Volkswagen plans to close factories in Germany, putting local job security at risk

![]() 09/06 2024

09/06 2024

![]() 520

520

Trade Union: Highly Irresponsible

”

Author | Wang Lei

Volkswagen has made an unprecedented decision to save costs.

It plans to close "at least" one major factory and component plant in its German headquarters, affecting its primary passenger car brands.

The goal is clear – to save money.

Through these measures, Volkswagen management aims to achieve its target of €10 billion in operating costs by 2026.

If implemented, this would be the first time in the company's 87-year history that it closes a factory in Germany.

The closures inevitably lead to layoffs, violating Volkswagen's agreement with the automotive trade union not to lay off workers before 2029.

Volkswagen faces high costs and a powerful trade union, struggling in the electric vehicle market and even losing ground at home. 01 Facing Closure Reluctantly

"The European automotive industry faces harsh conditions, and Germany, as a key manufacturing base, has lost much of its competitiveness compared to other regions."

Oliver Blume, CEO of Volkswagen Group, is blunt, stating that new players are entering the German market, making the economic environment even more challenging.

In his view, Volkswagen must "act decisively" to improve competitiveness.

Although Volkswagen's statement did not specify which factories or component plants would close, analysts suggest that the plants in Osnabrück and Dresden, Saxony, are likely targets.

The Osnabrück plant operated at less than 20% capacity in 2023, and Dresden's was only 30%.

If closed, this would mark Volkswagen's first factory closure in 40 years and the first in its German headquarters since its founding in 1937.

Volkswagen has closed factories before, but the last time was in 1988 when it shuttered its Westmoreland plant in Alabama, USA. Since then, no factory closures have occurred.

However, the current situation is different, and Volkswagen has long planned to close factories.

Two months ago, German media reported Volkswagen's plans to restructure global factories, hinting that "a European factory will become redundant," though the Brussels Audi plant was initially mentioned.

On July 9th, Volkswagen announced that its Supervisory Board had initiated an "information and consultation process" at the Brussels plant to develop solutions with partners, potentially leading to its closure.

While Volkswagen's German factory closures are still in the planning stage, their impact cannot be underestimated.

The closures violate a 1994 employment protection agreement between Volkswagen and the trade union, promising no layoffs in Germany before 2029.

Volkswagen employs nearly 680,000 people worldwide, over 40% in Germany, putting jobs at risk with factory closures.

This also strains relations with the powerful automotive trade union, influential within European automakers, as seen in the recent three-month-long strike.

Within Volkswagen, the trade union wields significant influence, with half of the Supervisory Board seats held by labor representatives. Volkswagen's Wolfsburg headquarters is in Lower Saxony, where the state government owns 20% of Volkswagen shares and supports the union.

Volkswagen's decision has already drawn harsh criticism from the union. Germany's largest industrial union, IG Metall, vows to fight to save jobs.

IG Metall's Chief Negotiator, Thorsten Groger, stated in a press release that the Board's plan is irresponsible, jeopardizing Volkswagen's foundation and threatening jobs and factories.

Volkswagen's works council chair, Daniela Cavallo, also an IG Metall member, vowed to "strongly oppose" the plan.

Embarrassingly, just months ago, the union demanded a 7% pay rise for 120,000 employees within a year.

Volkswagen plans to discuss the closures with the union later this week, and Herbert Diess's position may be at risk if labor disputes escalate.

In Volkswagen's history, conflicts with the union have forced some predecessors to step down, including Diess in 2022 over mass layoff plans.

Similarly, Bernd Pischetsrieder and Wolfgang Bernhard, Volkswagen CEOs from 2002-2007, were ousted over conflicts with the union over operational efficiency improvements.

02 The Decline of a Once-Great Brand

Why is Volkswagen closing factories despite challenges?

Insights can be gained from official statements by Volkswagen executives and the company's current financial situation.

Thomas Schäfer, CEO of Volkswagen's Passenger Cars division, states that "the situation is extremely tense and cannot be resolved through simple cost-cutting measures."

Oliver Blume echoes this, emphasizing the pressing issue of costs.

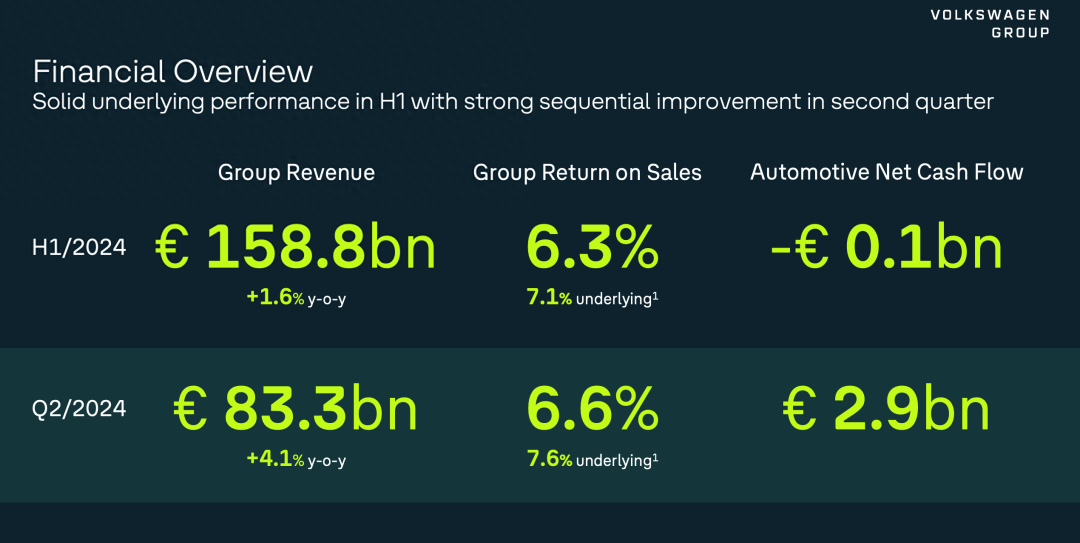

High operating costs stem from declining profit margins. In H1 2023, Volkswagen sold 4.341 million vehicles, down 0.6% YoY. While revenue increased slightly, operating profit fell 11.4% YoY to €10.1 billion, with an operating margin of 6.3%, down from 7.3% in H1 2022.

Crucially, operating profit for Volkswagen's core passenger car brands declined from €1.64 billion to €0.966 billion, with a margin down from 3.8% to 2.3%. Even luxury brands Audi and Porsche outperformed the core Volkswagen brand.

Volkswagen aims to cut €10 billion in costs and achieve a 6.5% sales return by 2026, as announced last year. However, H1 2023 results fell short of expectations.

The H1 2023 results indicate that bolder measures are needed to meet the €10 billion cost-cutting target by 2026.

Volkswagen's struggles in its largest market, China, added to its woes.

In H1 2023, Volkswagen sold 1.345 million vehicles in China, down 7.4% YoY, due to intense local competition. Operating profit in China fell 30% YoY to €0.801 billion (approx. RMB 6.3 billion) and 43% compared to H1 2022. Volkswagen even incurred a loss of €0.193 billion (approx. RMB 1.52 billion) in Q2 2023, reversing a profit of €0.348 billion (approx. RMB 2.74 billion) in Q2 2022.

China accounted for 30.9% of Volkswagen's global sales in H1 2023, down from over 40% at its peak. Volkswagen also lost its leading position in the Chinese market to BYD, which sold over 1.6 million vehicles in H1 2023.

Facing sales and profit pressures, Volkswagen must reduce capacity and close factories to cut costs.

While Volkswagen relied on its Chinese operations during the global automotive downturn, its struggles in China now impact its German headquarters, exposing long-standing European issues.

Volkswagen remains committed to electrification, investing heavily in China, its epicenter. However, turning this ship around won't be easy.