Follow-up on the Founders' Dispute at TuSimple: A New Battle Looms?

![]() 08/28 2024

08/28 2024

![]() 417

417

TuSimple, a star company in autonomous driving, has been embroiled in a power struggle.

Now, under the leadership of refounder Chen Mo and CEO Lv Cheng, who have regained control, TuSimple has recently announced its entry into the generative AI application field. Meanwhile, Hou Xiaodi, another founder who left in anger, has embarked on a new venture with the vision of L4 autonomous driving.

The apparent calm that followed the internal palace intrigue belies the underlying currents.

According to a report by Blue Whale News, while frequently giving interviews and expressing his determination for his new company Bot.Auto, Hou Xiaodi has also been quietly courting TuSimple's small and medium shareholders, showing great interest in TuSimple's substantial cash reserves.

A battle for control seems to be brewing again. Both generative AI and autonomous driving are hot trends, and every move by Chen Mo and Hou Xiaodi attracts significant attention from the outside world.

In this power struggle, some core information remains elusive: Why did Chen Mo leave? Why was Hou Xiaodi removed from his position by the board? After joining forces with Chen Mo to regain control of TuSimple, why did Hou Xiaodi leave again? And why, after his high-profile new venture, did Hou Xiaodi attempt to regain control of TuSimple?

Although Hou Xiaodi responded to these incidents through social media, there has never been a complete account. Notably, the executive team that was defined as Hou Xiaodi's opposition, including Chen Mo, Huang Zehua, Lv Cheng, domestic investors Sina and CDH, as well as TuSimple China's executives and employees, remained silent amidst the overwhelming coverage.

The more silence there is, the more curiosity it arouses from the outside world.

As the media searched for clues, some details gradually emerged. Hou Xiaodi, regarded as TuSimple's spiritual leader and a brilliant scientist, gradually revealed a side unknown to the outside world.

I. The Founders' Rift

Power struggles often occur in promising star companies due to the enticing benefits that come with great potential.

TuSimple, once a star in autonomous driving, stood out in fierce competition with its leading technology and well-established business ecosystem. Chen Mo and Hou Xiaodi, TuSimple's most important founders, have been portrayed numerous times:

Chen Mo, as a serial entrepreneur, excels in financing and commercialization, while Hou Xiaodi, as a genius scientist, serves as the soul of TuSimple's technology. Lv Cheng, who became CEO before the IPO, has a solid financial background and was brought in as a professional manager to facilitate the listing.

A typical high-quality male.

Unlike other Chinese companies listed overseas, due to concerns about autonomous driving technology and data, TuSimple underwent CFIUS (Committee on Foreign Investment in the United States) review before its IPO. CFIUS, led by the U.S. Treasury Department and involving numerous government agencies, conducts national security risk reviews of foreign investments in the U.S. The final agreement between CFIUS and TuSimple stipulated that the two Chinese directors appointed by Sina would not be renewed upon expiration, that there would be a technological separation between the Chinese and American companies, and that CFIUS would appoint a national security director to the company.

TuSimple eventually listed on Nasdaq in April 2021 with a valuation exceeding $8 billion at its peak. Post-IPO, roles were clearly defined: Chairman Chen Mo was based in China and responsible for operating TuSimple China, while Lv Cheng and Hou Xiaodi, both based in the U.S., with Lv Cheng serving as CEO of TuSimple USA and Hou Xiaodi as CTO and director.

However, due to differing styles, serious disagreements arose between Lv Cheng and Hou Xiaodi in managing TuSimple USA. Hou Xiaodi sought help from Chen Mo and demanded that the Chinese directors (who were still in their terms at the time) make a choice between the two. After Chen Mo's mediation, Sina agreed and accepted Chen Mo's reasoning: Hou Xiaodi, as a long-time co-founder and the core figure of the technology company, was indispensable to TuSimple.

This was not the first time Chen Mo had supported Hou Xiaodi in personnel disputes. Chen Mo also intervened when Hou Xiaodi clashed with Huang Zehua, another co-founder who left months before Lv Cheng, requesting Huang's departure. Lin Ming (a pseudonym), from TuSimple's investor Sina Investment, described Chen Mo as having a "dedicated" personality, always striving to meet Hou Xiaodi's demands, whether it was establishing a company in the U.S. or increasing R&D efforts.

During the process of removing Lv Cheng, Hou Xiaodi also requested to become Chairman, citing the need for more power in the future, as Chen Mo was based in China and the board would soon be entirely composed of American directors. Chen Mo agreed, stepping down as Chairman but retaining his board seat.

In March 2022, TuSimple announced this change: Hou Xiaodi assumed the roles of CEO, CTO, and Chairman, becoming TuSimple's sole decision-maker. However, just three months later, TuSimple announced Chen Mo's resignation from the board, effectively ending his involvement with the company.

The official reason for Chen Mo's departure was his plan to establish Hydron, a heavy-duty truck company, which had overlapping business interests with TuSimple. To avoid conflicts, Chen Mo distanced himself from the board. A core member of TuSimple's management team stated that while avoiding conflicts was true, Chen Mo's resignation was not his own decision but rather the result of Hou Xiaodi's repeated persuasion using this rationale.

Trusting Hou Xiaodi and supporting TuSimple's future, Chen Mo agreed. However, to his surprise, the day after resigning from the board, he received a compliance review authorized by CEO Hou Xiaodi, focusing on his personal interests in Hydron and TuSimple.

This enraged Chen Mo, as the core management team member revealed: "Hou Xiaodi knew about and participated in Hydron from start to finish, and the project was completely transparent with no secrets. Initiating a review the day after Chen Mo's resignation seemed premeditated. Hou Xiaodi's actions shocked Chen Mo, who felt deceived out of TuSimple."

Chen Mo could no longer console himself with the idea of prioritizing the company's interests, leading to a complete rift with Hou Xiaodi and the first salvo in the power struggle.

II. Why Won't You Tell the Truth?!

In power struggles, verbal battles and mixed messages often confuse the outside world, making it difficult to discern the truth.

Around the time Hou Xiaodi consolidated power, the terms of the Chinese directors appointed by Sina expired, and they were not renewed. It was understandable that the new American directors had questions about Hydron, but what should have been a reasonable explanation was complicated by Hou Xiaodi's surprising claim of "not knowing anything," plunging TuSimple back into CFIUS scrutiny.

According to Blue Whale News, even before the IPO, the founding team and board, including Hou Xiaodi, had discussed vehicle manufacturing. The strategic rationale was that, despite TuSimple's dominance in autonomous driving and its order from heavy-duty truck manufacturer Navistar in 2021, the trend towards heavy truck manufacturers entering the autonomous driving space was evident.

To avoid potential future passivity, TuSimple needed a reliable heavy-duty truck OEM partner, and manufacturing their own trucks seemed the optimal solution. However, given the timing, TuSimple could not both judge and participate, which could affect current and potential partners. Chen Mo, with his experience in multiple startups, was deemed the most suitable person to lead this venture, hence the establishment of Hydron.

Hydron's plans were discussed and documented in board meetings at least twice post-IPO. An informed source told Blue Whale News that Hou Xiaodi not only participated in these meetings but also led technical discussions related to potential collaborations between TuSimple and Hydron, indicating full knowledge of the Hydron project.

Yet bizarrely, when questioned by the new directors and the U.S. National Security Director about Hydron, Hou Xiaodi broke down in tears, claiming ignorance. According to those present, this shocked even directors who had participated in previous discussions on Hydron.

Hou Xiaodi's emotional denial, as the then-sole decision-maker, easily led the new directors and the U.S. National Security Director to suspect foul play in Hydron. If Hou Xiaodi was "innocent," Chen Mo could not escape responsibility. This led to a compliance review of Chen Mo and subsequent CFIUS scrutiny of TuSimple and Hydron over technology and interest transfers.

News of this farce quickly reached Chinese shareholders. Lin Ming expressed his frustration, repeatedly asking Hou Xiaodi, "Why won't you tell the truth?" Lin Ming believed that as Chairman, CEO, and CTO, Hou Xiaodi had the authority and logic to explain the situation clearly rather than exacerbating it by distancing himself.

However, Hou Xiaodi remained silent, ignoring these inquiries.

III. Six Months of Sole Decision-Making Power

Power, with its alluring allure, attracts countless contenders.

From Lv Cheng's departure in March 2022 to Hou Xiaodi's removal by the board in October 2022, Hou Xiaodi held sole decision-making power for six months. After Chen Mo resigned from the board and the terms of the Sina-appointed directors expired, there was a vacuum period of several months during which Chen Mo and Chinese shareholders claim they knew little of Hou Xiaodi's activities beyond being asked to cooperate with internal board investigations.

At the time, there were no Chinese directors on TuSimple's board, and some TuSimple China executives believed that Hou Xiaodi was trying to curry favor with the board by doing things like distancing himself from Hydron. However, some of his demands crossed boundaries, such as requesting all operational data, codes, driving data, and employee personal data from the Chinese company to the American company under the guise of a board investigation.

The board's internal investigation focused on potential related-party transactions between Hydron and TuSimple and did not involve the aforementioned data. Moreover, according to the agreement between TuSimple and CFIUS before the IPO, to protect data security, technical operations and data were isolated between the Chinese and American businesses and could not be exchanged.

According to Blue Whale News, Lv Cheng never requested such data from the Chinese company during his tenure. From a Chinese technology and data security perspective, the Chinese company could not provide such data to the American company. For these reasons, Hao Jianan, CEO of TuSimple China, rejected Hou Xiaodi's repeated requests for data.

Shortly after refusing to submit the data, TuSimple China employees received personal compliance reviews authorized by Hou Xiaodi, targeting senior executives and employees of the Chinese team. Hou Xiaodi, citing board disapproval, also refused to grant Chinese employees a planned equity award that had been discussed and approved by the board a year earlier.

The TuSimple China team had long sensed that Hou Xiaodi viewed the Chinese business as a supplement to his autonomous driving dreams. At one point, Hou Xiaodi even demanded that cooperation with Foton, a crucial partner of TuSimple, be halted to satisfy the demands of the U.S. National Security Director. Against this backdrop, Chen Mo, out of responsibility for the Chinese business he once oversaw and the Chinese shareholders, briefly led efforts to sell TuSimple China, which Hou Xiaodi supported but ultimately did not materialize due to process and approval complexities.

However, Hou Xiaodi never gained the trust of the new board. After six months of sole control, he was abruptly removed. The board explained to the outside world that it had lost confidence in Hou Xiaodi's judgment, decision-making abilities, and leadership as CEO, particularly in light of the Hydron review he initiated.

Hou Xiaodi penned a tragic open letter questioning the board's process and conclusions, stating, "My professional and personal life are completely transparent, and I fully cooperate with the board because I have nothing to hide." Many media outlets analyzed that Hou Xiaodi's removal might be due to his "taking the blame for Hydron."

However, the truth was different. According to TuSimple's settlement with CFIUS in May 2024 regarding the Hydron review, there were no faults in TuSimple's communications with Hydron, and the company only admitted fault in removing the U.S. National Security Director and reached a settlement. This was not the real reason for Hou Xiaodi's removal.

According to Blue Whale News, Hou Xiaodi's knowledge of Hydron eventually came to light, combined with his chaotic management and capricious strategies, ultimately leading to his removal by the board.

According to TuSimple employees, Hou Xiaodi employed a centralized management style: all departments had to report to him directly, reducing efficiency and making cooperation difficult.

Perhaps genius often comes with arrogance. Multiple interviewees stated that Hou Xiaodi had difficulty tolerating dissenting voices and would immediately attack those who disagreed with him. Beyond centralized management, he was hands-on and detail-oriented, which might not be appropriate for a CEO.

In media interviews, Hou Xiaodi reflected, "I used to think that professionals should do their specialized jobs, but now I realize I need to set a core strategy to unite all levels... Now I intervene less in details. If an algorithm issue takes an extra month to resolve, I won't jump in like before. I won't execute tasks myself if you can't finish them. But I'll spend more time on the big picture, aligning everyone on principles and strategies."

However, the cost of this lesson was high, evident in the board's loss of confidence in Hou Xiaodi. When Lv Cheng was CEO, he primarily communicated with the board, while Hou Xiaodi, as CTO, only addressed technical issues. After taking over as CEO, Hou Xiaodi's management shortcomings and inconsistent statements quickly became apparent to the board, leading to a loss of trust and confidence in him.

Confidence is often more valuable than gold.

IV. Chen Mo's Return and Hou Xiaodi's Departure

As an early investor in TuSimple, Lin Ming was deeply involved until Chen Mo's departure. According to Lin Ming, he only learned of Hou Xiaodi's removal as CEO through media reports. Although dissatisfied with Hou Xiaodi's actions regarding Hydron, Lin Ming still called to express concern based on their long-standing relationship.

Hou Xiaodi allegedly cried on the phone, claiming malicious removal by American directors aiming to seize control of TuSimple. He hoped Lin Ming would mediate with Chen Mo, urging them to exercise their super-voting rights together to oust the American directors.

Super-voting rights are common in listed companies to ensure founders' control. Typically, super-voting rights are granted only to the most important founders. However, in TuSimple's structure, Chen Mo and Hou Xiaodi each held around 31% super-voting rights. Whenever they jointly exercised these rights, they could control the company.

According to the lawyer involved in TuSimple's IPO structure design, Chen Mo insisted on granting equal super-voting rights to Hou Xiaodi, despite the lawyer's opposition. Chen Mo's logic was simple: since they held equal shares, they should have equal voting rights.

For Lin Ming, this was a difficult mediation task. Chen Mo had severed ties with Hou Xiaodi and firmly refused Lin Ming's request, unable to trust Hou Xiaodi after the betrayal. He even advocated selling his shares alongside Sina and other Chinese shareholders, even if the share price had plummeted 95% from its peak, to completely sever ties with TuSimple.

This is clearly not a rational proposal, especially from a profit perspective. For Chinese shareholders, persuading Chen Mo to return is the most promising option. In this situation, multiple Chinese shareholders took turns to act as intermediaries and persuade Chen Mo to join forces with Hou Xiaodi. In desperation, Chen Mo proposed very harsh conditions for his return: first, to reinstate Lu Cheng as CEO of TuSimple; second, to grant Hou Xiaodi's super voting rights to him for two years.

For Hou Xiaodi, it was obviously difficult to accept bringing back someone who had personally driven him out of the company. However, to oust the American directors who had removed him, he ultimately agreed.

According to TuSimple's announcement on November 10, 2022, after obtaining super voting rights, Chen Mo dismissed all American directors from the board except Hou Xiaodi, appointed Lu Cheng as CEO, and appointed himself as Executive Chairman of the board. During the previous negotiations for Chen Mo's return, he agreed to Hou Xiaodi's request to remain CTO, but as the board that removed Hou Xiaodi had initiated an internal investigation against him, the CTO appointment process needed to wait until the investigation was completed.

However, the TuSimple that Chen Mo and Lu Cheng inherited was completely different from the one six months ago, reflected in the stock price: When Lu Cheng left in March 2022, TuSimple's share price was $16.97 per share, a decline of 58% from the IPO price of $40 per share. However, from March 2022 to October 31, 2022, when Hou Xiaodi was ousted, TuSimple's share price fell from $16.97 to $3.43 per share, a decline of 80% in just six months.

Several things shocked Chen Mo and Lu Cheng. First, since taking power, Hou Xiaodi rarely went to the company, preferring to call all senior executives to his home for meetings. At that time, COVID-19 restrictions in the US had long been lifted, making it unreasonable for the top decision-maker to rarely visit the company. Core technical executives had not communicated with Hou Xiaodi for half a year because he disliked hearing their opinions.

Second, to aggressively pursue autonomous driving, Hou Xiaodi began aggressively hiring R&D personnel after TuSimple's successful IPO, increasing the number of American R&D personnel from about 600 to over 1,000 in just one year. In 2022, TuSimple's total cash expenditures approached $400 million, posing an imminent cash flow crisis for a company with negligible revenue and far from commercialization.

The third and most critical issue was that Navistar and Scania, major truck manufacturers that had placed orders and worked closely with TuSimple, demanded to terminate their cooperation during Hou Xiaodi's tenure as CEO, eliminating TuSimple's once-proud commercial ecosystem. According to insiders, after Lu Cheng resumed his role as CEO, he attempted to restart cooperation with these manufacturers but was rejected.

"The reason these truck manufacturers terminated their cooperation was that communication with TuSimple became very difficult. They said TuSimple was very aggressive and did not respect them. Coupled with various internal turmoil and investigations, they chose to terminate their cooperation," said an insider. "As for why they won't restart cooperation, who would dare to guarantee that there won't be any more changes in a company that has had four CEOs in half a year and has been frequently investigated? Who would dare to continue cooperating?"

The withdrawal of truck manufacturers has made TuSimple's commercialization uncertain. If TuSimple continues to bear high R&D costs, its cash on hand will soon become insufficient. Therefore, after Chen Mo and Lu Cheng returned, they quickly initiated layoffs at the American company. Hou Xiaodi was outraged and even publicly criticized TuSimple for firing hundreds of employees he deemed "extremely talented."

At that time, most of TuSimple's former competitors had gone bankrupt or shifted to L2 autonomous driving, while TuSimple had lost its truck manufacturing partners in the US and faced complex geopolitical issues and CFIUS reviews. Why did Hou Xiaodi still maintain a radical expansionist "positive" attitude? According to Lanjing News, Hou Xiaodi expressed optimism about the future, believing that cash flow issues could be resolved through financing.

However, it is clear that the financing environment is not optimistic. After returning, Chen Mo and Lu Cheng began to favor scaling back operations in the US and rebuilding a commercial ecosystem in countries like Japan and Australia, but Hou Xiaodi disagreed: TuSimple must focus on L4 autonomous driving, with the US as its primary market.

Having experienced the drama, Chen Mo and Lu Cheng could no longer unconditionally support Hou Xiaodi's ambitions. They needed to face the objective reality that the company's cash on hand was gradually decreasing. At the end of 2021, TuSimple had $1.9 billion in cash and cash equivalents, but by the end of 2022, this had fallen to $887 million.

According to Lanjing News, discussions among the three about future directions ended badly multiple times. Hou Xiaodi, who had temporarily lost his super voting rights, knew that his opinions would not be accepted at the final board meeting, so he angrily left the company, taking some core employees with him to start a new "TuSimple."

A new starting point has emerged in the story.

V. The New Battle for Control

Looking back from this new starting point, the impact of the battle has not dissipated.

After Hou Xiaodi's departure, the chaos continued, with the company downsizing its American operations, suspending its listing plans, facing shareholder lawsuits, and receiving temporary restraining orders. In May 2024, TuSimple reached a settlement with CFIUS regarding the Hydron review, clearing the company of any wrongdoing. On August 15, TuSimple announced its entry into the generative AI field and its partnership with The Three-Body Problem IP, seeking new business growth points and commercialization as soon as possible.

Meanwhile, Hou Xiaodi was actively fundraising for Bot.auto, the company he founded, and gave numerous media interviews to express his vision and dreams for autonomous driving. Ideally, Chen Mo and Hou Xiaodi could part ways and move on, but in reality, a new battle for control was brewing.

According to Lanjing News, the two-year super voting rights granted to Chen Mo by Hou Xiaodi will expire in November, and the December 2024 shareholder meeting will elect a new board of directors and chairman. After TuSimple's internal turmoil, most major shareholders deeply involved in the company's operations sided with Chen Mo out of profit considerations, leaving small and medium-sized shareholders as a potential breakthrough for Hou Xiaodi.

Genius scientist, tragic hero pursuing his dreams, cautious hero – these are just some of the labels the media has attached to Hou Xiaodi. According to multiple media professionals who have interacted with him, Hou Xiaodi has an innocent baby face and communicates sincerely, constantly expressing his passion and dedication to autonomous driving technology, making him very charismatic. Recently, Hou Xiaodi has been frequently active in the public eye, and according to the aforementioned insiders, he has characterized Chen Mo as a businessman and himself as a scientist in his efforts to gain support, arguing that "everyone will believe a scientist." This is precisely the image of Hou Xiaodi as a genius scientist that Chen Mo worked hard to preserve during the IPO, but now the two are on opposite sides.

"The reason TuSimple chose to establish its R&D center in the US was simply because it was potentially viable from a business model perspective due to the high labor costs of American truck drivers," said a TuSimple China employee. "In reality, the domestic policy and environment are more favorable for the implementation of autonomous driving. The faster pace of development in the US was merely to achieve commercialization sooner." However, Hou Xiaodi still chose the US as the destination for his new venture.

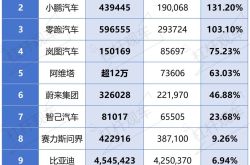

According to Lanjing News, Hou Xiaodi is promoting Bot.Auto's business plan to investors. The plan states that the company, which focuses on L4 autonomous driving, has already raised $10.5 million in funding and plans to raise $25 to $50 million in 2024. Investors told Lanjing News that Hou Xiaodi has begun close contact with domestic capital.

However, from the perspective of TuSimple China's shareholders, autonomous driving has become one of the core technologies in the competition between major powers. Domestic capital investing in Bot is essentially repeating TuSimple's old path. Any non-US capital investment in a "company that may involve US national security" will inevitably trigger another CFIUS review, leading to internal friction and affecting the company's operations.

According to Bot's business plan, Hou Xiaodi believes the company can achieve break-even in 2027 and profitability in 2028. In an interview with Jizi Guangnian, he believes that autonomous driving will achieve lower operating costs per kilometer than humans by the first half of 2026. However, he admits that this is not a consensus in the industry, stating, "No one else believes it either, but everyone lives in their own beliefs."

In today's capital environment, it is clearly very difficult to exchange dreams for investment, and primary market investors have become very pragmatic. Under these circumstances, regaining control of TuSimple, which still has at least $700 million in cash and short-term investments on its balance sheet, is an easier path for Hou Xiaodi to "realize his personal beliefs through entrepreneurship."

Another factor that cannot be ignored is that while TuSimple has never formally initiated a commercial competition investigation against Bot, it does have the right to do so at any time. At the same time, TuSimple holds some basic IP related to L4 autonomous driving technology (intellectual property for already disclosed technologies) and has begun licensing it to other companies that need autonomous driving technology. As Hou Xiaodi continues to work on L4 autonomous driving, he cannot avoid licensing these basic IPs.

According to sources, while courting small and medium-sized shareholders, Hou Xiaodi vowed to "regain control of TuSimple." Despite losing the trust of American directors and all TuSimple's founding partners, Hou Xiaodi remains confident.

The story continues.