Some earn over ten billion while others lose billions: the joys and sorrows of new energy vehicle companies are not shared

![]() 08/30 2024

08/30 2024

![]() 550

550

Lead

The new energy vehicle market may seem to be thriving, but in reality, "the same electricity, different fates." Listed vehicle companies have successively released their 2024 half-year reports, and the mid-term results of new energy vehicle companies vary widely, with some achieving record net profits for the same period, while others posting the largest losses in history.

Produced by: Heyan Yueche Studio

Written by: Li Suwan

Edited by: Heyanzi

Total word count: 3664

Estimated reading time: 5 minutes

BYD remains the king, with revenue, net profit, and other key performance indicators reaching new highs for the same period in history once again in the first half of this year.

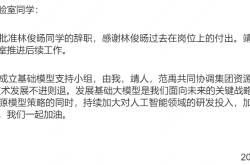

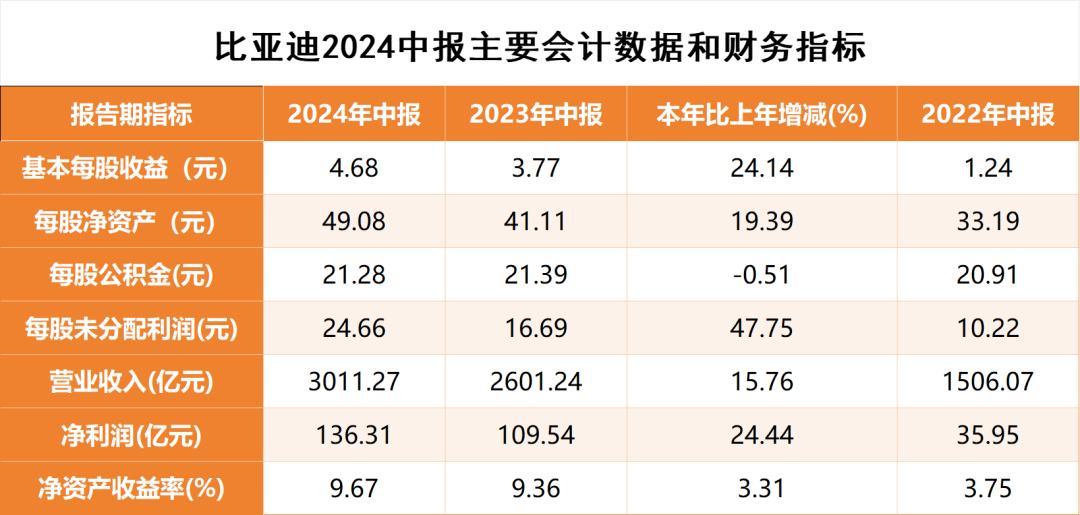

On the evening of August 28, BYD (002594.SZ) released its 2024 half-year report. In the first half of this year, the company achieved revenue of 301.1 billion yuan, an increase of 15.76% year-on-year; net profit was 13.63 billion yuan, an increase of 24% year-on-year.

△BYD delivered impressive 2024 half-year results

Why can BYD earn over 13.6 billion in half a year?

Why did BYD achieve such mid-term results? The company attributed the revenue growth primarily to the increase in new energy vehicle business and mobile phone components and assembly business; the increase in net profit was mainly due to the growth of the new energy vehicle business.

By business segment, in the first half of the year, BYD's automotive, automotive-related products, and other product businesses generated revenue of approximately 228.3 billion yuan, an increase of 9.33% year-on-year; mobile phone components, assembly, and other product businesses generated revenue of approximately 72.8 billion yuan, an increase of 42.45%. The proportions of these revenues in the company's total revenue were 75.82% and 24.17%, respectively.

△The increase in BYD's net profit is mainly due to the growth of its new energy vehicle business

The industry was not surprised by BYD's mid-term results. According to BYD's previously released production and sales reports, the company sold 1.613 million new energy vehicles in the first half of 2024, an increase of 28.5% year-on-year. This year, BYD continued to outperform the overall Chinese auto market by more than 20 percentage points through aggressive pricing strategies, further increasing its market share in the new energy vehicle segment, retaining its position as the domestic sales champion and ranking first globally in new energy vehicle sales.

However, it is worth noting that unlike Tesla, which previously raised prices, leading to a decrease in gross margins, BYD, which initiated the price war in 2024, achieved a gross margin of 20.01% in the first half of this year, compared to 18.33% in the same period last year. BYD stated that the increase in gross margin was primarily driven by the growth of its new energy vehicle business. This suggests that in addition to technologies such as blade batteries and DM, BYD's vertical supply chain system and economies of scale are also strengthening its moat. Compared to sales volume, indicators such as net profit and gross margin better demonstrate BYD's rising competitiveness.

BYD, which is flush with profits, is becoming increasingly aggressive. At the 27th Chengdu International Automobile Exhibition, which opened on August 30, BYD exhibited for the first time in a dedicated pavilion, showcasing its entire brand lineup, including the Dynasty series, Ocean series, NIO, FANGZHENGBAO, and DENZA. During the exhibition, BYD's Dynasty Network MC concept car made its global debut, and the SEAL 06GT was unveiled for the first time. BYD also created a nearly 10,000-square-meter intelligent street area, showcasing NIO U8's emergency flotation, intelligent off-road climbing, and FANGZHENGBAO's extreme off-road capabilities.

Regarding future plans, BYD stated that it will firmly implement its development strategy, strengthen the independent controllability of core technologies, and continuously enhance product competitiveness; closely follow market trends, adhere to consumer demand orientation, and continue to promote the construction of a multi-brand matrix; accelerate its overseas expansion, leveraging its comprehensive strength in the new energy vehicle field to provide new energy vehicle products to global consumers, helping the Chinese automotive industry lead the global new energy vehicle transformation. In the field of new energy passenger vehicles, the company will continue to deepen core electrification and intelligent technology research and development, drive product upgrades through innovative technologies, empower the gradient layout of multiple brands, meet consumers' differentiated vehicle needs, and consolidate and strengthen the company's leading position.

In addition to its own efforts, BYD recently announced a collaboration with Huawei to create the FANGZHENGBAO intelligent driving system. The two companies jointly developed the world's first dedicated intelligent driving solution for rugged vehicles, which will be first equipped on the FANGZHENGBAO BAO8 model. BYD leveraged Huawei's expertise to accelerate its intelligence capabilities.

△The intelligent driving solution developed by BYD and Huawei will be first equipped on the BAO8 model

Why did BAIC BJEV lose over 2.5 billion in half a year?

Unlike BYD's elation, BAIC BJEV (600733.SH) has little to smile about. Despite being a deep cooperation partner of Huawei's intelligent vehicles and HarmonyOS ecosystem, BAIC BJEV is far less fortunate than BYD and even less fortunate than Seres, another Huawei partner. BAIC BJEV's mid-year results have been released, revealing the largest loss for the same period in its history.

In the first half of 2024, BAIC BJEV achieved revenue of 3.741 billion yuan, a decrease of 35.16% year-on-year, and its losses widened to 2.571 billion yuan, the largest loss for the same period in the company's history. In the first half of last year, the company lost 1.979 billion yuan, and its net cash flow from operating activities was a net outflow of 2.057 billion yuan, compared to a net outflow of 1.58 billion yuan in the same period last year.

△BAIC BJEV posted the largest loss for the same period in its history in the first half of the year

Low sales volumes were the primary reason for BAIC BJEV's poor performance. In the first half of the year, the company sold 28,011 vehicles, a decrease of 20.4% year-on-year. The decrease in operating cash flow was also due to the decrease in sales, leading to a corresponding decrease in sales remittances.

BAIC BJEV attributed its first-half loss to two main reasons: Firstly, the competition in the new energy vehicle market has become increasingly fierce, with intensified price wars compressing profit margins. Secondly, the company has continued to invest in technology research and development, brand channel construction, brand image enhancement, and operational efficiency improvement to promote the high-end development of its products, which has had a certain impact on short-term performance.

In its half-year report, BAIC BJEV pointed out that during the first half of 2024, the industry's internal competition led to a severe market competition situation. The Chinese new energy vehicle industry became increasingly competitive, with competing automakers densely deployed and rapidly iterating products in the market, forming a diversified market landscape. To compete for market share, automakers have resorted to price reductions, intensifying market competition. Meanwhile, the new energy vehicle industry is rapidly evolving towards intelligence and connectivity, with rapid technology iterations shortening product production cycles and lifecycles, posing new challenges to the company's design, production, and manufacturing capabilities.

Previously, BAIC BJEV had suffered losses for four consecutive years, with a cumulative loss of 22.59 billion yuan. Coupled with the losses in the first half of 2024, the company has incurred a cumulative loss of 25.161 billion yuan over four and a half years. Currently, BAIC BJEV is searching for ways to break the ice. The company stated that it is fully committed to building three major brands: ARCFOX, ENJOY, and BEIJING.

To emerge from its trough, BAIC BJEV has further embraced Huawei, hoping to replicate AITO's success. At Huawei's recent HarmonyOS Intelligent Driving new product launch event, Yu Chengdong, Chairman of Huawei's Intelligent Automotive Solutions BU, revealed that ENJOY S9, equipped with Huawei ADS 3.0, received over 8,000 pre-orders within 20 days of its launch, exceeding expectations.

△ENJOY S9 is expected to help BAIC BJEV break the ice

Who are the members of the new energy vehicle profitability alliance?

In fact, BAIC BJEV's plight resonates deeply with other new energy vehicle companies, as only a handful of domestic electric vehicle companies have managed to escape the quagmire of losses. It remains challenging for new energy vehicle companies to turn losses into profits, but as the new energy vehicle market continues to heat up, there is a growing trend of companies joining the profitability ranks. Apart from BYD, which capitalized on opportunities to reap substantial profits, LIXIANG, the sales champion among new forces, has maintained profitability in the first half of this year after achieving its first annual profitability last year, albeit with reduced earnings.

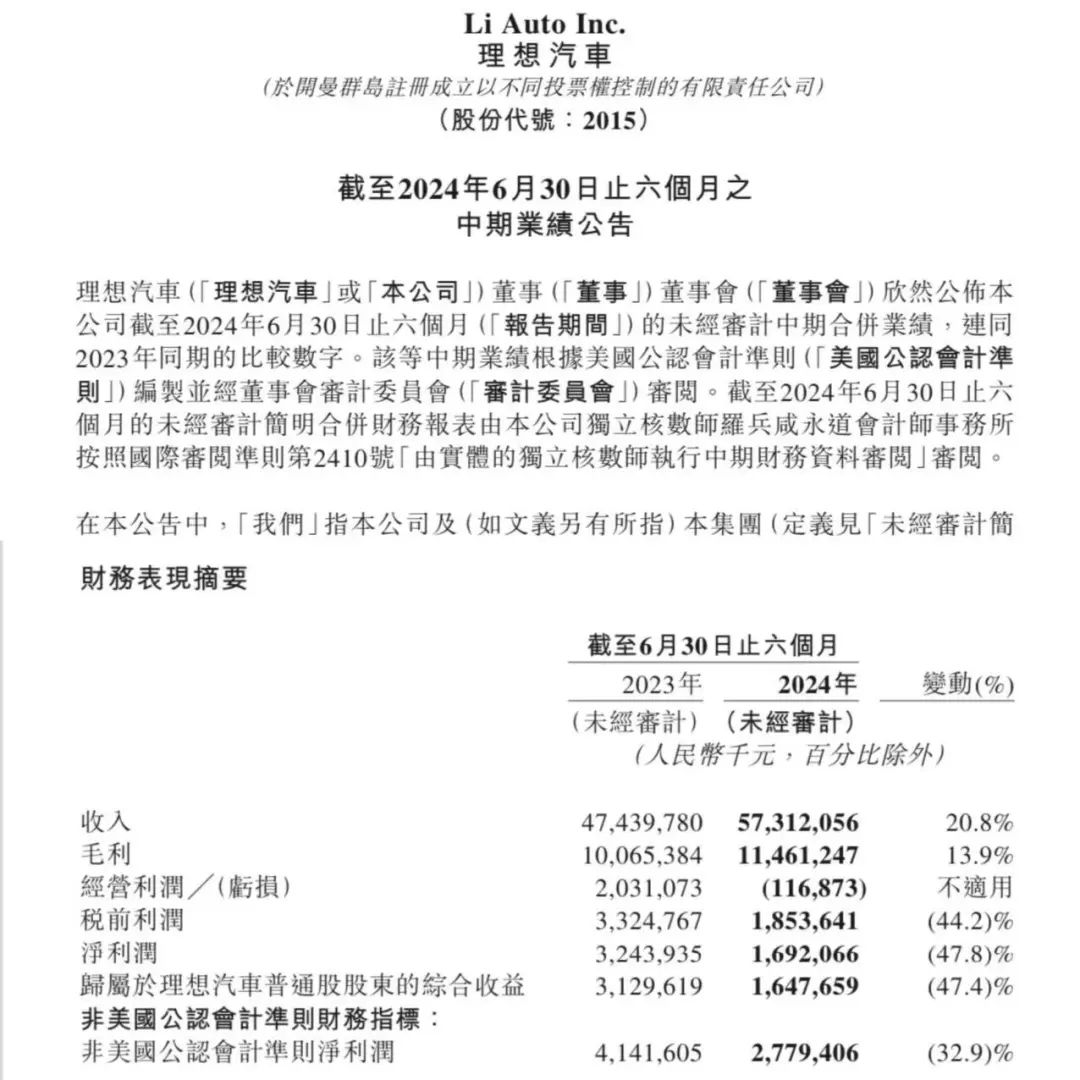

△LIXIANG's net profit shrank in the first half of the year

According to LIXIANG AUTO-W's (02015.HK) latest 2024 interim results, the company's unaudited revenue for the reporting period was 57.3 billion yuan, an increase of 20.8% year-on-year; gross profit was 11.46 billion yuan, an increase of 13.9% year-on-year; pre-tax profit was 1.85 billion yuan, a decrease of 44.2% year-on-year; and net profit was 1.69 billion yuan, a decrease of 47.8% year-on-year. Excluding non-GAAP accounting principles, LIXIANG AUTO's net profit was 2.78 billion yuan, a decrease of 32.9% year-on-year.

Unlike BYD, which continued to increase its net profit by initiating this year's electric vehicle price war, LIXIANG AUTO's net profit shrank in the first half of the year. Although LIXIANG AUTO delivered 189,000 vehicles in the first half of the year, an increase of 35.8% year-on-year, thanks to the new L6 model, the intensifying market competition and the aggressive pricing strategies of competitors like AITO forced LIXIANG AUTO to join the price war, impacting its profits. Due to changing market conditions, LIXIANG AUTO's previous plans for its all-electric series were disrupted, and its sales target of reaching 800,000 vehicles this year may not be achievable. Currently, LIXIANG AUTO is further enriching its product portfolio, focusing on user experience and product quality, and enhancing organizational operational efficiency.

△Sales performance of new force auto companies in 2023 and the first half of 2024

LIXIANG AUTO's pressure this year is partly related to the suppression from AITO, which is backed by Huawei. For several months, AITO surpassed LIXIANG AUTO to become the sales champion among new forces. Thanks to AITO's surging sales, Seres (601127.SH) finally joined the ranks of profitable new energy vehicle companies in the first half of this year. Seres disclosed in its 2024 half-year report that the company achieved revenue of 65.044 billion yuan in the first half of the year, an increase of 489.58% year-on-year; net profit attributable to shareholders of listed companies reached 1.625 billion yuan, turning losses into profits. Notably, in the second quarter, Seres achieved revenue of 38.484 billion yuan, an increase of 547.69% year-on-year and 44.89% quarter-on-quarter; net profit attributable to shareholders reached 1.405 billion yuan, an increase of 295.36% year-on-year and 539.94% quarter-on-quarter, demonstrating Seres' high growth potential and robust profitability. This was closely related to the robust growth of Seres' new energy vehicle business and the optimization of its product mix. The company officially commenced large-scale deliveries of its flagship model AITO M9 and launched new variants of AITO M5 and AITO M7 Ultra, providing users with more choices in terms of appearance, driving control, intelligent driving, and interior space.

△Rapid growth in AITO sales has helped Seres turn losses into profits

ZEEKR, a subsidiary of Geely, has also crossed the profitability threshold with profitability in the second quarter of this year, but whether it can maintain stable profitability remains to be seen. GAC AION managed to achieve profitability in individual months last year, but due to intensified competition and declining sales this year, it has yet to truly emerge from its losses. Among the former "NIO-Xpeng-LIXIANG" trio, apart from LIXIANG AUTO, NIO and Xpeng have been striving for a decade but have yet to turn losses into profits.

Commentary

Leveraging its technological, scale, and financial advantages, BYD has emerged as a dominant force in the new energy vehicle industry, leading a new round of aggressive expansion that has surpassed the 50% market share threshold traditionally held by fuel vehicles. At the same time, BYD's experience demonstrates that new energy vehicle companies can also earn substantial profits like traditional fuel vehicle giants. However, BYD's reliance on its scale advantage and aggressive pricing strategies has intensified competition in the new energy vehicle market, making it increasingly difficult for other electric vehicle companies to gain market share and achieve profitability. Although the new energy vehicle market continues to expand, the Matthew Effect is increasingly evident, with opportunities primarily reserved for top-selling automakers.

(This article is originally written by Heyan Yueche and may not be reproduced without authorization)