MIIT seeks public opinions on new energy consumption standards, making the future of fuel vehicles more challenging?

![]() 09/06 2024

09/06 2024

![]() 597

597

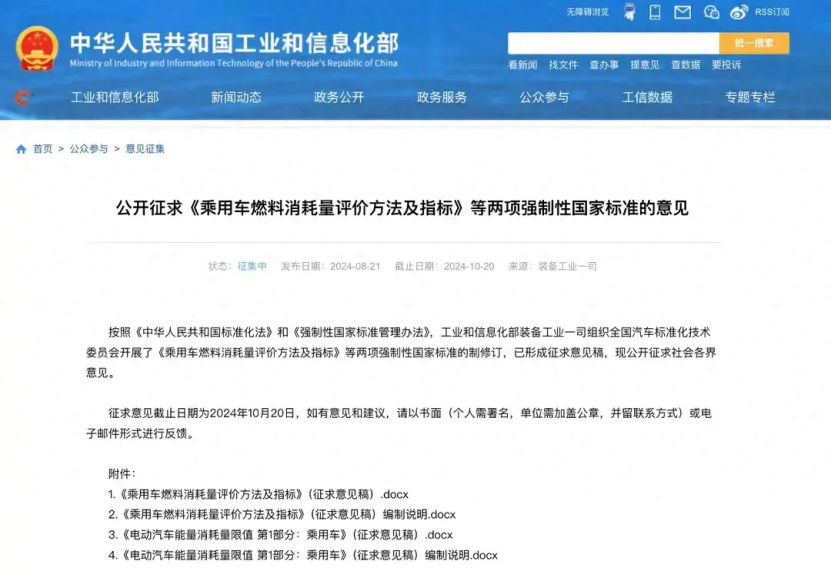

Recently, the Ministry of Industry and Information Technology (MIIT) officially announced the draft for public comment on two mandatory national standards, including the "Evaluation Method and Indicators for Passenger Car Fuel Consumption." Of particular interest is the new fuel consumption standard, which proposes a target of 3.3L/100km for passenger car fuel consumption by 2030 (electricity consumption converted to fuel consumption based on caloric value). The annual compliance ratio will be gradually tightened from 130% in 2026 to 100% in 2030, following a pattern of initially lenient and then stricter requirements.

Some argue that based on fuel consumption, most fuel vehicles currently available on the market cannot meet the new regulations, and even traditional fuel vehicles may face elimination. However, it's important to note that the corporate average fuel consumption (CAFC) target does not equal a single-vehicle limit. Companies can achieve compliance through various means, including improving fuel consumption of traditional vehicles, introducing new energy vehicles, and leveraging flexible credit mechanisms. The inability to meet the target value for a specific model does not necessarily mean production cannot proceed.

▍Strengthening the Dual-Credit Policy

According to the draft, vehicles weighing less than 1.09 tons must have a fuel consumption of no more than 2.57 liters per 100 kilometers. For vehicles weighing between 1.09 and 2.51 tons, the limit is 3.3 liters per 100 kilometers. For vehicles weighing over 2.51 tons, the limit is 4.7 liters per 100 kilometers. Currently, mainstream passenger vehicles on the market primarily fall into the second weight category.

Furthermore, the draft also introduces an "energy consumption rating system," which will, to some extent, affect companies' carbon credit calculations. Models with fuel consumption below the standard will earn positive credits, while those above the standard will incur negative credits. Producing electric vehicles will result in positive credits. According to the MIIT's "Dual-Credit" implementation report, the average transaction price of new energy vehicle credits in 2022 was 1,128 yuan per credit.

While the vehicle model target values are average requirements across all vehicle types, not specifically targeting traditional vehicles, they are based on the expected proportions and energy consumption performance of various vehicle types, including gasoline, diesel, hybrid, plug-in hybrid, and pure electric. Nevertheless, some companies believe they may need to rely more on carbon trading to meet targets in the short term.

In response, Cui Dongshu, Secretary-General of the China Passenger Car Association, stated to Auto Insight, "If the new regulations are approved, they will significantly accelerate the transition to new energy vehicles for joint venture and luxury automakers in the domestic market. If they cannot meet the corresponding fuel consumption standards, they will have to buy credits, which will directly increase costs and significantly weaken their market competitiveness."

From an operational cost perspective, Dr. Wang Yao, Deputy Chief Engineer of the China Association of Automobile Manufacturers, believes that companies requiring significant efficiency improvements will face increased costs. However, he emphasizes that this is a short-term phenomenon. In the long run, investments in energy-saving technologies and new energy technologies will help enhance companies' competitiveness in future markets.

Moreover, the draft's incentives for low-fuel-consumption fleets will assist companies in reducing overall operational costs by improving energy efficiency.

▍Accelerating the Transition to New Energy Vehicles

When discussing the new fuel consumption standards, the competition between joint ventures and domestic brands cannot be overlooked. Industry insiders suggest that if implemented, the new regulations will primarily impact joint venture fuel vehicles, as their technology update speed may not keep pace with policy changes.

A responsible person from a joint venture automaker told Auto Insight, "The time allowed by the new regulations puts pressure on companies, both in terms of technology cooperation and R&D. Currently, even our most fuel-efficient hybrid models cannot meet the standards, and traditional fuel vehicles are far from the mark." However, many automaker executives revealed that their R&D focus has shifted significantly towards plug-in hybrids, extended-range electric vehicles, and other powertrain technologies to ensure the rapid launch of new products.

Data shows that in the first seven months of 2024, China's new energy vehicle production and sales reached 5.914 million and 5.934 million units, respectively, up 28.8% and 31.1% year-on-year. In July, the penetration rate of new energy vehicles in the market exceeded 50%. Cui Dongshu believes that the introduction of new fuel consumption regulations will further accelerate the substitution of new energy vehicles, leading to a sharp decline in traditional fuel vehicle sales.

Since the official release of the second revision in 2021, new energy vehicles have entered a rapid growth phase. Market feedback indicates that some joint venture automakers' hastily launched new energy vehicles cannot fully meet consumer demands in terms of experience and pricing. Cui Dongshu believes that many marginal automakers lacking both funds and capabilities for rapid electrification transformation may face accelerated "clearing out."

During this transition period, luxury brands are also feeling the pressure, particularly those relying on imports. For instance, Porsche has confirmed the launch of all-electric versions of the Cayenne and Panamera, with the Macan EV already on the market. This is not only a positive response to market changes but also an important strategic move for the brand's future development.

It is crucial to clarify that this is currently only the public comment stage, and the proposed fuel consumption targets are not the "final version." However, it is certain that the new standards are not intended to ban the sale of fuel vehicles but rather to promote more energy-efficient and environmentally friendly fuel vehicles. According to the compilation instructions for these standards, future standards will still allow traditional fuel vehicles but require them to meet stricter fuel consumption targets.

In Wang Yao's view, the draft is not an additional burden on traditional fuel vehicles but a necessary step to drive the entire industry towards more energy-efficient and environmentally friendly transformation and upgrading. Companies should actively respond to these changes to maintain their competitiveness in future markets.

Typesetting by Yang Shuo | Image Sources: MIIT, Shutterstock