policies, the scale of vehicle trade-ins will be larger, the effects will be better, and the impact will be deeper.

Industry insiders believe that the introduction of detailed trade-in rules will help further increase the penetration rate of new energy vehicles in China.

Indeed, amidst the explosive growth of new energy vehicles, China produced and sold 984,000 and 991,000 new energy vehicles in July, respectively, representing year-on-year increases of 22.3% and 27%. The retail penetration rate of new energy vehicles surpassed 50% in July alone. From January to July, China produced and sold 5.914 million and 5.934 million new energy vehicles, respectively, representing year-on-year increases of 28.8% and 31.1%.

As the vehicle scrapping and renewal market accelerates its growth, and as local trade-in and scrapping renewal subsidy policies are rapidly implemented, the demand for vehicle replacements is expected to further stimulate automotive consumption growth. Meanwhile, the implementation of relevant preferential policies is expected to positively contribute to automotive sales growth in the second half of the year.